- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Three Undiscovered Gems in the United Kingdom with Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has dropped 1.0%, but it remains up 7.1% over the past year, with earnings expected to grow by 14% per annum over the next few years. In this dynamic environment, identifying stocks with strong potential involves looking for companies that demonstrate resilience and growth prospects despite market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.14 billion.

Operations: Yellow Cake generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

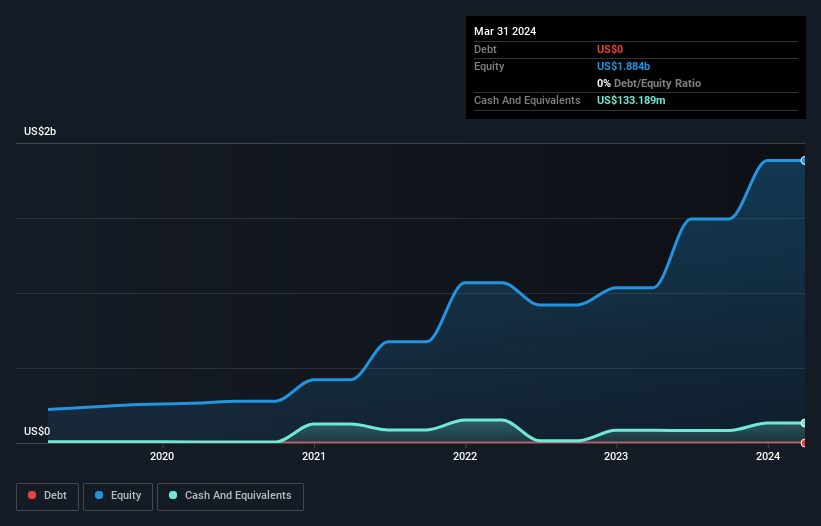

Yellow Cake, a UK-based uranium investment company, has shown impressive financials recently. The firm reported revenue of US$735.02 million for the year ending March 31, 2024, a significant turnaround from negative revenue of US$96.9 million the previous year. Net income also saw a dramatic shift to US$727.01 million from a net loss of US$102.94 million last year. Trading at a price-to-earnings ratio of 2.1x compared to the UK market's 16.5x, Yellow Cake presents an attractive valuation despite shareholder dilution over the past year and forecasted earnings decline by an average of 91% annually for the next three years.

- Click to explore a detailed breakdown of our findings in Yellow Cake's health report.

Evaluate Yellow Cake's historical performance by accessing our past performance report.

Alfa Financial Software Holdings (LSE:ALFA)

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC, with a market cap of £635.98 million, offers software and consultancy services to the auto and equipment finance industry across the UK, US, Europe, Middle East, Africa, and other international markets.

Operations: Alfa Financial Software Holdings generates revenue primarily from the sale of software and related services, totaling £101.40 million. The company's market cap stands at £635.98 million.

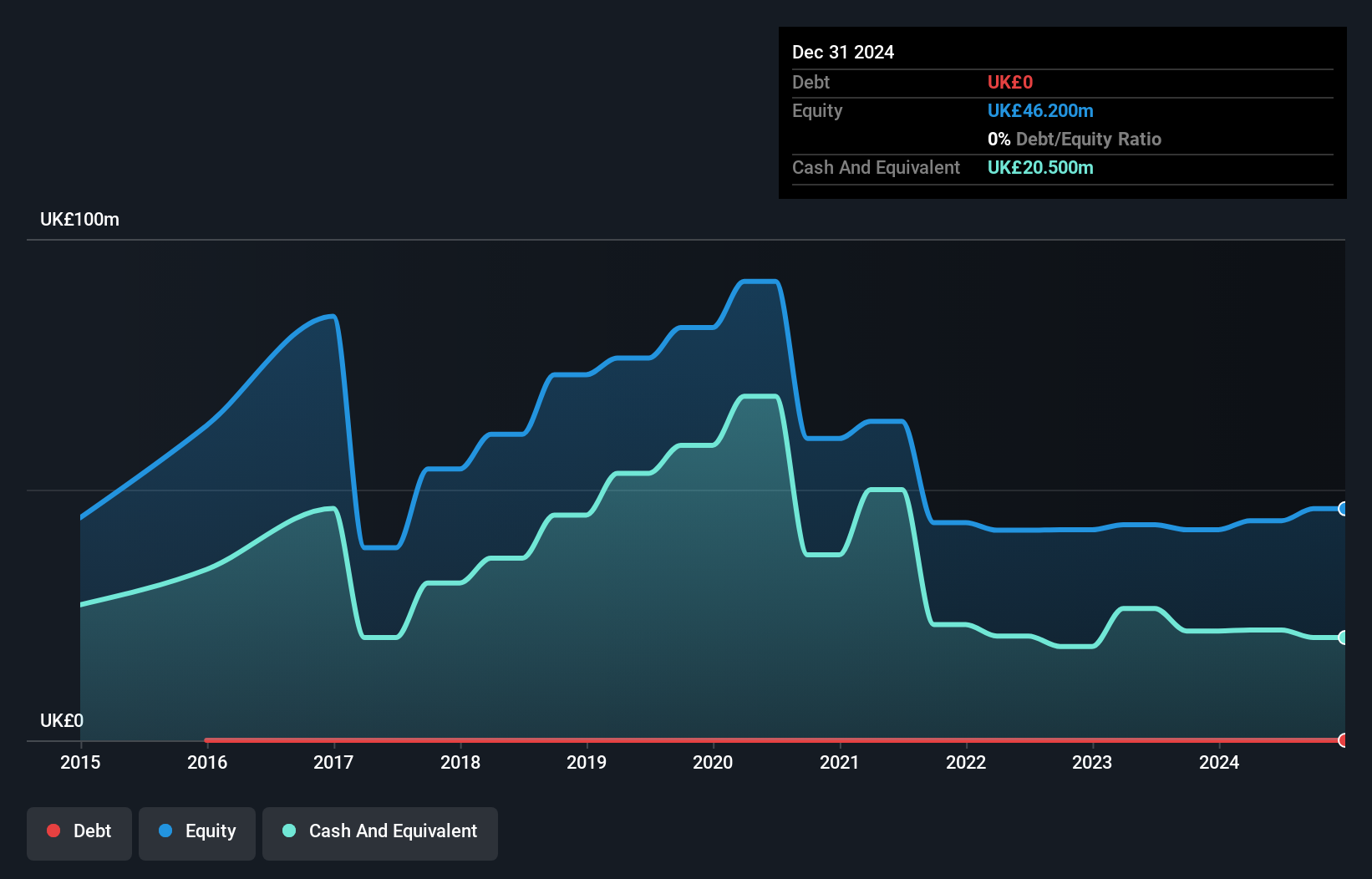

Despite facing a challenging year with a 15.6% earnings drop, Alfa Financial Software Holdings has maintained its debt-free status for the past five years, showcasing financial prudence. The company reported H1 2024 net income of £11.9M on sales of £52.3M, reflecting slight declines from last year’s figures. With a P/E ratio of 28.8x below the industry average and forecasted earnings growth at 6.1% annually, Alfa remains an intriguing prospect in the software sector's competitive landscape.

- Click here to discover the nuances of Alfa Financial Software Holdings with our detailed analytical health report.

Understand Alfa Financial Software Holdings' track record by examining our Past report.

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc operates as a maritime transport company with a market cap of £802.91 million.

Operations: Revenue streams for Irish Continental Group plc include €430.10 million from Ferries and €195.80 million from Container and Terminal operations.

