Midwich Group plc (LON:MIDW) Goes Ex-Dividend Soon

Readers hoping to buy Midwich Group plc (LON:MIDW) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Thus, you can purchase Midwich Group's shares before the 21st of September in order to receive the dividend, which the company will pay on the 27th of October.

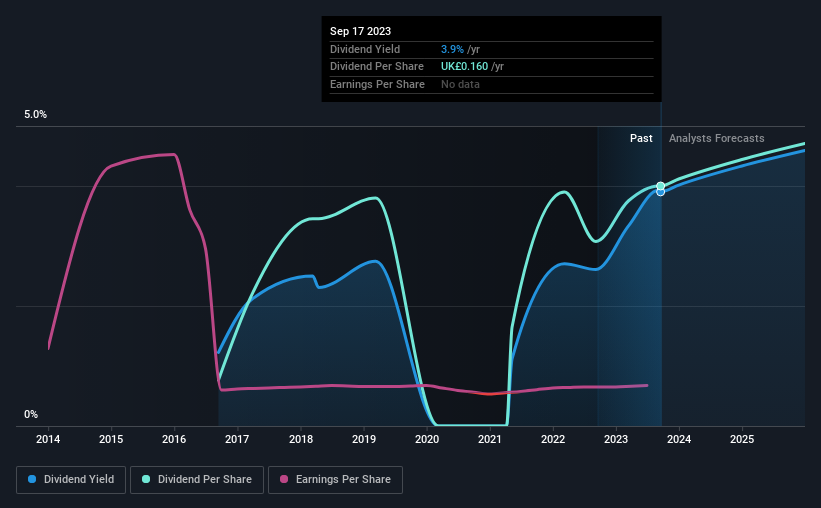

The company's next dividend payment will be UK£0.055 per share, and in the last 12 months, the company paid a total of UK£0.16 per share. Based on the last year's worth of payments, Midwich Group stock has a trailing yield of around 3.9% on the current share price of £4.1. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Midwich Group has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Midwich Group

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Midwich Group is paying out an acceptable 74% of its profit, a common payout level among most companies. A useful secondary check can be to evaluate whether Midwich Group generated enough free cash flow to afford its dividend. Dividends consumed 65% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's positive to see that Midwich Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at Midwich Group, with earnings per share up 2.2% on average over the last five years. Earnings per share growth has been slim, and the company is already paying out a majority of its earnings. While there is some room to both increase the payout ratio and reinvest in the business, generally the higher a payout ratio goes, the lower a company's prospects for future growth.

Midwich Group also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Midwich Group has delivered 27% dividend growth per year on average over the past seven years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has Midwich Group got what it takes to maintain its dividend payments? Earnings per share growth has been unremarkable, and while the company is paying out a majority of its earnings and cash flow in the form of dividends, the dividend payments don't appear excessive. To summarise, Midwich Group looks okay on this analysis, although it doesn't appear a stand-out opportunity.

If you want to look further into Midwich Group, it's worth knowing the risks this business faces. For example - Midwich Group has 3 warning signs we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MIDW

Midwich Group

Distributes audio visual (AV) solutions to trade customers in the United Kingdom, Ireland, Europe, the Middle East, Africa, the Asia Pacific, and North America.

Slight risk and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)