The five-year loss for Zhongyuan Bank (HKG:1216) shareholders likely driven by its shrinking earnings

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Zhongyuan Bank Co., Ltd. (HKG:1216) for half a decade as the share price tanked 73%. The falls have accelerated recently, with the share price down 12% in the last three months.

On a more encouraging note the company has added HK$731m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for Zhongyuan Bank

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

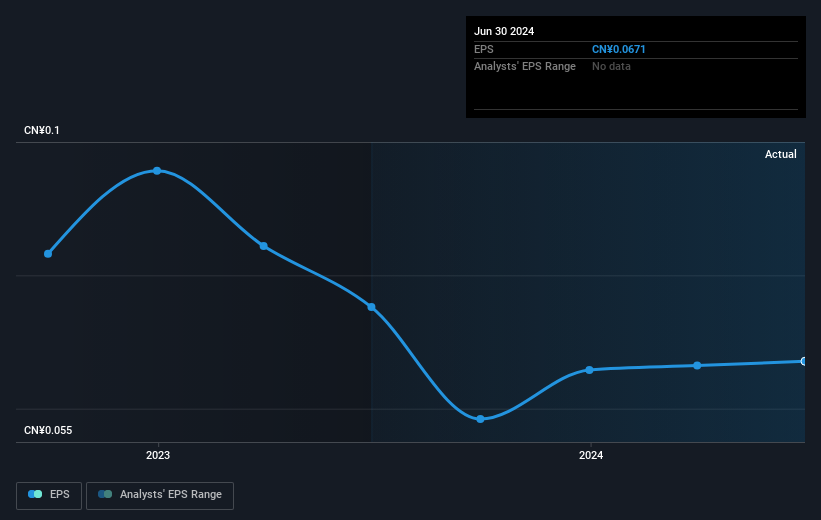

During the five years over which the share price declined, Zhongyuan Bank's earnings per share (EPS) dropped by 13% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 23% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 4.49 further reflects this reticence.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Zhongyuan Bank's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Zhongyuan Bank provided a TSR of 4.9% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Zhongyuan Bank better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Zhongyuan Bank , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhongyuan Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1216

Zhongyuan Bank

Offers banking services in the Asia Pacific, North America, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives