- United Kingdom

- /

- Hospitality

- /

- LSE:BOWL

Undervalued UK Small Caps With Insider Buying To Enhance Your Portfolio

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic pressures. In this environment, small-cap stocks in the UK may present unique opportunities for investors seeking potential growth and resilience amid broader market uncertainties. Identifying companies where insiders are buying shares can be a positive indicator of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.4x | 5.2x | 30.76% | ★★★★★★ |

| 4imprint Group | 17.9x | 1.5x | 30.67% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 34.12% | ★★★★★☆ |

| THG | NA | 0.3x | 29.94% | ★★★★★☆ |

| Gamma Communications | 22.0x | 2.3x | 39.82% | ★★★★☆☆ |

| iomart Group | 24.2x | 0.6x | 33.77% | ★★★★☆☆ |

| CVS Group | 25.9x | 1.0x | 47.49% | ★★★★☆☆ |

| XPS Pensions Group | 11.5x | 3.3x | 3.48% | ★★★☆☆☆ |

| Telecom Plus | 17.1x | 0.7x | 33.64% | ★★★☆☆☆ |

| Warpaint London | 24.2x | 4.2x | 1.38% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★★☆☆

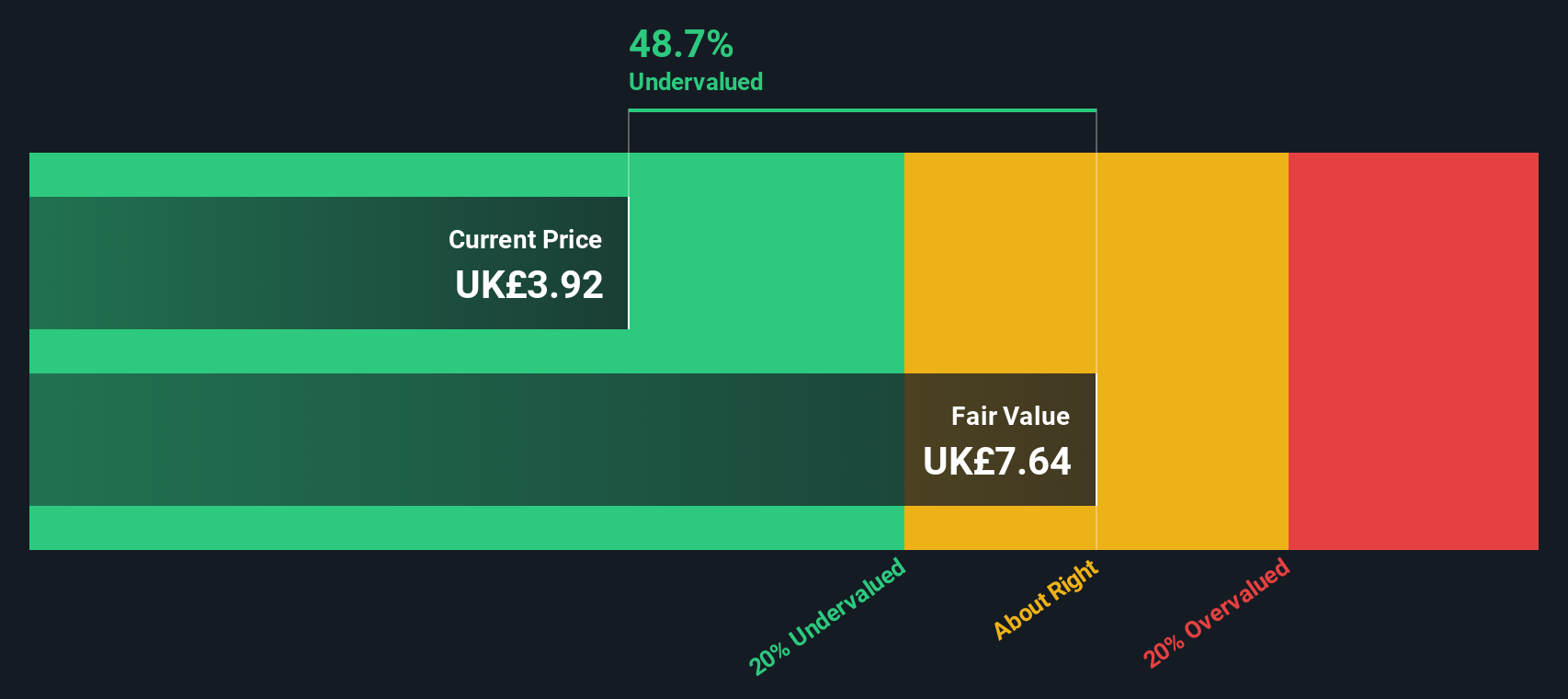

Overview: Hollywood Bowl Group operates a chain of ten-pin bowling centers across the UK, focusing on providing family-friendly entertainment experiences, with a market cap of approximately £0.48 billion.

Operations: Revenue is primarily derived from recreational activities, with recent figures reaching £230.40 million. The company experienced fluctuations in its gross profit margin, which decreased from 85.75% in September 2020 to 63.15% by September 2024. Operating expenses have been a significant component of the cost structure, impacting profitability alongside non-operating expenses and depreciation & amortization costs.

PE: 16.2x

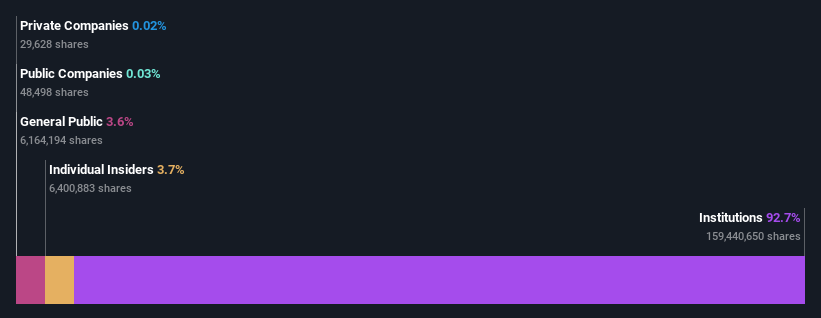

Hollywood Bowl Group, a smaller player in the UK market, exhibits potential for growth despite some challenges. Their earnings are projected to grow 11% annually. Recently, they reported sales of £230 million for the year ending September 2024, up from £215 million previously, though net income dipped to £29.91 million from £34.15 million. Insider confidence is evident as Peter Boddy acquired 100,000 shares worth approximately £320K in December 2024.

- Click to explore a detailed breakdown of our findings in Hollywood Bowl Group's valuation report.

Explore historical data to track Hollywood Bowl Group's performance over time in our Past section.

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★★★☆

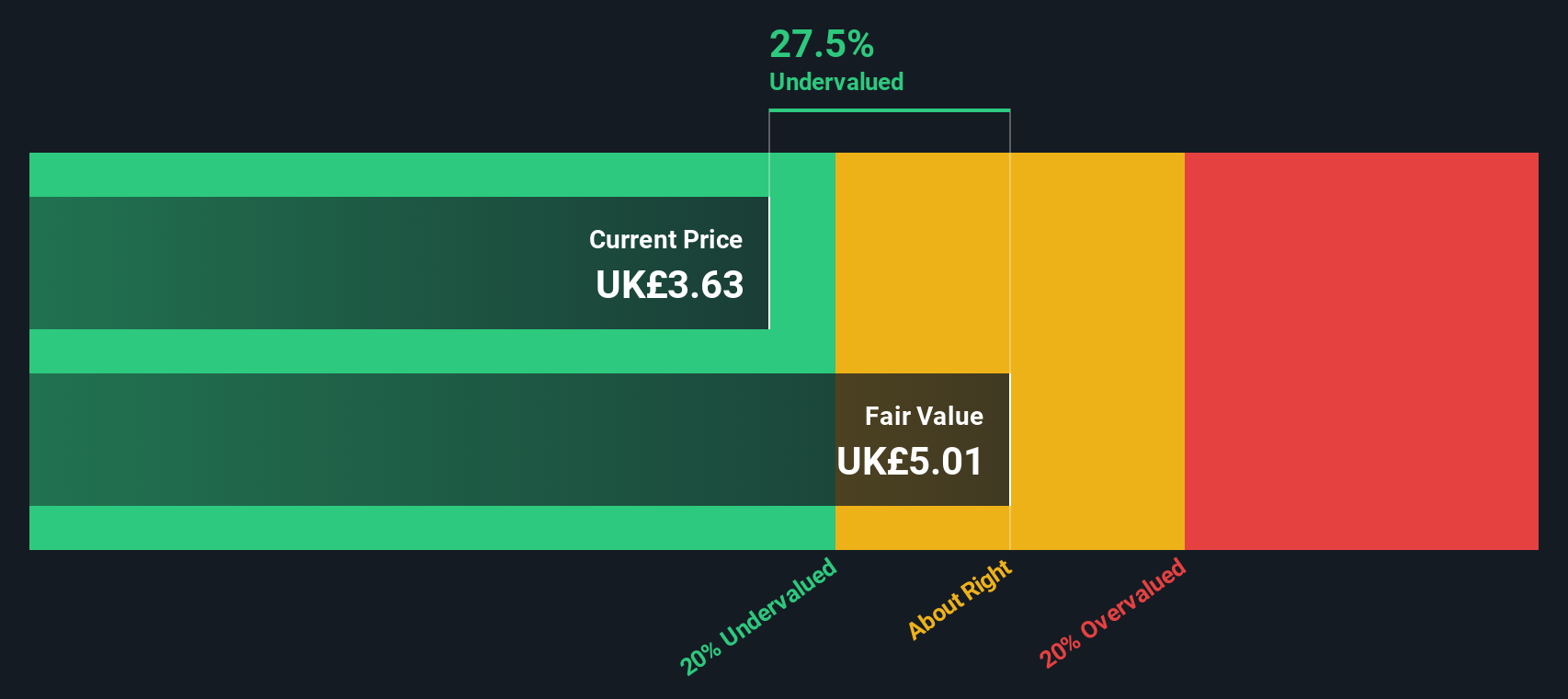

Overview: Breedon Group is a construction materials company operating primarily in the cement and aggregates sectors, with a market capitalization of £1.39 billion.

Operations: Breedon Group's revenue streams are primarily derived from its operations in Great Britain and Ireland, with significant contributions from its cement segment. The company has experienced fluctuations in its gross profit margin, with a notable decrease to 10.83% as of December 2023. Operating expenses have varied over time, impacting the net income margin which was recorded at 6.34% for June 2024.

PE: 15.3x

Breedon Group, a construction materials company in the UK, is attracting attention for its potential value. Despite relying on external borrowing for funding, which carries higher risk compared to customer deposits, Breedon's earnings are projected to grow 14% annually. Insider confidence is evident with recent share purchases made over the past six months. This suggests belief in future growth prospects within their industry. With these dynamics at play, Breedon presents an intriguing opportunity among smaller companies in the UK market.

- Get an in-depth perspective on Breedon Group's performance by reading our valuation report here.

Gain insights into Breedon Group's historical performance by reviewing our past performance report.

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★★★

Overview: Bytes Technology Group is an IT solutions provider with a focus on delivering software, security, hardware, and cloud services to businesses and public sector organizations, boasting a market capitalization of approximately £1.02 billion.

Operations: The company generates revenue primarily from its IT solutions, with a recent gross profit margin of 74.86%. Over time, the cost of goods sold has decreased significantly relative to revenue, contributing to an increase in net income margin to 25.47%.

PE: 20.4x

Bytes Technology Group, a UK-based company, is attracting attention due to its potential for growth and insider confidence. Insiders have shown confidence by purchasing shares in the last quarter of 2024. With earnings projected to grow 7.15% annually, the company displays promising prospects despite relying entirely on external borrowing for funding. While this increases financial risk, it also highlights an opportunity for investors seeking growth in this sector.

- Click here and access our complete valuation analysis report to understand the dynamics of Bytes Technology Group.

Learn about Bytes Technology Group's historical performance.

Taking Advantage

- Dive into all 40 of the Undervalued UK Small Caps With Insider Buying we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hollywood Bowl Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOWL

Hollywood Bowl Group

Operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives