- United Kingdom

- /

- Other Utilities

- /

- LSE:TEP

Undiscovered Gems In The UK Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The UK market has recently been under pressure, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, which has impacted companies heavily reliant on global commodity demand. In this challenging environment, small-cap stocks can offer unique opportunities for investors seeking growth potential that may be overlooked in larger indices; identifying these "undiscovered gems" requires a keen eye for companies with strong fundamentals and resilience amidst broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Applied Nutrition (LSE:APN)

Simply Wall St Value Rating: ★★★★★★

Overview: Applied Nutrition Plc manufactures, wholesales, and retails sports nutritional products in the United Kingdom and internationally, with a market capitalization of £347.50 million.

Operations: Applied Nutrition generates its revenue primarily through the sale of sports nutritional products across wholesale and retail channels. The company's financial performance is influenced by its ability to manage production costs and optimize pricing strategies.

Applied Nutrition, a rising star in the UK market, recently joined the FTSE All-Share Index after completing an IPO worth £157.5 million. Over the past year, earnings surged by 37.5%, outpacing the Personal Products industry's 10.8% growth rate. The company reported net income of £18.74 million for the year ended July 2024, compared to £13.63 million previously, with sales increasing from £60.78 million to £86.15 million in that period. Trading at 26% below its estimated fair value and being debt-free enhances its appeal as a potential investment opportunity with promising revenue forecasts of nearly 12% annual growth.

- Unlock comprehensive insights into our analysis of Applied Nutrition stock in this health report.

Explore historical data to track Applied Nutrition's performance over time in our Past section.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider delivering solutions to the automotive industry both in the United Kingdom and internationally, with a market cap of £290.16 million.

Operations: Pinewood Technologies Group derives its revenue primarily from its software segment, generating £22.62 million.

Pinewood Technologies Group, a small player in the UK tech scene, recently inked a significant 5-year contract with Marshall Motor Group, enhancing its market presence. Despite reporting a drop in net income to £5 million from £26.9 million last year, Pinewood's sales climbed to £16.1 million from £11 million. The company's debt management appears robust with its debt-to-equity ratio dropping from 65.6% to 25.9% over five years and interest payments well-covered by EBIT at 100x coverage. Although shareholders faced dilution this year, the stock trades at an attractive 34.8% below estimated fair value, offering potential upside as earnings are forecasted to grow by over 25% annually.

Telecom Plus (LSE:TEP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Telecom Plus Plc provides utility services in the United Kingdom and has a market capitalization of approximately £1.35 billion.

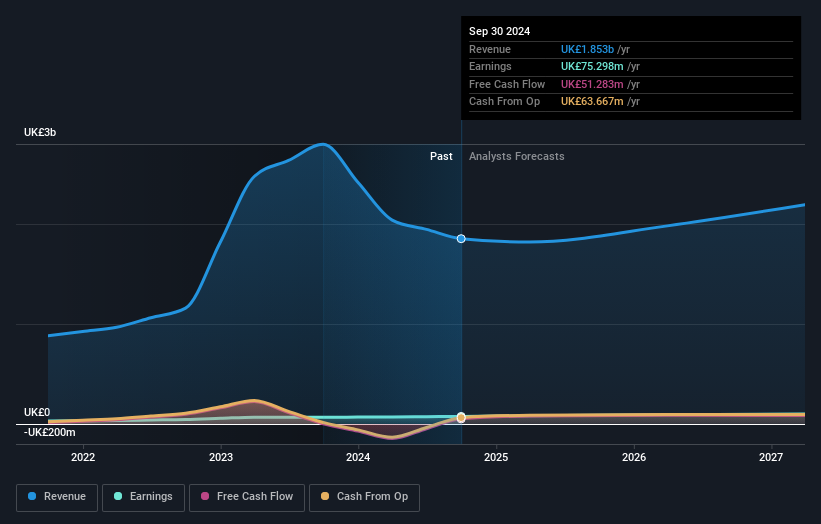

Operations: Telecom Plus generates revenue primarily from its non-regulated utility segment, totaling £1.85 billion.

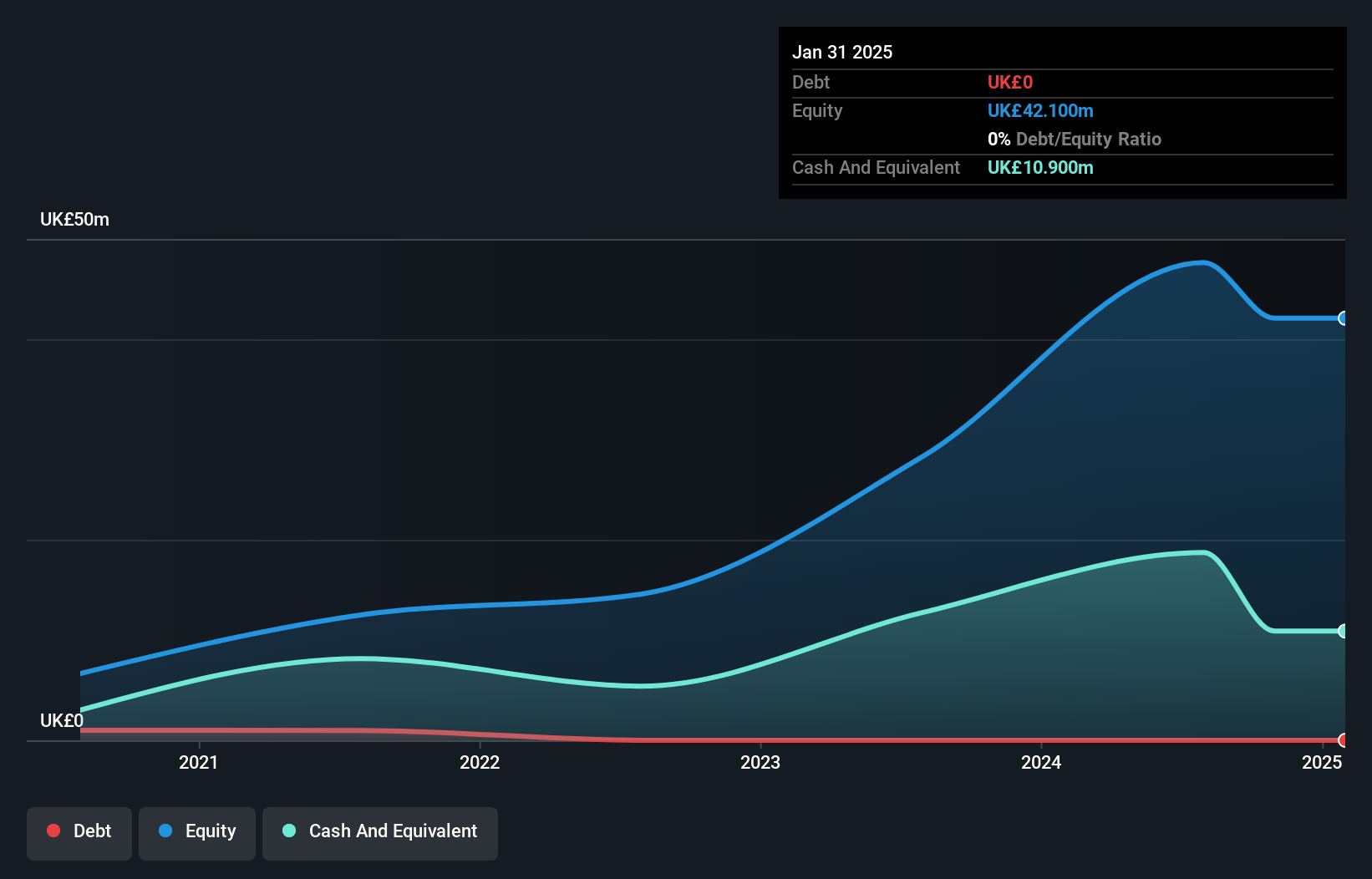

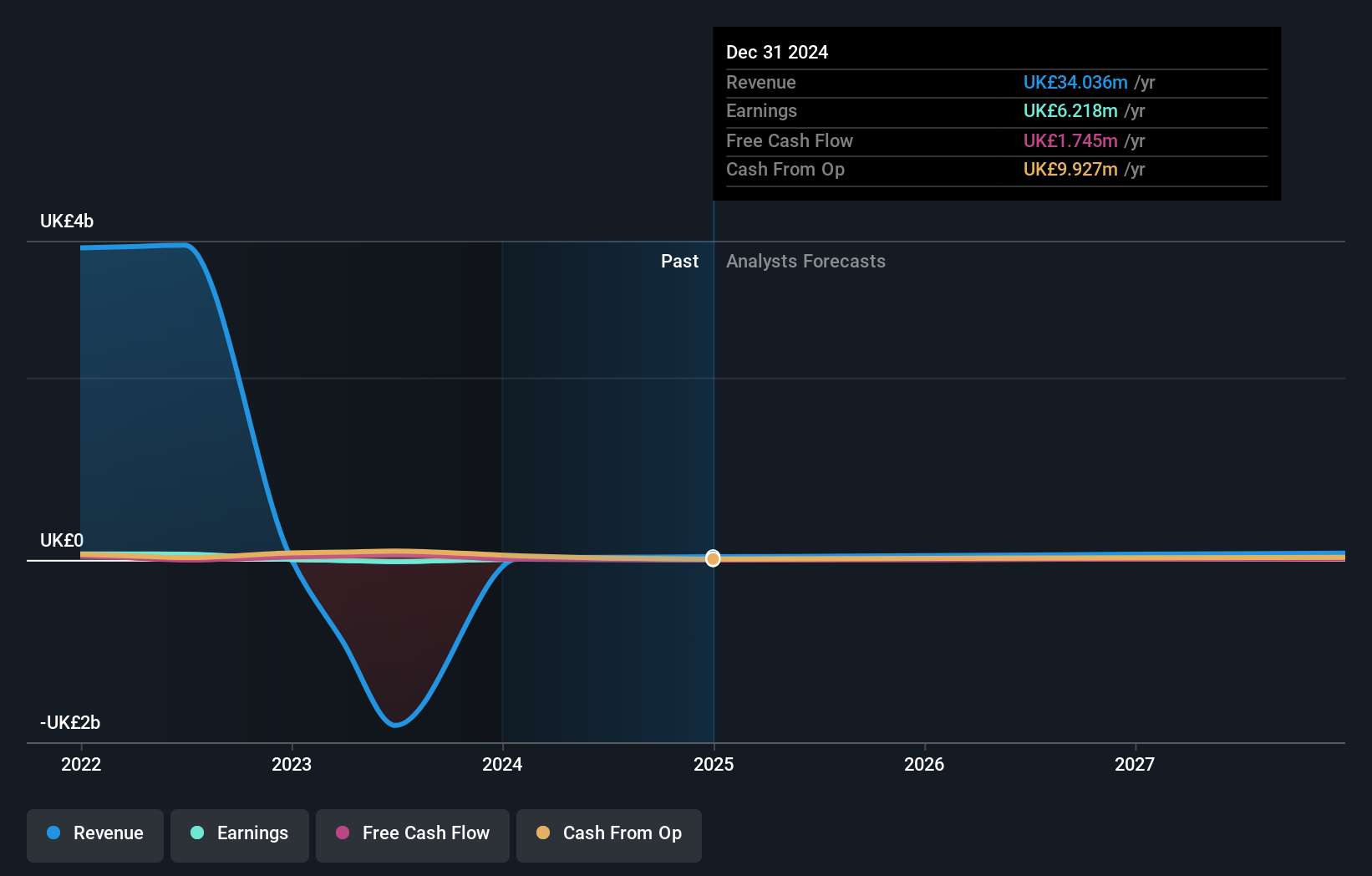

Telecom Plus, a smaller player in the utilities sector, has shown promising financial resilience despite some challenges. Over the past five years, its debt to equity ratio increased from 31.6% to 79.8%, indicating a rise in leverage; however, interest payments are well covered by EBIT at 12.1x coverage. The company reported half-year sales of £697.75 million and net income of £27.63 million for September 2024, with basic earnings per share rising to £0.351 from £0.295 last year—an indication of solid profitability amidst declining sales figures compared to the previous year’s £883.63 million revenue performance.

- Click here to discover the nuances of Telecom Plus with our detailed analytical health report.

Understand Telecom Plus' track record by examining our Past report.

Make It Happen

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 65 more companies for you to explore.Click here to unveil our expertly curated list of 68 UK Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telecom Plus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TEP

Telecom Plus

Engages in the provision of utility services in the United Kingdom.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives