- United Kingdom

- /

- Hospitality

- /

- LSE:DOM

Undervalued Small Caps With Insider Activity In United Kingdom October 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. Amid these broader market pressures, small-cap stocks in the UK may present unique opportunities for investors seeking potential growth and resilience. In this context, identifying small-cap companies with strong fundamentals and notable insider activity can be particularly compelling as they might offer insights into confidence within these firms despite external economic headwinds.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.1x | 0.6x | 37.54% | ★★★★★★ |

| Bytes Technology Group | 23.1x | 5.9x | 7.86% | ★★★★★☆ |

| John Wood Group | NA | 0.2x | 39.40% | ★★★★★☆ |

| Genus | 168.0x | 2.0x | 10.00% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 27.46% | ★★★★★☆ |

| Marlowe | NA | 0.7x | 41.41% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 38.66% | ★★★★☆☆ |

| Robert Walters | 43.6x | 0.3x | 39.48% | ★★★☆☆☆ |

| Sabre Insurance Group | 11.5x | 1.5x | 18.95% | ★★★☆☆☆ |

| Essentra | 727.3x | 1.4x | 14.56% | ★★☆☆☆☆ |

Let's uncover some gems from our specialized screener.

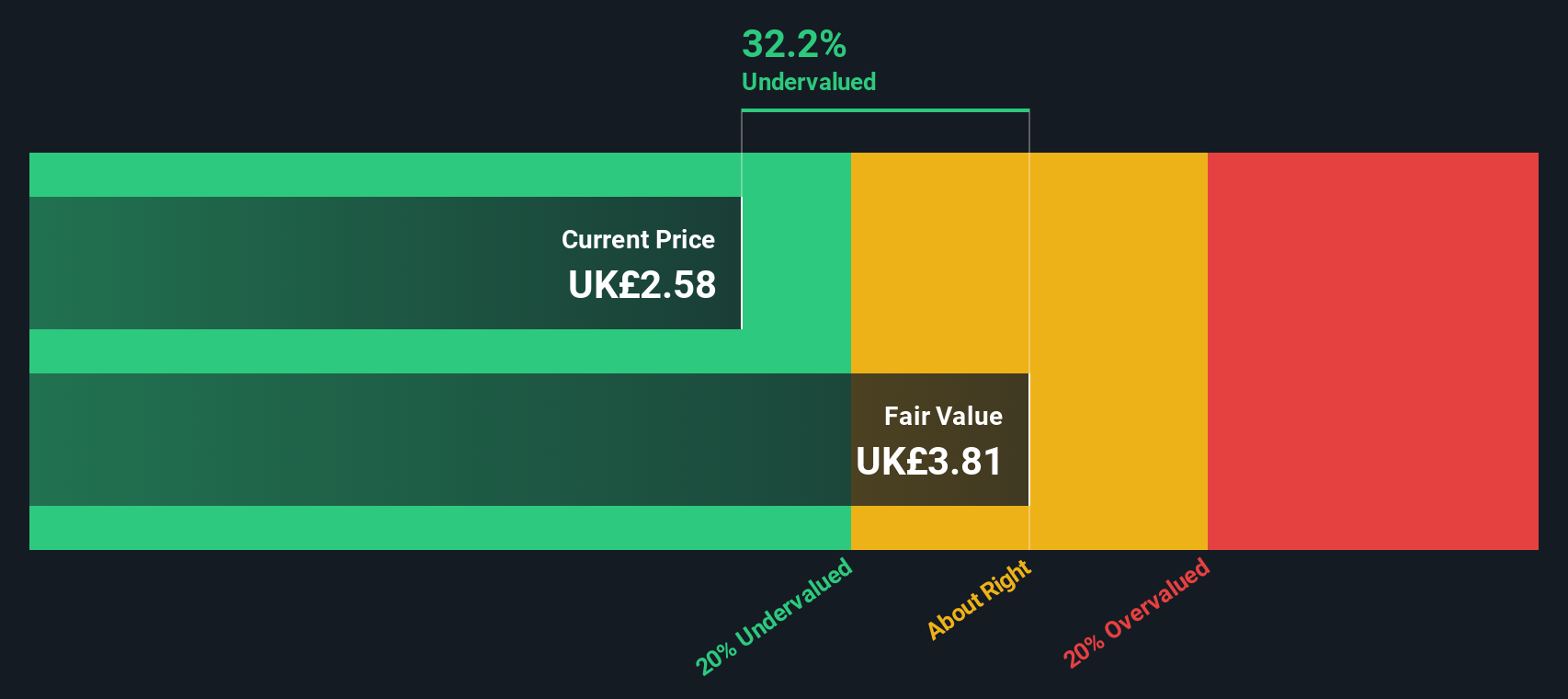

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bytes Technology Group is an IT solutions provider with a focus on software licensing, digital transformation, and cloud adoption services, boasting a market capitalization of approximately £1.05 billion.

Operations: The company generates revenue primarily from its IT solutions, with recent figures showing a gross profit margin of 74.86%. Operating expenses have consistently increased, reaching £90.85 million in the latest period.

PE: 23.1x

Bytes Technology Group, a UK-based company, has shown promising growth despite its reliance on higher-risk external borrowing. For the half year ending August 31, 2024, they reported net income of £30.45 million, up from £25.39 million the previous year. Earnings per share also increased significantly. Insider confidence is evident with recent share purchases by executives in September and October 2024. With earnings forecasted to grow at 7.38% annually and a dividend increase of 14.8%, Bytes appears poised for continued expansion in its sector.

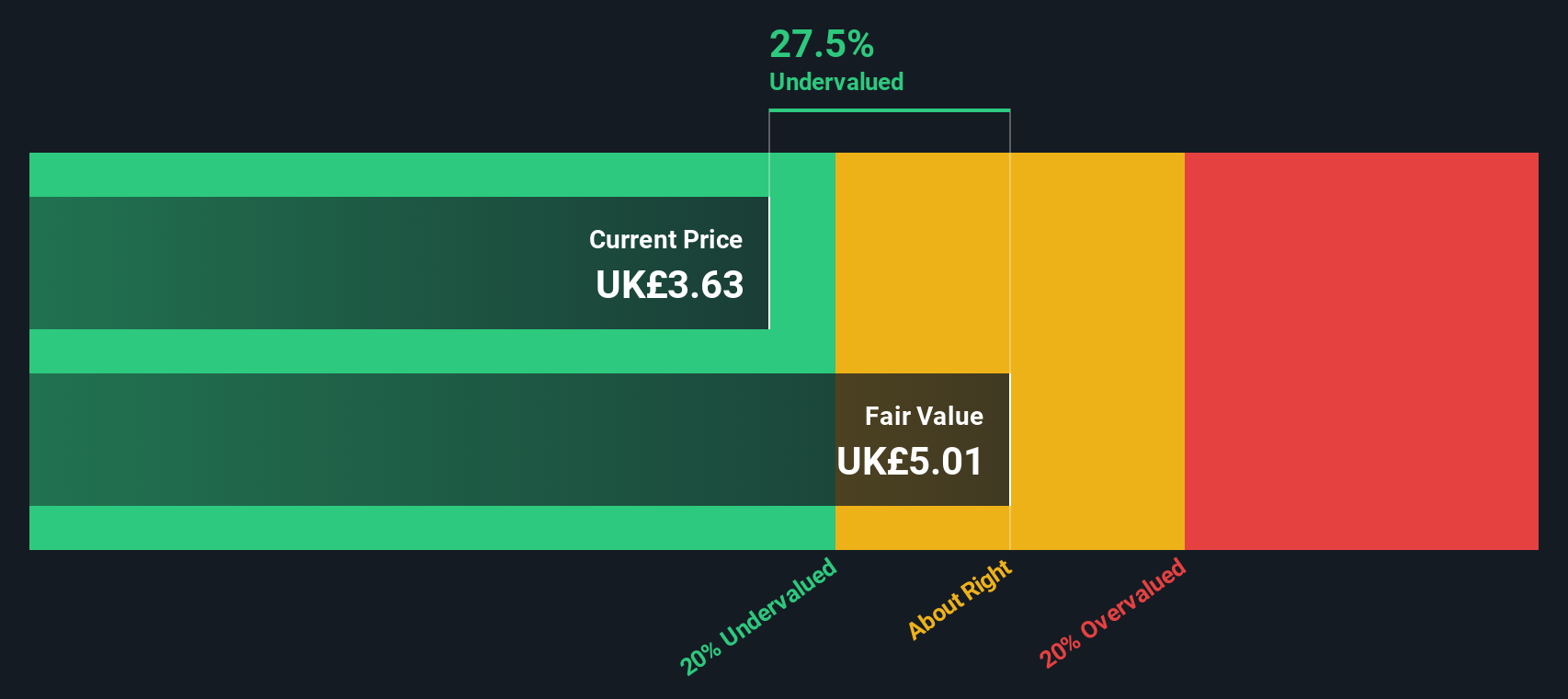

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group is a leading pizza delivery and carryout company, primarily generating revenue through sales to franchisees, corporate store income, national advertising and ecommerce income, rental income on properties, and royalties and franchise fees; it has a market cap of £1.62 billion.

Operations: The company generates revenue primarily from sales to franchisees, corporate store income, national advertising and ecommerce income, rental income on properties, and various fees including royalties. The cost of goods sold (COGS) is a significant expense impacting gross profit margins. Notably, the gross profit margin has shown an increasing trend over multiple periods reaching 47.48% in June 2024. Operating expenses include general and administrative costs as well as sales and marketing expenses.

PE: 15.5x

Domino's Pizza Group, a UK-based company with a smaller market capitalization, presents an intriguing investment opportunity due to its current valuation. Despite facing challenges such as declining profit margins from 18.2% to 11.4% and high debt levels, the company is actively repurchasing shares; having completed buybacks of 6.12% of its capital for £90.1 million by May 2024, reflecting strategic confidence in its future performance. Additionally, Domino's anticipates continued growth in orders and sales for fiscal year 2024 amidst market uncertainties.

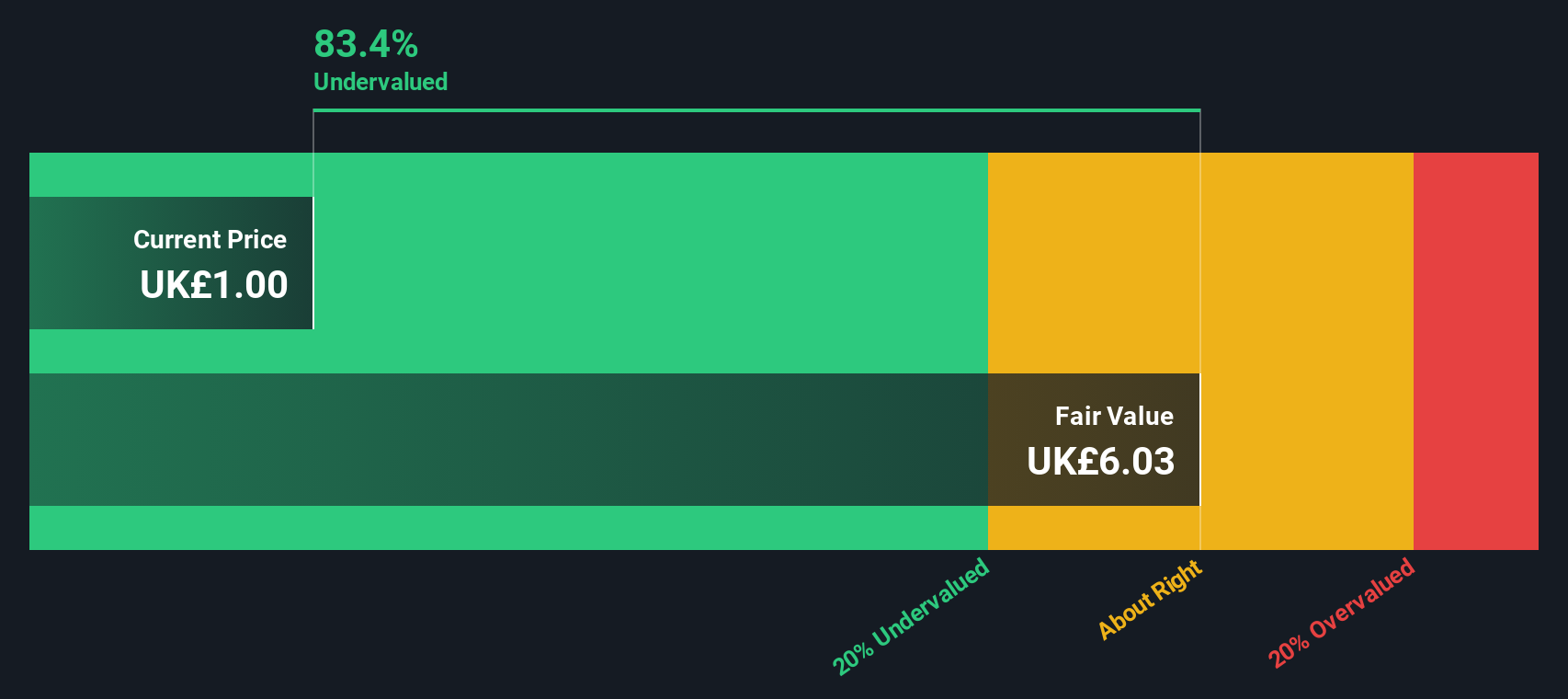

Videndum (LSE:VID)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Videndum is a company specializing in media, creative, and production solutions with a market cap of £0.47 billion.

Operations: Media Solutions generates the highest revenue at £144.70 million, followed by Production Solutions at £98 million and Creative Solutions at £54.90 million. The company's gross profit margin has shown variability, with recent figures around 36.65%.

PE: -10.1x

Videndum, a smaller company in the UK, recently reported a drop in sales to £153.3 million for the half-year ending June 2024, compared to £165 million last year. However, their net loss narrowed significantly from £46.5 million to £12.8 million. Despite being removed from the S&P Global BMI Index in September 2024 and experiencing share price volatility over three months, insider confidence remains evident through recent share purchases by insiders this year. Earnings are projected to grow annually by 113%, suggesting potential for future value appreciation despite current challenges with external borrowing risks and past shareholder dilution issues.

- Navigate through the intricacies of Videndum with our comprehensive valuation report here.

Gain insights into Videndum's historical performance by reviewing our past performance report.

Seize The Opportunity

- Take a closer look at our Undervalued UK Small Caps With Insider Buying list of 27 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DOM

Domino's Pizza Group

Owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)