- United Kingdom

- /

- Media

- /

- LSE:CAU

UK Penny Stocks: 3 Picks With At Least £10M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines as China's economic recovery struggles to gain momentum. Despite these broader market pressures, there remains a niche for investors interested in penny stocks—smaller or newer companies that can offer unique opportunities. While the term "penny stock" may seem outdated, these investments continue to hold potential for those seeking hidden value in companies with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.80 | £537.39M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.02 | £163.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.72 | £10.87M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.903 | £333.91M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.43 | £74.04M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.856 | £701.05M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Light Science Technologies Holdings (AIM:LST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Light Science Technologies Holdings Plc develops and manufactures electronic boards in the United Kingdom and Ireland, with a market cap of £13.32 million.

Operations: The company's revenue is primarily derived from its Contract Electronics Manufacture segment, generating £8.53 million, followed by Passive Fire Protection at £2.43 million and Controlled Environment Agriculture at £0.94 million.

Market Cap: £13.32M

Light Science Technologies Holdings Plc, with a market cap of £13.32 million, has recently secured two new contracts worth approximately £0.45 million in its Passive Fire Protection division, reflecting growing demand and legislative opportunities in the UK. The company reported half-year sales of £5.06 million and a reduced net loss compared to the previous year. Despite high volatility and low return on equity at 4.8%, its debt is well covered by operating cash flow, indicating financial stability. The management team is experienced, with no significant shareholder dilution recently noted, supporting investor confidence amidst sector challenges.

- Unlock comprehensive insights into our analysis of Light Science Technologies Holdings stock in this financial health report.

- Learn about Light Science Technologies Holdings' historical performance here.

Pebble Group (AIM:PEBB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Pebble Group plc, along with its subsidiaries, provides technology solutions, products, and services to the promotional merchandise industry across the UK, Continental Europe, North America, and internationally with a market cap of £77.28 million.

Operations: The company's revenue is divided into two main segments: Facilis Group, generating £17.29 million, and Brand Addition, contributing £105.82 million.

Market Cap: £77.28M

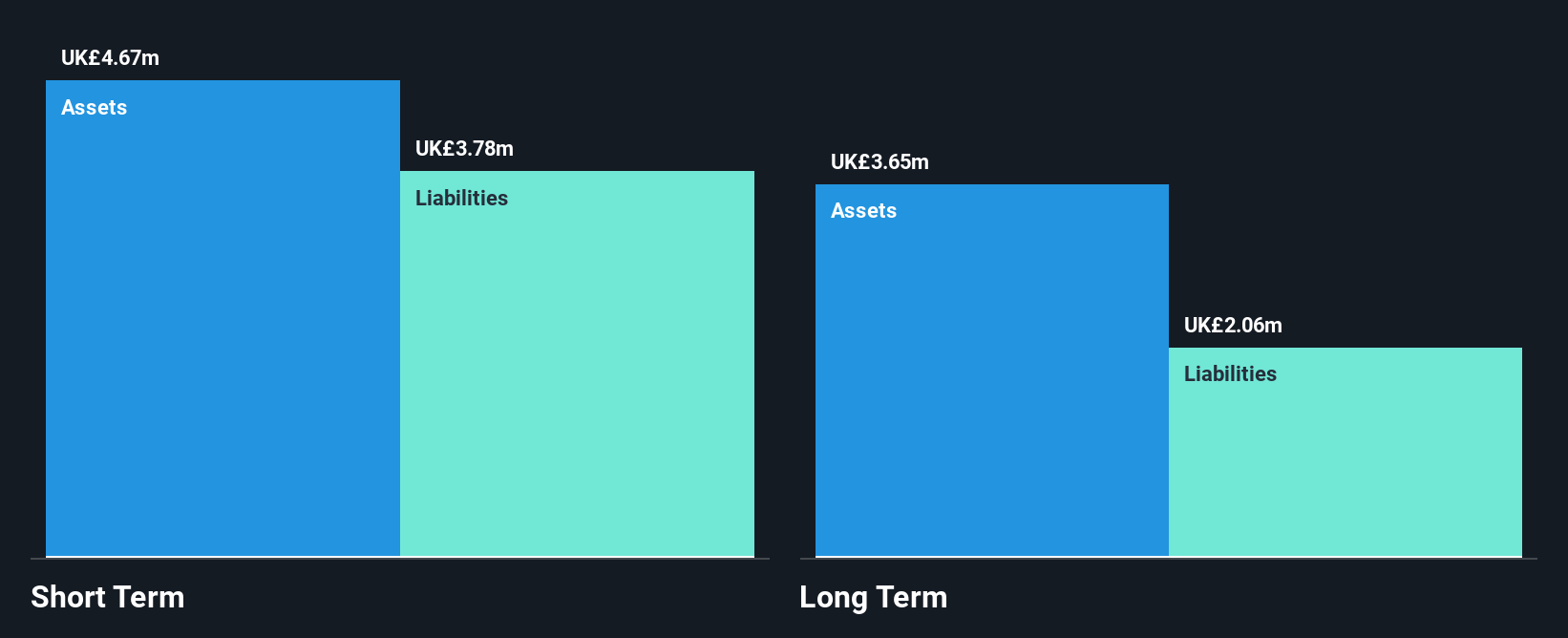

The Pebble Group, with a market cap of £77.28 million, has shown financial stability with short-term assets exceeding both short and long-term liabilities. The company is debt-free, which enhances its financial flexibility. Recent earnings growth of 5.9% surpassed the media industry's decline but fell below its own five-year average growth rate of 18.7%. Despite stable weekly volatility and no significant shareholder dilution, insider selling in the past quarter raises some concerns. The firm's recent share buyback program completed at £6.5 million may indicate confidence in its valuation amidst anticipated stable revenue for fiscal year 2025.

- Jump into the full analysis health report here for a deeper understanding of Pebble Group.

- Review our growth performance report to gain insights into Pebble Group's future.

Centaur Media (LSE:CAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaur Media Plc provides business information, learning, and specialist consultancy services to professional and commercial markets globally, with a market cap of £61.16 million.

Operations: The company generates revenue through its segment, The Lawyer, which contributes £9.41 million.

Market Cap: £61.16M

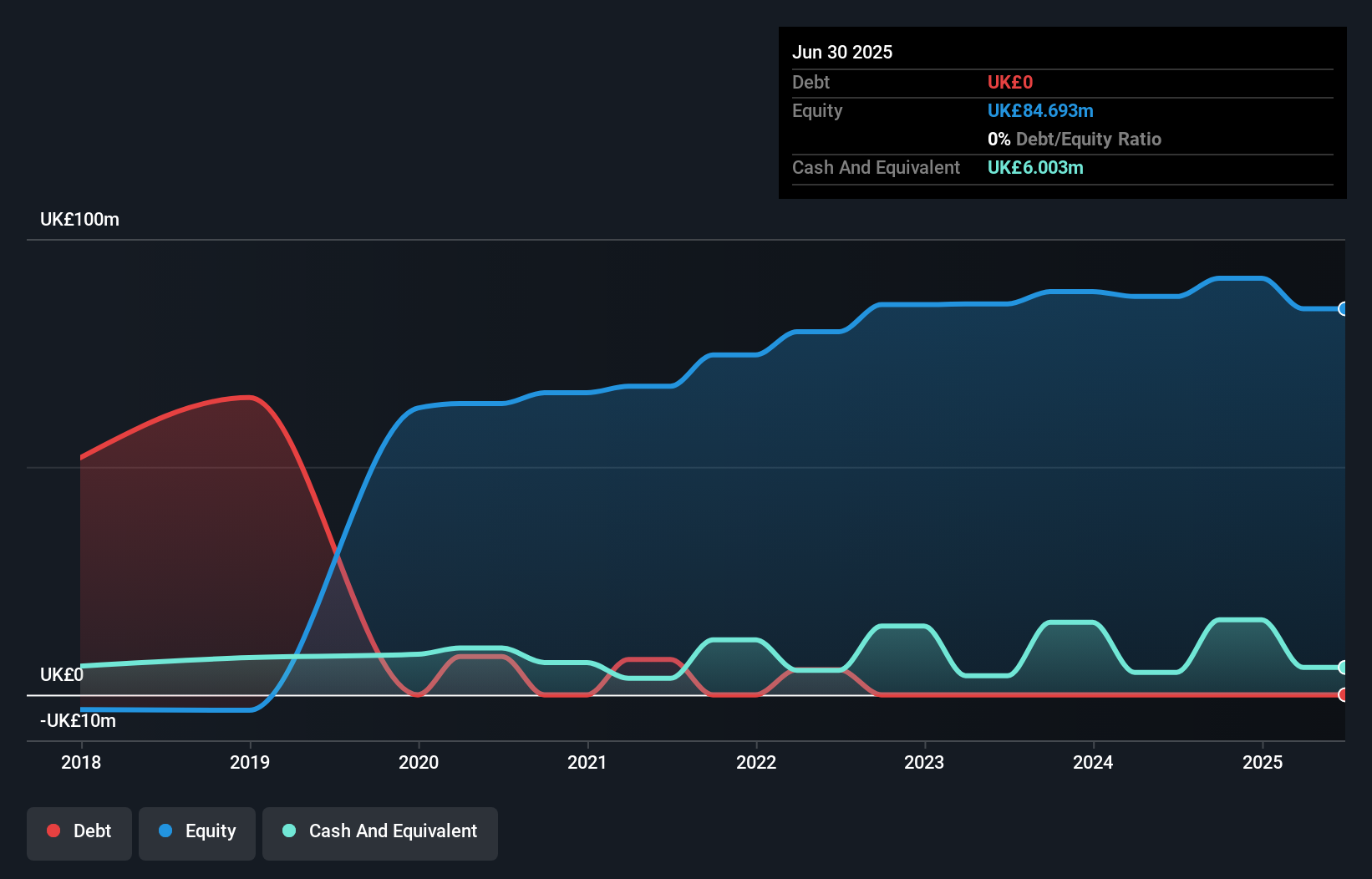

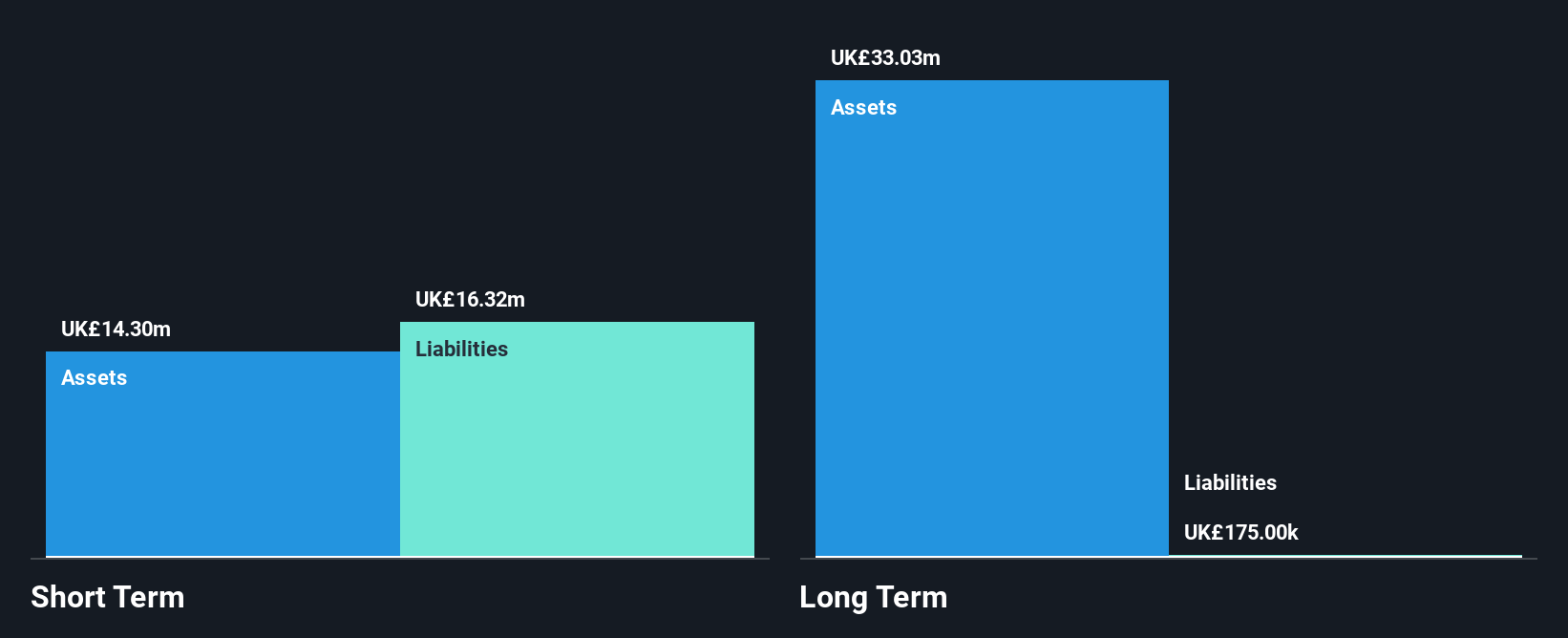

Centaur Media Plc, with a market cap of £61.16 million, operates in the business information sector and recently reported a net loss of £0.057 million for H1 2025 despite sales of £11.14 million. The company remains debt-free and has sufficient cash runway for over three years due to positive free cash flow growth. However, it faces challenges with unprofitability and increased losses over five years at 18.3% annually. While short-term assets exceed long-term liabilities, they fall short against short-term obligations (£16.3M). The board announced an interim dividend of 0.6 pence per share, reflecting ongoing shareholder returns amidst financial pressures.

- Dive into the specifics of Centaur Media here with our thorough balance sheet health report.

- Evaluate Centaur Media's prospects by accessing our earnings growth report.

Summing It All Up

- Reveal the 297 hidden gems among our UK Penny Stocks screener with a single click here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAU

Centaur Media

Engages in the provision of business information, learning, and specialist consultancy to professional and commercial markets in the United Kingdom, rest of Europe, North America, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives