- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

Personal Group Holdings Leads Our Top 3 UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery and its impact on global trade. Despite these broader market pressures, investors may find opportunities by exploring penny stocks—smaller or newer companies that can offer potential growth at a lower cost. While the term "penny stocks" might seem outdated, their relevance persists as they often combine affordability with promising financial strength, making them intriguing options for those looking beyond traditional blue-chip investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.025 | £459.02M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.06 | £166.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.72 | £131.73M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.965 | £14.57M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.04 | £25.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.455 | £70.28M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.53 | £45.68M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc provides employee services and salary sacrifice technology products in the United Kingdom with a market cap of £106.39 million.

Operations: The company's revenue is primarily derived from its Affordable Insurance segment, generating £34.15 million, and its Benefits Platform segment, contributing £13.26 million.

Market Cap: £106.39M

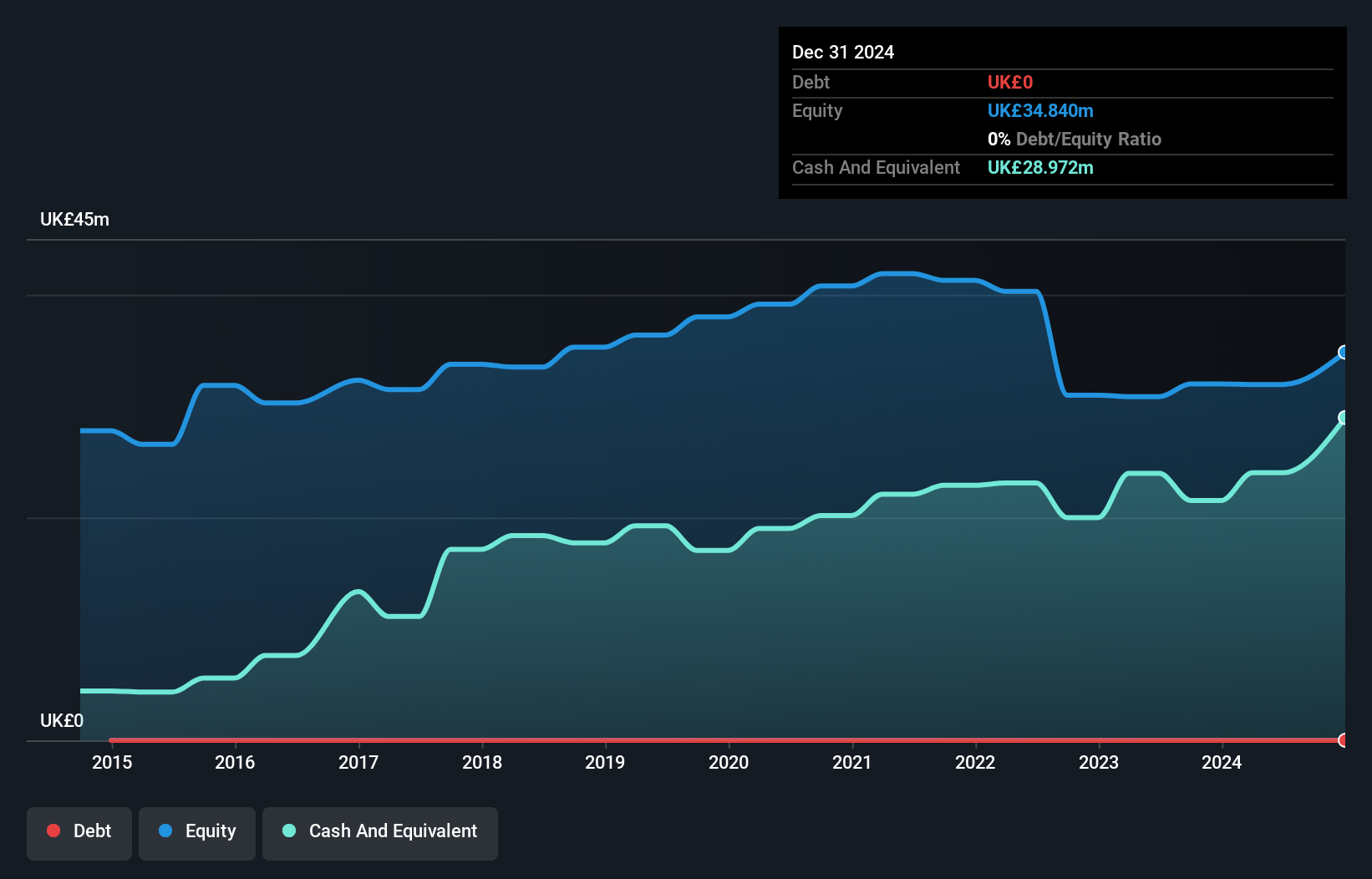

Personal Group Holdings Plc, with a market cap of £106.39 million, has shown robust performance in the penny stock category by delivering revenue growth to £23.34 million for the half-year ending June 2025, up from £21.04 million a year ago. Despite earnings declining by 12.2% annually over five years, recent figures indicate a turnaround with a 51.5% increase over the past year—surpassing industry averages—and net income rising to £2.99 million from £1.69 million previously reported. The company is debt-free and maintains strong asset coverage over liabilities while offering increased dividends despite an unstable track record.

- Dive into the specifics of Personal Group Holdings here with our thorough balance sheet health report.

- Understand Personal Group Holdings' earnings outlook by examining our growth report.

SRT Marine Systems (AIM:SRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SRT Marine Systems plc, along with its subsidiaries, develops and supplies AIS-based maritime domain awareness technologies, products, and systems, with a market cap of £182.17 million.

Operations: The company generates revenue of £78.02 million from its Marine Technology Business segment.

Market Cap: £182.17M

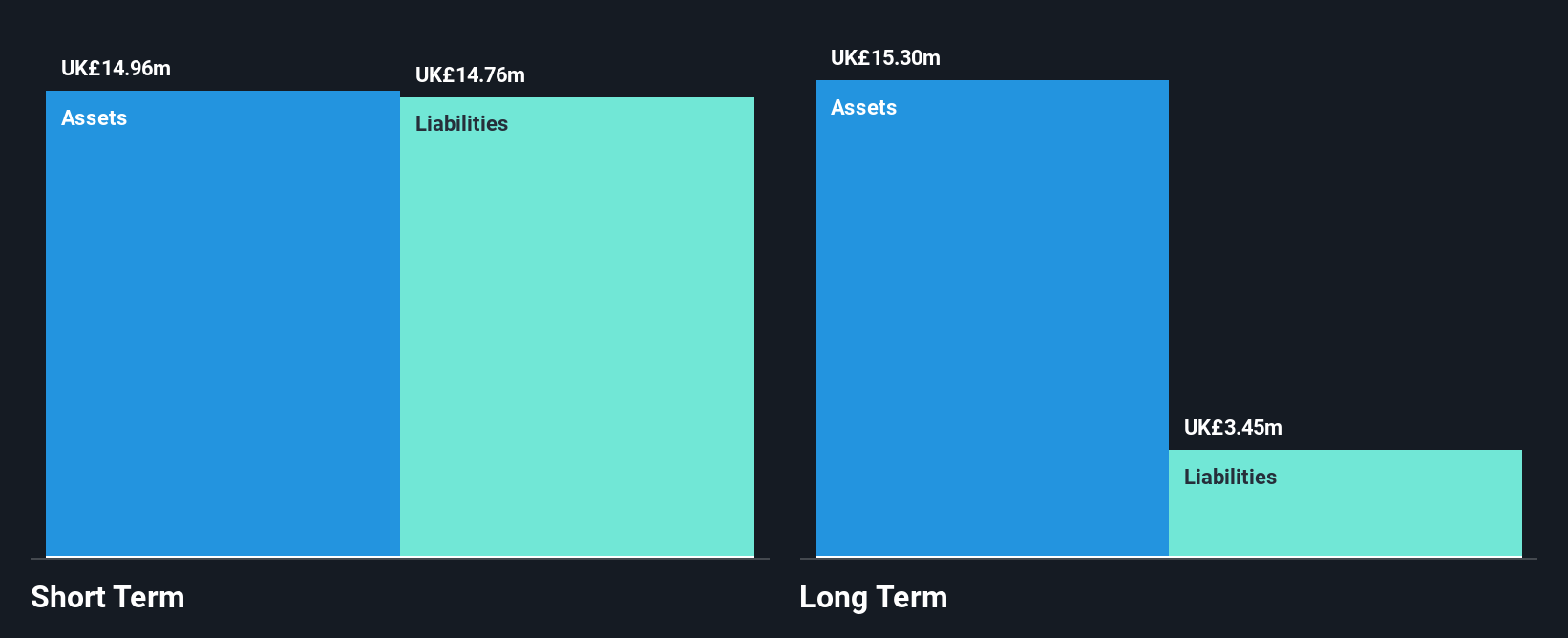

SRT Marine Systems, with a market cap of £182.17 million, has transitioned to profitability over the past year, reporting net income of £2.03 million on revenues of £78.02 million for the fiscal year ending June 30, 2025. The firm boasts strong short-term asset coverage over both short- and long-term liabilities and has reduced its debt-to-equity ratio from 65.3% to 61.8% over five years, though its net debt remains high relative to equity at 45.9%. A significant potential contract worth approximately US$200 million could further bolster its financial position if finalized successfully in the coming months.

- Click to explore a detailed breakdown of our findings in SRT Marine Systems' financial health report.

- Evaluate SRT Marine Systems' prospects by accessing our earnings growth report.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes fast-moving branded and discounted consumer goods across the UK, Ireland, the Netherlands, France, Europe, and internationally with a market cap of £184.19 million.

Operations: The company's revenue is primarily generated from Vaping (£137.57 million) and Drinks & Wellness (£65.16 million).

Market Cap: £184.19M

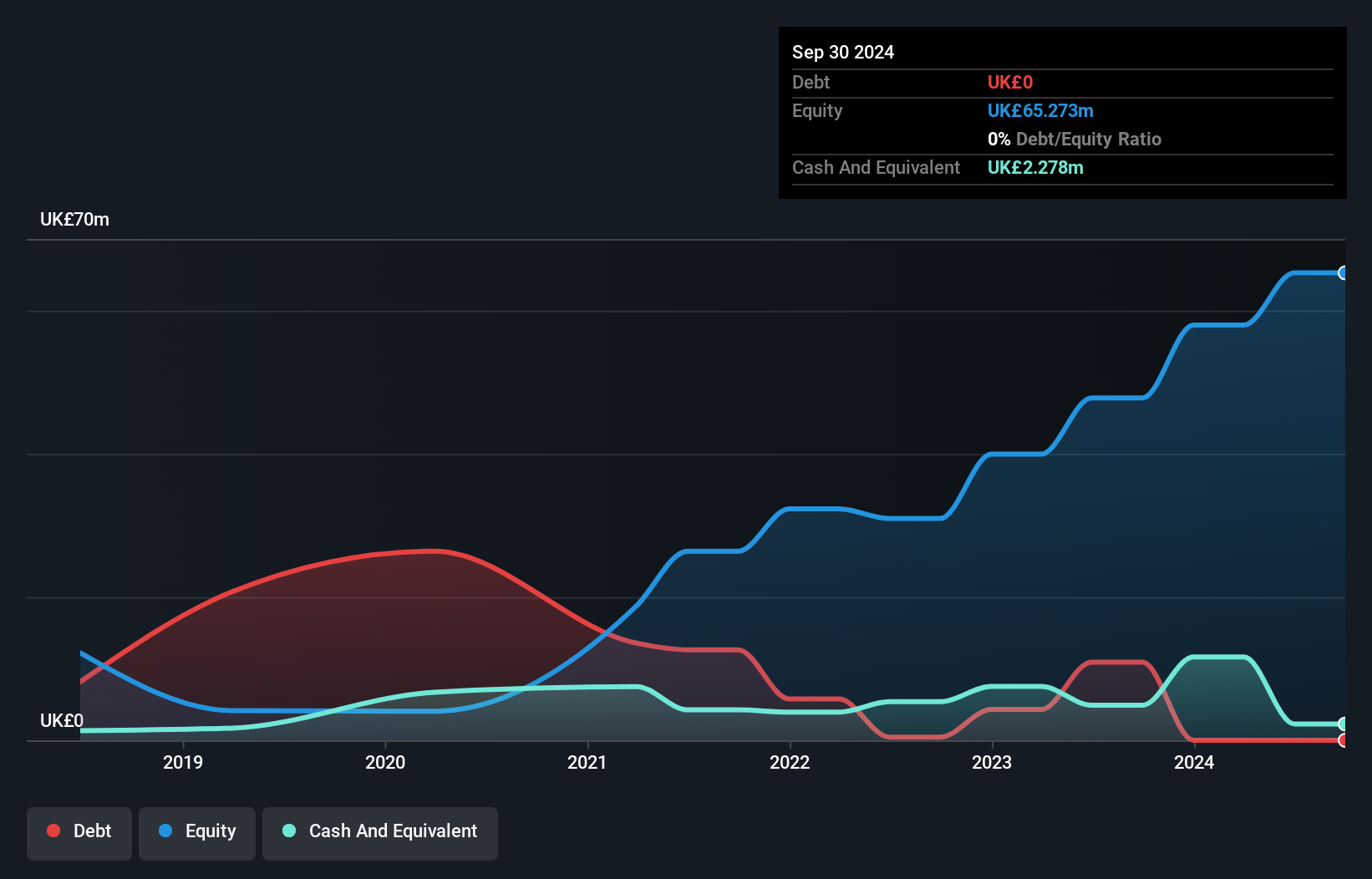

Supreme Plc, with a market cap of £184.19 million, has demonstrated resilience despite recent challenges. The company reported half-year sales of £132.56 million, an increase from the previous year, though net income declined to £9.01 million from £10.68 million. Supreme's debt-free status enhances its financial stability and positions it well against short- and long-term liabilities with ample asset coverage (£87.2M vs £60M total liabilities). Despite a slight dip in profit margins to 8.7%, the firm maintains high-quality earnings and strong return on equity at 26.8%. However, recent negative earnings growth highlights potential volatility in its performance outlook.

- Click here to discover the nuances of Supreme with our detailed analytical financial health report.

- Examine Supreme's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Investigate our full lineup of 305 UK Penny Stocks right here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SUP

Supreme

Owns, manufactures, and distributes fast-moving branded and discounted consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026