SEHK's Top Insider-Owned Growth Companies For September 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments and interest rate changes, the Hong Kong market has shown resilience amid these fluctuations. With growth stocks outperforming value shares globally, it is an opportune time to examine companies in the SEHK that combine robust growth potential with significant insider ownership. In this context, high insider ownership can signal strong confidence from those who know the company best, aligning management interests with shareholder value.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.7% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Lianlian DigiTech (SEHK:2598) | 19.7% | 92.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Jiangxi Rimag Group (SEHK:2522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Rimag Group Co., Ltd. operates medical imaging centers in China and has a market cap of HK$9.75 billion.

Operations: Revenue from the medical labs and research segment amounts to CN¥812.85 million.

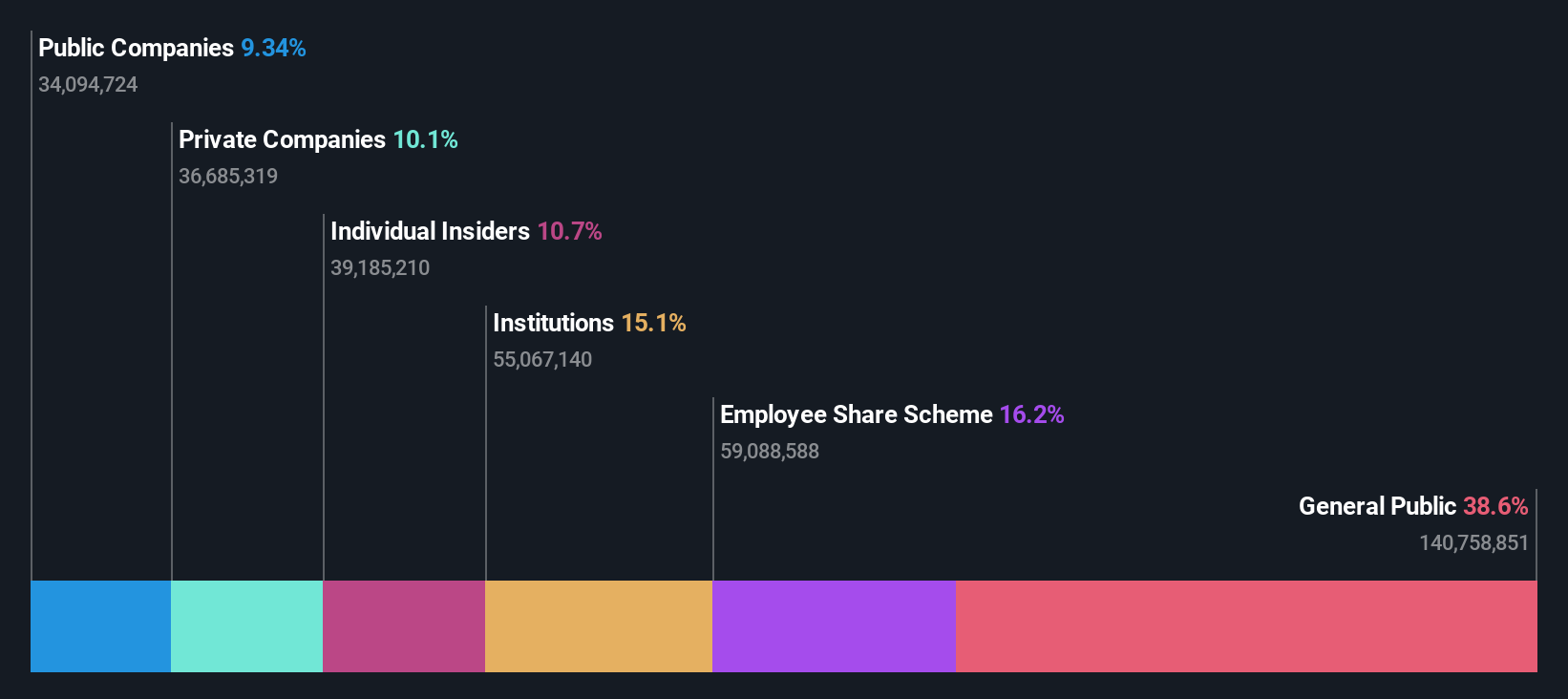

Insider Ownership: 24.3%

Revenue Growth Forecast: 30% p.a.

Jiangxi Rimag Group, a growth company with high insider ownership in Hong Kong, is forecast to see significant earnings growth of 71.8% annually over the next three years, outpacing the market's 11.7%. Despite trading at 44.4% below its estimated fair value, recent results show declining sales (CNY 413.71 million) and net income (CNY 3.84 million). Additionally, profit margins have decreased from last year’s figures and share price volatility remains high.

- Take a closer look at Jiangxi Rimag Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Jiangxi Rimag Group's current price could be inflated.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

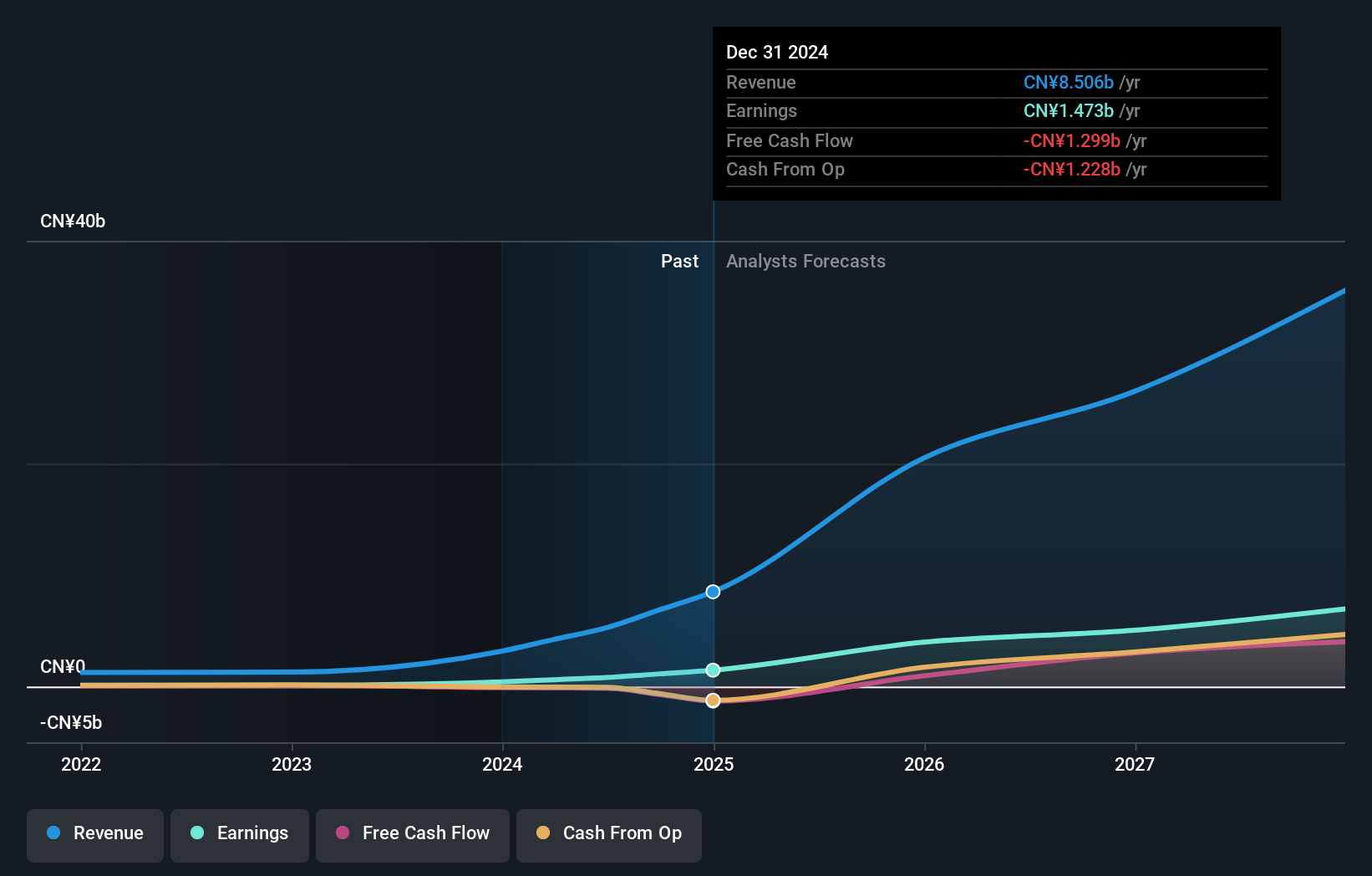

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$19.55 billion.

Operations: Laopu Gold generates revenue of CN¥5.28 billion from its Jewelry & Watches segment in Mainland China, Hong Kong, and Macau.

Insider Ownership: 36.4%

Revenue Growth Forecast: 28.8% p.a.

Laopu Gold's earnings are expected to grow significantly at 34.65% annually, outpacing the Hong Kong market's 11.7%. Revenue is forecast to increase by 28.8% per year, also surpassing the market average of 7.3%. Recent half-year results showed sales of CNY 3.52 billion and net income of CNY 587.81 million, reflecting substantial growth from last year’s figures. The company has completed a HKD 1 billion IPO, enhancing its capital structure and insider ownership remains strong with no recent significant insider trading activity reported.

- Unlock comprehensive insights into our analysis of Laopu Gold stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Laopu Gold shares in the market.

