- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines partly due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, certain investment opportunities remain appealing, particularly in the realm of penny stocks. While the term "penny stock" might seem outdated, it still signifies smaller or newer companies that can offer significant value when backed by strong financials. In this article, we explore three such UK penny stocks that combine balance sheet strength with potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £3.965 | £445.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.55 | £367.58M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.44 | £183.39M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.912 | £1.19B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.775 | £65.21M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.345 | £418.91M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.08 | £172.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.24 | £69.96M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 409 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Public Policy Holding Company (AIM:PPHC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Public Policy Holding Company, Inc. offers consulting services in the United States and has a market cap of £167.08 million.

Operations: The company generates revenue from three main segments: Diversified Services ($10.69 million), Government Relations ($102.46 million), and Public Affairs Consulting ($36.41 million).

Market Cap: £167.08M

Public Policy Holding Company, Inc., with a market cap of £167.08 million, operates primarily in the U.S. and is currently unprofitable but maintains a positive cash flow, offering a cash runway exceeding three years if growth continues. Despite trading at 75.4% below estimated fair value and having stable weekly volatility, its debt-to-equity ratio has increased significantly over five years to 39.4%, raising concerns about financial leverage. Recent private placements raised $4.95 million, indicating investor interest despite the company's challenges with dividend sustainability and inexperienced management and board teams averaging less than two years in tenure.

- Get an in-depth perspective on Public Policy Holding Company's performance by reading our balance sheet health report here.

- Understand Public Policy Holding Company's earnings outlook by examining our growth report.

Vianet Group (AIM:VNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vianet Group plc delivers smart, cloud-based, and Internet of Things solutions to the hospitality, unattended retail vending, and remote asset management sectors across the UK, Europe, the US, and Canada with a market cap of £24.85 million.

Operations: The company's revenue is derived from two primary segments: the Hospitality Division, generating £9.02 million, and the Unattended Retail Division, contributing £6.25 million.

Market Cap: £24.85M

Vianet Group plc, with a market cap of £24.85 million, has shown stable financial performance in the penny stock segment. The company's revenue for the year ended March 31, 2025, was £15.02 million, slightly up from £14.92 million the previous year. Net income increased to £0.857 million from £0.68 million, reflecting improved profitability with net profit margins rising to 5.7%. Vianet's short-term assets comfortably cover both its short and long-term liabilities while maintaining satisfactory debt levels with interest well-covered by EBIT (4.2x). Despite low return on equity at 3.2%, earnings have grown significantly over five years at an annual rate of 29.4%.

- Click here to discover the nuances of Vianet Group with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Vianet Group's track record.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across the UK, Europe, the Americas, and internationally, with a market cap of £121.68 million.

Operations: The company generates revenue through its Foundry Operations, which account for £197.94 million, and Machining Operations, contributing £32.13 million.

Market Cap: £121.68M

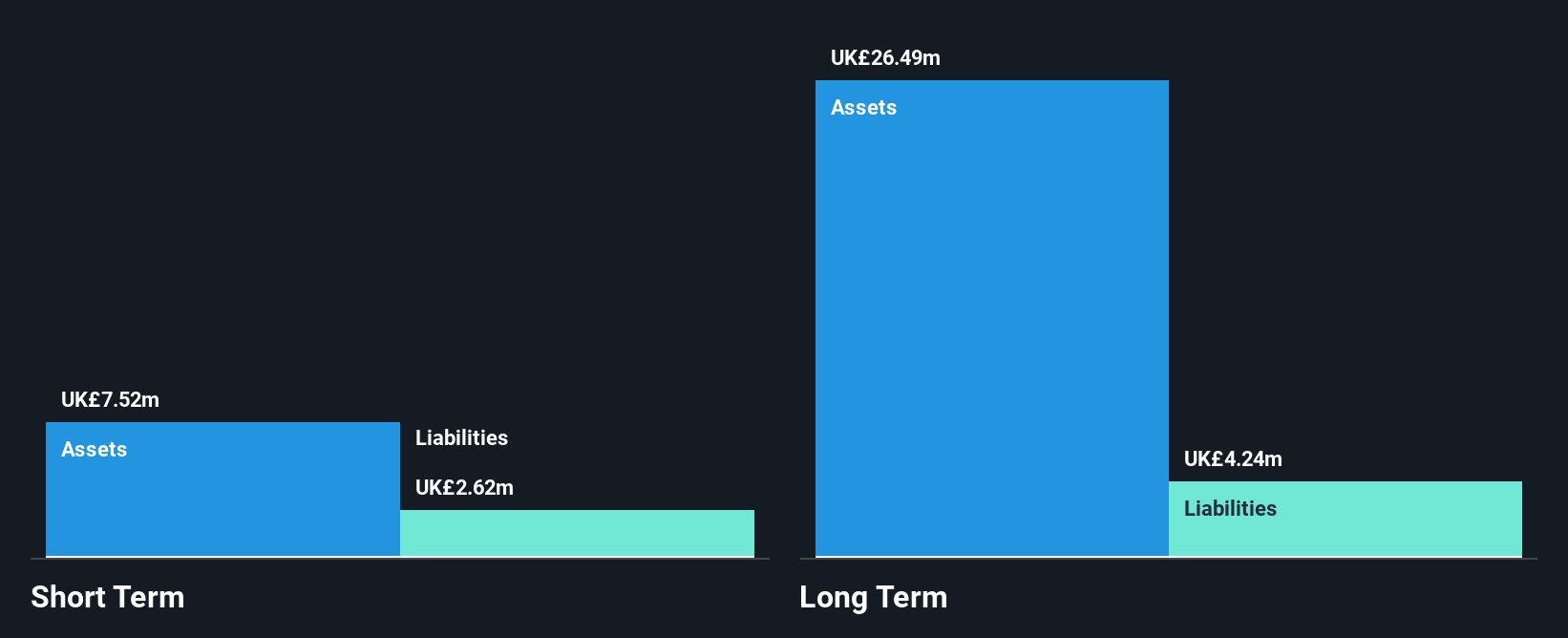

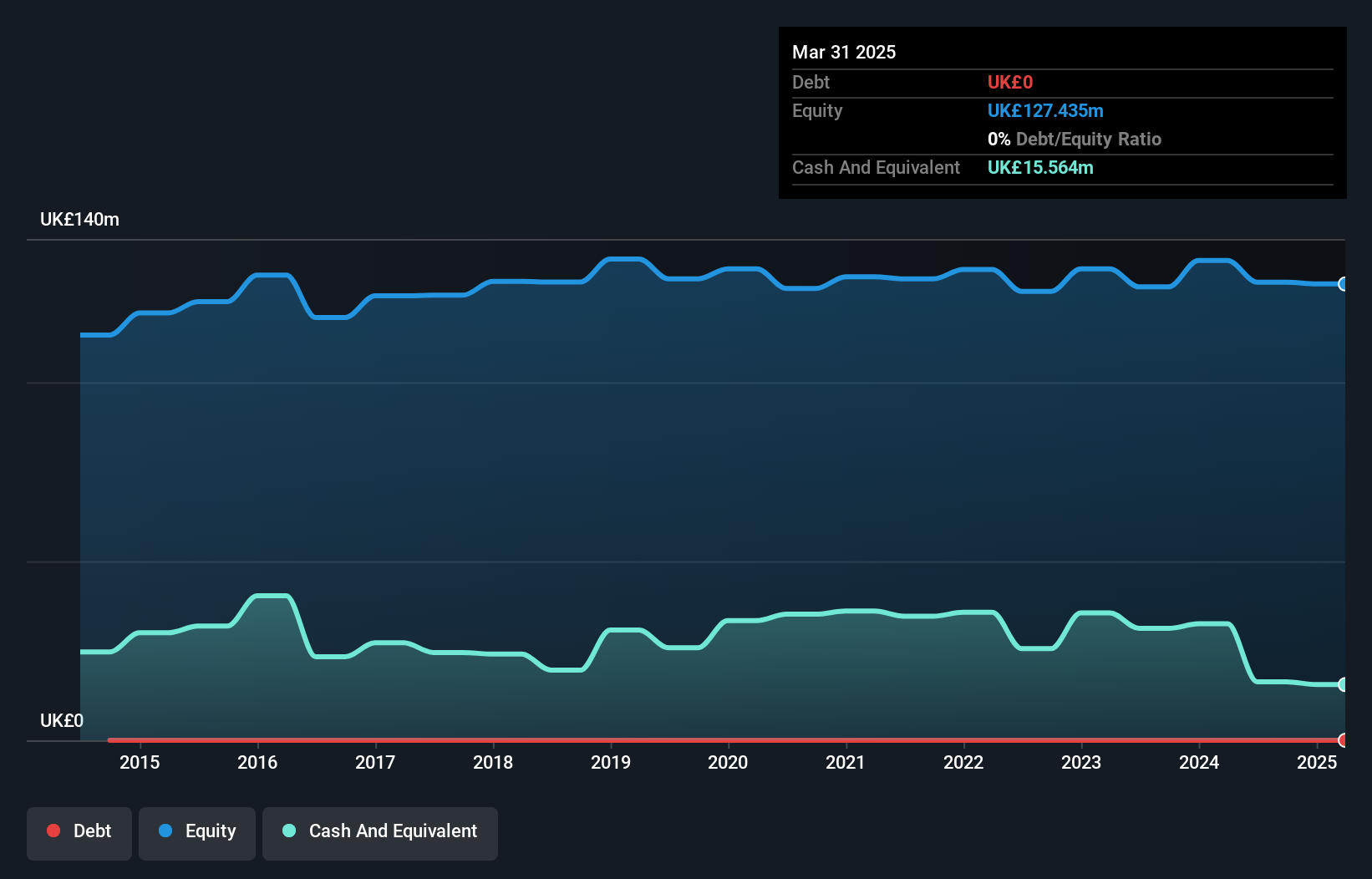

Castings P.L.C., with a market cap of £121.68 million, reported a decline in sales to £176.97 million and net income to £4.17 million for the full year ended March 31, 2025. Despite being debt-free with short-term assets exceeding both short and long-term liabilities, the company faces challenges with low return on equity at 3.3% and reduced profit margins of 2.4%. The dividend yield of 6.57% is not well covered by earnings or free cash flows, though dividends remain consistent year-on-year at 18.40 pence per share, reflecting management's commitment to shareholder returns amidst volatile earnings performance.

- Jump into the full analysis health report here for a deeper understanding of Castings.

- Examine Castings' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Gain an insight into the universe of 409 UK Penny Stocks by clicking here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives