- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

Earnings Beat: Ocean Wilsons Holdings Limited Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Models

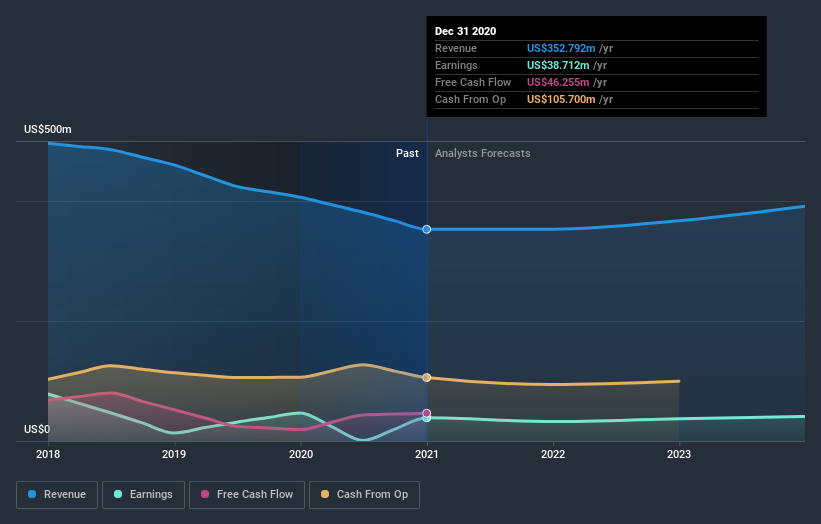

It's been a good week for Ocean Wilsons Holdings Limited (LON:OCN) shareholders, because the company has just released its latest yearly results, and the shares gained 4.8% to UK£8.65. It looks like a credible result overall - although revenues of US$353m were what the analyst expected, Ocean Wilsons Holdings surprised by delivering a (statutory) profit of US$1.08 per share, an impressive 145% above what was forecast. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimate suggests is in store for next year.

Check out our latest analysis for Ocean Wilsons Holdings

Taking into account the latest results, Ocean Wilsons Holdings' sole analyst currently expect revenues in 2021 to be US$352.9m, approximately in line with the last 12 months. Statutory earnings per share are expected to fall 16% to US$0.92 in the same period. Before this earnings report, the analyst had been forecasting revenues of US$363.6m and earnings per share (EPS) of US$0.83 in 2021. While revenue forecasts have been revised downwards, the analyst looks to have become more optimistic on the company's cost base, given the solid gain to to the earnings per share numbers.

The consensus has made no major changes to the price target of UK£12.50, suggesting the forecast improvement in earnings is expected to offset the decline in revenues next year.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. From these estimates it looks as though the analyst expects the years of declining sales to come to an end, given the flat revenue forecast out to 2021. That would be a definite improvement, given that the past five years have seen sales shrink 5.5% annually. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 10% per year. Although Ocean Wilsons Holdings' revenues are expected to improve, it seems that it is still expected to grow slower than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Ocean Wilsons Holdings' earnings potential next year. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Even so, long term profitability is more important for the value creation process. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Even so, be aware that Ocean Wilsons Holdings is showing 3 warning signs in our investment analysis , you should know about...

When trading Ocean Wilsons Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, offers maritime and logistics services in Brazil.

Flawless balance sheet established dividend payer.