As global markets navigate mixed signals, with U.S. stocks closing a strong year despite recent underperformance and economic indicators like the Chicago PMI showing contraction, investors are increasingly seeking stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream, providing potential resilience against market volatility and economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

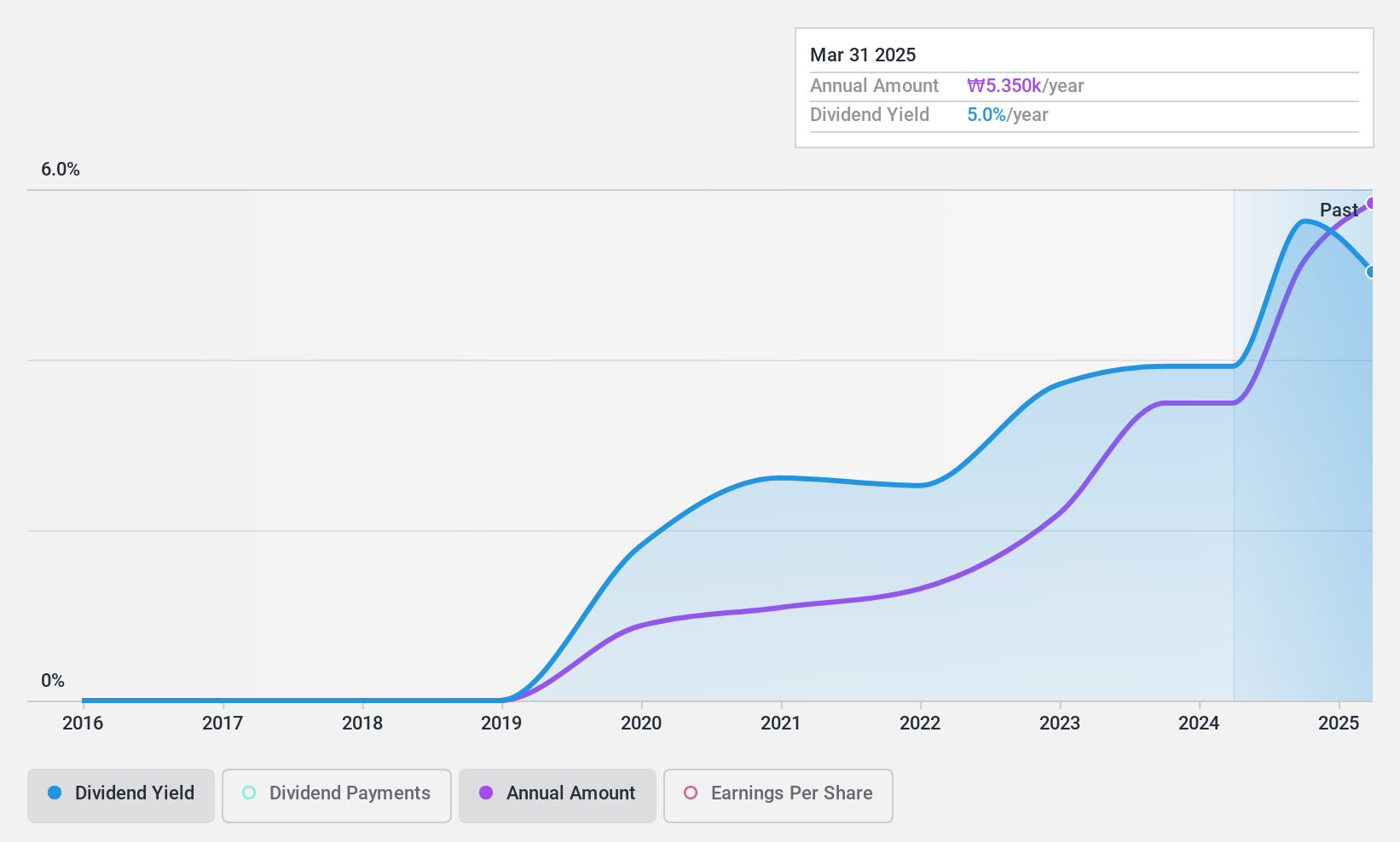

Youngone Holdings (KOSE:A009970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Holdings Co., Ltd. is a company that manufactures and sells apparel, footwear, gear, sportswear, and jackets both in South Korea and internationally, with a market cap of approximately ₩941.16 billion.

Operations: Youngone Holdings Co., Ltd.'s revenue segments include Domestic Retail at ₩1.01 billion, Manufacture OEM at ₩4.16 billion, and SCOTT at ₩980.97 million.

Dividend Yield: 5.8%

Youngone Holdings has demonstrated stable and reliable dividend payments, though it has a relatively short history of less than 10 years. The dividends are well-covered by both earnings (16.4% payout ratio) and cash flows (13.6% cash payout ratio), indicating sustainability. Its dividend yield is competitive, ranking in the top 25% in the Korean market at 5.76%. Additionally, the stock trades significantly below its estimated fair value, suggesting potential value for investors focused on dividends.

- Click to explore a detailed breakdown of our findings in Youngone Holdings' dividend report.

- The valuation report we've compiled suggests that Youngone Holdings' current price could be quite moderate.

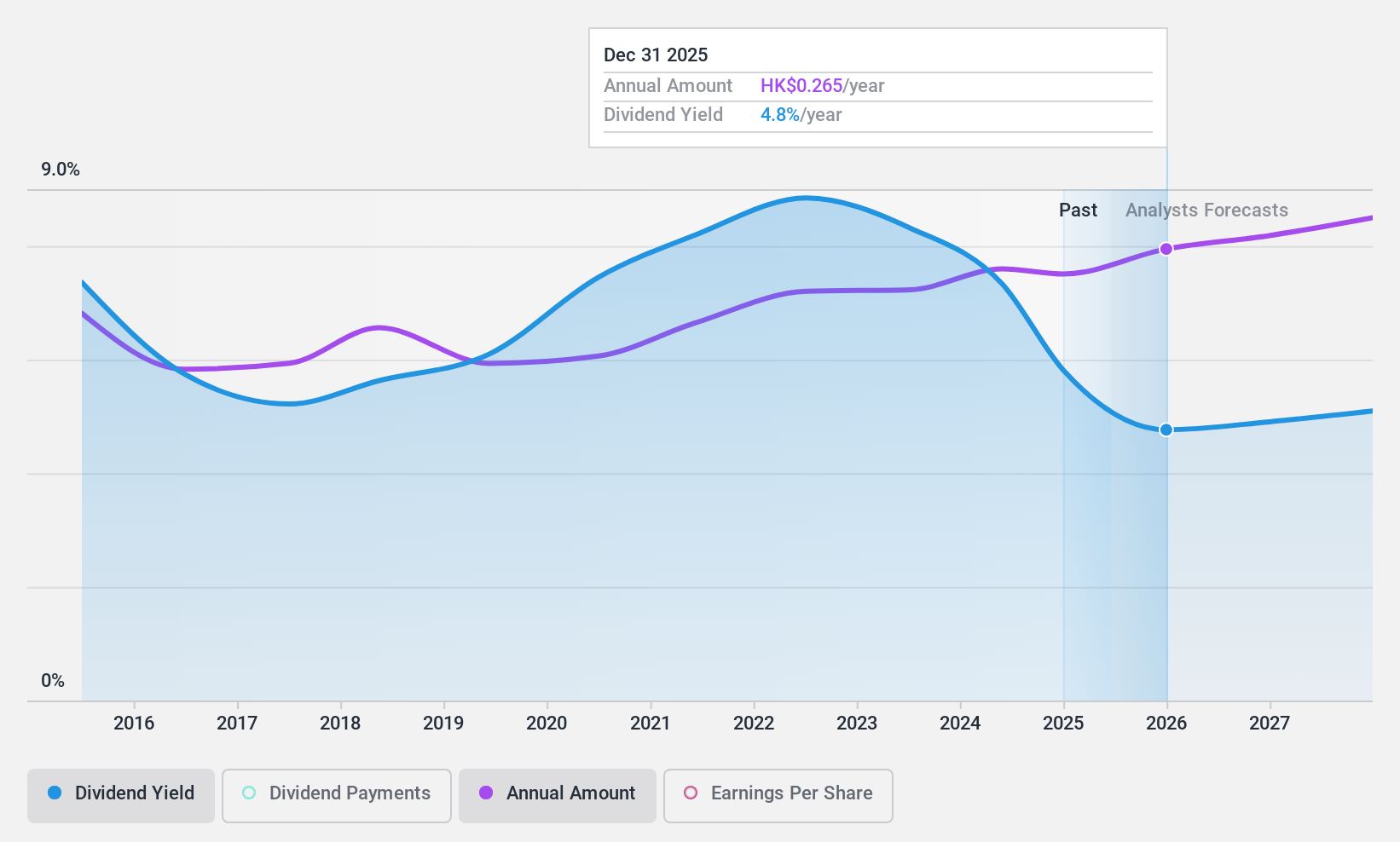

Agricultural Bank of China (SEHK:1288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited, along with its subsidiaries, offers a range of banking products and services and has a market cap of approximately HK$1.89 trillion.

Operations: Agricultural Bank of China Limited generates revenue through its diverse banking products and services.

Dividend Yield: 5.8%

Agricultural Bank of China offers stable and reliable dividends, with a payout ratio of 47.3%, ensuring coverage by earnings. Over the past decade, its dividend payments have shown consistent growth without volatility. Although its yield of 5.8% is lower than the top 25% in Hong Kong's market, it remains attractive for income-focused investors. Recent approval for interim dividends underscores its commitment to shareholder returns amidst ongoing executive changes and strategic financial decisions like fixed-income offerings.

- Unlock comprehensive insights into our analysis of Agricultural Bank of China stock in this dividend report.

- Our valuation report here indicates Agricultural Bank of China may be undervalued.

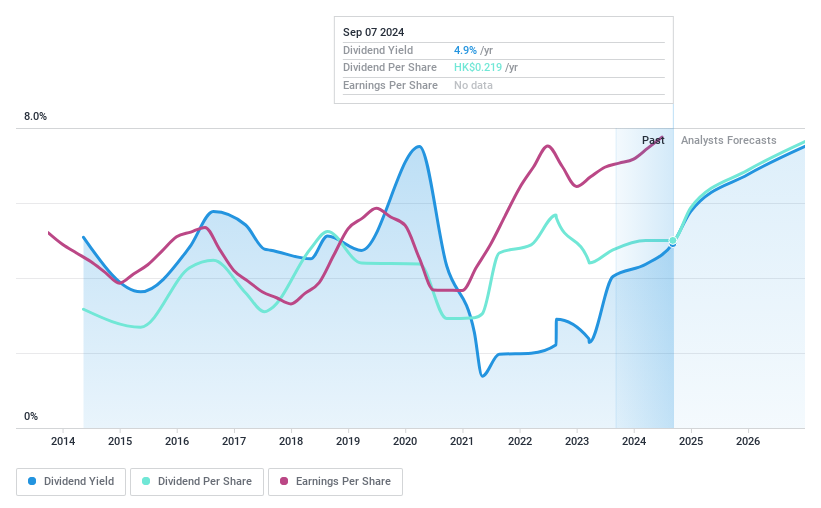

Xtep International Holdings (SEHK:1368)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xtep International Holdings Limited is a company that designs, develops, manufactures, and markets sports footwear, apparel, and accessories for adults and children in China with a market cap of HK$14.28 billion.

Operations: Xtep International Holdings Limited generates revenue from three main segments: Athleisure (CN¥1.68 billion), Mass Market (CN¥12.31 billion), and Professional Sports (CN¥1.04 billion).

Dividend Yield: 4%

Xtep International Holdings' dividend payments are covered by both earnings and cash flows, with a payout ratio of 48.8% and a cash payout ratio of 36.8%. However, the dividends have been volatile over the past decade despite growth. The recent special dividend announcement of HK$0.447 per share highlights its commitment to returning value to shareholders. While trading below its estimated fair value, Xtep's dividend yield is lower than top-tier payers in Hong Kong's market.

- Take a closer look at Xtep International Holdings' potential here in our dividend report.

- The analysis detailed in our Xtep International Holdings valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1997 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1368

Xtep International Holdings

Designs, develops, manufactures, markets, and sells sports footwear, apparel, and accessories for adults and children in Mainland China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives