- United Kingdom

- /

- Transportation

- /

- LSE:MCG

Mobico Group Plc's (LON:MCG) recent 9.2% pullback adds to one-year year losses, institutional owners may take drastic measures

Key Insights

- Given the large stake in the stock by institutions, Mobico Group's stock price might be vulnerable to their trading decisions

- The top 10 shareholders own 52% of the company

- Ownership research along with analyst forecasts data help provide a good understanding of opportunities in a stock

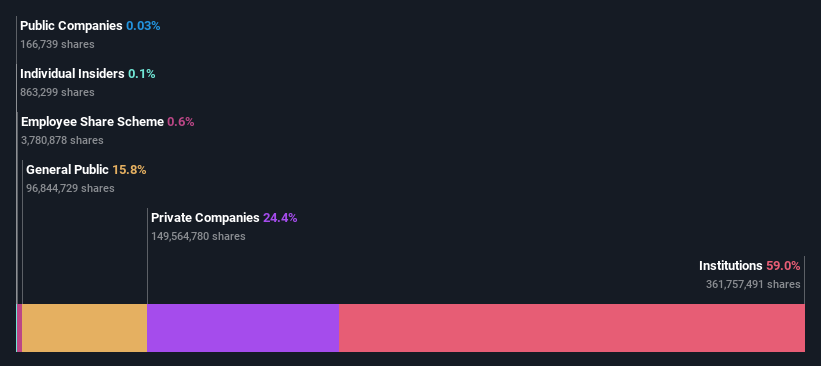

Every investor in Mobico Group Plc (LON:MCG) should be aware of the most powerful shareholder groups. And the group that holds the biggest piece of the pie are institutions with 59% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

And institutional investors saw their holdings value drop by 9.2% last week. Needless to say, the recent loss which further adds to the one-year loss to shareholders of 18% might not go down well especially with this category of shareholders. Institutions or "liquidity providers" control large sums of money and therefore, these types of investors usually have a lot of influence over stock price movements. Hence, if weakness in Mobico Group's share price continues, institutional investors may feel compelled to sell the stock, which might not be ideal for individual investors.

Let's delve deeper into each type of owner of Mobico Group, beginning with the chart below.

View our latest analysis for Mobico Group

What Does The Institutional Ownership Tell Us About Mobico Group?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

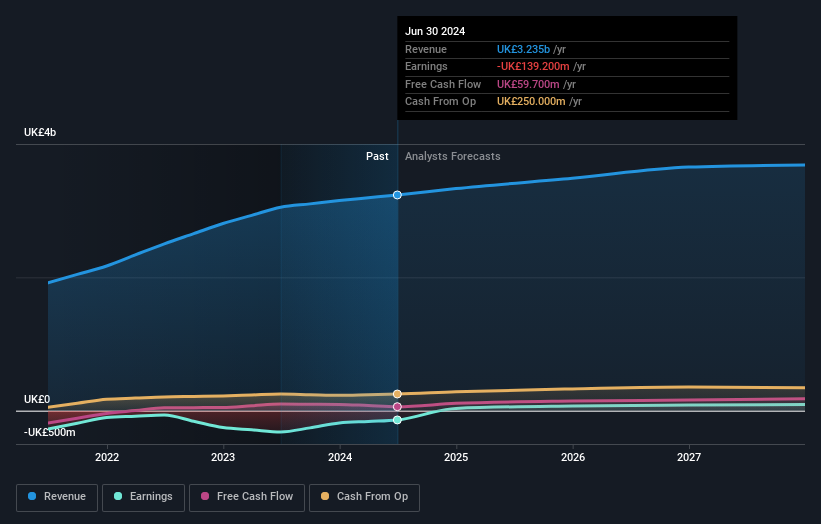

Mobico Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Mobico Group's historic earnings and revenue below, but keep in mind there's always more to the story.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Hedge funds don't have many shares in Mobico Group. The company's largest shareholder is European Express Enterprises Ltd., with ownership of 21%. In comparison, the second and third largest shareholders hold about 4.6% and 3.6% of the stock.

We also observed that the top 10 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Mobico Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own less than 1% of Mobico Group Plc. However, it's possible that insiders might have an indirect interest through a more complex structure. It seems the board members have no more than UK£628k worth of shares in the UK£446m company. We generally like to see a board more invested. However it might be worth checking if those insiders have been buying.

General Public Ownership

The general public, who are usually individual investors, hold a 16% stake in Mobico Group. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

Our data indicates that Private Companies hold 24%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Mobico Group better, we need to consider many other factors.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MCG

Mobico Group

Designs, mobilizes, and operates transport services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)