- United Kingdom

- /

- Airlines

- /

- LSE:IAG

Here's Why We Think International Consolidated Airlines Group S.A.'s (LON:IAG) CEO Compensation Looks Fair

Key Insights

- International Consolidated Airlines Group's Annual General Meeting to take place on 26th of June

- Total pay for CEO Luis Gallego Martin includes €980.0k salary

- The overall pay is 47% below the industry average

- International Consolidated Airlines Group's three-year loss to shareholders was 14% while its EPS grew by 122% over the past three years

The performance at International Consolidated Airlines Group S.A. (LON:IAG) has been rather lacklustre of late and shareholders may be wondering what CEO Luis Gallego Martin is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 26th of June. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for International Consolidated Airlines Group

Comparing International Consolidated Airlines Group S.A.'s CEO Compensation With The Industry

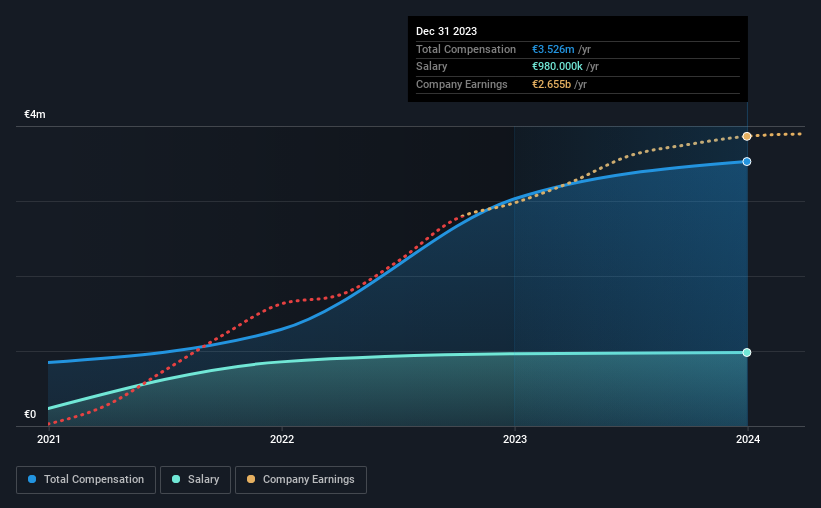

At the time of writing, our data shows that International Consolidated Airlines Group S.A. has a market capitalization of UK£8.3b, and reported total annual CEO compensation of €3.5m for the year to December 2023. We note that's an increase of 17% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €980k.

In comparison with other companies in the the United Kingdom Airlines industry with market capitalizations over UK£6.3b, the reported median total CEO compensation was €6.6m. This suggests that Luis Gallego Martin is paid below the industry median. Moreover, Luis Gallego Martin also holds UK£2.3m worth of International Consolidated Airlines Group stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €980k | €963k | 28% |

| Other | €2.5m | €2.1m | 72% |

| Total Compensation | €3.5m | €3.0m | 100% |

Speaking on an industry level, nearly 43% of total compensation represents salary, while the remainder of 57% is other remuneration. International Consolidated Airlines Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

International Consolidated Airlines Group S.A.'s Growth

International Consolidated Airlines Group S.A.'s earnings per share (EPS) grew 122% per year over the last three years. In the last year, its revenue is up 18%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has International Consolidated Airlines Group S.A. Been A Good Investment?

Given the total shareholder loss of 14% over three years, many shareholders in International Consolidated Airlines Group S.A. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The lacklustre share price returns is rather divergent to the robust growth in EPS, suggesting that there may be other factors weighing on it apart from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in International Consolidated Airlines Group we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, the United States, and rest of the world.

Undervalued with proven track record.