As global markets continue to reach record highs, with indices like the Dow Jones Industrial Average and S&P 500 Index seeing significant gains, investors are increasingly looking for stable options amidst geopolitical uncertainties and economic shifts. In this environment, dividend stocks stand out as a compelling choice for those seeking consistent income and potential growth, offering a buffer against market volatility while aligning with the current focus on economic stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.20% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

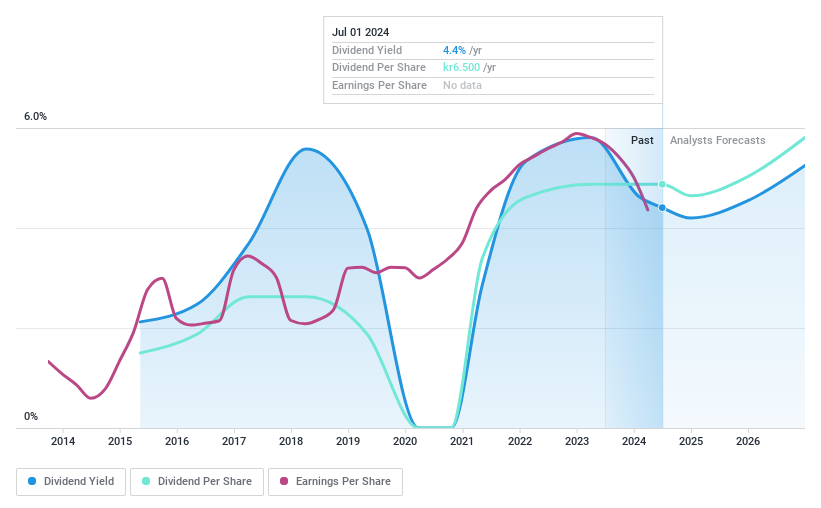

Inwido (OM:INWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inwido AB (publ) operates through its subsidiaries in the development, manufacture, and sale of windows and doors, with a market capitalization of approximately SEK10.81 billion.

Operations: Inwido AB (publ) generates revenue through its segments, with E-Commerce contributing SEK1.10 billion, Scandinavia SEK4.08 billion, Eastern Europe SEK1.71 billion, and Western Europe SEK1.83 billion.

Dividend Yield: 3.5%

Inwido's dividend payments are covered by earnings and cash flows, with payout ratios of 69.7% and 66%, respectively. Despite a history of volatility, dividends have increased over the past decade. However, they remain unreliable due to inconsistent growth patterns. The stock trades at a significant discount to its estimated fair value but offers a lower yield (3.49%) compared to top Swedish dividend payers (4.72%). Recent earnings show stable net income despite declining sales figures year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Inwido.

- According our valuation report, there's an indication that Inwido's share price might be on the cheaper side.

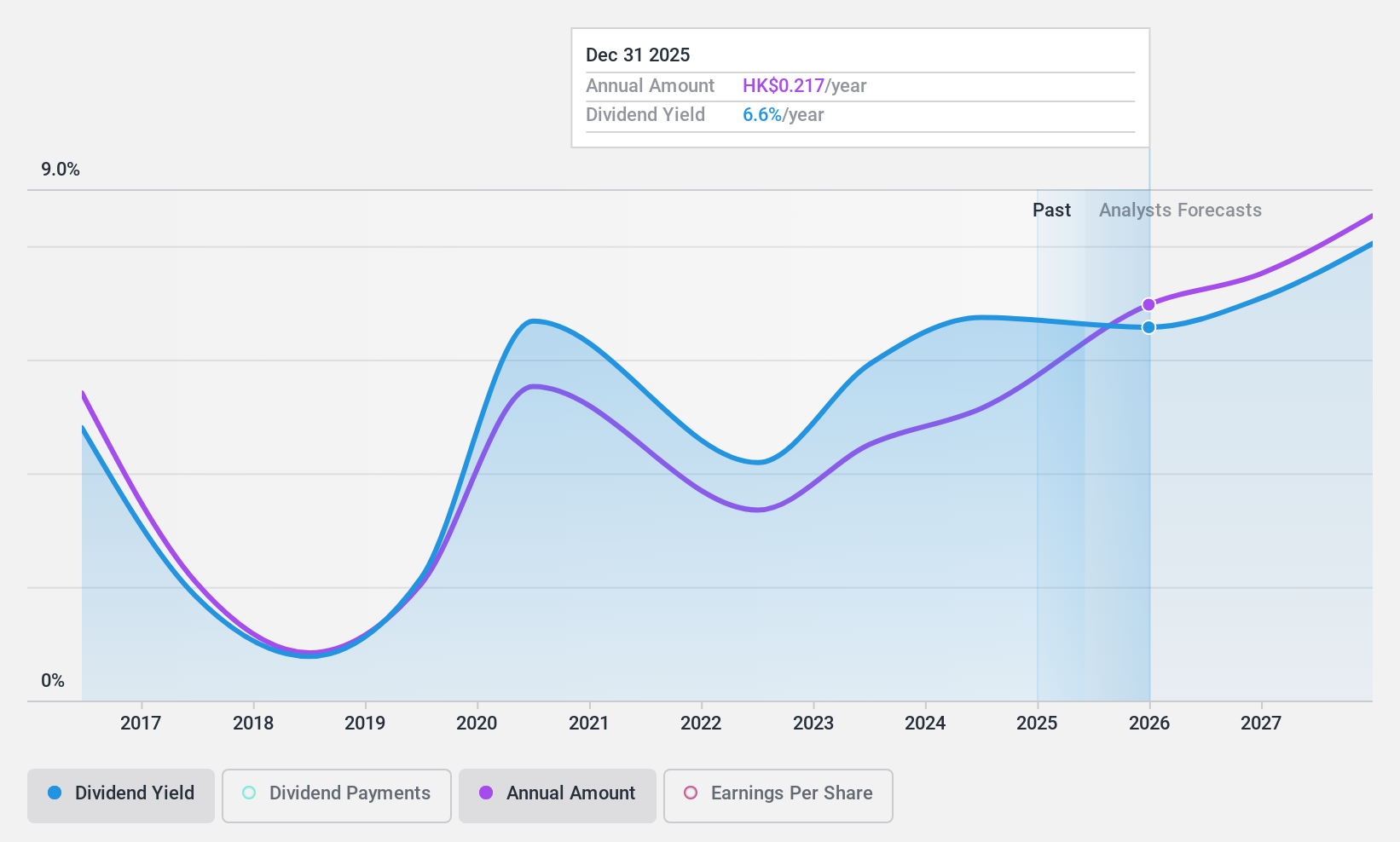

Huishang Bank (SEHK:3698)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huishang Bank Corporation Limited, along with its subsidiaries, offers a range of commercial banking products and services in the People's Republic of China and has a market capitalization of approximately HK$32.09 billion.

Operations: Huishang Bank Corporation Limited generates revenue through its diverse portfolio of commercial banking products and services across the People's Republic of China.

Dividend Yield: 6.8%

Huishang Bank's dividends are thoroughly covered by earnings, with a low payout ratio of 14%, and are expected to remain sustainable over the next three years. However, the dividend history has been volatile with inconsistent growth patterns over the past decade. Although its current yield of 6.75% is below top-tier Hong Kong dividend payers, the stock trades at a significant discount to its estimated fair value. Recent board changes may impact strategic direction and risk management.

- Dive into the specifics of Huishang Bank here with our thorough dividend report.

- The valuation report we've compiled suggests that Huishang Bank's current price could be quite moderate.

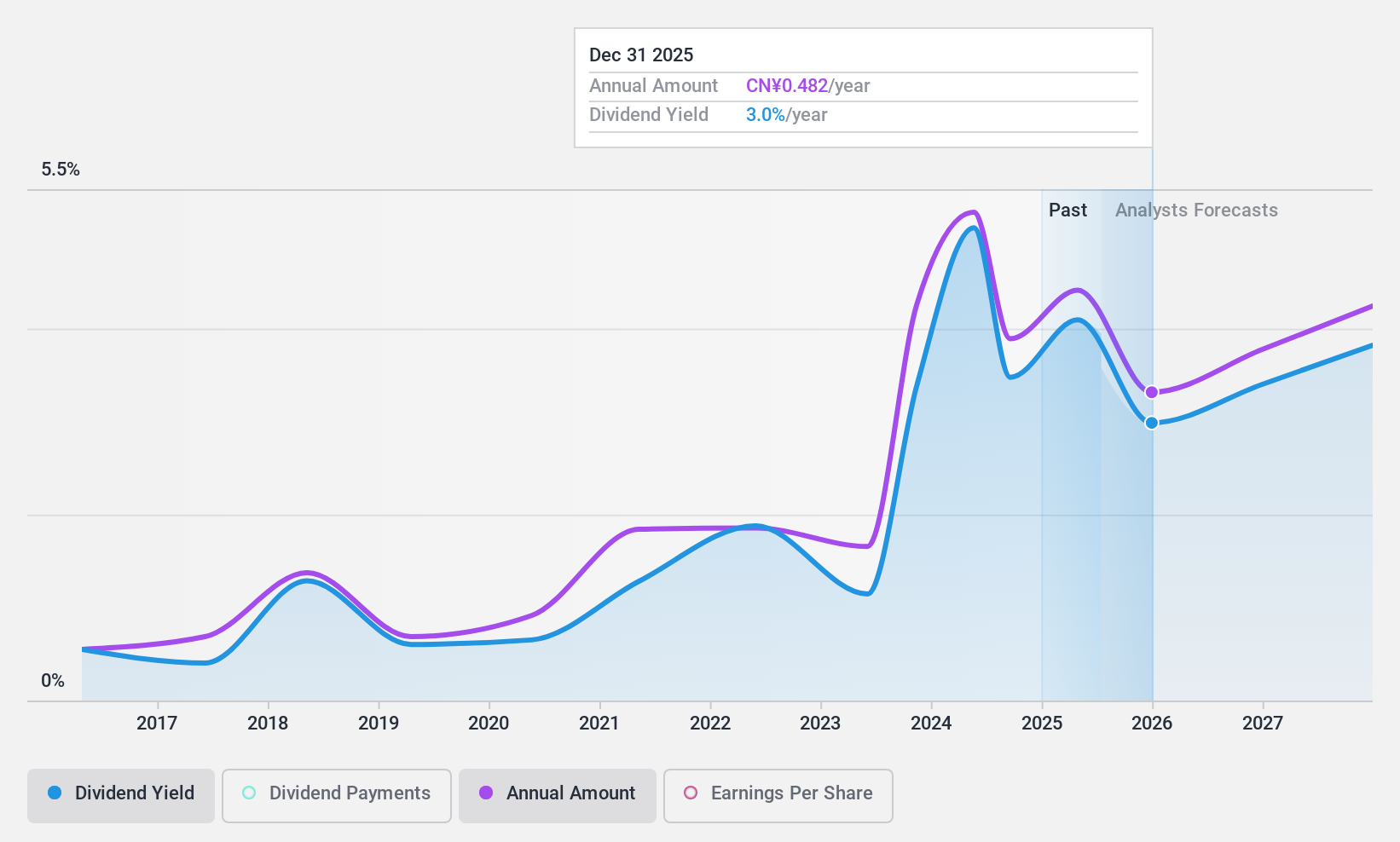

Zhejiang Dahua Technology (SZSE:002236)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Dahua Technology Co., Ltd. operates in the intelligent Internet of Things industry globally, with a market cap of approximately CN¥53.25 billion.

Operations: Zhejiang Dahua Technology Co., Ltd. generates its revenue primarily from the R&D, production, and sales of video IoT products, amounting to CN¥32.39 billion.

Dividend Yield: 3.5%

Zhejiang Dahua Technology's dividend yield of 3.48% is among the top in China, yet its sustainability is questionable due to a high cash payout ratio of 93.6%. While dividends have grown over the past decade, they have been unstable with significant annual drops. The company's earnings cover dividends well with a low payout ratio of 25.3%, but free cash flow coverage remains weak. Recent earnings show slight revenue growth but a decline in net income year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of Zhejiang Dahua Technology.

- Our expertly prepared valuation report Zhejiang Dahua Technology implies its share price may be lower than expected.

Where To Now?

- Explore the 1947 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INWI

Inwido

Through its subsidiaries, engages in development, manufacture, and sale of windows and doors.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives