- United Kingdom

- /

- Capital Markets

- /

- AIM:BLU

Spotlight On 3 UK Penny Stocks With Over £0 Market Cap

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, but it is up 6.1% over the past year with earnings forecasted to grow by 15% annually. For those looking to invest in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value when backed by solid financial foundations. These investments can provide a mix of affordability and growth potential, and we'll explore several that stand out for their financial strength and long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.55 | £180.75M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £355.43M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.875 | £66.27M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.15M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.316 | £202.97M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.39 | £433.8M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.3885 | $225.85M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Blue Star Capital (AIM:BLU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Blue Star Capital plc is a private equity and venture capital firm that invests in seed, early-stage, and late-stage companies, including buyouts, with a market cap of £636,596.

Operations: The company generates revenue through its venture capital segment, which reported -£5.16 million.

Market Cap: £636.6k

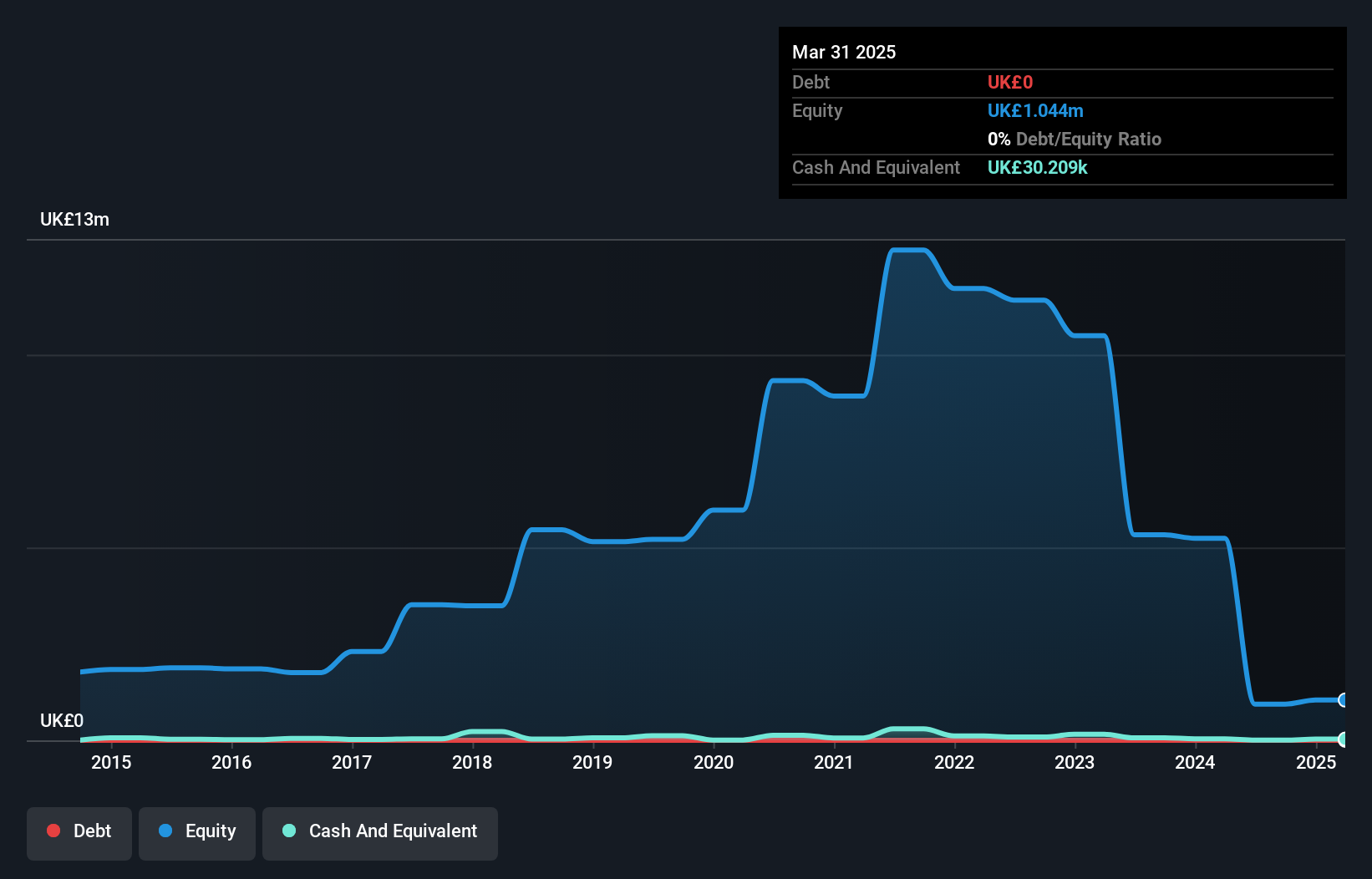

Blue Star Capital plc, with a market cap of £636,596, operates as a venture capital firm but remains pre-revenue with reported losses of -£5.16 million. The company is debt-free and its short-term assets exceed liabilities (£56.9K vs £37.2K), indicating some financial stability despite having less than a year of cash runway if current trends continue. Shareholders have experienced dilution over the past year, and weekly volatility has decreased yet remains high compared to other UK stocks. The firm’s unprofitability persists with declining earnings over the past five years at an annual rate of 58.6%.

- Jump into the full analysis health report here for a deeper understanding of Blue Star Capital.

- Learn about Blue Star Capital's historical performance here.

Crimson Tide (AIM:TIDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Crimson Tide plc offers mobility solutions and software development services mainly in the United Kingdom, the United States, and Ireland, with a market cap of £6.41 million.

Operations: The company generates revenue from Mobility Solutions and Related Development Services (£5.52 million) and Software Solutions Reselling, Development, and Support (£0.74 million).

Market Cap: £6.41M

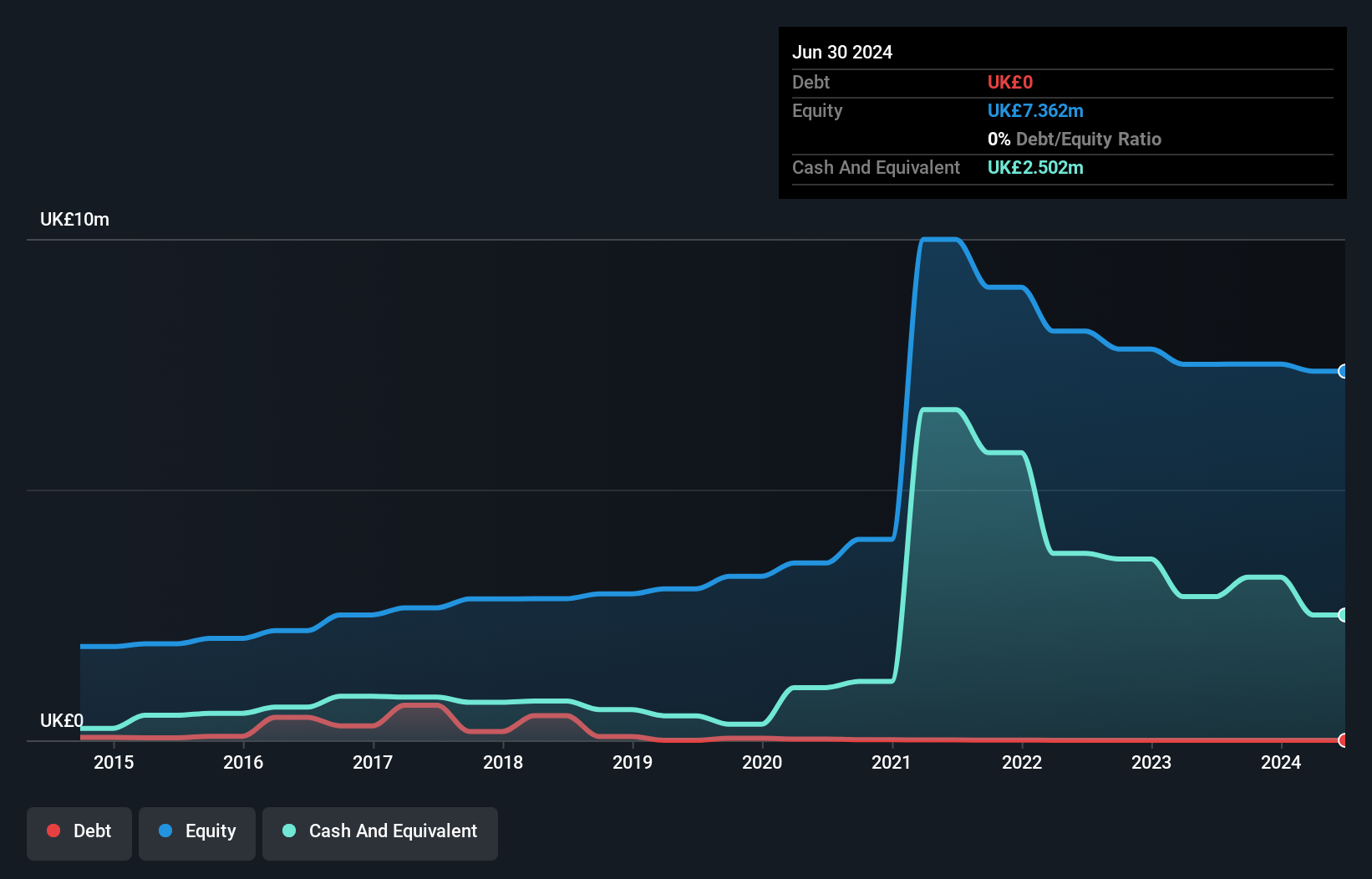

Crimson Tide plc, with a market cap of £6.41 million, reported half-year sales of £3.14 million and reduced its net loss to £0.051 million from the previous year's £0.271 million, indicating some improvement in financial performance despite being unprofitable. The company is debt-free and trades significantly below its estimated fair value, suggesting potential undervaluation compared to industry peers. While profits have not grown over the past five years, Crimson Tide's short-term assets exceed both short-term and long-term liabilities (£3.9M vs combined liabilities), providing a solid financial footing amidst ongoing challenges in achieving profitability.

