Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Royal Mail (LON:RMG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Royal Mail

How Fast Is Royal Mail Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Royal Mail's EPS went from UK£0.023 to UK£0.89 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

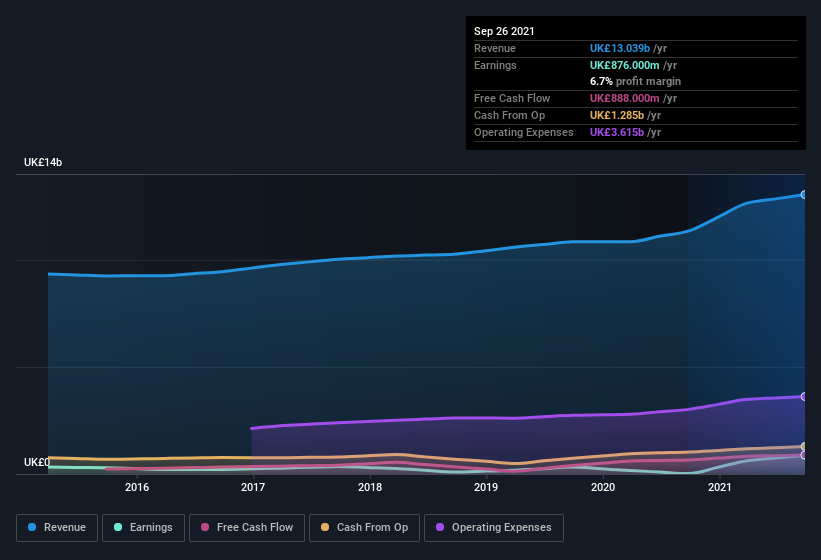

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Royal Mail is growing revenues, and EBIT margins improved by 3.4 percentage points to 7.8%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Royal Mail's forecast profits?

Are Royal Mail Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Royal Mail shares, in the last year. With that in mind, it's heartening that Keith Williams, the Independent Non-Executive Chairman & Member of Management Board of the company, paid UK£32k for shares at around UK£4.66 each.

It's reassuring that Royal Mail insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between UK£3.0b and UK£8.9b, like Royal Mail, the median CEO pay is around UK£1.6m.

The CEO of Royal Mail only received UK£186k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Royal Mail Worth Keeping An Eye On?

Royal Mail's earnings have taken off like any random crypto-currency did, back in 2017. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Royal Mail is at an inflection point, given the EPS growth. If so, then it the potential for further gains probably merit a spot on your watchlist. You still need to take note of risks, for example - Royal Mail has 1 warning sign we think you should be aware of.

As a growth investor I do like to see insider buying. But Royal Mail isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IDS

International Distribution Services

Operates as a universal postal service provider in the United Kingdom and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives