- United Kingdom

- /

- Chemicals

- /

- LSE:VCT

Undervalued Small Caps With Insider Action In UK For February 2025

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been influenced by weak trade data from China, causing the FTSE 100 and FTSE 250 to slip amid concerns over global economic recovery. As these indices react to international pressures, small-cap stocks in the UK present unique opportunities for investors seeking potential value amidst broader market challenges. In this context, identifying small-cap companies with notable insider activity can provide insights into potential undervaluation and resilience in a fluctuating economic environment.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 21.5x | 5.5x | 26.52% | ★★★★★★ |

| Stelrad Group | 11.9x | 0.6x | 22.20% | ★★★★★★ |

| Speedy Hire | NA | 0.2x | 39.33% | ★★★★★☆ |

| Gamma Communications | 23.1x | 2.4x | 36.75% | ★★★★☆☆ |

| CVS Group | 26.4x | 1.1x | 46.31% | ★★★★☆☆ |

| Franchise Brands | 38.2x | 2.0x | 30.44% | ★★★★☆☆ |

| XPS Pensions Group | 11.5x | 3.3x | 3.36% | ★★★☆☆☆ |

| Telecom Plus | 17.5x | 0.7x | 32.13% | ★★★☆☆☆ |

| Warpaint London | 24.3x | 4.2x | 1.71% | ★★★☆☆☆ |

| Eagle Eye Solutions Group | 18.7x | 2.3x | 22.02% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

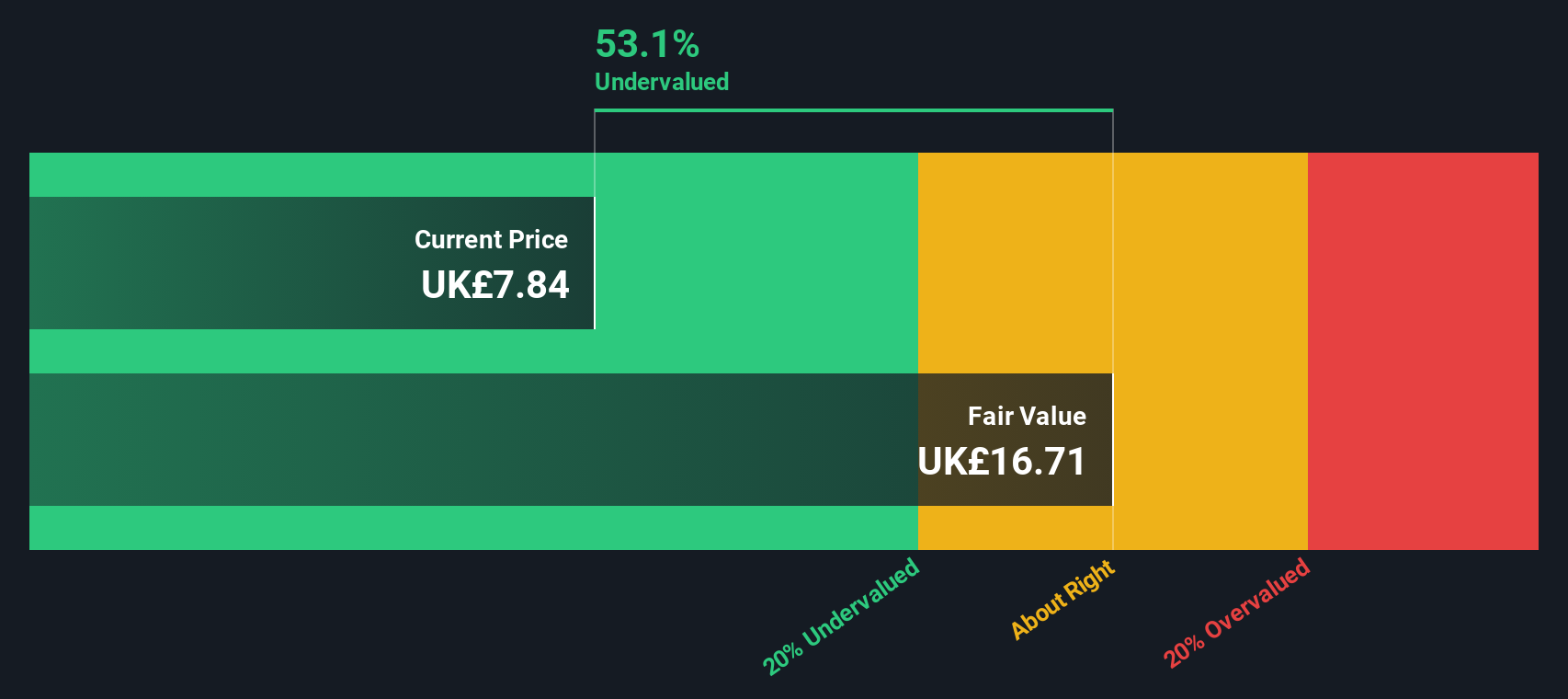

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pinewood Technologies Group specializes in software solutions, with a focus on automotive retail management systems, and has a market capitalization of £1.35 billion.

Operations: Pinewood Technologies Group primarily generates revenue from its software segment, with a recent gross profit margin of 88.98%. The company's cost structure includes operating expenses and non-operating expenses, which have impacted its net income over various periods.

PE: 37.2x

Pinewood Technologies Group, a small company in the UK, is drawing attention for its potential value. They have not diluted shares over the past year, suggesting stability in shareholder equity. Insider confidence is evident as Ollie Mann purchased 31,498 shares worth £102,452 recently. Despite relying on external borrowing for funding—a higher-risk approach—earnings are forecasted to grow by 25% annually. This growth outlook may appeal to investors seeking opportunities in smaller companies with promising trajectories.

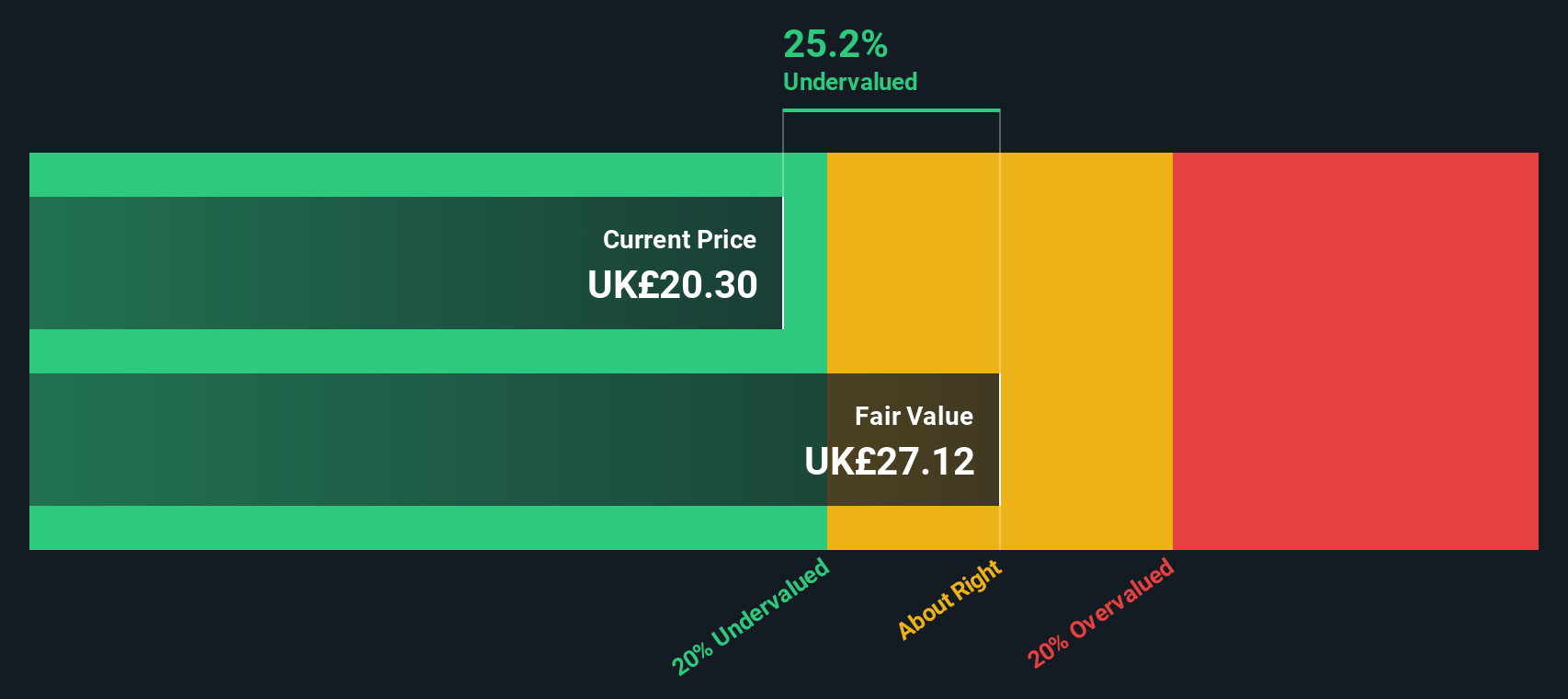

Telecom Plus (LSE:TEP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Telecom Plus is a multi-utility provider offering bundled services such as energy, broadband, and mobile to residential and small business customers, with a market cap of £1.67 billion.

Operations: The company's revenue is primarily derived from non-regulated utility services, reaching £1.85 billion. Over recent periods, the gross profit margin has shown an upward trend, reaching 19.32% by September 2024. Operating expenses are a significant cost component, with general and administrative expenses consistently being the largest portion of these costs.

PE: 17.5x

Telecom Plus, a smaller player in the UK market, has seen insider confidence with Charles Wigoder purchasing 200,000 shares for £3.54 million recently. Despite a drop in sales to £697.75 million for the half-year ending September 2024 from £883.63 million previously, net income rose to £27.63 million from £23.37 million, indicating operational resilience and potential growth prospects with earnings forecasted to grow by nearly 12% annually. The company's reliance on external borrowing adds risk but hasn't hindered profitability improvements or dividend offerings of £0.37 per share due December 2024.

- Navigate through the intricacies of Telecom Plus with our comprehensive valuation report here.

Gain insights into Telecom Plus' past trends and performance with our Past report.

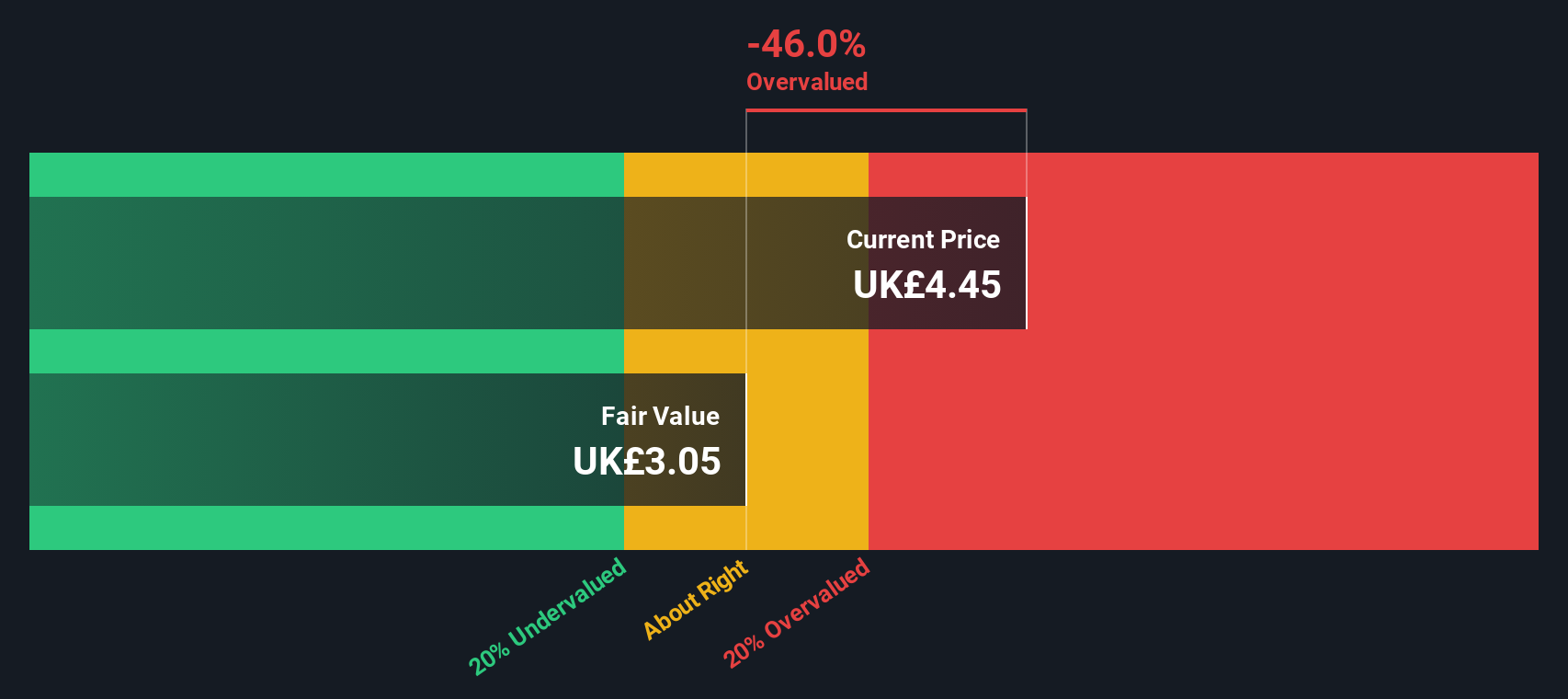

Victrex (LSE:VCT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Victrex is a company specializing in the production of high-performance polymers, particularly polyaryletherketones (PAEK), with a market capitalization of £1.49 billion.

Operations: Victrex generates revenue primarily from its Sustainable Solutions segment, amounting to £240.60 million, while the Medical segment contributes £53 million. The company's gross profit margin has experienced a notable decline from 65.01% in March 2014 to 44.36% by September 2024, reflecting changes in cost structures and pricing strategies over time.

PE: 50.2x

Victrex, a UK-based company, is drawing attention in the small-cap sector due to its potential for growth despite recent financial challenges. Insider confidence is evident with purchases made in the past year, reflecting belief in future prospects. Although sales dropped to £291 million and net income fell to £17.2 million for fiscal 2024, earnings are projected to grow by 29% annually. The firm relies entirely on external borrowing, posing higher risk but manageable under current conditions.

- Take a closer look at Victrex's potential here in our valuation report.

Examine Victrex's past performance report to understand how it has performed in the past.

Make It Happen

- Click here to access our complete index of 40 Undervalued UK Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VCT

Victrex

Through its subsidiaries, engages in the manufacture and sale of polymer solutions worldwide.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)