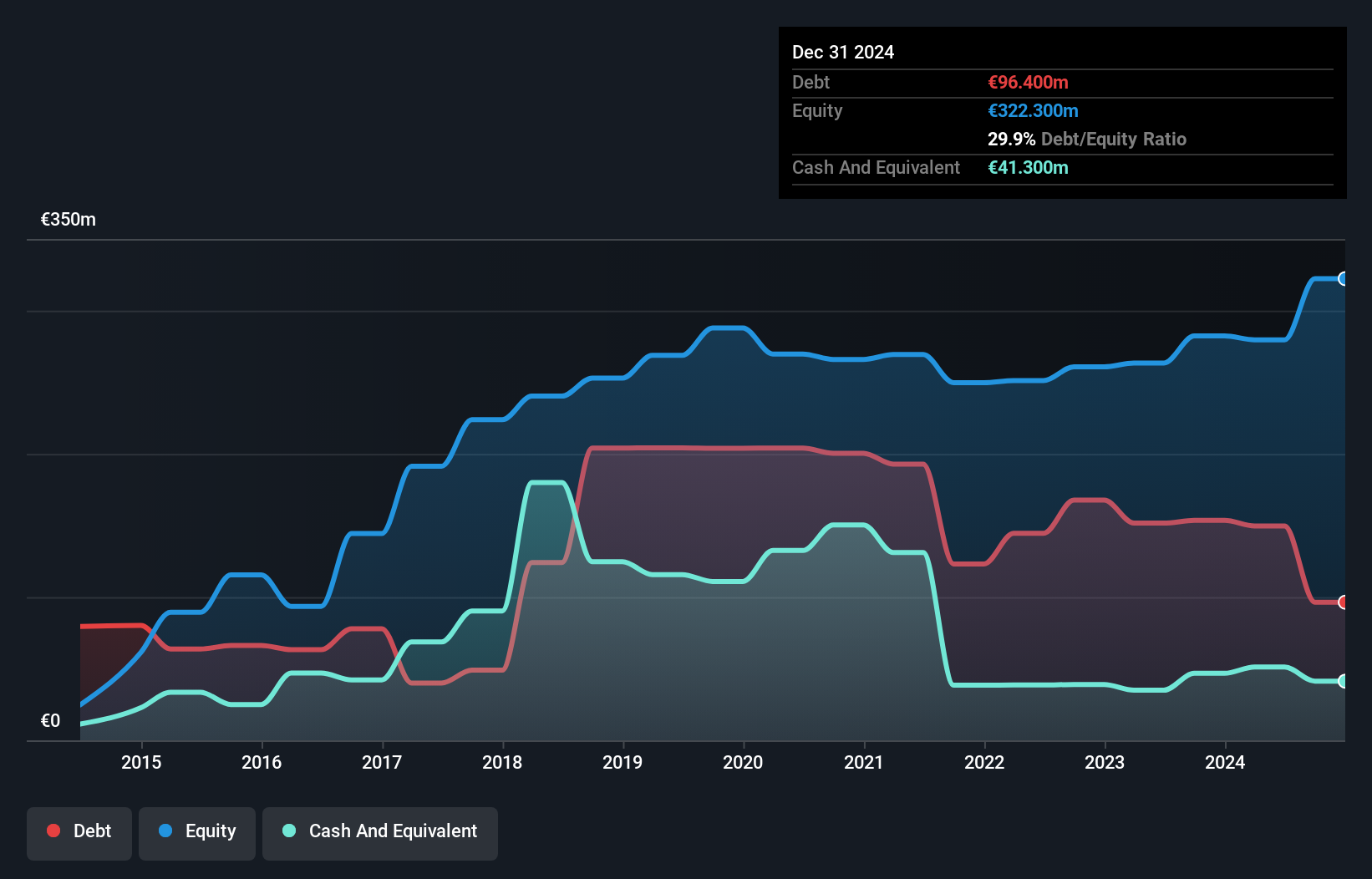

Irish Continental Group (ICG) has shown notable financial health, with its debt to equity ratio decreasing from 76% to 53.5% over the past five years. The company is trading at 11.6% below estimated fair value and reported earnings growth of 7.2%, outperforming the shipping industry's -29.8%. Recent half-year results showed sales of €285.5 million and net income of €13.7 million, up from €264 million and €12.9 million respectively, last year; basic earnings per share rose to €0.083 from €0.075.

- Delve into the full analysis health report here for a deeper understanding of Irish Continental Group.

Gain insights into Irish Continental Group's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 81 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet and good value.