- United Kingdom

- /

- Machinery

- /

- LSE:VSVS

Discover UK Dividend Stocks With Yields Up To 6.2%

Reviewed by Simply Wall St

The UK stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting the interconnectedness of global economies. In such uncertain times, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking to navigate volatile market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Seplat Energy (LSE:SEPL) | 5.39% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.00% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.34% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.06% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.57% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.30% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.36% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.44% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.81% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.50% | ★★★★★★ |

Click here to see the full list of 51 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

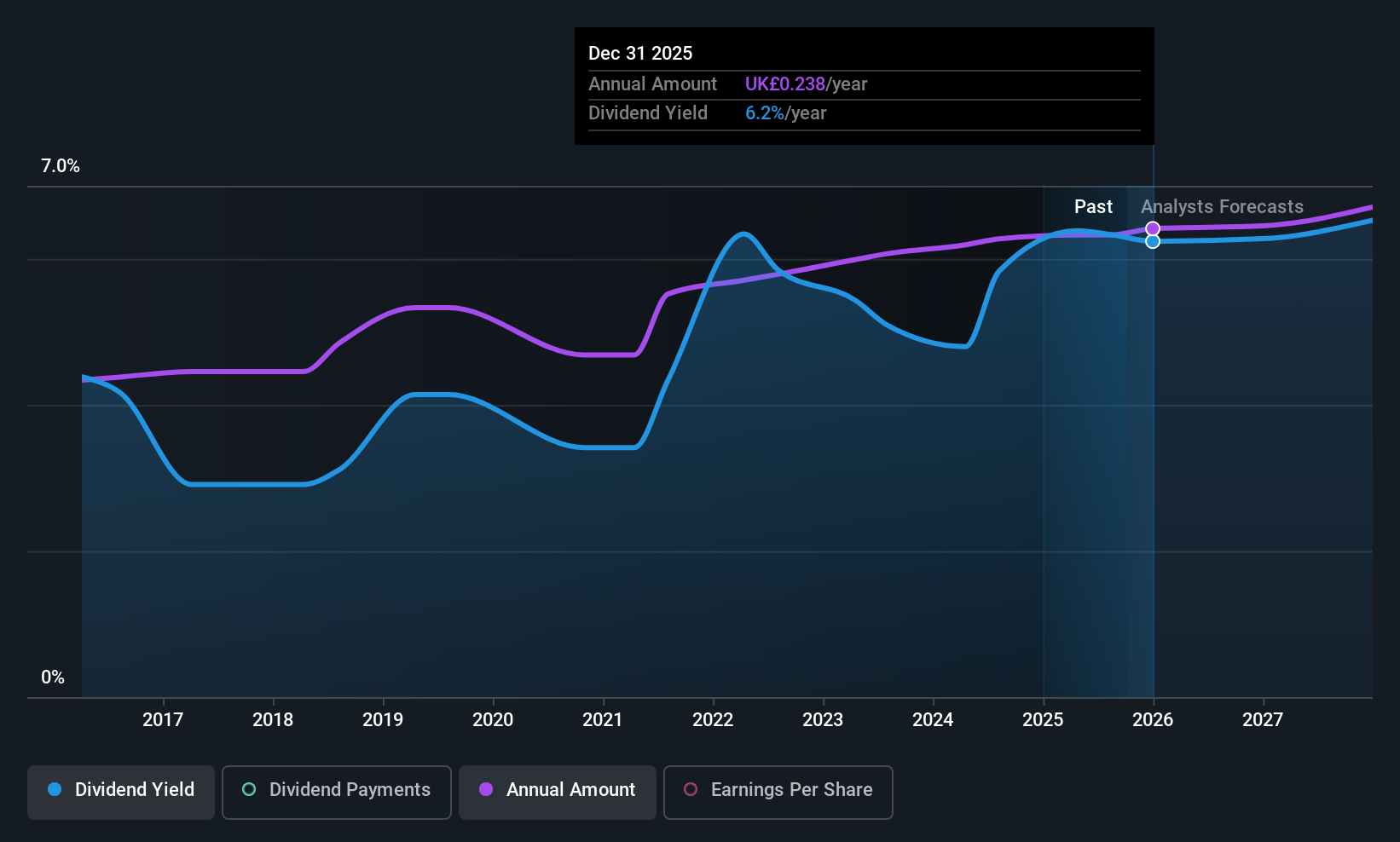

Arbuthnot Banking Group (AIM:ARBB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arbuthnot Banking Group PLC, along with its subsidiaries, offers private and commercial banking products and services in the United Kingdom, with a market cap of £149.14 million.

Operations: Arbuthnot Banking Group PLC generates revenue from several segments, including Wealth Management (£15.21 million), Asset Alliance Group (£15.40 million), Renaissance Asset Finance (£14.09 million), and Arbuthnot Commercial Asset Based Lending (£20.31 million).

Dividend Yield: 5.4%

Arbuthnot Banking Group's dividend yield ranks in the top 25% of UK payers, with recent increases reflecting a stable payout ratio. However, past dividend volatility and a high bad loans ratio (3.7%) pose risks. Despite earnings coverage for dividends being forecasted at 40.6% in three years, recent financial results show decreased net income and profit margins compared to last year. Recent board changes may influence future strategic directions impacting dividends.

- Take a closer look at Arbuthnot Banking Group's potential here in our dividend report.

- The valuation report we've compiled suggests that Arbuthnot Banking Group's current price could be quite moderate.

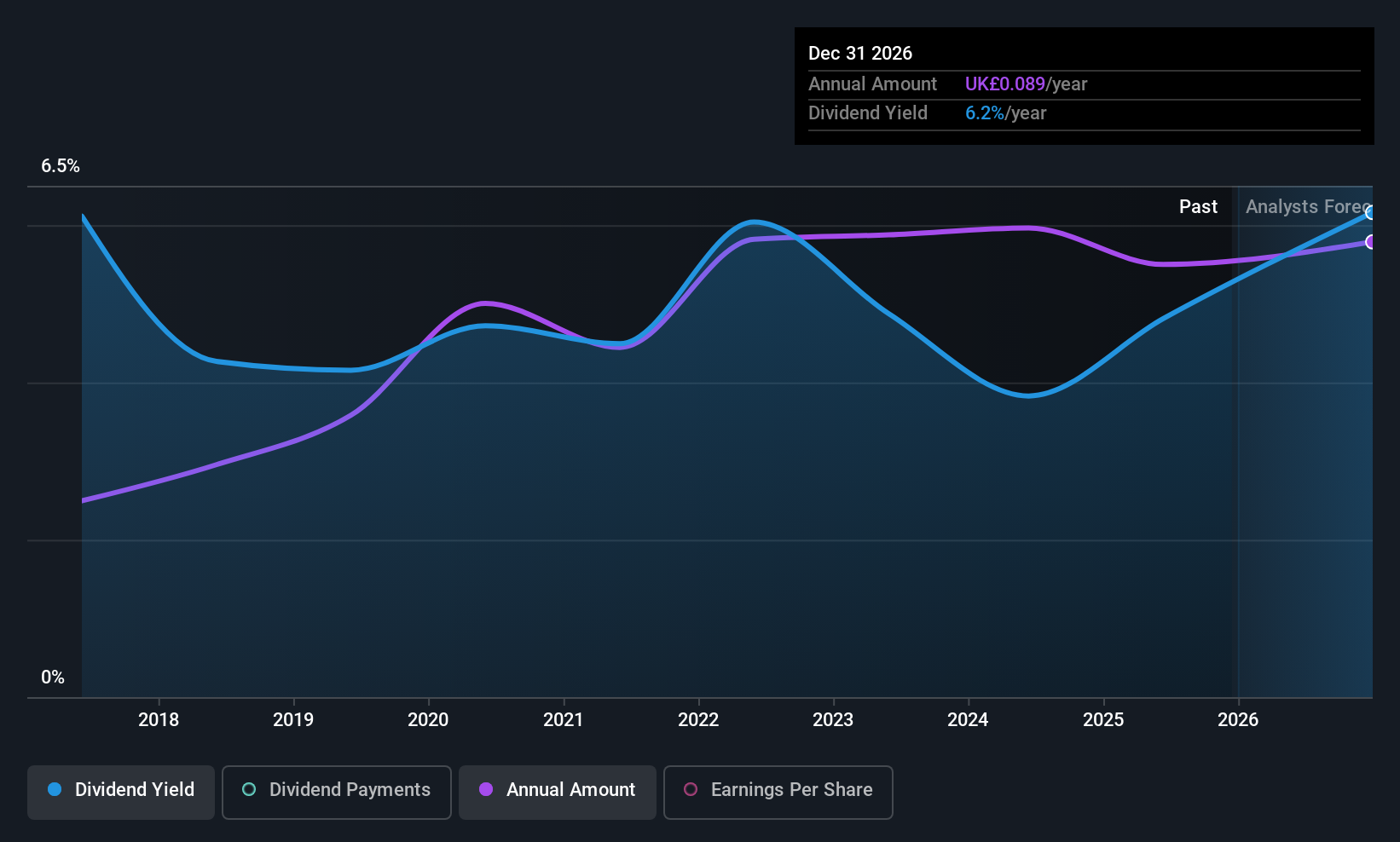

Spectra Systems (AIM:SPSY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spectra Systems Corporation invents, develops, and sells integrated optical systems in the United States and internationally, with a market cap of £76.32 million.

Operations: Spectra Systems Corporation's revenue is primarily derived from its Authentication Systems segment at $40.77 million and Software Security segment at $2.96 million.

Dividend Yield: 5.5%

Spectra Systems' dividend yield is among the top 25% of UK payers, supported by a sustainable payout ratio of 65.4%. Recent earnings showed significant growth, with net income rising to US$10.06 million for the first half of 2025. However, dividends have been paid for less than a decade, indicating limited historical reliability. The stock trades at a discount compared to its estimated fair value and peers, though future earnings are expected to decline significantly.

- Click here and access our complete dividend analysis report to understand the dynamics of Spectra Systems.

- Insights from our recent valuation report point to the potential undervaluation of Spectra Systems shares in the market.

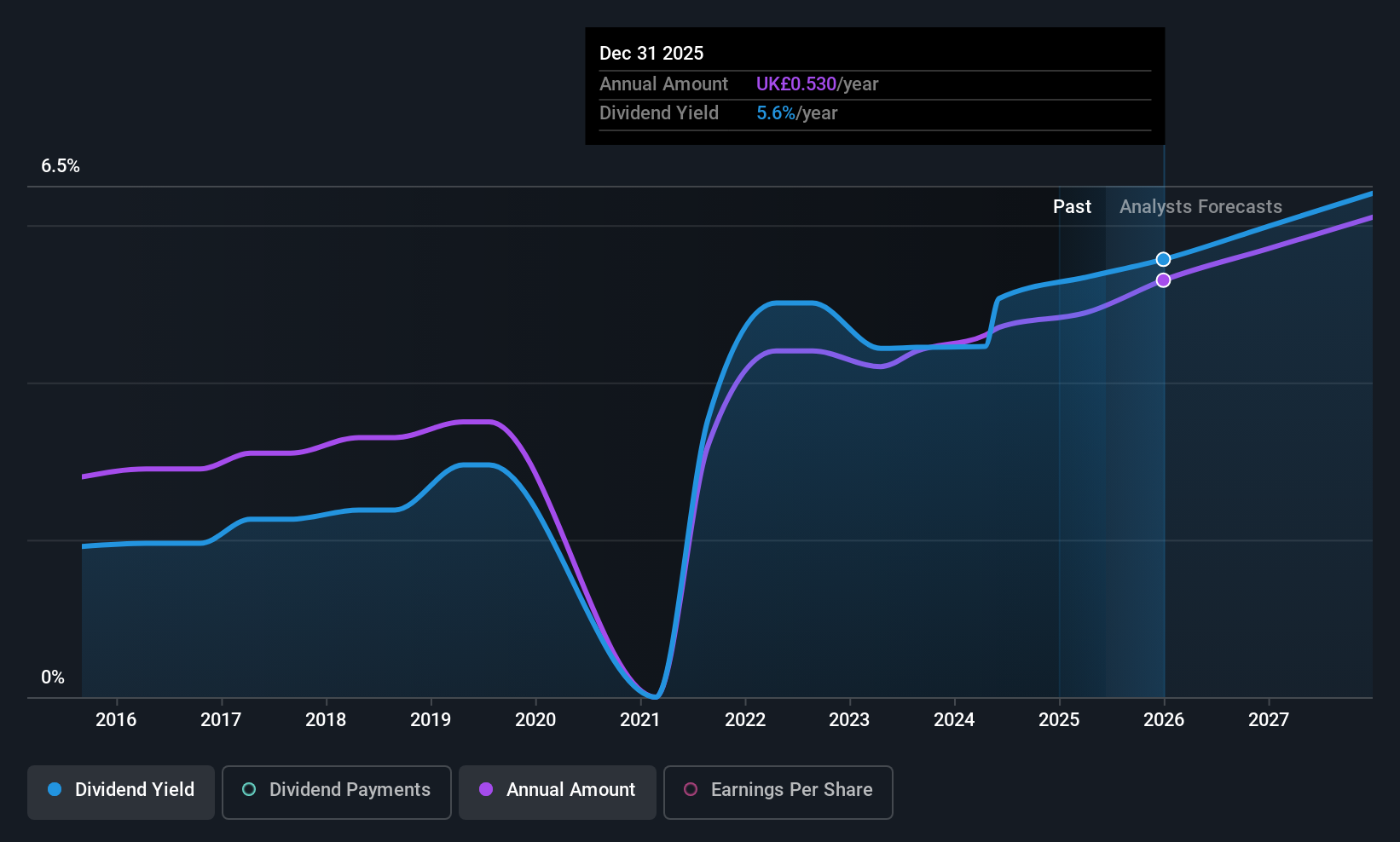

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc offers molten metal flow engineering and technology services to the steel and foundry casting industries globally, with a market cap of approximately £916.20 million.

Operations: Vesuvius plc generates revenue through its segments: Foundry (£463 million), Steel - Flow Control (£753.40 million), Steel - Sensors & Probes (£36.30 million), and Steel - Advanced Refractories (£538.30 million).

Dividend Yield: 6.3%

Vesuvius offers a dividend yield in the top 25% of UK payers, but its payout ratio of 84.1% suggests limited coverage by earnings. Despite recent affirmations, dividends have been volatile over the past decade and are not well covered by free cash flows, with a cash payout ratio of 235.3%. The stock trades at a significant discount to its estimated fair value and industry peers, though historical reliability remains an issue for investors seeking stable income.

- Click here to discover the nuances of Vesuvius with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Vesuvius' share price might be too pessimistic.

Seize The Opportunity

- Click this link to deep-dive into the 51 companies within our Top UK Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VSVS

Vesuvius

Provides molten metal flow engineering and technology services to steel and foundry casting industries worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)