- Greece

- /

- Renewable Energy

- /

- ATSE:TENERGY

TERNA ENERGY Industrial Commercial Technical Societe Anonyme's (ATH:TENERGY) investors will be pleased with their enviable 388% return over the last five years

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. To wit, the TERNA ENERGY Industrial Commercial Technical Societe Anonyme (ATH:TENERGY) share price has soared 300% over five years. This just goes to show the value creation that some businesses can achieve. In the last week shares have slid back 2.1%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for TERNA ENERGY Industrial Commercial Technical Societe Anonyme

SWOT Analysis for TERNA ENERGY Industrial Commercial Technical Societe Anonyme

- No major strengths identified for TENERGY.

- Earnings declined over the past year.

- Interest payments on debt are not well covered.

- Dividend is low compared to the top 25% of dividend payers in the Renewable Energy market.

- Annual revenue is forecast to grow faster than the Greek market.

- Trading below our estimate of fair value by more than 20%.

- Debt is not well covered by operating cash flow.

- Dividends are not covered by earnings.

We don't think that TERNA ENERGY Industrial Commercial Technical Societe Anonyme's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, TERNA ENERGY Industrial Commercial Technical Societe Anonyme can boast revenue growth at a rate of 7.6% per year. That's a pretty good long term growth rate. Arguably it's more than reflected in the very strong share price gain of 32% a year over a half a decade. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

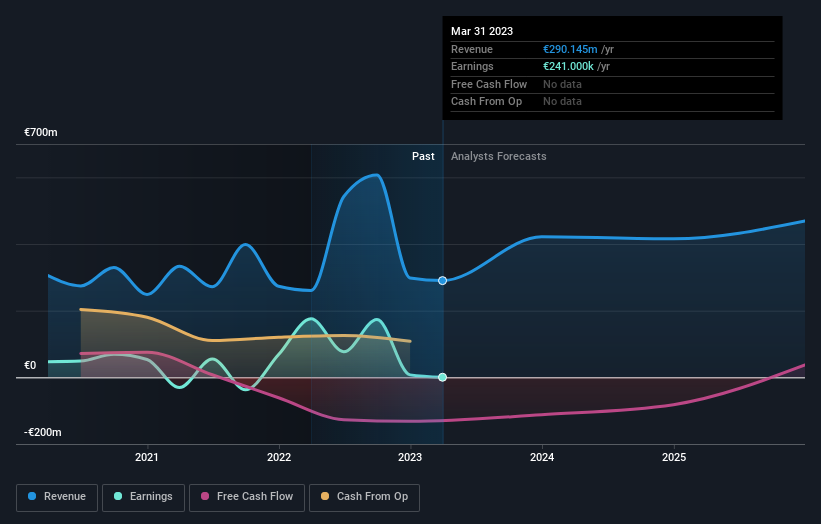

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling TERNA ENERGY Industrial Commercial Technical Societe Anonyme stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for TERNA ENERGY Industrial Commercial Technical Societe Anonyme the TSR over the last 5 years was 388%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

TERNA ENERGY Industrial Commercial Technical Societe Anonyme shareholders gained a total return of 12% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 37% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for TERNA ENERGY Industrial Commercial Technical Societe Anonyme (1 shouldn't be ignored!) that you should be aware of before investing here.

But note: TERNA ENERGY Industrial Commercial Technical Societe Anonyme may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

If you're looking to trade TERNA ENERGY Industrial Commercial Technical Societe Anonyme, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TERNA ENERGY Industrial Commercial Technical Societe Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:TENERGY

TERNA ENERGY Industrial Commercial Technical Societe Anonyme

Operates in the renewable energy sources sector in Greece, Balkans, Eastern Europe, and North America.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives