- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

3 UK Dividend Stocks Yielding Up To 8.6%

Reviewed by Simply Wall St

The UK market is currently grappling with global economic pressures, as evidenced by the FTSE 100's recent downturn following weak trade data from China. In such uncertain times, dividend stocks can offer a measure of stability and income, making them an attractive option for investors seeking consistent returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.09% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.85% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.39% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.63% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.52% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.17% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.67% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.27% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.64% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.45% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

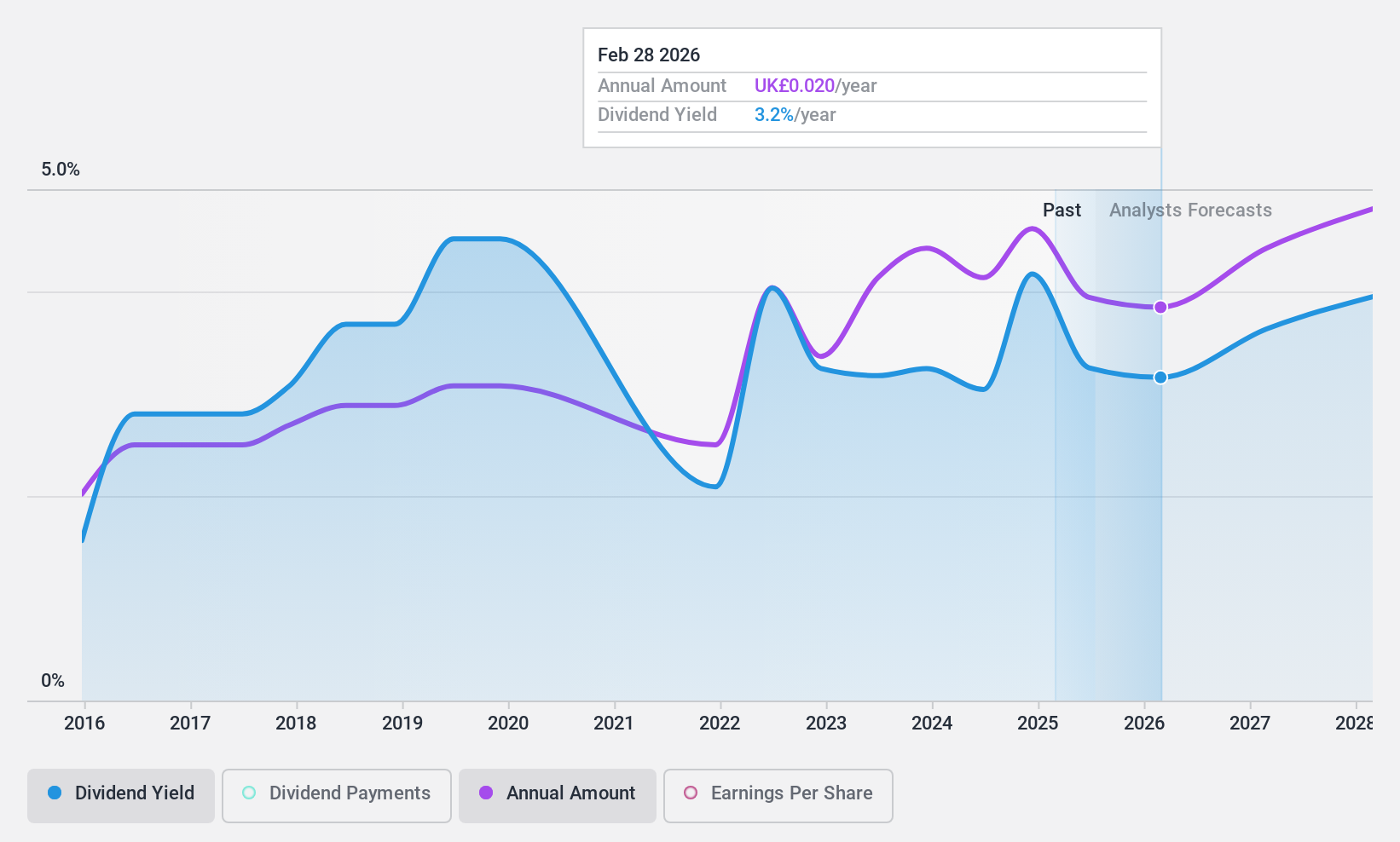

Vertu Motors (AIM:VTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc is an automotive retailer operating in the United Kingdom with a market cap of £196.56 million.

Operations: Vertu Motors plc generates its revenue primarily from its operations as a retailer in the gasoline and auto dealership sector, amounting to £4.79 billion.

Dividend Yield: 3.9%

Vertu Motors offers a mixed dividend profile. Its dividends are well-covered by both earnings and cash flows, with payout ratios of 41.8% and 17.2%, respectively. However, the dividend history has been volatile over the past decade despite recent growth in payments. The company has initiated a share buyback program worth £12 million to reduce share capital, which may impact future dividends positively by lowering outstanding shares but doesn't address the historical volatility concern directly.

- Take a closer look at Vertu Motors' potential here in our dividend report.

- Our valuation report unveils the possibility Vertu Motors' shares may be trading at a premium.

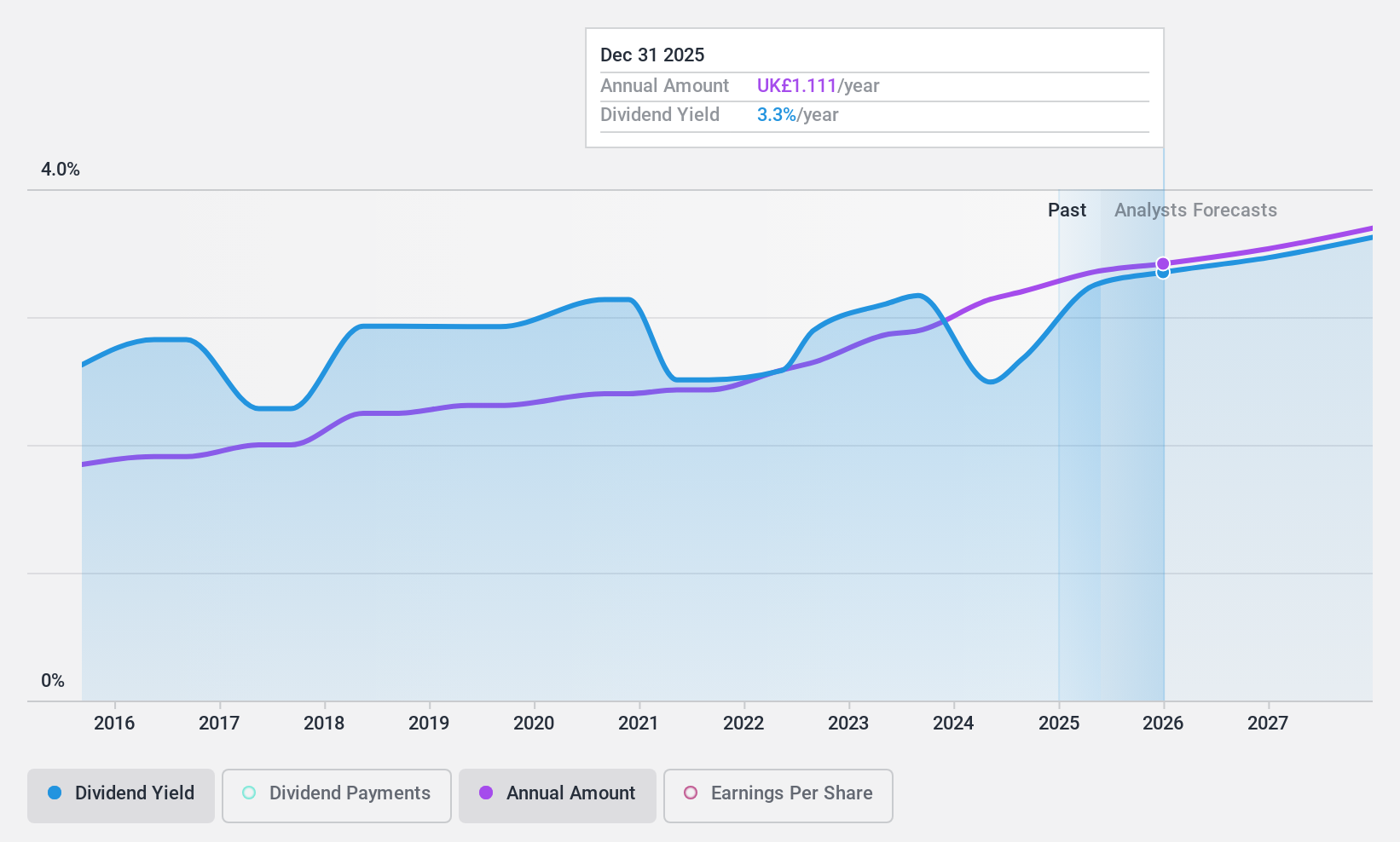

Clarkson (LSE:CKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clarkson PLC offers integrated shipping services across Europe, the Middle East, Africa, the Americas, Asia-Pacific, and globally with a market cap of £1.02 billion.

Operations: Clarkson PLC's revenue is primarily derived from its Broking segment at £529.30 million, followed by Support at £65 million, Financial at £42.60 million, and Research at £24.50 million.

Dividend Yield: 3.3%

Clarkson PLC's dividend payments are well-supported by earnings and cash flows, with payout ratios of 39.4% and 31.2%, respectively. Although dividends have increased over the past decade, their history is marked by volatility, including annual declines exceeding 20%. The recent recommendation for a final dividend increase to £0.77 per share underscores the company's commitment to returning value to shareholders despite its lower yield compared to top UK dividend payers.

- Dive into the specifics of Clarkson here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Clarkson shares in the market.

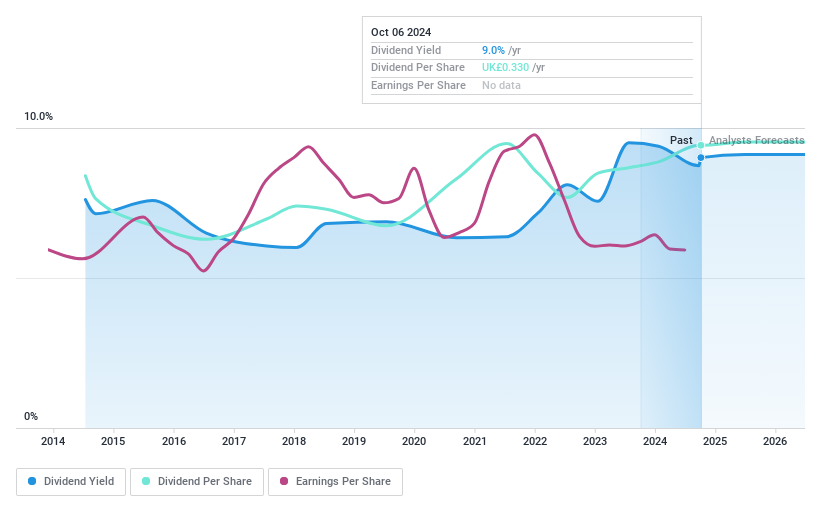

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market capitalization of £178.40 million.

Operations: City of London Investment Group PLC generates revenue of $72.64 million from its asset management segment.

Dividend Yield: 8.6%

City of London Investment Group's dividend yield of 8.61% ranks among the top UK payers but is not well supported by earnings, with a high payout ratio of 111.6%. Although dividends have increased over the past decade, they have been volatile and unreliable. Recent earnings showed growth, with revenue reaching US$35.3 million for the half-year ending December 2024. The appointment of Ben Stocks as an Independent Non-Executive Director may enhance governance and strategic oversight.

- Click here to discover the nuances of City of London Investment Group with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, City of London Investment Group's share price might be too pessimistic.

Summing It All Up

- Click this link to deep-dive into the 61 companies within our Top UK Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives