- United Kingdom

- /

- Software

- /

- LSE:APTD

Aptitude Software Group (LON:APTD) Is Paying Out A Dividend Of £0.036

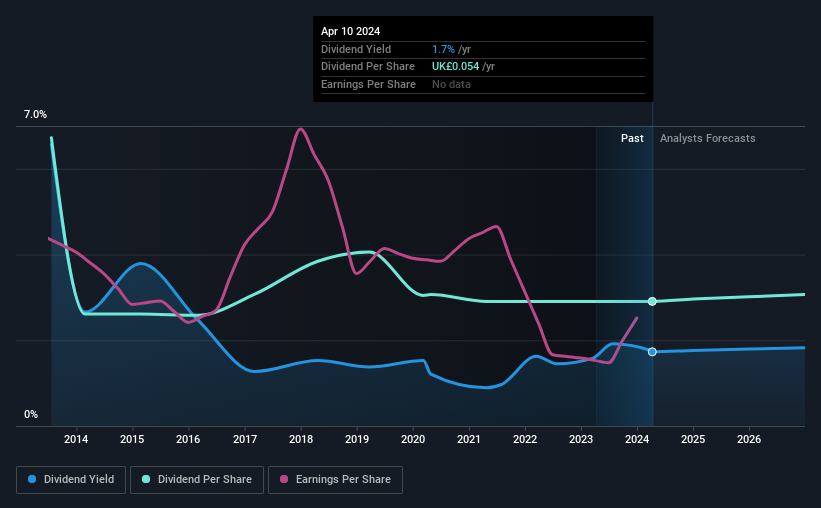

Aptitude Software Group plc's (LON:APTD) investors are due to receive a payment of £0.036 per share on 14th of June. This means that the annual payment will be 1.7% of the current stock price, which is in line with the average for the industry.

View our latest analysis for Aptitude Software Group

Aptitude Software Group's Payment Has Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, Aptitude Software Group's dividend made up quite a large proportion of earnings but only 28% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Looking forward, could fall by 6.6% if the company can't turn things around from the last few years. If recent patterns in the dividend continue, we could see the payout ratio reaching 81% in the next 12 months which is on the higher end of the range we would say is sustainable.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the annual payment back then was £0.125, compared to the most recent full-year payment of £0.054. Doing the maths, this is a decline of about 8.0% per year. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Is Doubtful

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. In the last five years, Aptitude Software Group's earnings per share has shrunk at approximately 6.6% per annum. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Aptitude Software Group's payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Are management backing themselves to deliver performance? Check their shareholdings in Aptitude Software Group in our latest insider ownership analysis. Is Aptitude Software Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:APTD

Aptitude Software Group

Provides financial management software in the United Kingdom and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)