Has Hang Seng Bank’s 65% Rally Priced in Hong Kong Policy Shifts?

Reviewed by Bailey Pemberton

If you have kept a curious eye on Hang Seng Bank lately, you are not alone. Investors have been buzzing as the stock keeps climbing, with moves that might surprise even the most seasoned market followers. Over just the past week, shares climbed an impressive 26.1%, and the growth streak continues, up 26.7% in the last month, a massive 59.1% year-to-date, and almost 65% over the last 12 months. These numbers stand out on their own, but look deeper and you'll notice that Hang Seng Bank's long-term return is equally jaw-dropping, gaining more than 68% over five years.

What’s driving this rally? In large part, it boils down to improving market sentiment toward Asian financials, along with renewed confidence following recent macroeconomic policy moves in Hong Kong. Investors are now weighing whether the risk profile for domestic banks is less daunting than it seemed only months ago. Still, with all this optimism swirling, the real question is: has the rally left the stock looking pricey, or is there still value on the table?

To answer that, it helps to look at Hang Seng Bank’s value score, which sits at 0 out of 6, meaning it doesn't tick any of the boxes that would typically qualify it as undervalued right now. But is this traditional approach to valuation really the best way to judge the stock's true potential? Let’s break down the main valuation methods, and afterward, I’ll share a more effective lens you can use to see through the market’s noise.

Hang Seng Bank scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hang Seng Bank Excess Returns Analysis

The Excess Returns valuation model focuses on measuring the returns a company is able to generate above its cost of equity, making it especially relevant for banks where return on invested capital is key. Rather than simply projecting profits, this method weighs how much value Hang Seng Bank creates for its shareholders compared to the required benchmark return.

Based on analyst estimates, Hang Seng Bank’s average return on equity comes in at 9.54%, with a stable earnings per share (EPS) forecasted at HK$8.51 and a stable book value at HK$89.22 per share. The cost of equity stands at HK$7.44 per share, so the company generates an excess return of HK$1.07 for every share. This suggests Hang Seng Bank is able to reliably generate profits above what shareholders require, supported by the consistent outlook from seven different analysts.

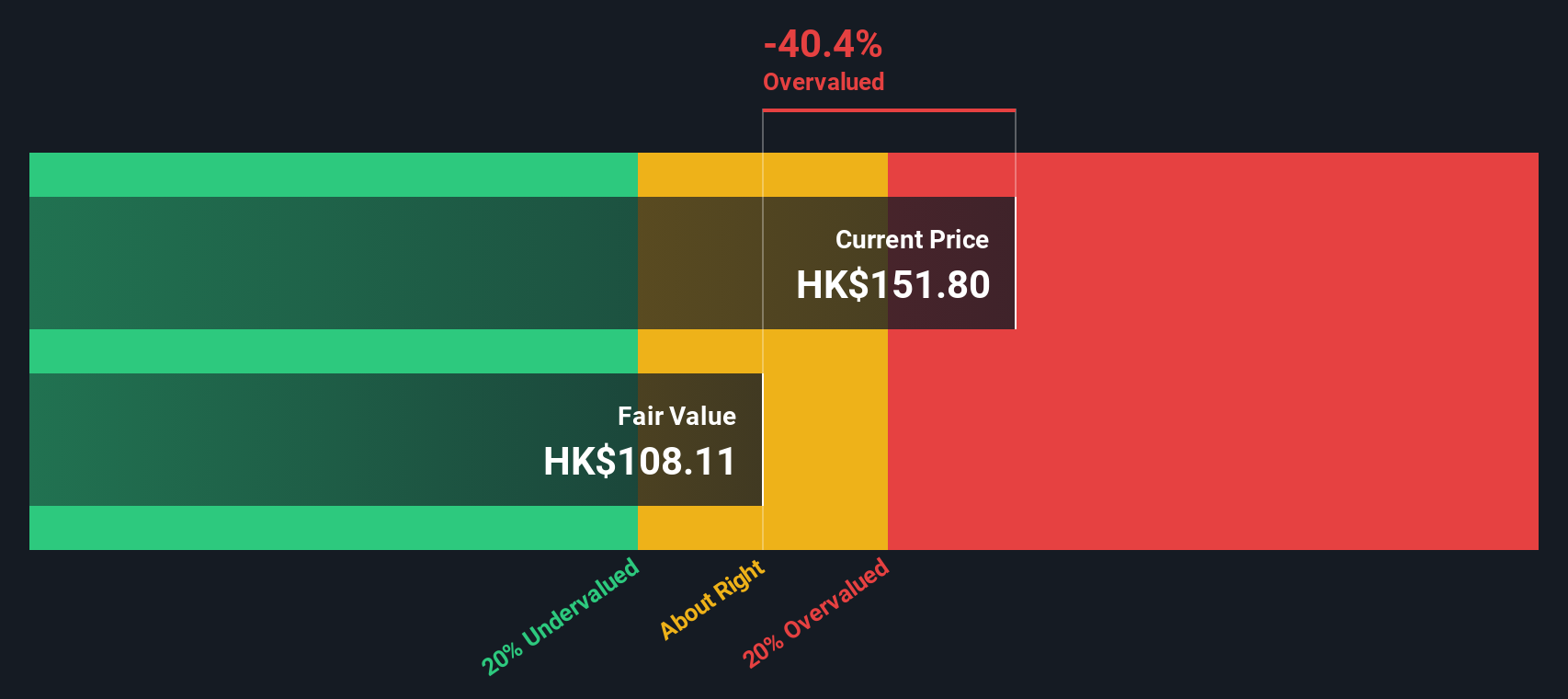

Despite these positives, the Excess Returns model estimates an intrinsic value of HK$108.15 per share. This indicates the stock is currently trading about 39.1% above what fundamentals justify. As a result, Hang Seng Bank appears overvalued based on its ability to deliver excess returns over the long term.

Result: OVERVALUED

Our Excess Returns analysis suggests Hang Seng Bank may be overvalued by 39.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hang Seng Bank Price vs Earnings

When evaluating established, profitable companies like Hang Seng Bank, the Price-to-Earnings (PE) ratio is one of the most popular and effective valuation tools. This metric quickly shows how much investors are willing to pay for each dollar of a company's earnings, making it a useful yardstick for comparing companies with steady profits.

A PE ratio is not meant to be high or low in isolation. Ideally, it should reflect expectations for a company's future growth and the risks surrounding its business. Higher growth prospects or a safer business model can justify a higher PE, while lower growth or higher risk usually brings this multiple down.

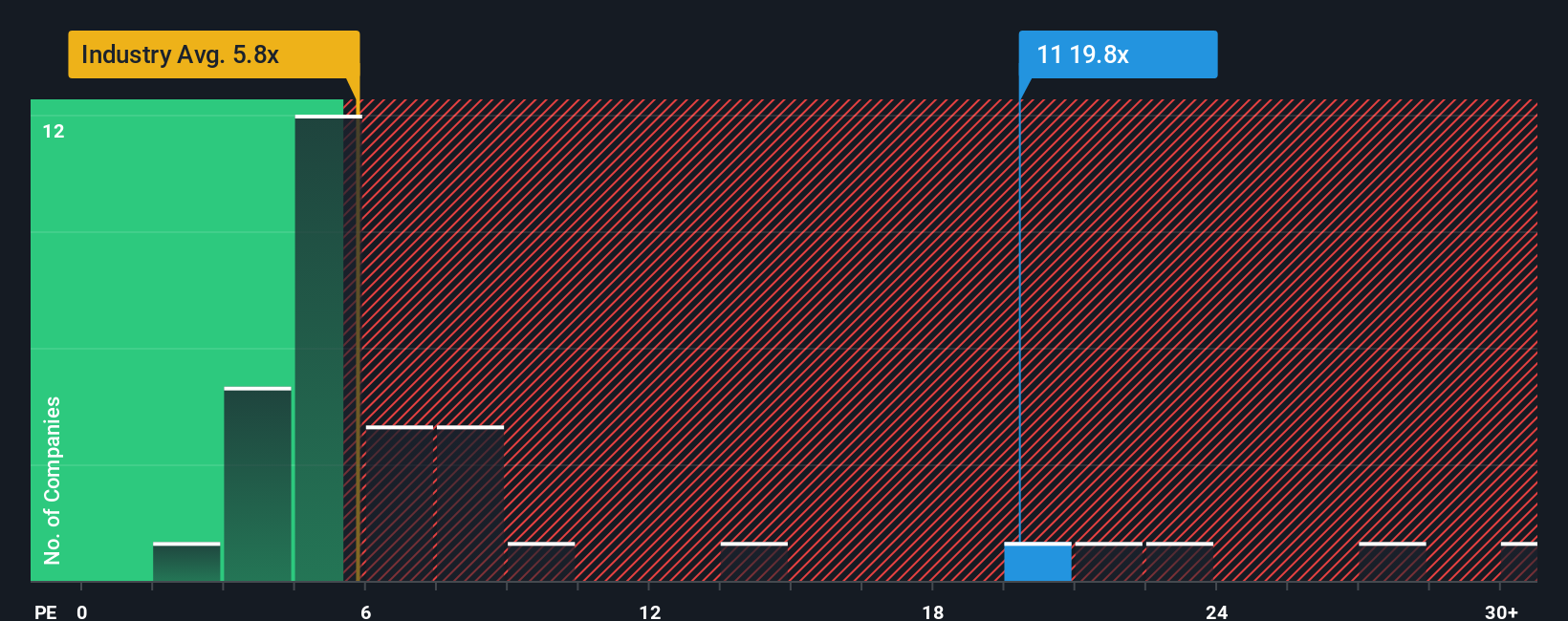

Hang Seng Bank currently trades at a PE ratio of 19.62x. That figure stands out against both the Banks industry average of 5.58x and the average of its peers, which is around 6.40x. On the surface, this suggests Hang Seng Bank is valued at a significant premium to its rivals.

To add depth, Simply Wall St’s proprietary “Fair Ratio” tool blends factors like Hang Seng Bank's earnings growth, profit margins, industry, and market cap to identify a more customized benchmark. For Hang Seng Bank, the Fair PE Ratio comes in at 6.68x, so this stock still trades well above what that holistic analysis suggests is justified, even after accounting for its strengths.

When comparing Hang Seng Bank’s actual PE of 19.62x to the Fair Ratio of 6.68x, the stock appears significantly overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hang Seng Bank Narrative

Earlier we hinted there is a smarter way to see through market noise. Welcome to Narratives. Instead of relying solely on traditional metrics, Narratives let you craft a story behind the numbers: your perspective on Hang Seng Bank’s future, including assumptions about revenue, earnings, and what you feel is a fair value.

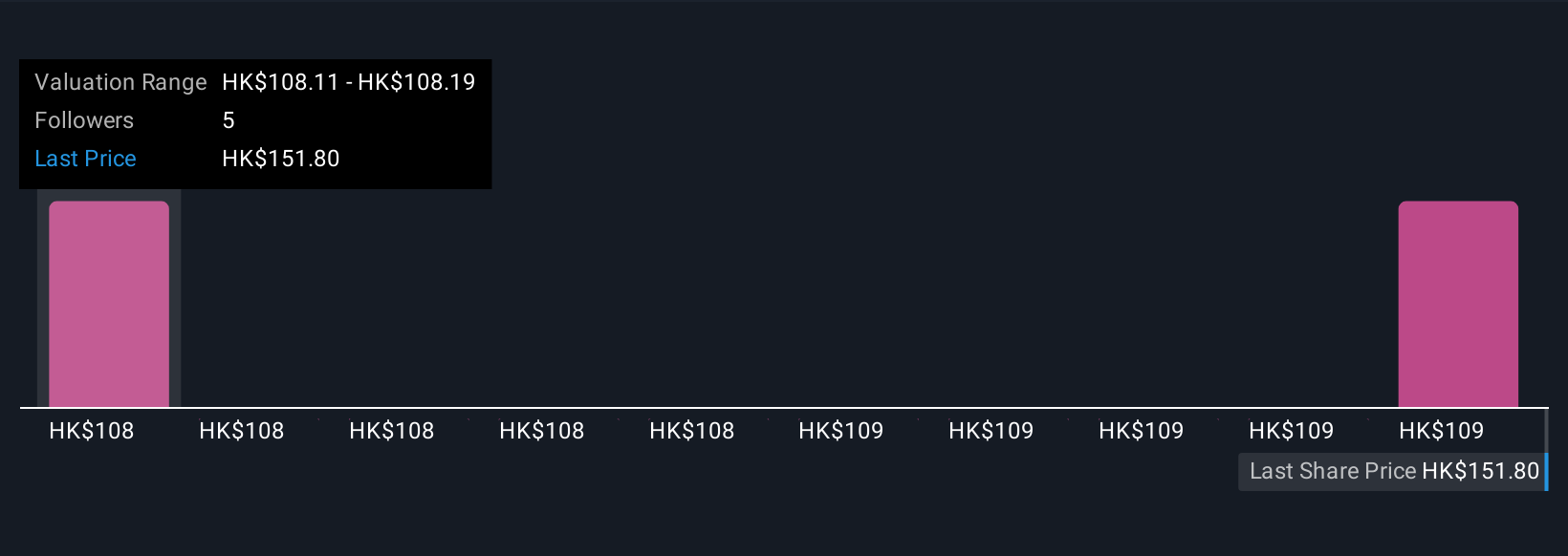

This approach links your understanding of the bank’s business and industry drivers directly to a clear financial forecast. From there, it calculates a fair value unique to your outlook. Narratives are already at your fingertips on Simply Wall St’s Community page, used by millions, making it easy for you to compare your thinking with others and track how your story evolves as new information hits the market.

With Narratives, you can quickly see where your fair value lands versus the current price and decide when it might be time to buy, hold, or sell. Because they update automatically as fresh news or earnings emerge, you are never left making decisions on stale data.

For example, on Hang Seng Bank, the most optimistic investors see value as high as HK$131.0, while the most conservative peg it at just HK$85.0. This reflects how your own Narrative can guide your next move with clarity and confidence.

Do you think there's more to the story for Hang Seng Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hang Seng Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:11

Hang Seng Bank

Provides various banking and related financial services to individual, corporate, commercial, and small and medium sized enterprise customers in Hong Kong, Mainland China, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives