- United Kingdom

- /

- Software

- /

- AIM:OMG

M.P. Evans Group And 2 Other Leading UK Dividend Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, closing lower due to weak trade data from China, which has struggled to recover from the pandemic. Despite these market challenges, investors often look for stability and income through dividend stocks, which can provide consistent returns even in volatile economic conditions. In this article, we will explore M.P. Evans Group and two other leading UK dividend stocks that stand out for their reliable performance and potential to offer steady dividends amidst fluctuating market trends.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.89% | ★★★★★★ |

| OSB Group (LSE:OSB) | 8.42% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.25% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.30% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.95% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.78% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.49% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.71% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.02% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.38% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £465.69 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

Operations: M.P. Evans Group PLC generates its revenue primarily from the ownership and development of oil palm plantations in Indonesia and Malaysia.

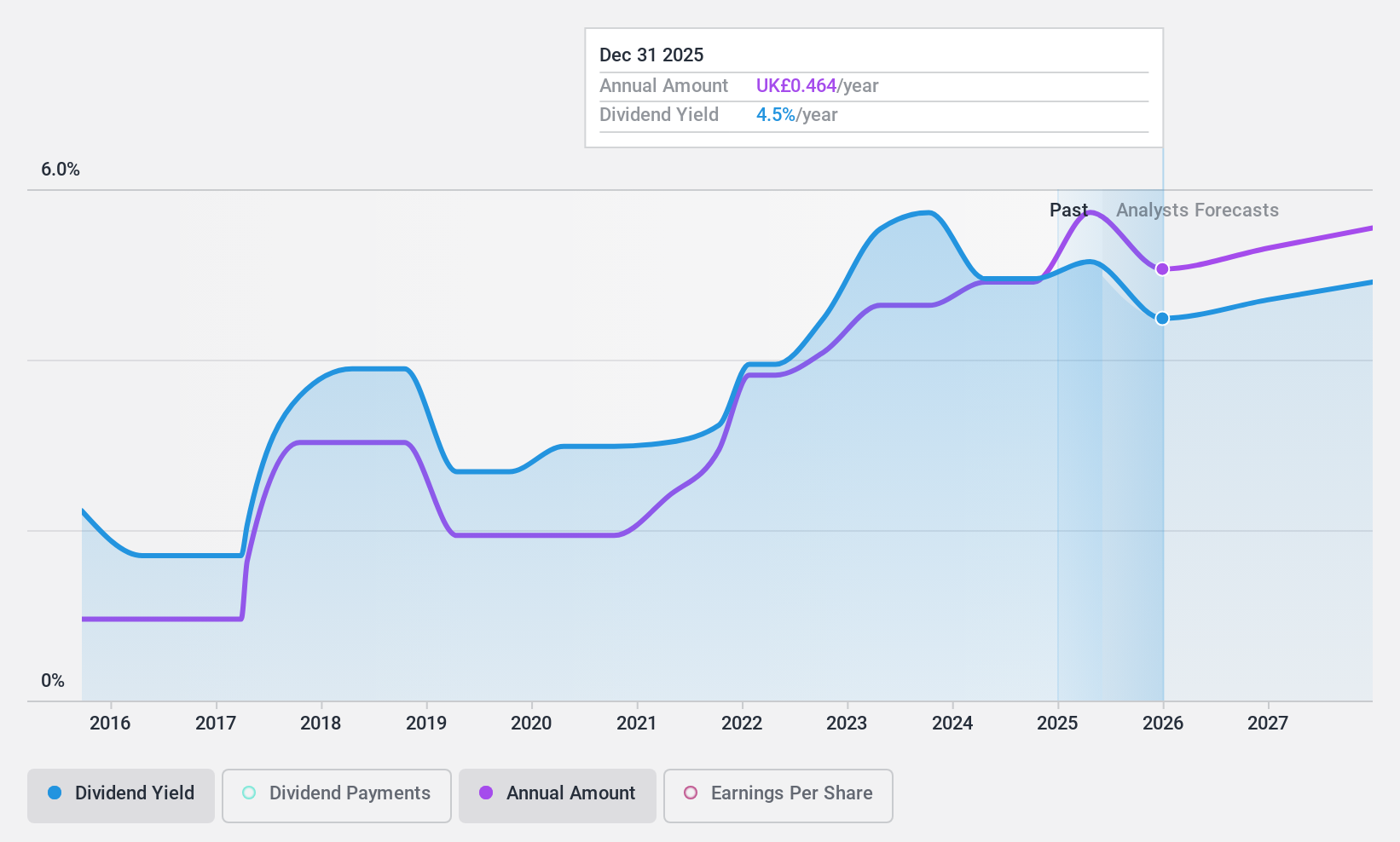

Dividend Yield: 4.8%

M.P. Evans Group's dividend sustainability is supported by a payout ratio of 58.7% and a cash payout ratio of 64.3%. Despite a volatile dividend history, the company has increased dividends over the past decade. Recent earnings for H1 2024 showed significant growth with net income rising to US$30.08 million from US$16.59 million year-over-year, leading to an interim dividend increase of 20%, reflecting improved performance and board confidence in long-term prospects.

- Click here to discover the nuances of M.P. Evans Group with our detailed analytical dividend report.

- Our valuation report unveils the possibility M.P. Evans Group's shares may be trading at a discount.

Oxford Metrics (AIM:OMG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oxford Metrics plc operates as a smart sensing and software company in the United Kingdom and internationally, with a market cap of £103.84 million.

Operations: Oxford Metrics plc generates revenue from its Vicon UK segment (£23.62 million) and Vicon USA segment (£21.09 million), with a segment adjustment of £1.76 million.

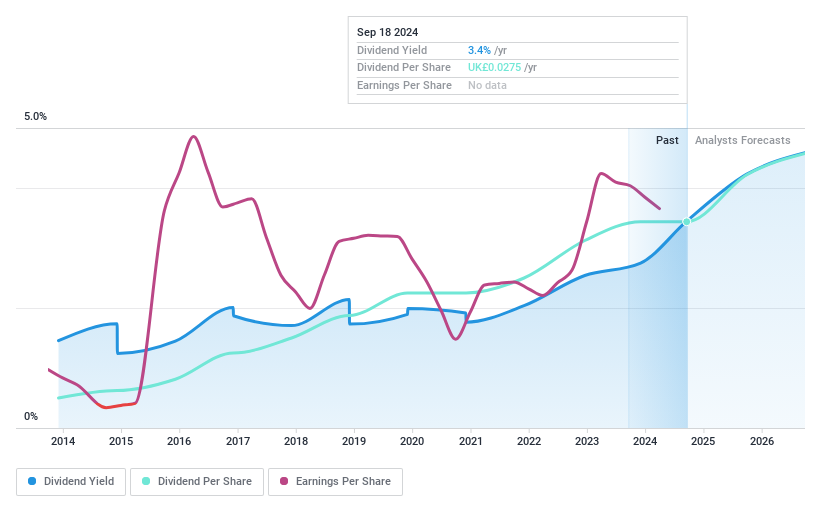

Dividend Yield: 3.5%

Oxford Metrics' dividend payments have been stable and growing over the past decade, but its 3.48% yield is low compared to top UK dividend payers. The payout ratio of 70.7% indicates dividends are covered by earnings, yet a high cash payout ratio (739.2%) suggests poor coverage by cash flows, raising sustainability concerns. Recent executive changes include Zoe Fox as CFO from July 2024, with David Deacon aiding the transition until September while focusing on M&A activities.

- Dive into the specifics of Oxford Metrics here with our thorough dividend report.

- The valuation report we've compiled suggests that Oxford Metrics' current price could be quite moderate.

Grafton Group (LSE:GFTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grafton Group plc operates in the distribution, retailing, and manufacturing sectors across Ireland, the Netherlands, Finland, and the United Kingdom with a market cap of £2.16 billion.

Operations: Grafton Group plc's revenue segments include £257.64 million from Retailing, £123.80 million from Manufacturing, £793.17 million from UK Distribution, £134.42 million from Finland Distribution, £630.06 million from Ireland Distribution, and £342.09 million from Netherlands Distribution.

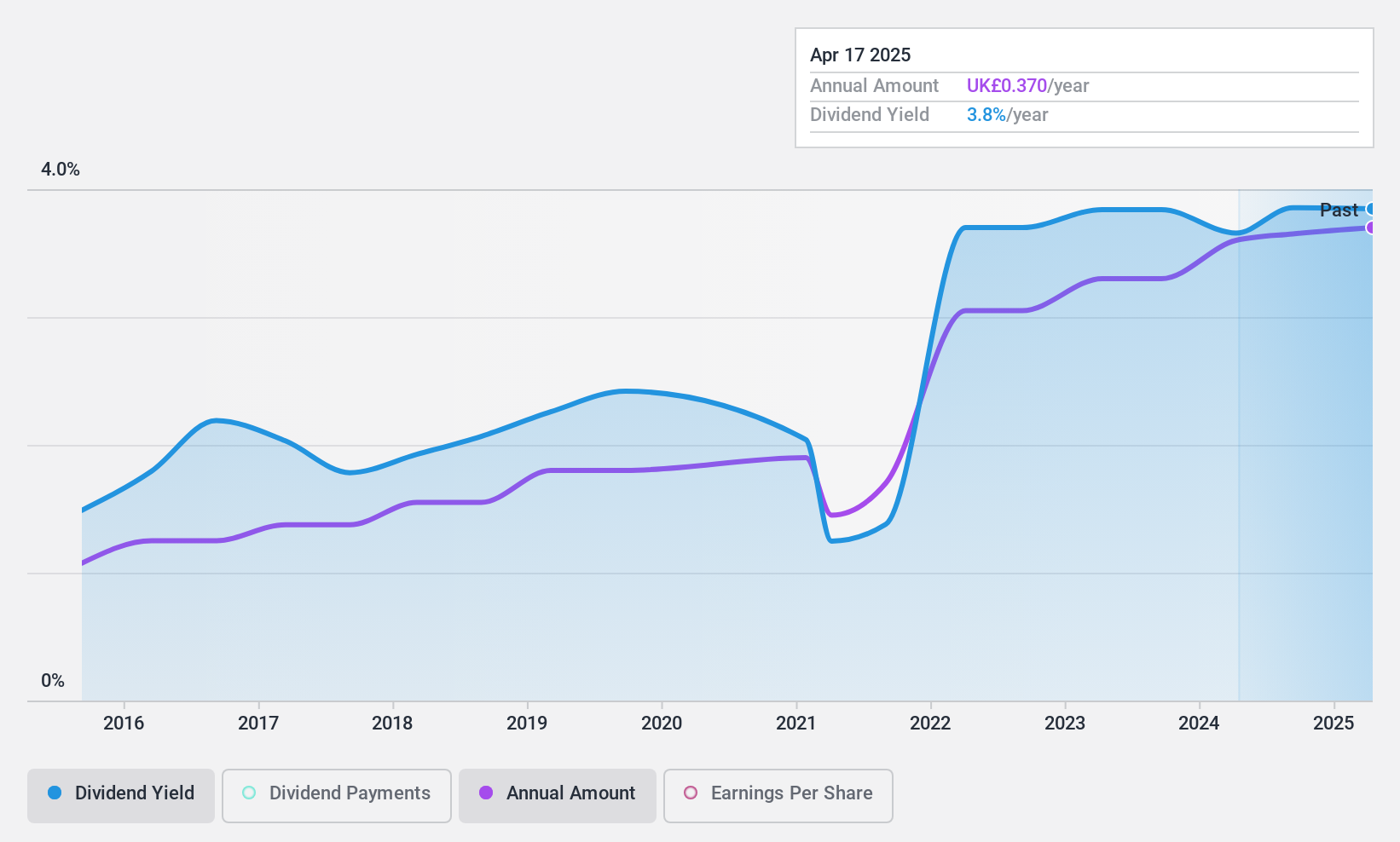

Dividend Yield: 3.4%

Grafton Group's interim dividend increased by 5% to 10.50 pence per share, highlighting its commitment to returning capital to shareholders. The company’s dividends are well-covered by earnings (57.1% payout ratio) and cash flows (37.2% cash payout ratio). Despite challenging trading conditions, Grafton maintains a strong balance sheet and is actively seeking acquisitions, supported by robust free cash flow generation and a £30 million share buyback program initiated in August 2024.

- Click to explore a detailed breakdown of our findings in Grafton Group's dividend report.

- Upon reviewing our latest valuation report, Grafton Group's share price might be too pessimistic.

Turning Ideas Into Actions

- Unlock our comprehensive list of 59 Top UK Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:OMG

Oxford Metrics

Operates as a smart sensing and software company in the United Kingdom and internationally.

Flawless balance sheet, good value and pays a dividend.