- Hong Kong

- /

- Auto Components

- /

- SEHK:1899

3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable shift as cooling inflation and robust bank earnings have propelled major U.S. stock indexes higher, with value stocks outperforming growth shares significantly. Amid this backdrop, small-cap stocks, as represented by indices like the Russell 2000, have also seen positive momentum, reflecting investor optimism in sectors poised for recovery. In such an environment, identifying promising small-cap companies often involves looking at those with strong fundamentals and insider buying activity across regions—factors that can signal confidence in the company's potential for growth.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.5x | 1.3x | 40.17% | ★★★★★☆ |

| Paradeep Phosphates | 25.7x | 0.8x | 24.73% | ★★★★★☆ |

| Maharashtra Seamless | 10.0x | 1.7x | 36.50% | ★★★★★☆ |

| Robert Walters | 35.7x | 0.2x | 28.68% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 12.6x | 2.1x | 39.49% | ★★★★☆☆ |

| Logistri Fastighets | 12.3x | 8.7x | 42.40% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 12.9x | 4.2x | 7.69% | ★★★☆☆☆ |

| Savaria | 30.7x | 1.6x | 28.10% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.2x | 19.36% | ★★★☆☆☆ |

| THG | NA | 0.3x | -509.22% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Nivika Fastigheter (OM:NIVI B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nivika Fastigheter focuses on real estate rental operations and has a market capitalization of SEK 5.45 billion.

Operations: Nivika Fastigheter generates revenue primarily from its real estate rental segment, with recent figures showing SEK 675.74 million. The company has seen fluctuations in its net income margin, which recently improved to 0.20%. Operating expenses and non-operating expenses significantly impact profitability, with the latter reaching SEK 296.41 million in the latest period.

PE: 28.4x

Nivika Fastigheter exhibits insider confidence with Hakan Eriksson acquiring 75,000 shares valued at SEK 2.8 million, signaling potential undervaluation. The company reported improved financials for the third quarter ending September 2024, with sales rising to SEK 171.31 million and net income of SEK 5.48 million versus a previous loss. Despite relying solely on external borrowing, Nivika's green bond issuance of SEK 400 million aligns with sustainable finance principles, potentially enhancing its growth prospects amidst forecasted earnings growth of nearly 44% annually.

- Click here to discover the nuances of Nivika Fastigheter with our detailed analytical valuation report.

Explore historical data to track Nivika Fastigheter's performance over time in our Past section.

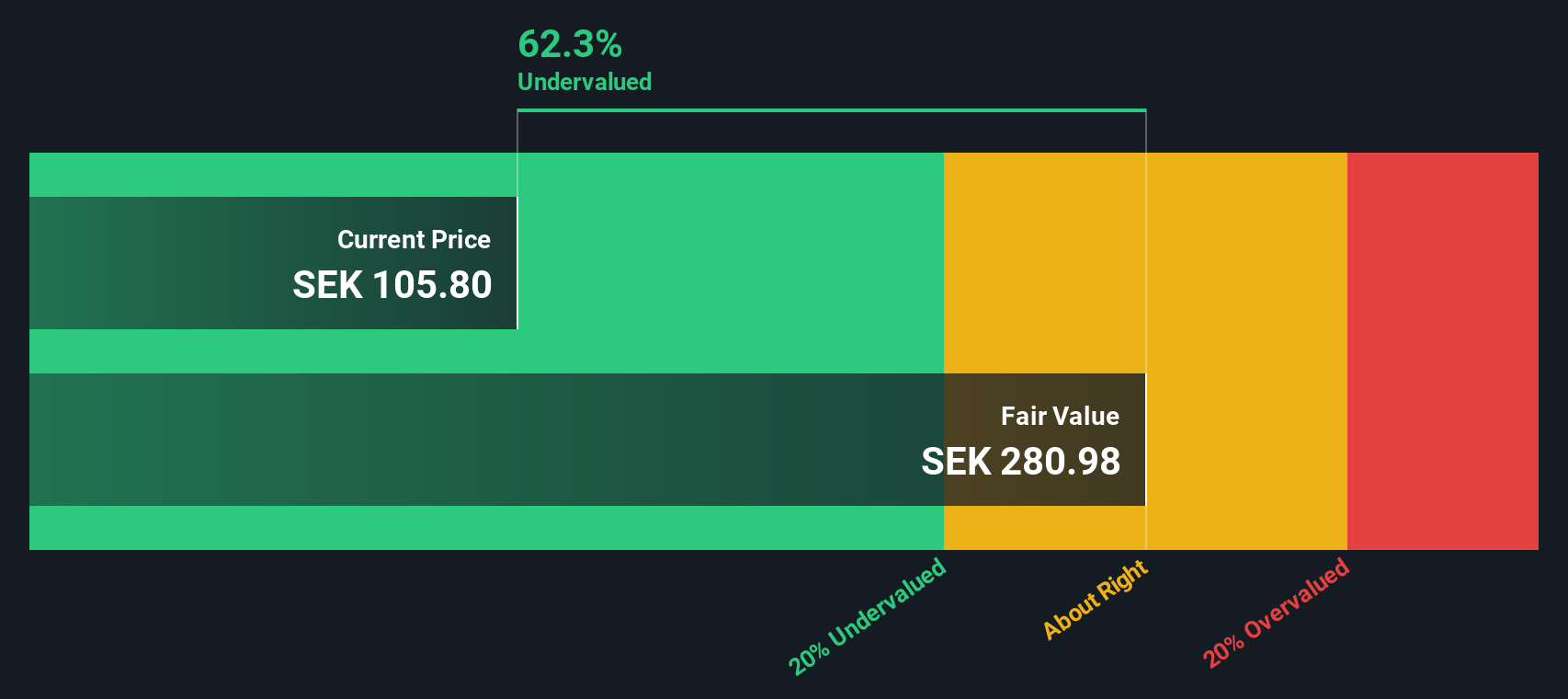

Proact IT Group (OM:PACT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Proact IT Group is a provider of data and information management solutions, operating across the Nordics & Baltics, UK, West (Belgium and Netherlands), and Central (Czech Republic and Germany) regions, with a market capitalization of approximately SEK 2.57 billion.

Operations: Proact IT Group generates revenue primarily from its operations in the Nordics & Baltics, UK, West (Belgium and Netherlands), and Central (Czech Republic and Germany) regions. The company's cost of goods sold significantly impacts its gross profit margin, which has shown a trend reaching 24.20% by September 2024. Operating expenses are largely driven by sales and marketing efforts, with general and administrative costs also contributing to the overall expense structure.

PE: 13.1x

Proact IT Group, a smaller company in the tech sector, has shown impressive growth under its outgoing CEO, with revenues climbing from SEK 3 billion to nearly SEK 5 billion over seven years. Their cloud segment has significantly boosted recurring revenues to almost SEK 1.8 billion. Despite this progress, Proact anticipates a sales dip of 10-15% in Q4 2024 compared to last year. Recent insider confidence is evident through share purchases by executives throughout the past year, reflecting belief in the company's potential amidst leadership transitions and external borrowing risks.

- Take a closer look at Proact IT Group's potential here in our valuation report.

Assess Proact IT Group's past performance with our detailed historical performance reports.

Xingda International Holdings (SEHK:1899)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xingda International Holdings is a company engaged in the production and sale of radial tire cords, bead wires, and other wires, with a market capitalization of approximately CN¥1.95 billion.

Operations: The company generates revenue primarily from the sale of radial tire cords, bead wires, and other wires, with recent revenue reaching CN¥12.24 billion. Gross profit margin has shown a decreasing trend over several periods, recently recorded at 19.46%. Operating expenses have consistently included significant allocations to sales and marketing as well as general and administrative functions.

PE: 5.7x

Xingda International Holdings, a smaller company in the tire cord industry, has been drawing attention for its potential undervaluation. Recently, insider confidence was evident as significant shares were acquired by Liu Jinlan, who increased their stake by 26.41% in November 2024. Despite relying on external borrowing for funding, Xingda's financial position remains stable with manageable debt levels. Additionally, the announcement of a special dividend of HKD 0.15 per share further highlights shareholder value focus amidst ongoing consolidation activities within the company.

Where To Now?

- Investigate our full lineup of 188 Undervalued Small Caps With Insider Buying right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1899

Xingda International Holdings

An investment holding company, manufactures and trades in radial tire cords, bead wires, and other wires in the People's Republic of China, India, the United States, Thailand, Korea, Slovakia, Brazil, and internationally.

Solid track record average dividend payer.