Guangzhou Automobile Group (HKG:2238) Is Due To Pay A Dividend Of CN¥0.1099

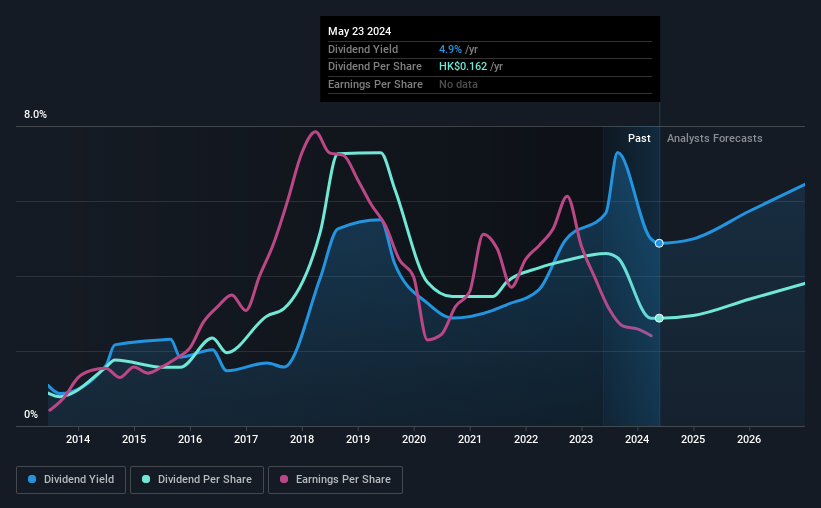

Guangzhou Automobile Group Co., Ltd. (HKG:2238) has announced that it will pay a dividend of CN¥0.1099 per share on the 21st of June. However, the dividend yield of 4.9% is still a decent boost to shareholder returns.

View our latest analysis for Guangzhou Automobile Group

Guangzhou Automobile Group's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Guangzhou Automobile Group is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

The next year is set to see EPS grow by 38.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 32%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was CN¥0.0459 in 2014, and the most recent fiscal year payment was CN¥0.15. This implies that the company grew its distributions at a yearly rate of about 13% over that duration. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Guangzhou Automobile Group's EPS has declined at around 16% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Guangzhou Automobile Group's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Guangzhou Automobile Group is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Guangzhou Automobile Group that investors should know about before committing capital to this stock. Is Guangzhou Automobile Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2238

Guangzhou Automobile Group

Research, develops, manufactures, and sells vehicles and motorcycles, and parts and components in Mainland China and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)