Zhejiang Leapmotor Technology (SEHK:9863)

Simply Wall St Growth Rating: ★★★★★☆

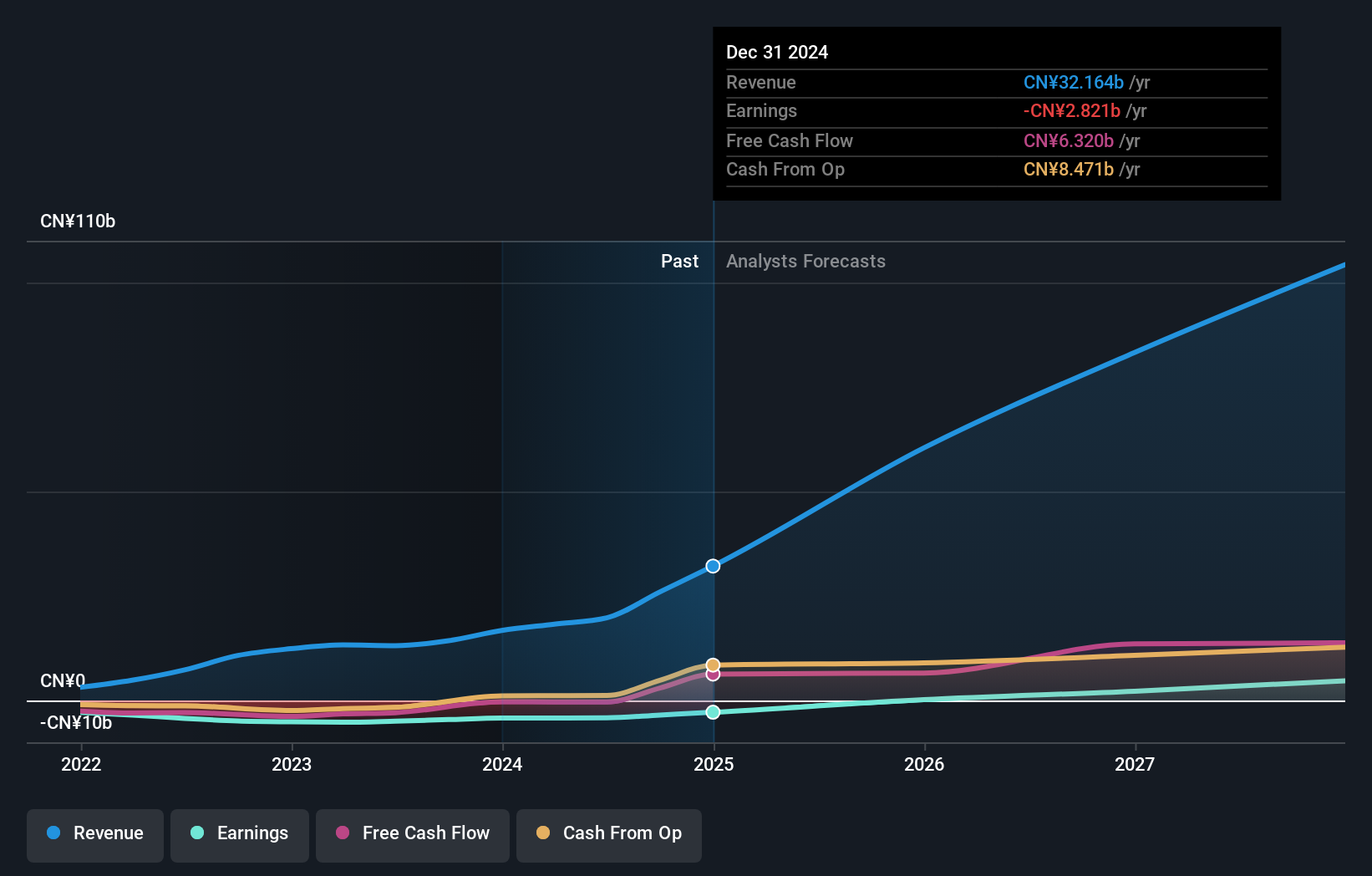

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of energy vehicles in China and has a market cap of HK$31.35 billion.

Operations: The company generates CN¥19.78 billion from its production, research and development, and sales of new energy vehicles.

Insider Ownership: 14.7%

Revenue Growth Forecast: 34.1% p.a.

Zhejiang Leapmotor Technology has seen substantial insider buying in the past three months, signaling confidence from its leadership. The company reported half-year sales of CNY 8.85 billion, up from CNY 5.81 billion a year ago, though it still posted a net loss of CNY 2.21 billion. Earnings are forecast to grow at an impressive rate of nearly 79% annually, with revenue expected to increase by 34.1% per year, outpacing the broader Hong Kong market's growth expectations.

- Get an in-depth perspective on Zhejiang Leapmotor Technology's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Zhejiang Leapmotor Technology's shares may be trading at a discount.

Taking Advantage

- Click through to start exploring the rest of the 43 Fast Growing SEHK Companies With High Insider Ownership now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.