- United Kingdom

- /

- Metals and Mining

- /

- AIM:GFM

Discover These 3 Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has dropped 2.3%, but it has risen by 7.4% over the past year, with earnings expected to grow by 14% per annum over the next few years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; here are three such undiscovered gems in the UK market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and operation of mineral properties, with a market cap of £278.64 million.

Operations: Griffin Mining generates revenue primarily from its Caijiaying Zinc Gold Mine, which reported $146.02 million in revenue.

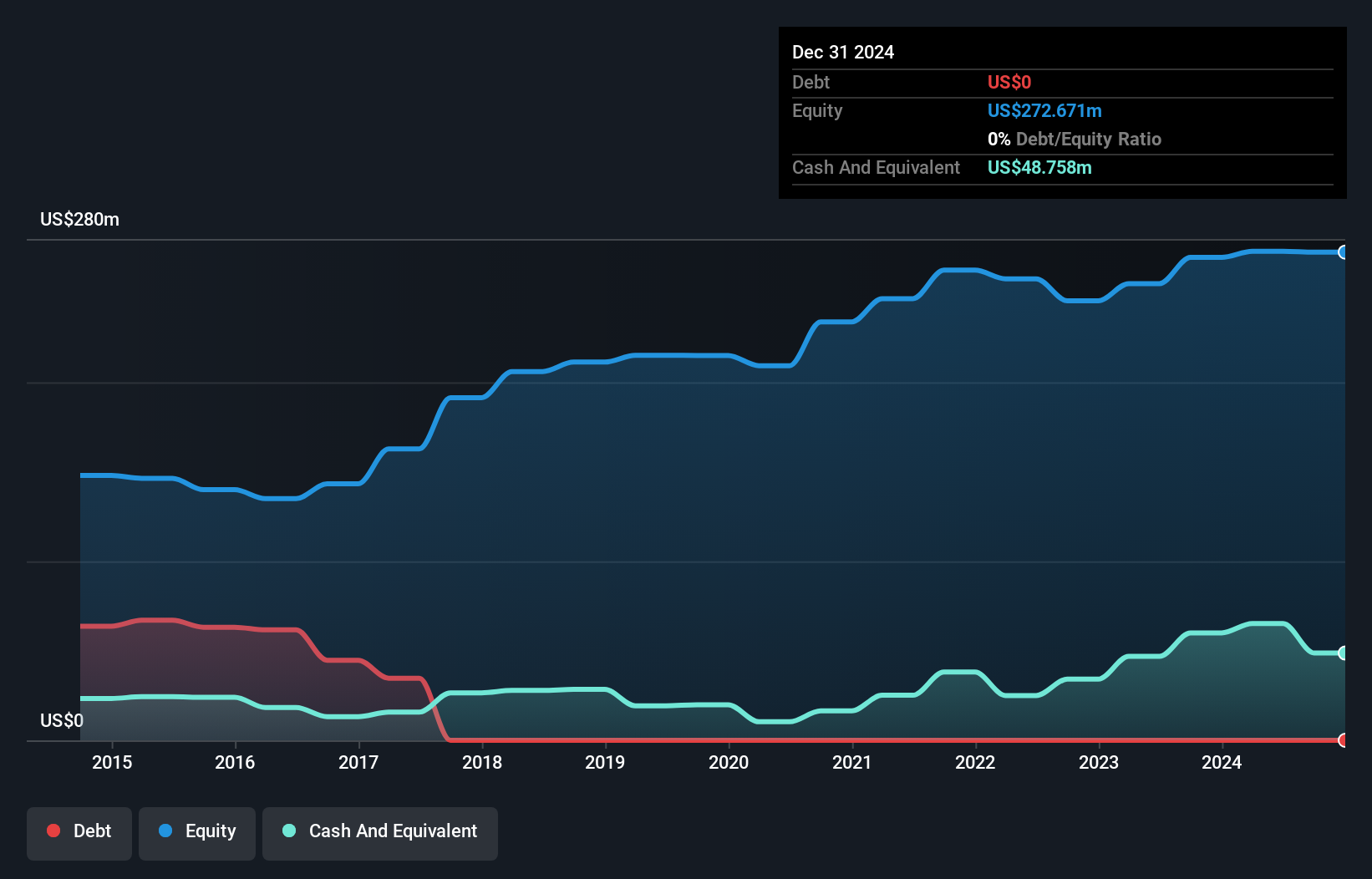

Griffin Mining, a small-cap player in the UK, has shown impressive performance with earnings growth of 97.8% over the past year, outpacing the Metals and Mining industry at 8.7%. The company mined 429,448 tonnes of ore in Q2 2024 compared to 366,762 tonnes last year. With no debt and trading at 66.2% below its estimated fair value, Griffin appears undervalued. Future earnings are forecasted to grow by 4.27% annually.

- Get an in-depth perspective on Griffin Mining's performance by reading our health report here.

Evaluate Griffin Mining's historical performance by accessing our past performance report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £259.32 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: Yü Group PLC generates revenue primarily from its Retail segment (£459.80 million) and Smart segment (£5.56 million), with minimal contributions from Metering Assets (£0.08 million). The company also engages in intra-segment trading, which offsets £5.43 million of its revenue.

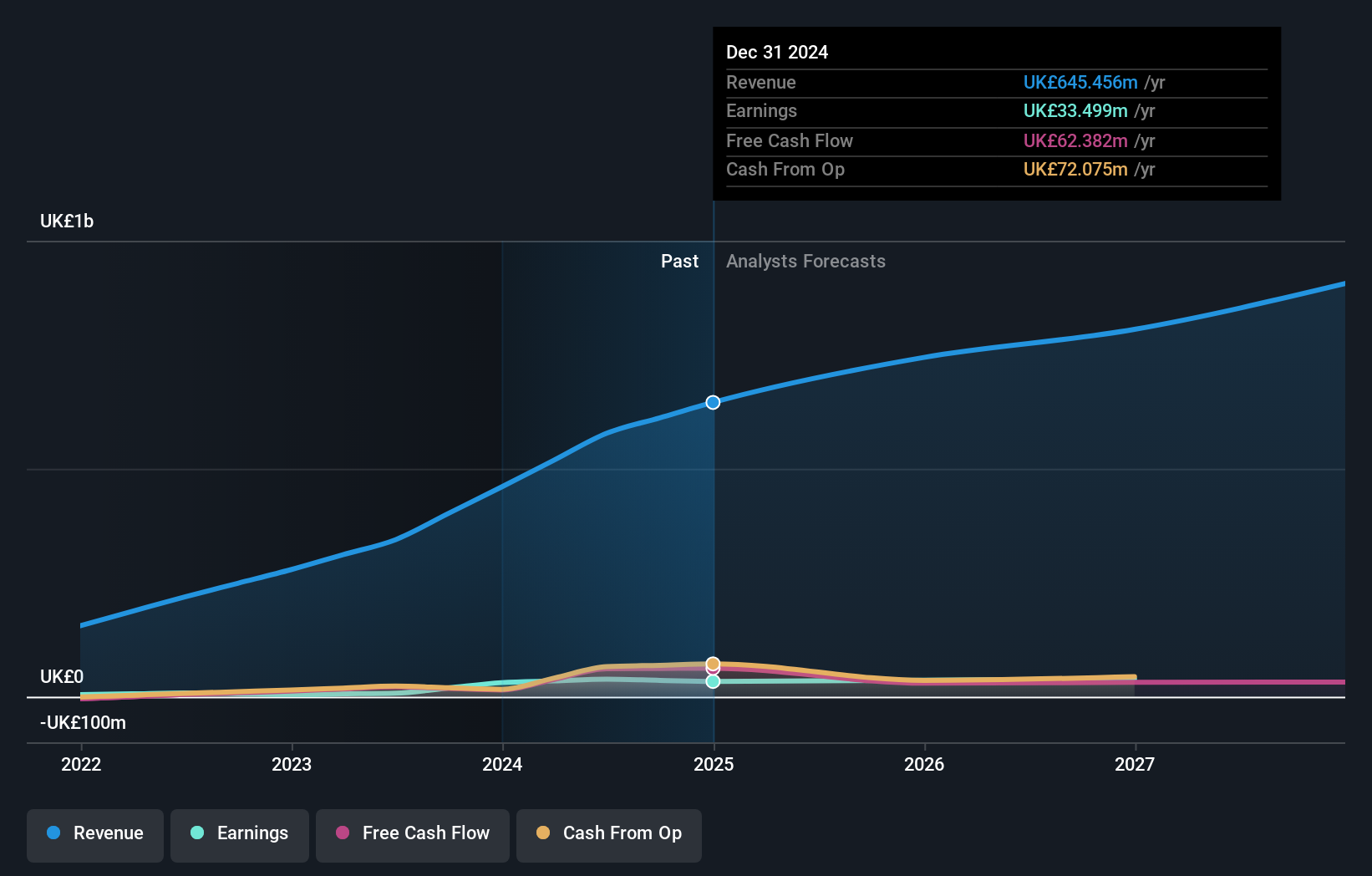

Yü Group, a small cap energy supplier, shows promising financial health with cash exceeding total debt and a modest debt to equity ratio of 0.8%. Over the past year, earnings surged by 547%, significantly outpacing the Renewable Energy industry's -13.6%. Trading at 67.5% below its fair value estimate, Yü appears undervalued compared to peers. Despite recent share price volatility, it remains profitable with strong interest coverage and positive free cash flow of £21.53M as of June 30, 2023.

- Dive into the specifics of Yü Group here with our thorough health report.

Review our historical performance report to gain insights into Yü Group's's past performance.

Alfa Financial Software Holdings (LSE:ALFA)

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC, with a market cap of £643.36 million, offers software and consultancy services to the auto and equipment finance industry across various regions including the United Kingdom, the United States, Europe, the Middle East, Africa, and internationally.

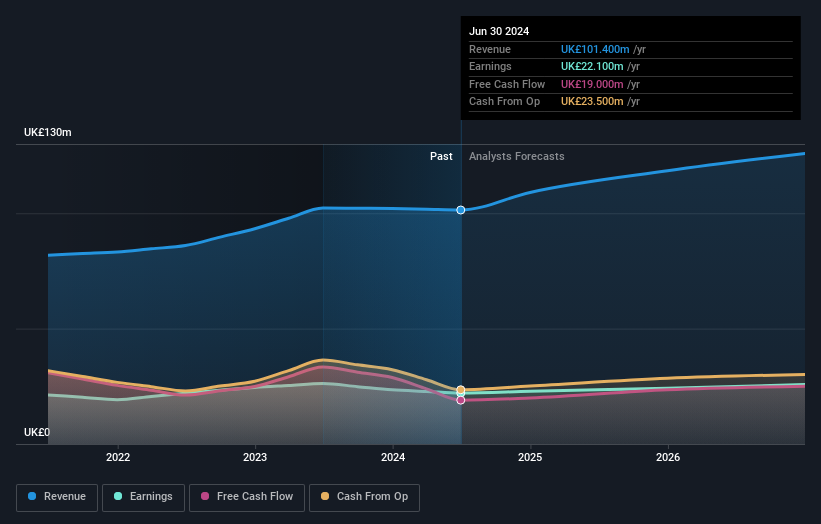

Operations: Alfa Financial Software Holdings generates revenue primarily from the sale of software and related services, totaling £101.40 million. The company operates across multiple regions including the UK, US, Europe, the Middle East, and Africa.

Alfa Financial Software Holdings, trading at a P/E ratio of 29.1x compared to the industry average of 36.8x, offers good relative value. Despite a challenging year with earnings growth at -15.6%, Alfa remains debt-free and has consistently high-quality earnings over the past five years. Recent half-year results showed sales of GBP 52.3 million and net income of GBP 11.9 million, reflecting its stable financials amidst market fluctuations.

- Click to explore a detailed breakdown of our findings in Alfa Financial Software Holdings' health report.

Understand Alfa Financial Software Holdings' track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 82 UK Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GFM

Griffin Mining

A mining and investment company, engages in the mining, exploration, and development of mineral properties.

Flawless balance sheet with solid track record.