- Hong Kong

- /

- Auto Components

- /

- SEHK:1316

Did Nexteer’s New Mexico Technical Center Just Shift Its (SEHK:1316) Investment Narrative?

Reviewed by Sasha Jovanovic

- Nexteer Automotive recently held the opening ceremony for its new Mexico Technical Center (MXTC), highlighting an expansion of local engineering and technical support capabilities for OEM customers in Mexico and North America.

- This center emphasizes the company’s focus on innovation, regional collaboration, and enhancing operational efficiency to support customer-focused growth through a skilled, multidisciplinary workforce.

- We'll explore how the enhanced engineering capabilities brought by the MXTC may shape Nexteer Automotive's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nexteer Automotive Group Investment Narrative Recap

For shareholders in Nexteer Automotive Group, belief in the value of expanding advanced engineering solutions closer to North American OEMs is key. The new Mexico Technical Center (MXTC) could support the company's biggest short-term catalyst, renewed bookings and program wins in the region, but its long-term impact on booking momentum may take time to be realized. The materiality of this news to immediate risks, like shifts in North American OEM demand, remains limited for now.

The recent introduction of Nexteer’s Direct Drive Hand Wheel Actuator (DD-HWA) aligns closely with the MXTC’s focus on next-generation technologies, especially Steer-by-Wire, as the company reinforces its technical edge for future OEM programs. Both developments speak to Nexteer's ongoing commitment to innovation and could become differentiators as automaker requirements grow in complexity for newer models and architectures.

However, behind the momentum in technology launches, investors should be aware...

Read the full narrative on Nexteer Automotive Group (it's free!)

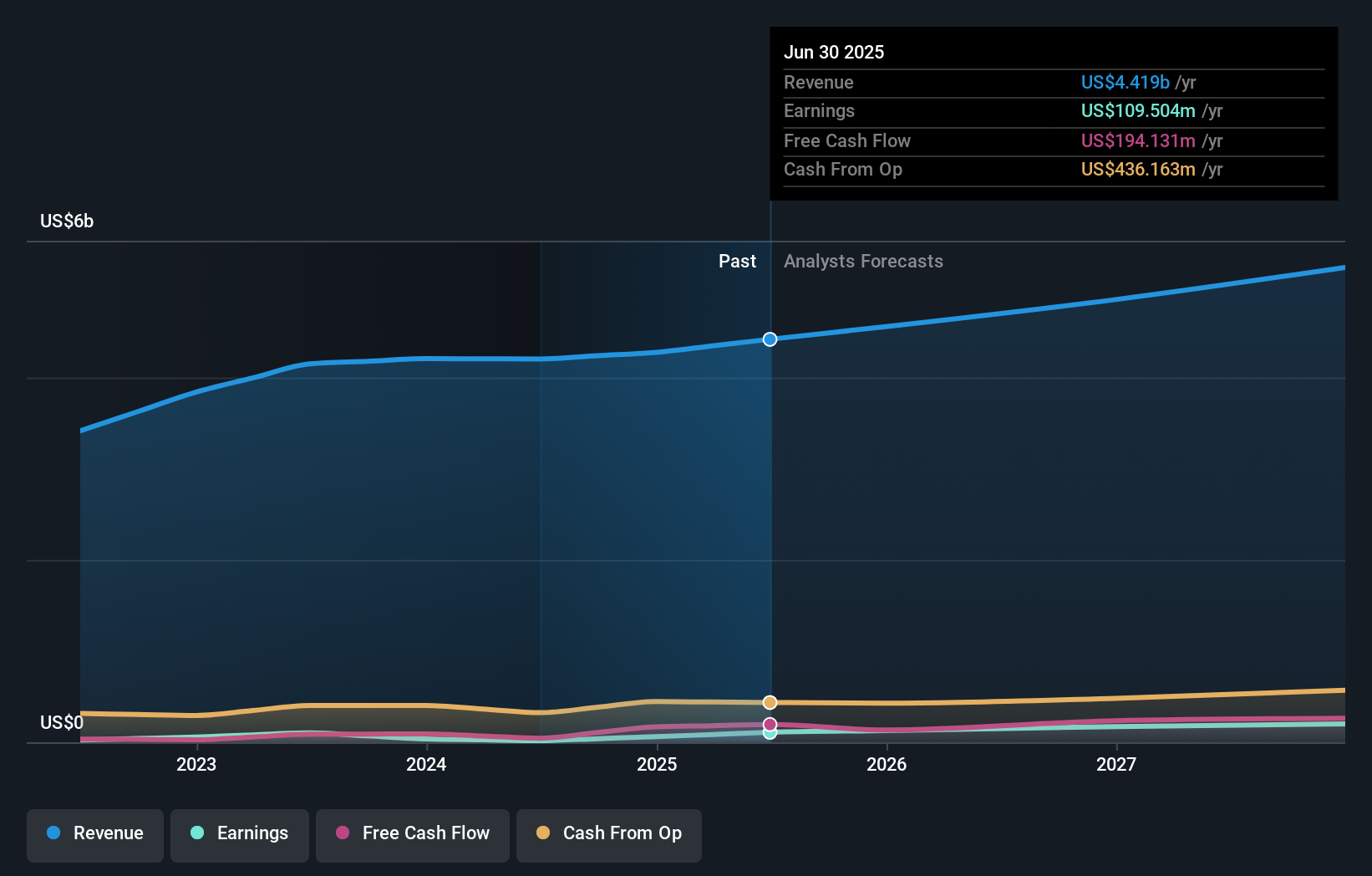

Nexteer Automotive Group is expected to reach $5.0 billion in revenue and $175.4 million in earnings by 2028. This forecast is based on an annual revenue growth rate of 4.4% and a $65.9 million earnings increase from current earnings of $109.5 million.

Uncover how Nexteer Automotive Group's forecasts yield a HK$7.72 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users currently offer one fair value estimate for Nexteer at HK$7.72. While consensus analyst opinion highlights slow booking momentum in North America, community members invite you to consider alternative forecasts and risks.

Explore another fair value estimate on Nexteer Automotive Group - why the stock might be worth as much as 13% more than the current price!

Build Your Own Nexteer Automotive Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nexteer Automotive Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Nexteer Automotive Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nexteer Automotive Group's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nexteer Automotive Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1316

Nexteer Automotive Group

A motion control technology company, develops, manufactures, and supplies steering and driveline systems to original equipment manufacturer worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)