- Get an in-depth perspective on Crimson Tide's performance by reading our balance sheet health report here.

- Evaluate Crimson Tide's prospects by accessing our earnings growth report.

Bisichi (LSE:BISI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bisichi PLC is involved in coal mining and processing activities, with a market cap of £11.74 million.

Operations: The company generates revenue primarily from its mining operations (£45.14 million) and property activities (£1.27 million).

Market Cap: £11.74M

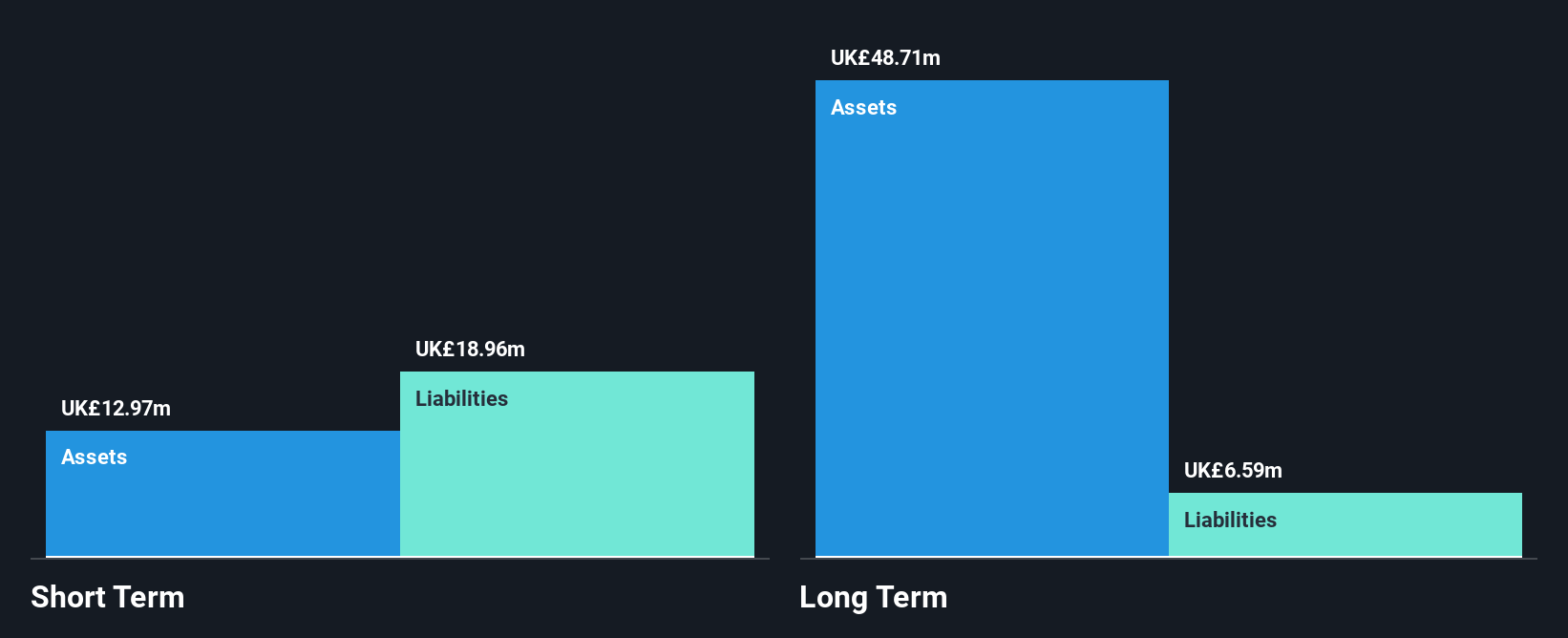

Bisichi PLC, with a market cap of £11.74 million, has shown mixed financial performance recently. The company reported half-year sales of £23.48 million and net income of £1.96 million, marking a turnaround from the previous year's loss. However, its current net profit margin has declined compared to last year, and earnings growth remains negative over the past year despite significant 5-year growth. Bisichi's debt is well managed with satisfactory coverage by operating cash flow and EBIT, yet short-term liabilities exceed assets (£24.2M vs £14.3M). Recent board changes include Stephen Crabb's appointment as Non-executive Director.

- Take a closer look at Bisichi's potential here in our financial health report.

- Understand Bisichi's track record by examining our performance history report.

Taking Advantage

- Take a closer look at our UK Penny Stocks list of 463 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Star Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BLU

Blue Star Capital

A private equity and venture capital firm specializing in investments in seed, early stage, and late-stage companies, including buyouts.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives