Is It Too Late To Consider BYD After Recent Rally And Cooling Sentiment?

Reviewed by Bailey Pemberton

- If you are wondering whether BYD is still a smart buy at today’s price, or if the big gains are mostly behind it, this article will walk through what the current market is really pricing in.

- After a 14.4% gain year to date and a 46.5% climb over 3 years, the recent 2.0% pullback over the last month suggests sentiment is cooling a bit, but not necessarily the long term story.

- Investors have been reacting to a mix of headlines around global EV competition, shifting subsidies in China, and ongoing trade tensions that could affect export-led growth. At the same time, BYD’s push into new overseas markets and its expanding model lineup have kept it firmly in the conversation as a long term EV leader.

- Right now, BYD only scores 1 out of 6 on our basic undervaluation checks. This might sound underwhelming at first. However, different valuation approaches can tell very different stories, and there is an even better way to think about fair value that we will get to by the end of this article.

BYD scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BYD Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today’s value. For BYD, this is done using a 2 stage Free Cash Flow to Equity approach in CN¥.

BYD’s latest twelve month free cash flow is negative at roughly CN¥29.1 billion, reflecting heavy investment. Analysts expect this to swing strongly positive, with CN¥66.2 billion in free cash flow projected for 2026 and around CN¥101.3 billion by 2035, based on analyst estimates for the next few years and then Simply Wall St extrapolations for later years.

When all of those future cash flows are discounted back to today, the model estimates an intrinsic value of about HK$111.82 per share. Compared with the current share price, this implies the stock is roughly 11.9% undervalued, which indicates a modest margin of safety for long term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BYD is undervalued by 11.9%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

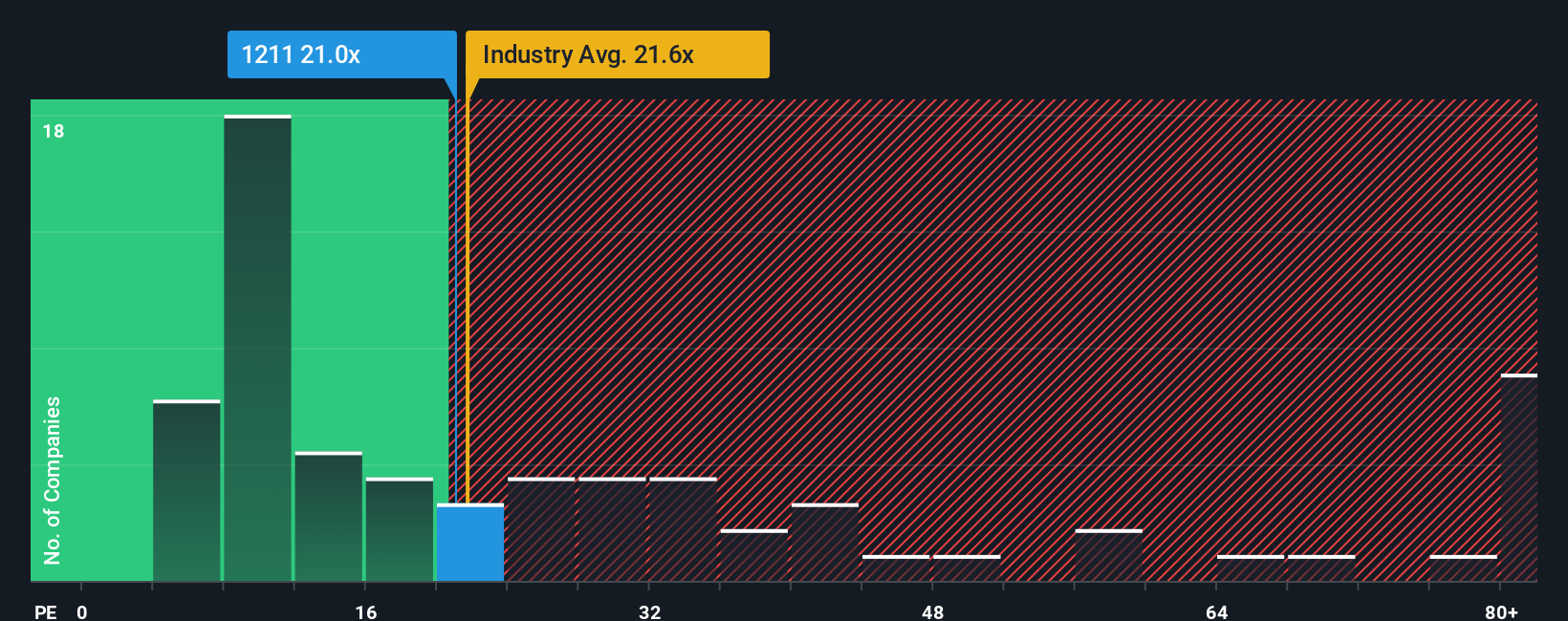

Approach 2: BYD Price vs Earnings

For a profitable company like BYD, the price to earnings (PE) ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It naturally connects today’s share price with the earnings power that ultimately supports it.

A higher PE can be justified when investors expect faster earnings growth or perceive lower risk, while slower growth or higher uncertainty usually calls for a lower PE. BYD currently trades on a PE of about 21.2x, above both the Auto industry average of roughly 18.7x and the peer group average near 8.9x, which suggests the market is already baking in stronger prospects.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable PE should be once you factor in BYD’s earnings growth outlook, profitability, risk profile, industry dynamics and market cap. For BYD, this Fair Ratio comes out at around 14.6x, indicating the current 21.2x multiple sits meaningfully above what those fundamentals alone would justify. On this basis, the stock looks priced at a premium to its fair multiple.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

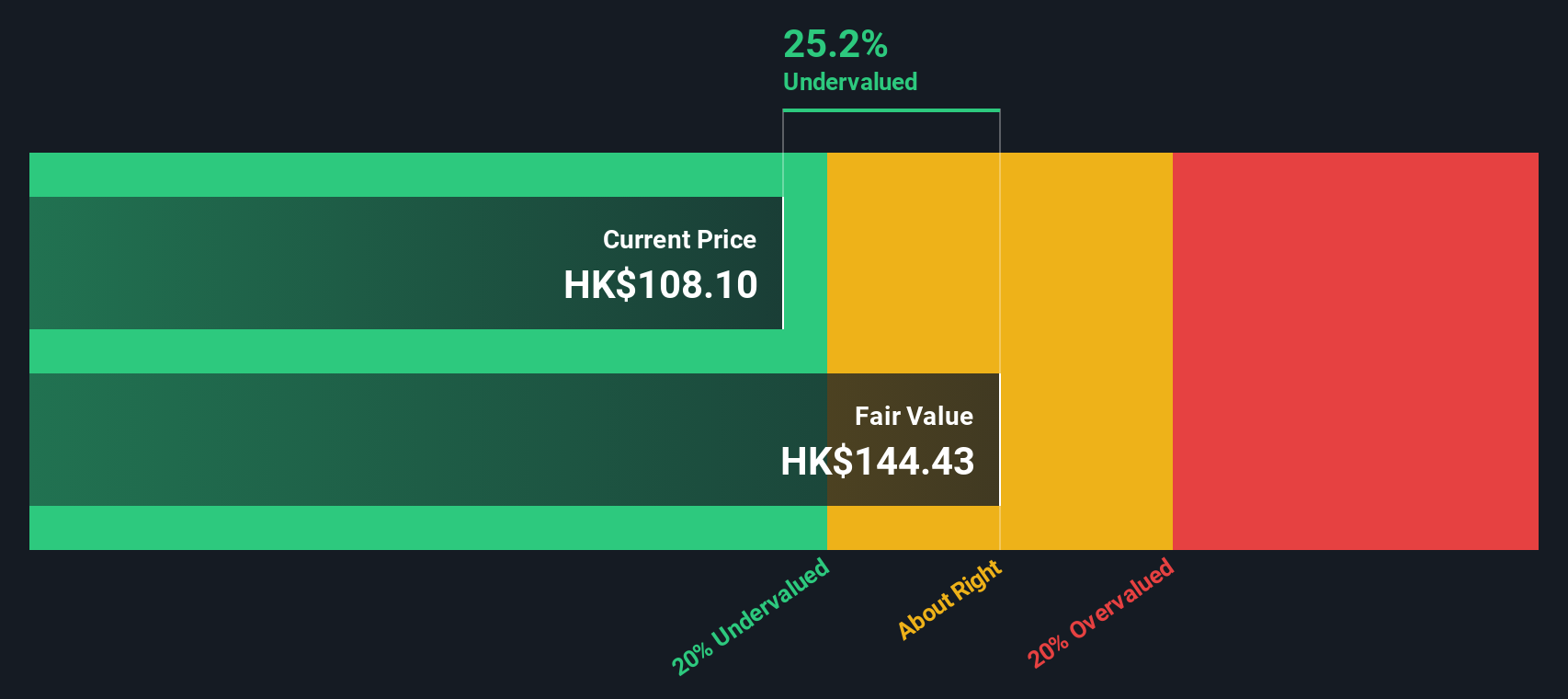

Upgrade Your Decision Making: Choose your BYD Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by combining your view of BYD’s future revenue, earnings and margins with a corresponding fair value estimate. A Narrative links three things together in one place: the company’s story, a financial forecast, and the fair value that naturally follows from that forecast. On Simply Wall St’s Community page, used by millions of investors, you can create or explore Narratives for BYD, adjusting assumptions in an accessible way while the platform automatically converts them into projected cash flows and a fair value you can compare to today’s share price to decide if BYD looks like a buy, hold or sell. Narratives also update dynamically as new information arrives, such as earnings results or major news, so your story and valuation stay in sync with reality. For example, one BYD Narrative might assume very strong global expansion and high margins that justify a much higher fair value, while another assumes slower growth and thinner margins that result in a far lower fair value.

Do you think there's more to the story for BYD? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)