- United Kingdom

- /

- Communications

- /

- AIM:FTC

Exploring Filtronic And Two Other Promising Small Caps In The UK

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weak trade data from China and declining commodity prices, the UK market presents both challenges and opportunities for investors. In this environment, identifying promising small-cap stocks requires a keen eye for companies with robust fundamentals and growth potential that can withstand broader economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology across various regions including the United Kingdom, Europe, and the Americas with a market cap of £287.89 million.

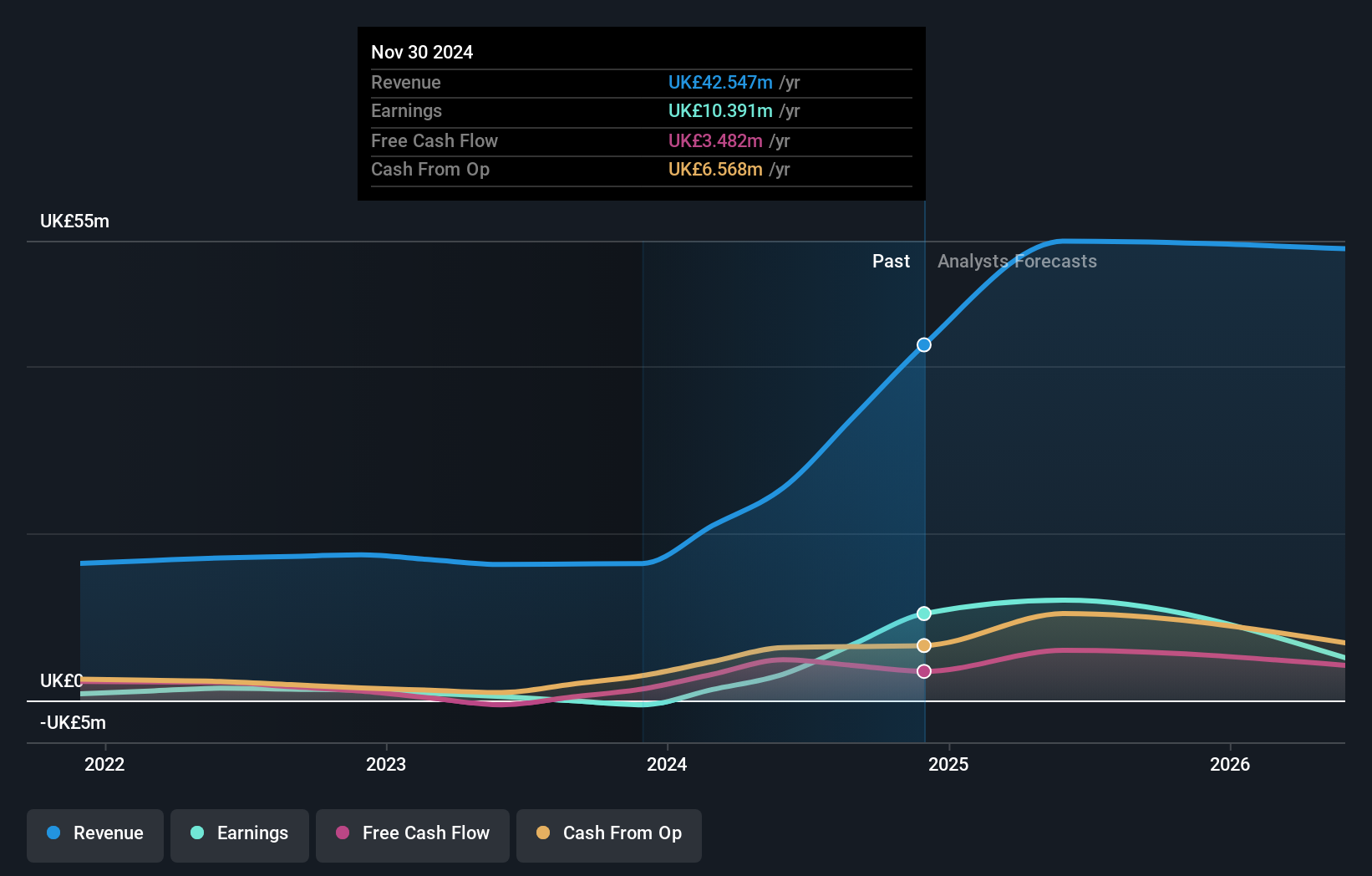

Operations: Revenue for Filtronic primarily comes from its Wireless Communications Equipment segment, totaling £56.32 million.

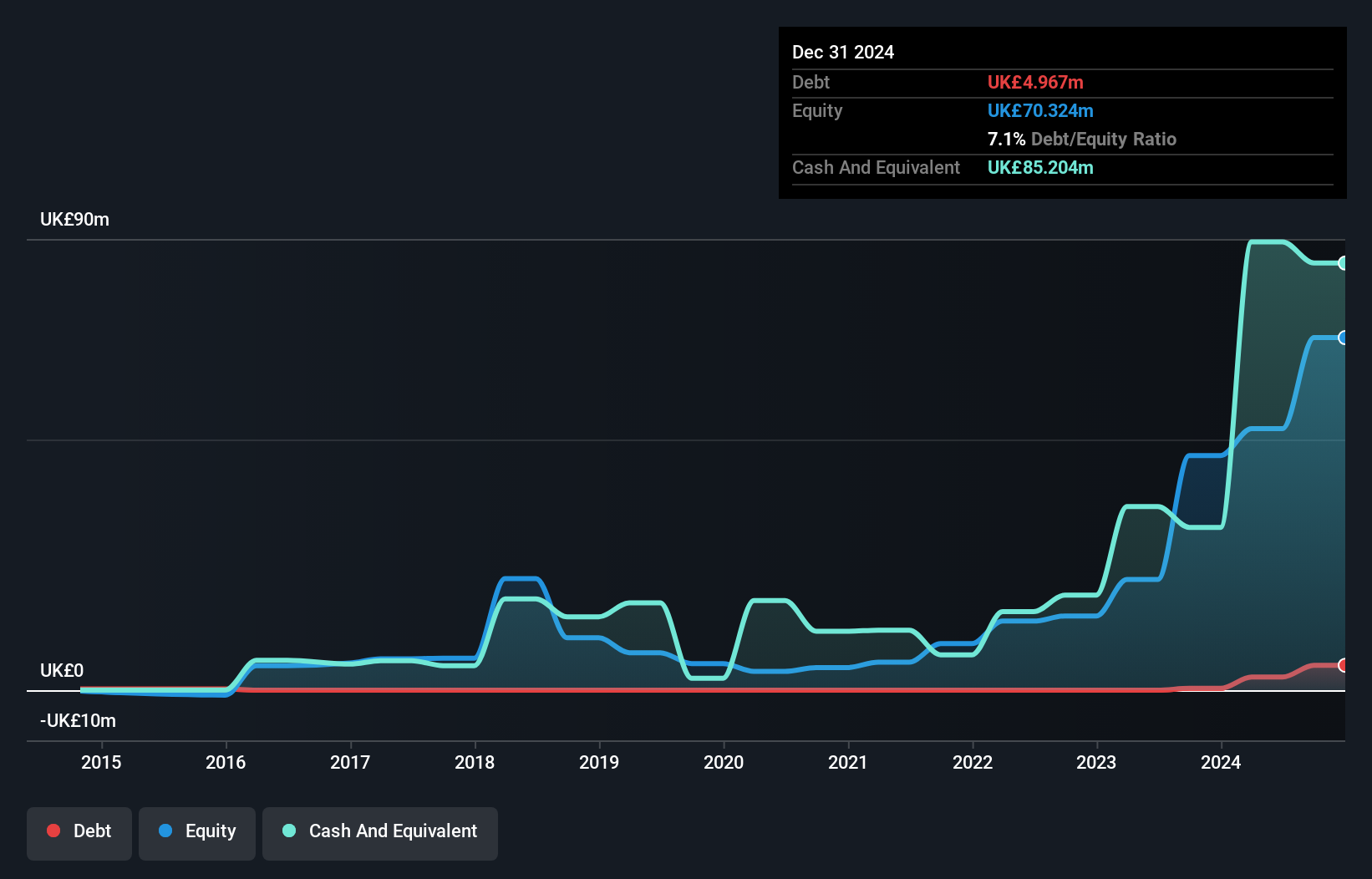

Filtronic, a nimble player in the communications sector, has demonstrated impressive earnings growth of 347.3% over the past year, significantly outpacing the industry average of 11.5%. This small entity is debt-free, with a price-to-earnings ratio of 20.5x, well below the industry norm of 159.2x. Recent developments include securing its largest order to date worth £47.3 million ($62.5 million) from SpaceX for next-gen GaN E-band products, showcasing technical prowess and strategic alignment in satellite communications and aerospace applications. Despite this momentum, earnings are forecasted to decline by an average of 45% annually over the next three years.

- Navigate through the intricacies of Filtronic with our comprehensive health report here.

Evaluate Filtronic's historical performance by accessing our past performance report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £253.54 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: The company generates revenue primarily from supplying energy and utility solutions in the UK. It has a market cap of £253.54 million.

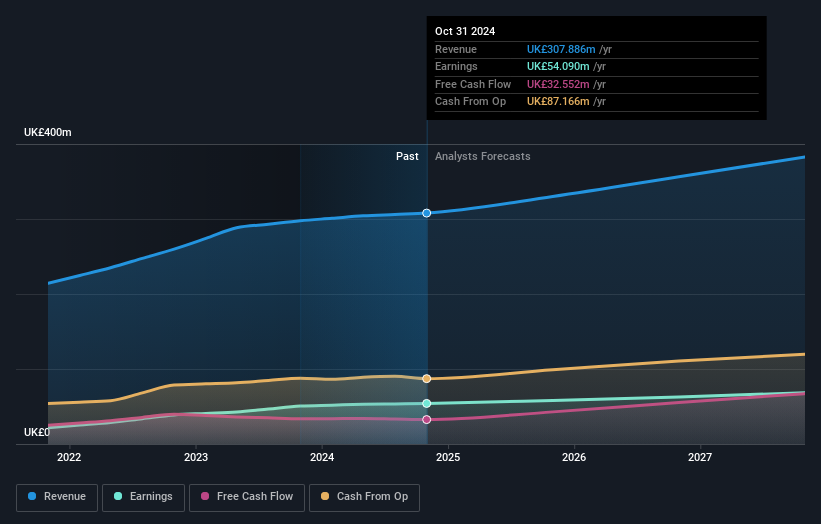

Yü Group, a small player in the UK energy market, is trading at a notable 67.5% below its estimated fair value, suggesting potential for growth. The company reported sales of £341.04 million for the first half of 2025, up from £312.68 million the previous year, while net income rose to £16.52 million from £14.69 million. Despite negative earnings growth of -7.6% last year compared to the industry's -20%, Yü's debt-to-equity ratio increased to 10.3% over five years but remains manageable with cash exceeding total debt and positive free cash flow observed recently at £61.93 million as of September 2024.

- Dive into the specifics of Yü Group here with our thorough health report.

Examine Yü Group's past performance report to understand how it has performed in the past.

ME Group International (LSE:MEGP)

Simply Wall St Value Rating: ★★★★★★

Overview: ME Group International plc operates and services a variety of instant-service equipment in the United Kingdom, with a market capitalization of £691.23 million.

Operations: ME Group International generates revenue primarily from its personal services segment, amounting to £311.32 million.

ME Group International, a nimble player in the UK market, is trading at 64% below its estimated fair value, offering potential upside. Over the past five years, it has reduced its debt-to-equity ratio from 50.2% to 19.8%, showing prudent financial management. Despite earnings growth of 7.9% last year trailing the Consumer Services industry's 22.7%, ME Group's interest payments are well covered by EBIT at a robust 30.5x coverage ratio. The company is expanding into self-service laundry and automated solutions to diversify beyond its traditional photo booth business and aims for an annual revenue growth rate of 8.2%.

Next Steps

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 65 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and rest of the world.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)