- United Kingdom

- /

- Insurance

- /

- AIM:HUW

accesso Technology Group And 2 Other Promising UK Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, investors can still find opportunities by focusing on companies that demonstrate strong financial health and potential for growth. Penny stocks, though often seen as relics of past trading days, continue to offer intriguing prospects for those willing to explore smaller or newer companies with solid fundamentals and promising trajectories.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.67 | £522.84M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.20 | £258.52M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.302 | £142.33M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.415 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.892 | £329.84M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.70 | £277.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.385 | £121.73M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.20 | £191.01M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £72.22M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

accesso Technology Group (AIM:ACSO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: accesso Technology Group plc, with a market cap of £165.69 million, develops technology solutions for the attractions and leisure industry through its subsidiaries.

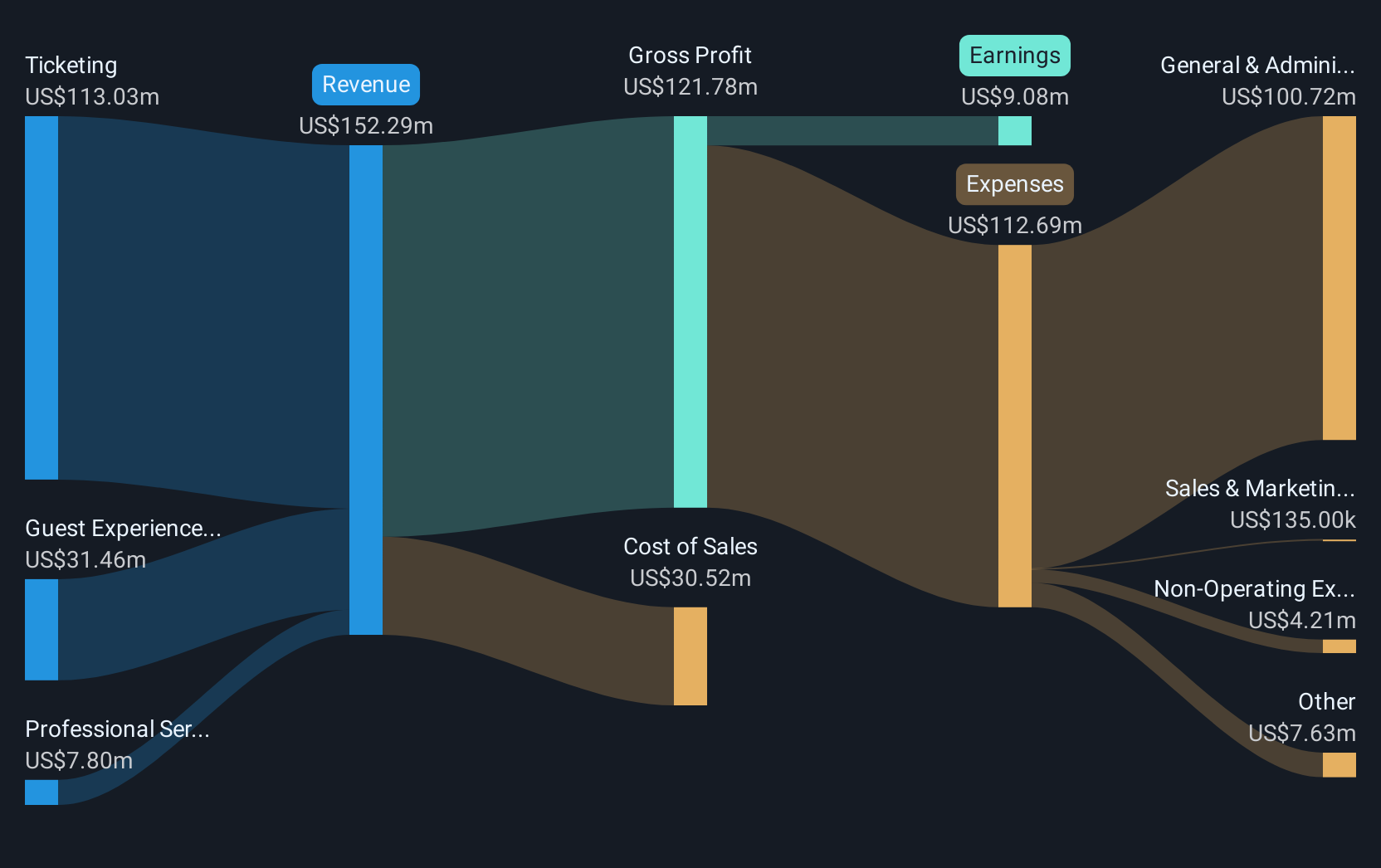

Operations: The company's revenue is primarily generated from Ticketing ($113.03 million), Guest Experience ($31.46 million), and Professional Services ($7.80 million) segments.

Market Cap: £165.69M

accesso Technology Group plc, with a market cap of £165.69 million, has shown stable weekly volatility and improved debt levels over the past five years. Despite earnings growth of 18.1% last year, its forecasted decline in earnings by 2.7% annually over the next three years presents concerns for investors in penny stocks. The company recently renewed a key contract with Six Flags Entertainment, securing its position as an exclusive ticketing provider until 2030, which may bolster future revenues despite lowered guidance for 2025. Additionally, management changes include appointing Brian Nelson as a Non-Executive Director to potentially strengthen strategic direction.

- Take a closer look at accesso Technology Group's potential here in our financial health report.

- Gain insights into accesso Technology Group's future direction by reviewing our growth report.

Helios Underwriting (AIM:HUW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Helios Underwriting plc, operating through its subsidiaries, offers limited liability investments in the Lloyd’s insurance market in the UK and has a market cap of £153.81 million.

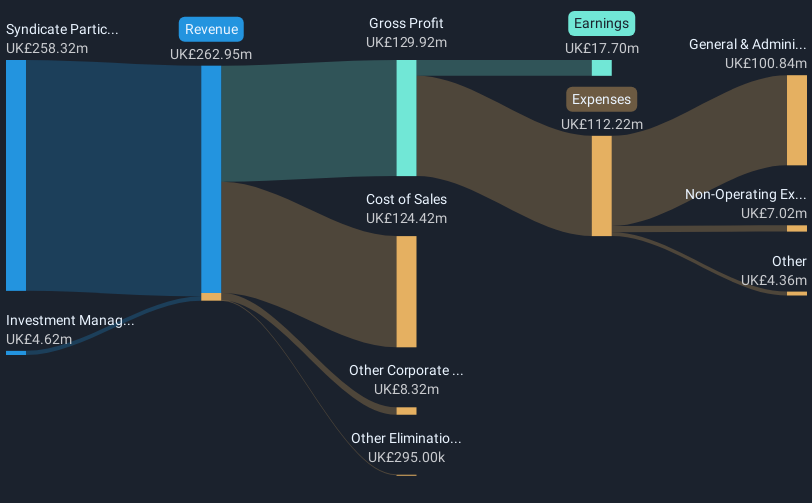

Operations: The company generates revenue of £36.00 million from its operations in the United Kingdom.

Market Cap: £153.81M

Helios Underwriting plc, with a market cap of £153.81 million, is navigating challenges in the insurance sector. The company reported a decline in revenue to £36 million and net income to £18.58 million for 2024, reflecting negative earnings growth over the past year. Despite this, Helios maintains high-quality earnings and satisfactory debt levels with a net debt-to-equity ratio of 17.1%. Recent board changes and strategic appointments may influence future performance as the company aims to stabilize its operations amidst industry volatility. The dividend yield of 4.65% is not well-covered by free cash flows, indicating potential sustainability issues.

- Jump into the full analysis health report here for a deeper understanding of Helios Underwriting.

- Explore Helios Underwriting's analyst forecasts in our growth report.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Netcall plc designs, develops, sells, and supports software products and services in the United Kingdom with a market cap of £205.13 million.

Operations: The company's revenue is generated from £43.18 million in the design, development, sale, and support of software products and services.

Market Cap: £205.13M

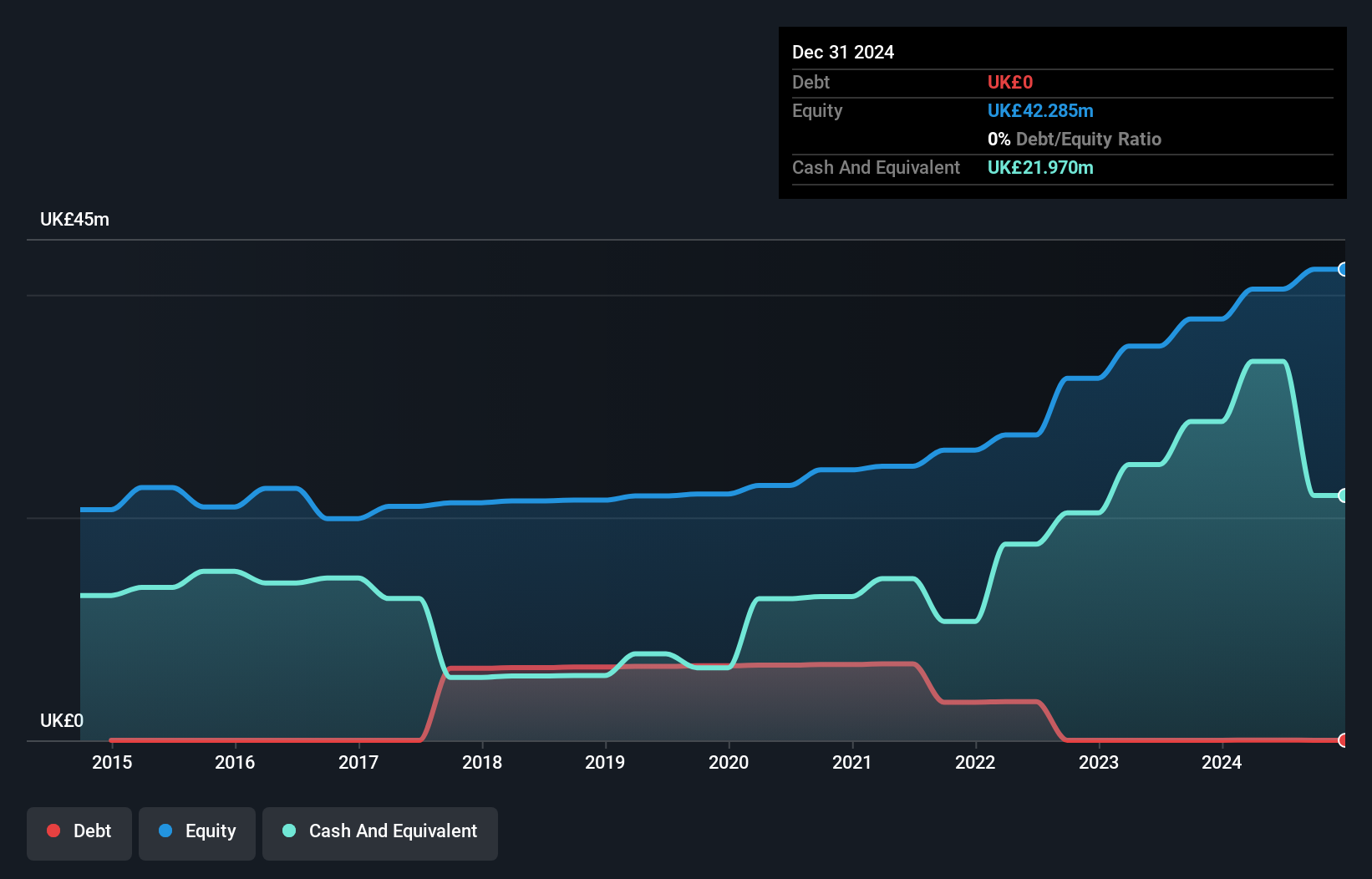

Netcall plc, with a market cap of £205.13 million, has seen significant earnings growth over the past five years at 42.9% annually, although recent performance showed a decline in earnings by 3.8%. The company is debt-free and its short-term assets (£29.1M) exceed long-term liabilities (£4.6M), but do not cover short-term liabilities (£35.4M). The management team is experienced with an average tenure of 3.8 years, while the board's tenure averages 15.1 years, indicating stability in leadership. Despite lower profit margins compared to last year and low return on equity (12.2%), revenue is forecasted to grow by 10.56% annually.

- Get an in-depth perspective on Netcall's performance by reading our balance sheet health report here.

- Evaluate Netcall's prospects by accessing our earnings growth report.

Next Steps

- Unlock more gems! Our UK Penny Stocks screener has unearthed 295 more companies for you to explore.Click here to unveil our expertly curated list of 298 UK Penny Stocks.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Underwriting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HUW

Helios Underwriting

Provides a limited liability investment for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives