Lacklustre Performance Is Driving Fieratex S.A.'s (ATH:FIER) Low P/S

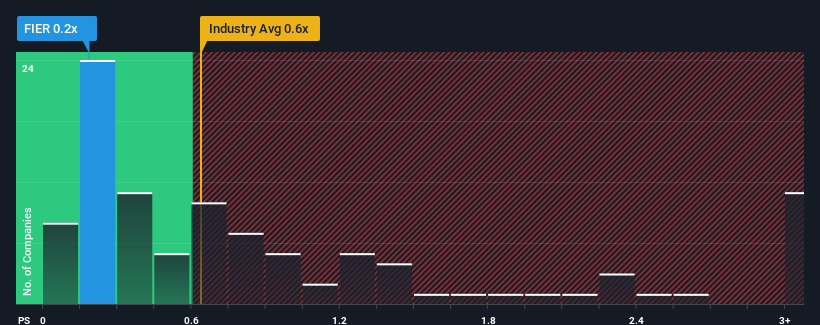

With a price-to-sales (or "P/S") ratio of 0.2x Fieratex S.A. (ATH:FIER) may be sending bullish signals at the moment, given that almost half of all the Luxury companies in Greece have P/S ratios greater than 1.4x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Fieratex

What Does Fieratex's Recent Performance Look Like?

For instance, Fieratex's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Fieratex will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Fieratex's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 7.9% shows it's noticeably less attractive.

With this information, we can see why Fieratex is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Fieratex revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Fieratex that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:FIER

Slight and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)