The Price Is Right For Geely Automobile Holdings Limited (HKG:175)

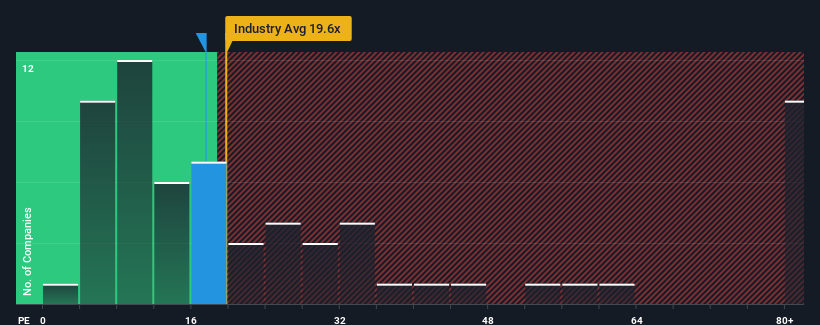

With a price-to-earnings (or "P/E") ratio of 17.5x Geely Automobile Holdings Limited (HKG:175) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

There hasn't been much to differentiate Geely Automobile Holdings' and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Geely Automobile Holdings

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Geely Automobile Holdings' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 9.1% overall from three years ago. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 29% each year over the next three years. That's shaping up to be materially higher than the 16% per annum growth forecast for the broader market.

With this information, we can see why Geely Automobile Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Geely Automobile Holdings' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Geely Automobile Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Geely Automobile Holdings with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Geely Automobile Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:175

Geely Automobile Holdings

An investment holding company, operates as an automobile manufacturer primarily in the People’s Republic of China.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives