- Hong Kong

- /

- Auto Components

- /

- SEHK:360

We Think New Focus Auto Tech Holdings (HKG:360) Has A Fair Chunk Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies New Focus Auto Tech Holdings Limited (HKG:360) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does New Focus Auto Tech Holdings Carry?

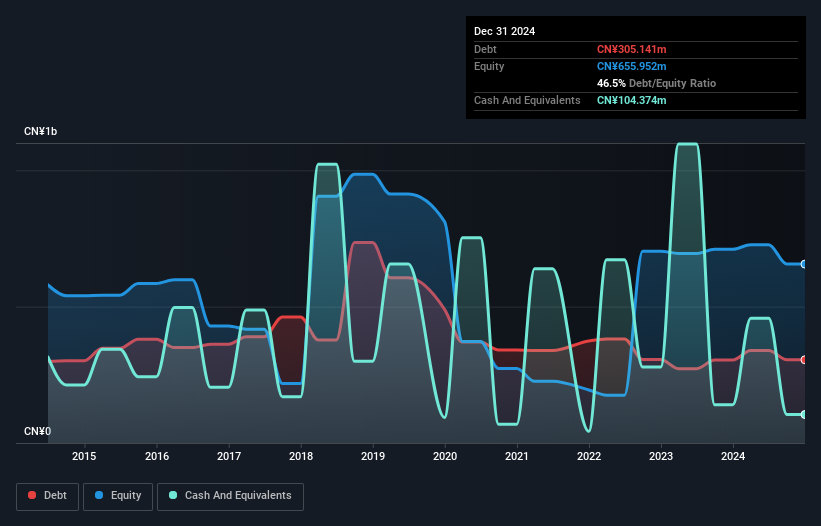

The chart below, which you can click on for greater detail, shows that New Focus Auto Tech Holdings had CN¥305.1m in debt in December 2024; about the same as the year before. However, it does have CN¥104.4m in cash offsetting this, leading to net debt of about CN¥200.8m.

How Strong Is New Focus Auto Tech Holdings' Balance Sheet?

The latest balance sheet data shows that New Focus Auto Tech Holdings had liabilities of CN¥722.6m due within a year, and liabilities of CN¥135.8m falling due after that. Offsetting this, it had CN¥104.4m in cash and CN¥419.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥334.8m.

This deficit isn't so bad because New Focus Auto Tech Holdings is worth CN¥657.2m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But it is New Focus Auto Tech Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

View our latest analysis for New Focus Auto Tech Holdings

Over 12 months, New Focus Auto Tech Holdings made a loss at the EBIT level, and saw its revenue drop to CN¥519m, which is a fall of 6.6%. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months New Focus Auto Tech Holdings produced an earnings before interest and tax (EBIT) loss. Indeed, it lost CN¥66m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of CN¥68m into a profit. So we do think this stock is quite risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with New Focus Auto Tech Holdings , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if New Focus Auto Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:360

New Focus Auto Tech Holdings

An investment holding company, engages in the manufacturing and sales of electronic and power-related automotive parts and accessories in the People’s Republic of China, the United States, Europe, and the Asia Pacific.

Excellent balance sheet with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)