How Should Investors React To Image Scan Holdings' (LON:IGE) CEO Pay?

This article will reflect on the compensation paid to Bill Mawer who has served as CEO of Image Scan Holdings Plc (LON:IGE) since 2014. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Image Scan Holdings.

Check out our latest analysis for Image Scan Holdings

Comparing Image Scan Holdings Plc's CEO Compensation With the industry

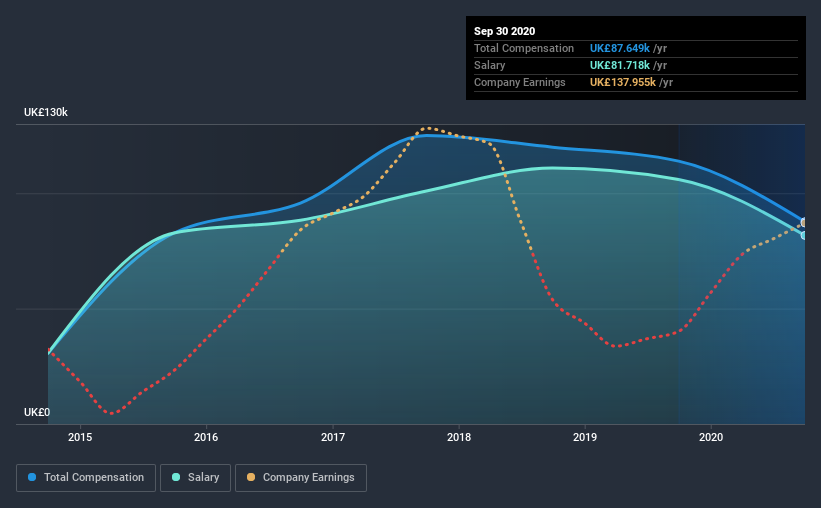

At the time of writing, our data shows that Image Scan Holdings Plc has a market capitalization of UK£4.2m, and reported total annual CEO compensation of UK£88k for the year to September 2020. We note that's a decrease of 23% compared to last year. In particular, the salary of UK£81.7k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below UK£146m, reported a median total CEO compensation of UK£240k. That is to say, Bill Mawer is paid under the industry median. Moreover, Bill Mawer also holds UK£156k worth of Image Scan Holdings stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£82k | UK£106k | 93% |

| Other | UK£5.9k | UK£7.9k | 7% |

| Total Compensation | UK£88k | UK£114k | 100% |

On an industry level, around 78% of total compensation represents salary and 22% is other remuneration. It's interesting to note that Image Scan Holdings pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Image Scan Holdings Plc's Growth Numbers

Image Scan Holdings Plc has reduced its earnings per share by 39% a year over the last three years. It achieved revenue growth of 47% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Image Scan Holdings Plc Been A Good Investment?

With a three year total loss of 56% for the shareholders, Image Scan Holdings Plc would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Image Scan Holdings Plc is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But poor shareholder returns EPS growth have hampered the company over the past three years. Conversely, revenues are increasing at a healthy pace, recently. Although it's fair to say CEO compensation is modest, shareholders might want to see healthier investor returns before thinking Bill deserves a raise.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which is concerning) in Image Scan Holdings we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Image Scan Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IGE

Image Scan Holdings

Through its subsidiary 3DX-Ray Limited, engages in the manufacture and sale of portable X-ray systems in the United Kingdom, Europe, the Middle East, Africa, Asia, Indian Subcontinent, and the Americas.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)