- United Kingdom

- /

- Airlines

- /

- LSE:WIZZ

It's Down 28% But Wizz Air Holdings Plc (LON:WIZZ) Could Be Riskier Than It Looks

Wizz Air Holdings Plc (LON:WIZZ) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

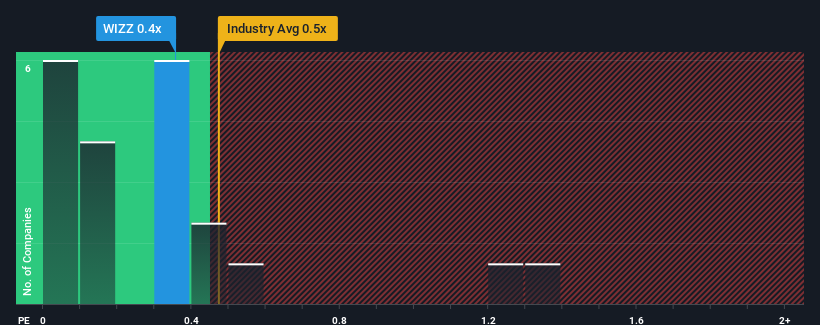

Even after such a large drop in price, there still wouldn't be many who think Wizz Air Holdings' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when it essentially matches the median P/S in the United Kingdom's Airlines industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Wizz Air Holdings

What Does Wizz Air Holdings' P/S Mean For Shareholders?

Wizz Air Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Wizz Air Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Wizz Air Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 17% per annum over the next three years. With the industry only predicted to deliver 7.0% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Wizz Air Holdings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Wizz Air Holdings looks to be in line with the rest of the Airlines industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Wizz Air Holdings' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 2 warning signs for Wizz Air Holdings that you need to take into consideration.

If these risks are making you reconsider your opinion on Wizz Air Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wizz Air Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIZZ

Wizz Air Holdings

Engages in the provision of passenger air transportation services in Europe, Iceland, Liechtenstein, Norway, and Switzerland, the United Kingdom, and Other European countries.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives