- United Kingdom

- /

- Communications

- /

- LSE:SPT

Exploring High Growth Tech Stocks in the UK December 2024

Reviewed by Simply Wall St

In recent months, the United Kingdom's market has been influenced by global economic factors, with the FTSE 100 index experiencing declines due to weak trade data from China and reduced domestic demand in the world's second-largest economy. As investors navigate these challenging conditions, identifying high-growth tech stocks in the UK requires a focus on companies that demonstrate resilience and innovation amidst broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Windar Photonics | 42.38% | 56.12% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Seeing Machines | 21.40% | 97.67% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our UK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Beeks Financial Cloud Group (AIM:BKS)

Simply Wall St Growth Rating: ★★★★★☆

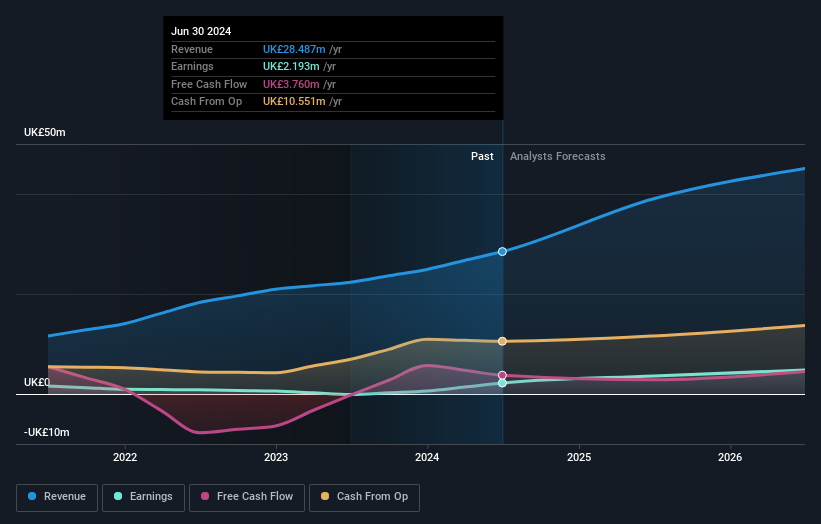

Overview: Beeks Financial Cloud Group plc offers managed cloud computing, connectivity, and analytics services for the capital markets and financial services sectors across the UK, Europe, the US, and internationally with a market cap of £197.79 million.

Operations: The company generates revenue primarily through its Public/Private Cloud services, contributing £25.01 million, and Proximity/Exchange Cloud services, which add £3.47 million.

Beeks Financial Cloud Group, a UK-based tech firm, recently pivoted from a loss to a profit, with net income reaching GBP 2.19 million from a previous year's loss of GBP 0.089 million. This turnaround is underscored by an impressive revenue growth forecast of 22.1% annually, outpacing the UK market's average of 3.6%. The company's commitment to innovation is evident in its R&D spending trends which are integral to sustaining this growth trajectory. However, concerns were raised by their auditor about the company’s ability to continue as a going concern, highlighting potential risks despite the financial upswing and strategic board reshuffles aimed at strengthening governance. The firm’s earnings are expected to surge by 36.9% per year over the next three years—a rate significantly higher than the broader market projection of 14.9%. These figures suggest robust future prospects if Beeks can maintain its current momentum and address underlying challenges flagged in recent audits. Their strategic focus on high-performance computing and connectivity solutions for financial markets positions them well within an increasingly digital and data-driven economy.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc is a company that offers online market research services across various regions including the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific with a market capitalization of approximately £533.62 million.

Operations: The company generates revenue primarily through three segments: Research (£177.70 million), Data Products (£83.80 million), and Consumer Panel Services (£74.20 million).

YouGov, amidst a challenging landscape marked by activist pressures for operational reviews and potential sales processes, remains poised with a revenue forecast growing at 8.5% annually—outstripping the UK's average of 3.6%. This growth trajectory is complemented by an expected surge in earnings, projected to expand by 55% per year. Significantly, the firm dedicates substantial resources to R&D, aligning its strategy with evolving market demands and ensuring sustained innovation. This strategic focus is crucial as it navigates investor critiques and recent shifts from profit to a net loss of GBP 2.4 million this fiscal year, highlighting the volatile nature of high-growth sectors but also underscoring potential for recovery and value realization through targeted improvements and market responsiveness.

- Click here and access our complete health analysis report to understand the dynamics of YouGov.

Gain insights into YouGov's past trends and performance with our Past report.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

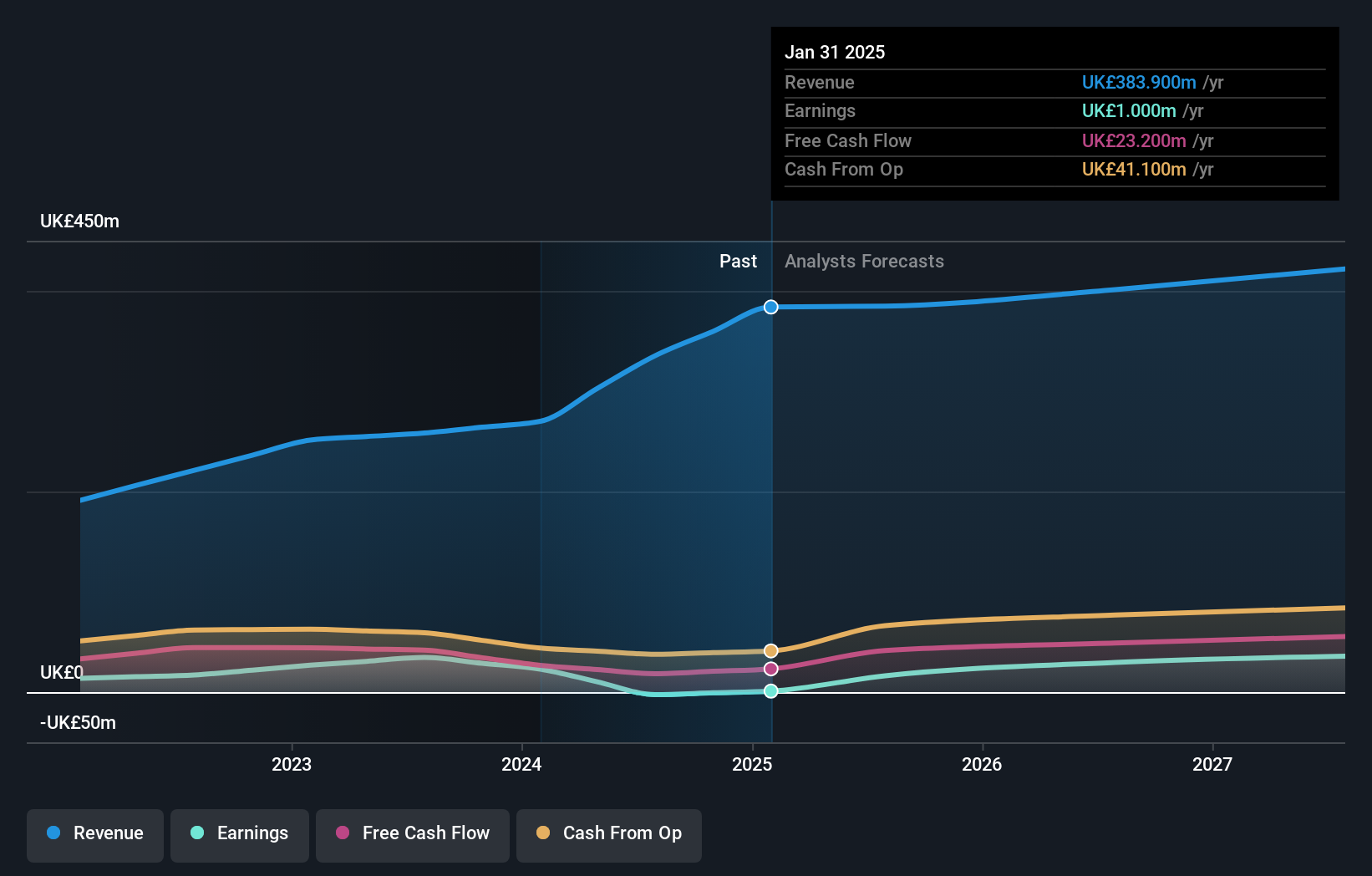

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market capitalization of £1.03 billion.

Operations: The company generates revenue primarily from its Networks & Security segment, which accounts for $258.50 million. The business focuses on providing automated test and assurance solutions across multiple regions.

Spirent Communications, a UK-based tech firm, is navigating a challenging landscape with strategic agility. Despite a 5.6% revenue growth forecast outpacing the UK market average of 3.6%, Spirent faces hurdles with earnings growth at -81.1% over the past year and profit margins reduced to 3% from last year's 12.8%. However, its R&D investment remains robust, aligning with industry demands for innovation in high-speed Ethernet infrastructure and automotive safety standards—critical areas expected to drive future performance in their respective sectors. Recent engagements include developing standards for China’s automotive positioning systems and deploying advanced testing solutions for AI-driven applications, showcasing Spirent’s pivotal role in shaping tech advancements globally.

Make It Happen

- Click here to access our complete index of 49 UK High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SPT

Spirent Communications

Provides automated test and assurance solutions in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.