- United Kingdom

- /

- Wireless Telecom

- /

- LSE:VOD

Vodafone (LSE:VOD) Valuation in Focus After Recent Share Price Rally

Reviewed by Simply Wall St

Vodafone Group (LSE:VOD) has quietly caught investor attention after the stock edged up 1% today, extending a run that has seen it gain over 28% since the start of the year. While there is no major headline event, this sustained move higher might leave some observers wondering if something is brewing beneath the surface, or if the shares are simply catching up after a stretch of lackluster years. For those weighing whether now is the right time to make a move, the current price action offers food for thought.

Looking at the bigger picture, Vodafone Group has rebounded strongly over the past year, reversing some of the longer-run underperformance that has kept the stock on many value-oriented watchlists. Short-term momentum is clearly building, as shown by a 6% gain in the past month and over 12% in the past 3 months. The stock struggled over the last three years, but a positive shift in sentiment hints at changing market expectations, even without any single news catalyst driving the trend.

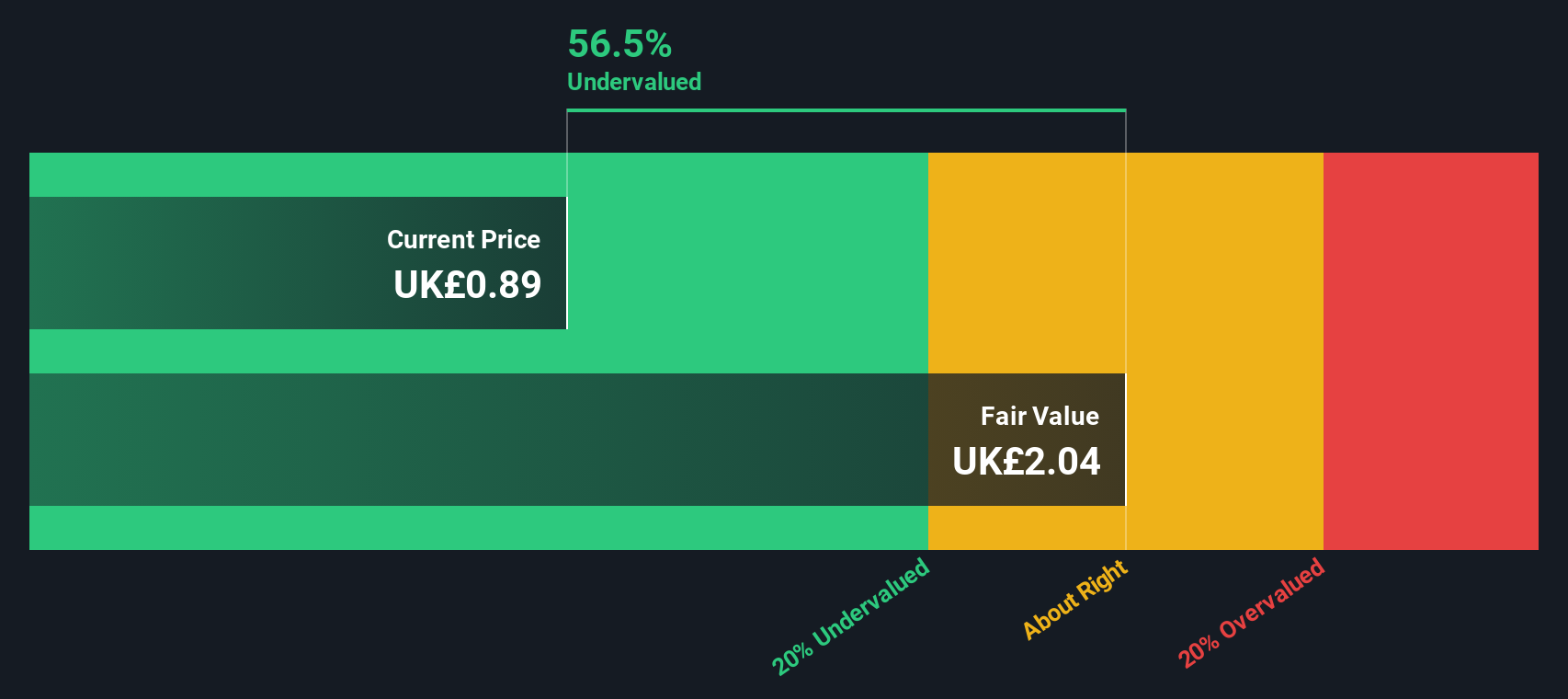

With the rally so far this year, the real question is whether Vodafone Group shares are still trading below their true value or if the recent climb means markets have already priced in better days ahead for the telecom giant.

Most Popular Narrative: 4.4% Overvalued

According to community narrative, Vodafone Group is estimated to be overvalued by 4.4% based on forward-looking earnings and margins assumptions discounted at a rate of 8.9%. Analysts have pulled together key strategic moves and forecast data to arrive at this valuation.

The strategic partnerships with industry players such as Google and Accenture, together with investment in digital services, are considered catalysts for revenue growth and potentially higher margins through increased service offerings and higher-margin digital products. The sale of assets in Italy and the realization of significant proceeds from previous sales, for example Vantage Towers and Spain, provide Vodafone with financial flexibility for strategic investments. This may enhance future earnings and allow for capital return programs, which can positively impact earnings per share (EPS).

Is Vodafone’s growth story built to last, or is there a twist in the numbers still to discover? The analysts backing this valuation are making bold assumptions about emerging earnings power and future profitability, which drives confidence in the price target. Wondering which specific financial leaps and margin shifts are at the heart of this narrative? Explore the decisive projections that may shift Vodafone’s valuation.

Result: Fair Value of £0.85 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, risks remain, such as continued weak performance in Germany and the challenges involved in executing large-scale restructuring. These factors could impact future earnings. Find out about the key risks to this Vodafone Group narrative.Another View: A Different Take from Our DCF Model

While many focus on market multiples to judge Vodafone’s pricing, our DCF model tells a very different story. This approach currently suggests the shares are deeply undervalued. Which method should investors really trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vodafone Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vodafone Group Narrative

If you have a different perspective, or want to dig into the numbers and shape your own viewpoint, you can generate a custom Vodafone Group narrative in just a few minutes by using do it your way.

A great starting point for your Vodafone Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your research stop with Vodafone Group. Plenty of other compelling opportunities await. The Simply Wall Street Screener brings top prospects into focus for you. Give yourself an edge and keep your investment strategy sharp with these hand-picked ideas that may add new dimensions to your portfolio:

- Find reliable income sources by uncovering dividend stocks with yields > 3% that pay generous yields above 3% and have a proven track record of rewarding shareholders.

- Spot cutting-edge breakthroughs when you check out quantum computing stocks driving the future of technology with advancements in quantum computing.

- Strengthen your watchlist with undervalued stocks based on cash flows trading at attractive valuations based on robust cash flow analysis and market sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VOD

Vodafone Group

Provides telecommunication services in Germany, the United Kingdom, rest of Europe, Turkey, and South Africa.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives