- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

UK Penny Stocks: Afentra And 2 Others To Watch Closely

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating markets, identifying stocks with robust financials becomes crucial for investors seeking resilience and potential growth. Penny stocks, though often considered a throwback term, can still offer intriguing opportunities when they are backed by strong fundamentals; this article will explore three UK penny stocks that stand out in this regard.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.68 | £523.96M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.20 | £258.52M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.36 | £150.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.4148 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.839 | £322.08M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.71 | £277.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.4345 | £123.17M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.1953 | £191.81M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £72.22M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Afentra (AIM:AET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Afentra plc, with a market cap of £110.14 million, is an upstream oil and gas company focusing on operations primarily in Africa.

Operations: The company's revenue is derived from its Oil & Gas - Exploration & Production segment, totaling $180.86 million.

Market Cap: £110.14M

Afentra plc, with a market cap of £110.14 million, has demonstrated strong financial metrics for a penny stock. The company has become profitable recently, growing earnings significantly over the past five years. Its Return on Equity is outstanding at 53.1%, and its debt is well covered by operating cash flow, indicating robust financial health despite an increase in the debt-to-equity ratio to 42% over five years. Additionally, Afentra's short-term assets exceed both short- and long-term liabilities, suggesting solid liquidity management. Analysts expect the stock price to rise significantly based on current valuation estimates below fair value.

- Unlock comprehensive insights into our analysis of Afentra stock in this financial health report.

- Evaluate Afentra's prospects by accessing our earnings growth report.

BATM Advanced Communications (LSE:BVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BATM Advanced Communications Ltd. develops, produces, and supplies real-time technologies and associated services across Israel, the United States, and Europe, with a market cap of £69.43 million.

Operations: The company's revenue is primarily derived from four segments: Cyber ($9.96 million), Networks ($9.21 million), Non-Core ($57.45 million), and Diagnostics ($42.20 million).

Market Cap: £69.43M

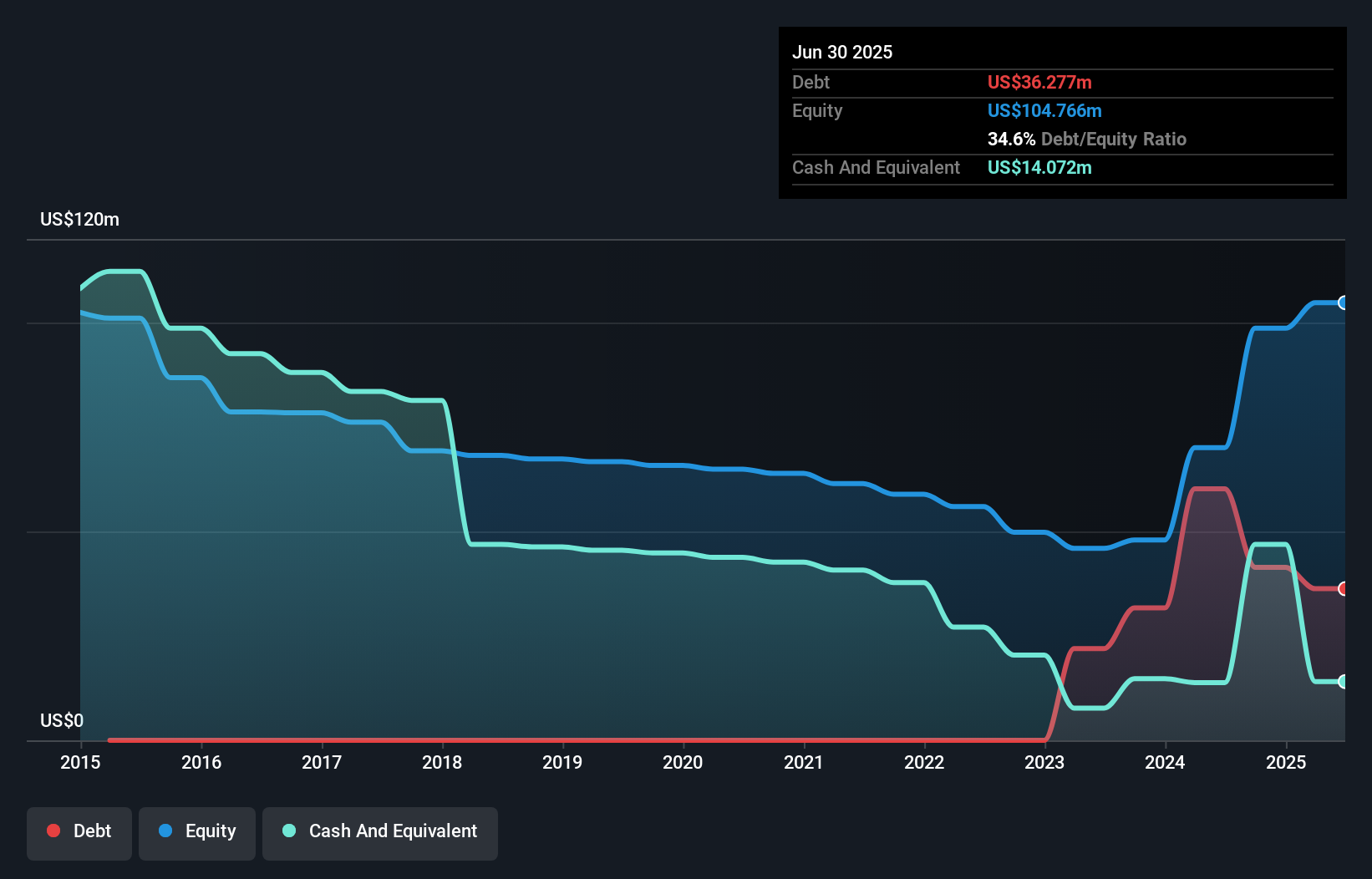

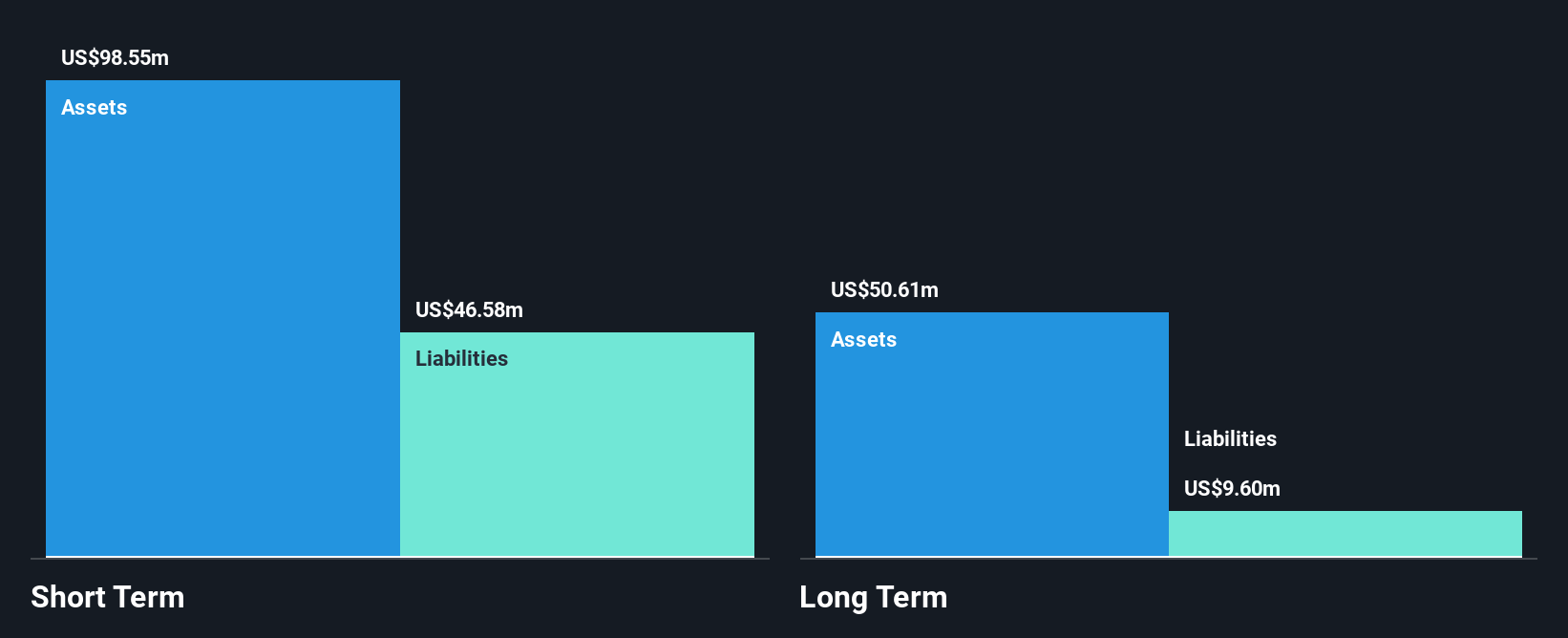

BATM Advanced Communications Ltd., with a market cap of £69.43 million, faces challenges as it remains unprofitable, reporting a net loss of US$3.73 million for the half year ending June 2025 despite sales increasing to US$60.36 million from US$58.88 million year-on-year. The company benefits from strong short-term asset coverage over liabilities and reduced debt-to-equity ratio over five years, indicating improved financial positioning. However, its negative Return on Equity and declining earnings highlight operational hurdles. Recent management changes may impact strategic direction as the new CFO brings extensive experience in financial management within technology sectors globally.

- Click to explore a detailed breakdown of our findings in BATM Advanced Communications' financial health report.

- Assess BATM Advanced Communications' future earnings estimates with our detailed growth reports.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £523.96 million.

Operations: The company's revenue is primarily derived from its Infrastructure segment (£95.89 million), followed by Private Equity (£50.52 million) and Foresight Capital Management (£7.58 million).

Market Cap: £523.96M

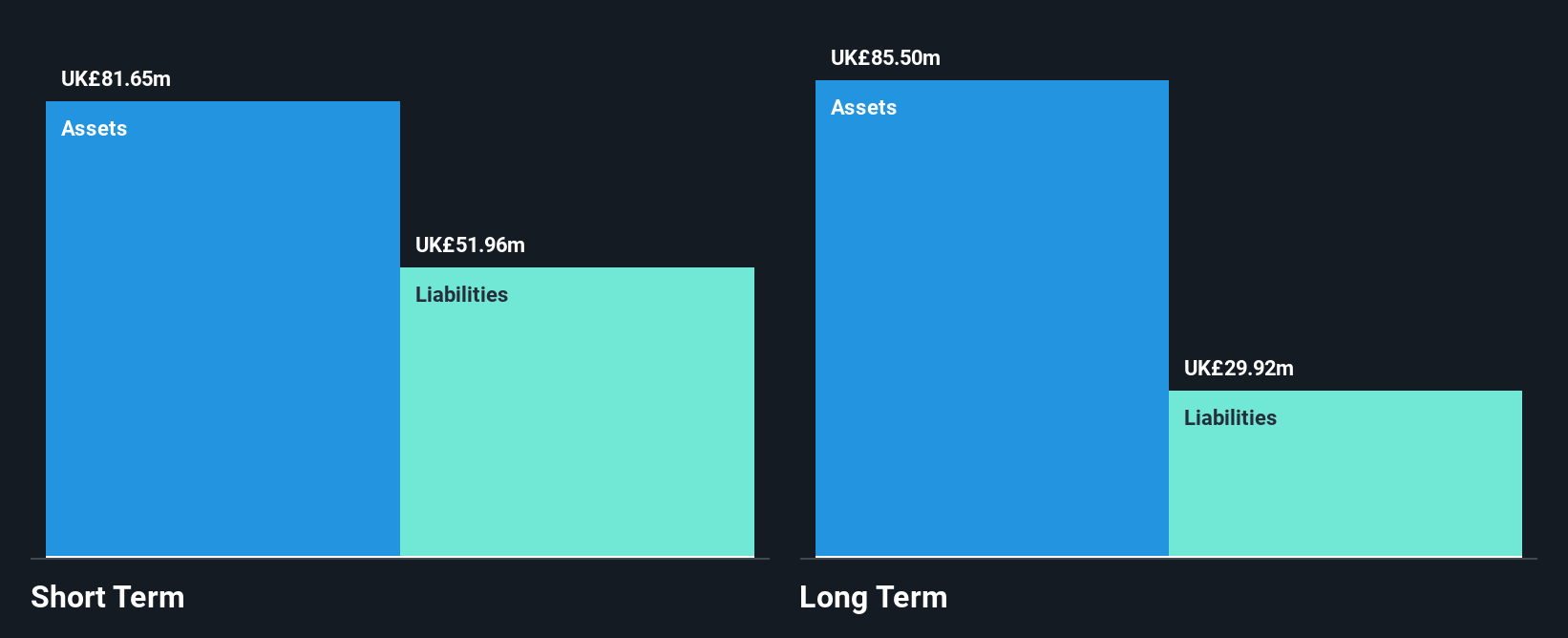

Foresight Group Holdings, with a market cap of £523.96 million, demonstrates robust financial health and strategic growth potential. The company reported sales of £153.99 million for the year ended March 31, 2025, with net income rising to £33.25 million from the previous year. It maintains strong cash reserves exceeding total debt and has significantly reduced its debt-to-equity ratio over five years. Recent dividend increases and active pursuit of M&A opportunities reflect a proactive growth strategy under new CEO Gary Fraser's leadership. Earnings have consistently grown faster than industry averages, supported by high-quality earnings and solid profit margins.

- Click here to discover the nuances of Foresight Group Holdings with our detailed analytical financial health report.

- Examine Foresight Group Holdings' earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Navigate through the entire inventory of 299 UK Penny Stocks here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives