A Piece Of The Puzzle Missing From Loulis Mills S.A.'s (ATH:KYLO) Share Price

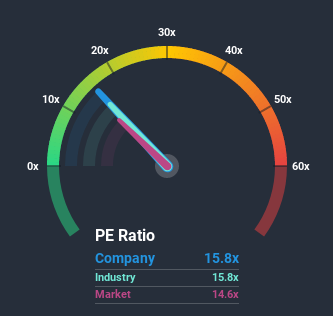

There wouldn't be many who think Loulis Mills S.A.'s (ATH:KYLO) price-to-earnings (or "P/E") ratio of 15.8x is worth a mention when the median P/E in Greece is similar at about 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Loulis Mills has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Loulis Mills

Does Loulis Mills Have A Relatively High Or Low P/E For Its Industry?

An inspection of the typical P/E's throughout Loulis Mills' industry may help to explain its fairly average P/E ratio. You'll notice in the figure below that P/E ratios in the Food industry are also similar to the market. So it appears the company's ratio could be influenced considerably by these industry numbers currently. Some industry P/E's don't move around a lot and right now most companies within the Food industry should be getting restrained. Ultimately though, it's going to be the fundamentals of the business like earnings and growth that count most.

Is There Some Growth For Loulis Mills?

The only time you'd be comfortable seeing a P/E like Loulis Mills' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 139%. EPS has also lifted 8.6% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Comparing that to the market, which is predicted to shrink 6.3% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's peculiar that Loulis Mills' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Loulis Mills revealed its growing earnings over the medium-term aren't contributing to its P/E as much as we would have predicted, given the market is set to shrink. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Loulis Mills (2 are a bit concerning!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Loulis Mills. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade Loulis Mills, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ATSE:KYLO

Loulis Food Ingredients

Produces and supplies raw materials for nutrition in Greece, Cyprus, and Bulgaria.

Flawless balance sheet and good value.

Market Insights

Community Narratives