- Greece

- /

- Real Estate

- /

- ATSE:LAMDA

Market Still Lacking Some Conviction On LAMDA Development S.A. (ATH:LAMDA)

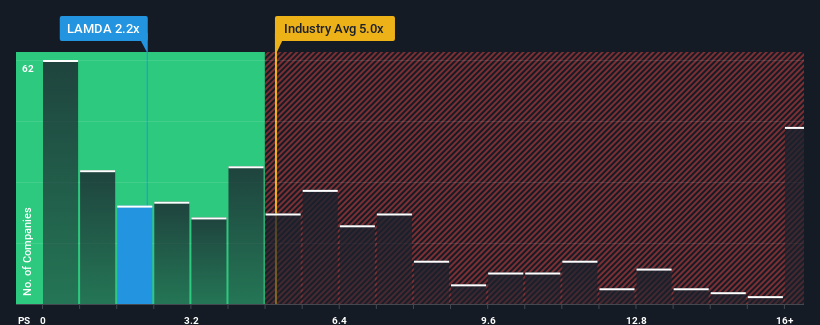

When you see that almost half of the companies in the Real Estate industry in Greece have price-to-sales ratios (or "P/S") above 6.6x, LAMDA Development S.A. (ATH:LAMDA) looks to be giving off very strong buy signals with its 2.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for LAMDA Development

What Does LAMDA Development's Recent Performance Look Like?

LAMDA Development could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LAMDA Development.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as LAMDA Development's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 150% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 37% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to contract by 7.7%, which would indicate the company is doing very well.

With this information, we find it very odd that LAMDA Development is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What We Can Learn From LAMDA Development's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into LAMDA Development's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for LAMDA Development you should be aware of.

If you're unsure about the strength of LAMDA Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:LAMDA

LAMDA Development

Lamda Development S.A., together with its subsidiaries, engages in the investment in, development, and project management activities in the commercial real estate market in Greece and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives