- United Kingdom

- /

- Retail Distributors

- /

- LSE:ULTP

3 UK Penny Stocks With Market Caps Under £60M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, investors can still find opportunities in lesser-known areas of the stock market. Penny stocks, while an older term, continue to represent a viable investment area for those looking to uncover potential value in smaller or newer companies with strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £527.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.27 | £183.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.985 | £14.87M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.675 | £96.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £73.12M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.904 | £719.19M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Checkit (AIM:CKT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Checkit plc, with a market cap of £17.28 million, provides predictive operations solutions for large facilities and multi-site locations in the United Kingdom and the Americas.

Operations: The company generates revenue of £14.3 million from its Electronic Components & Parts segment.

Market Cap: £17.28M

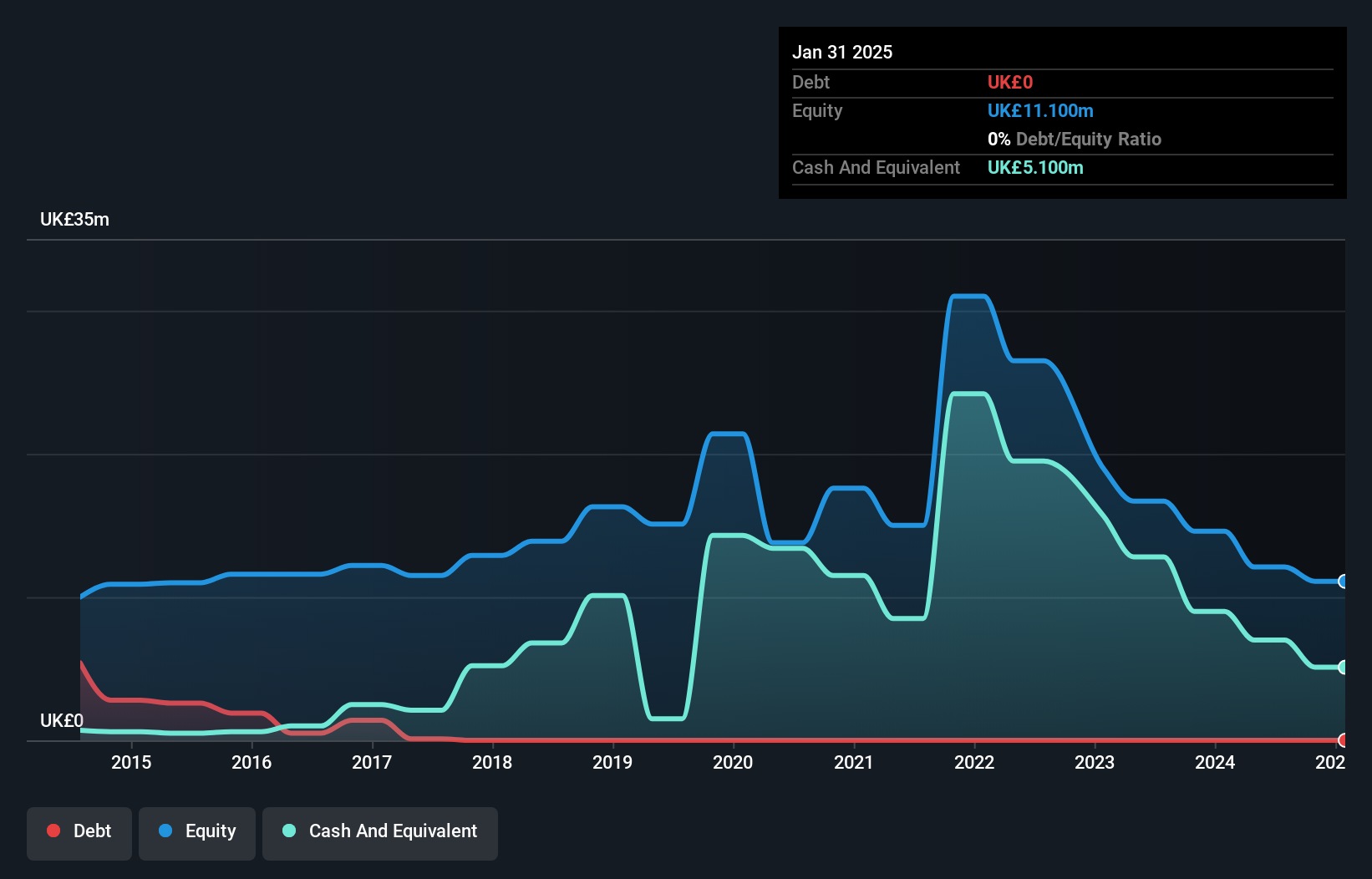

Checkit plc, with a market cap of £17.28 million, focuses on predictive operations solutions and reported half-year sales of £6.9 million, slightly up from £6.7 million the previous year while reducing its net loss to £2.1 million. The company is debt-free and has short-term assets exceeding both its short- and long-term liabilities, although it faces less than a year of cash runway based on current free cash flow trends. Despite being unprofitable, Checkit has reduced losses over five years by 10% annually but continues to experience high share price volatility and negative return on equity.

- Take a closer look at Checkit's potential here in our financial health report.

- Gain insights into Checkit's future direction by reviewing our growth report.

Ingenta (AIM:ING)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ingenta plc, along with its subsidiaries, offers content management, advertising, and commercial enterprise solutions and services across the UK, US, Netherlands, France, and globally with a market cap of £14.87 million.

Operations: The company generates revenue of £10.28 million from its Internet Software & Services segment.

Market Cap: £14.87M

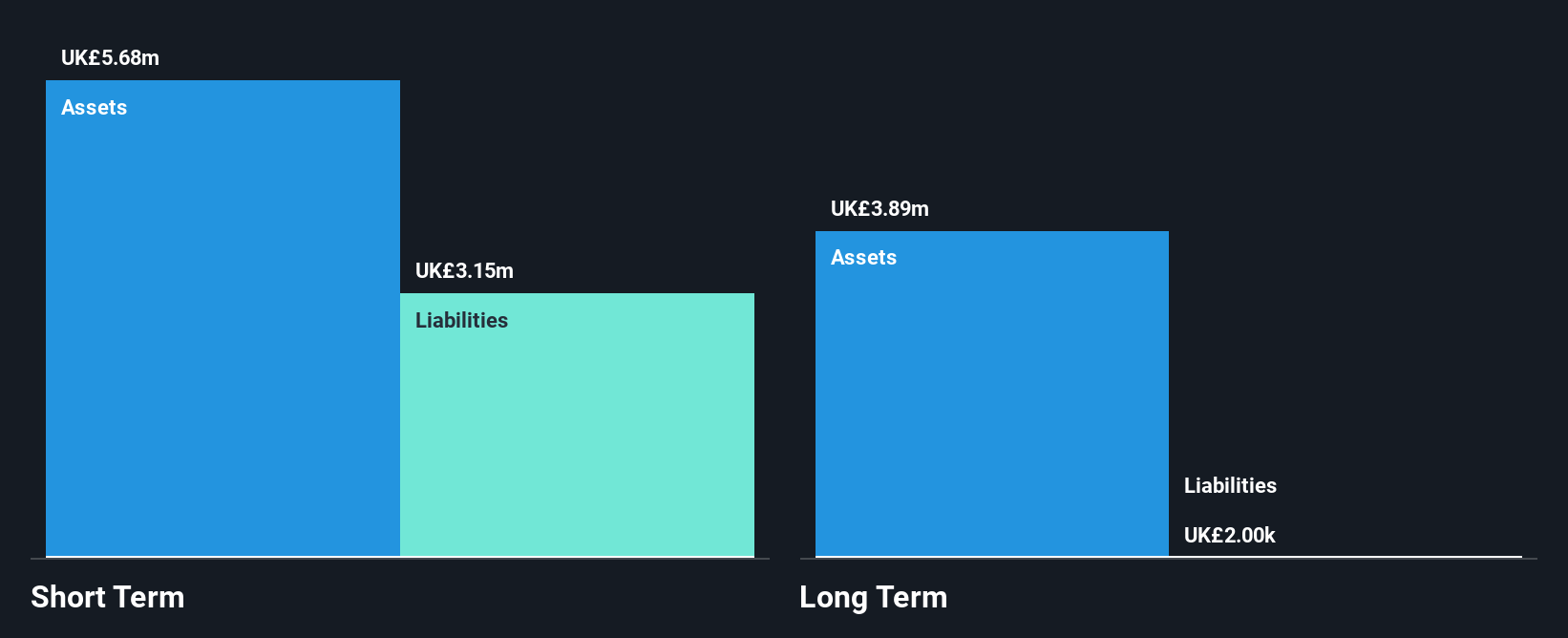

Ingenta plc, with a market cap of £14.87 million, has demonstrated robust earnings growth of 36.3% over the past year, outpacing its five-year average and the broader IT industry. The company is debt-free and maintains high-quality earnings with a strong Return on Equity of 27.7%. Its short-term assets (£5.5M) comfortably cover both short- (£2.6M) and long-term liabilities (£2K). Despite a volatile share price recently, Ingenta's net profit margin improved to 18.3%, supported by increased half-year sales of £5.16 million and net income doubling to £1.19 million compared to last year’s figures.

- Click here and access our complete financial health analysis report to understand the dynamics of Ingenta.

- Understand Ingenta's track record by examining our performance history report.

Ultimate Products (LSE:ULTP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ultimate Products Plc, along with its subsidiaries, supplies branded household products across the United Kingdom, Germany, the rest of Europe, and internationally with a market cap of £54.36 million.

Operations: The company generates revenue through its Wholesale - Miscellaneous segment, amounting to £150.14 million.

Market Cap: £54.36M

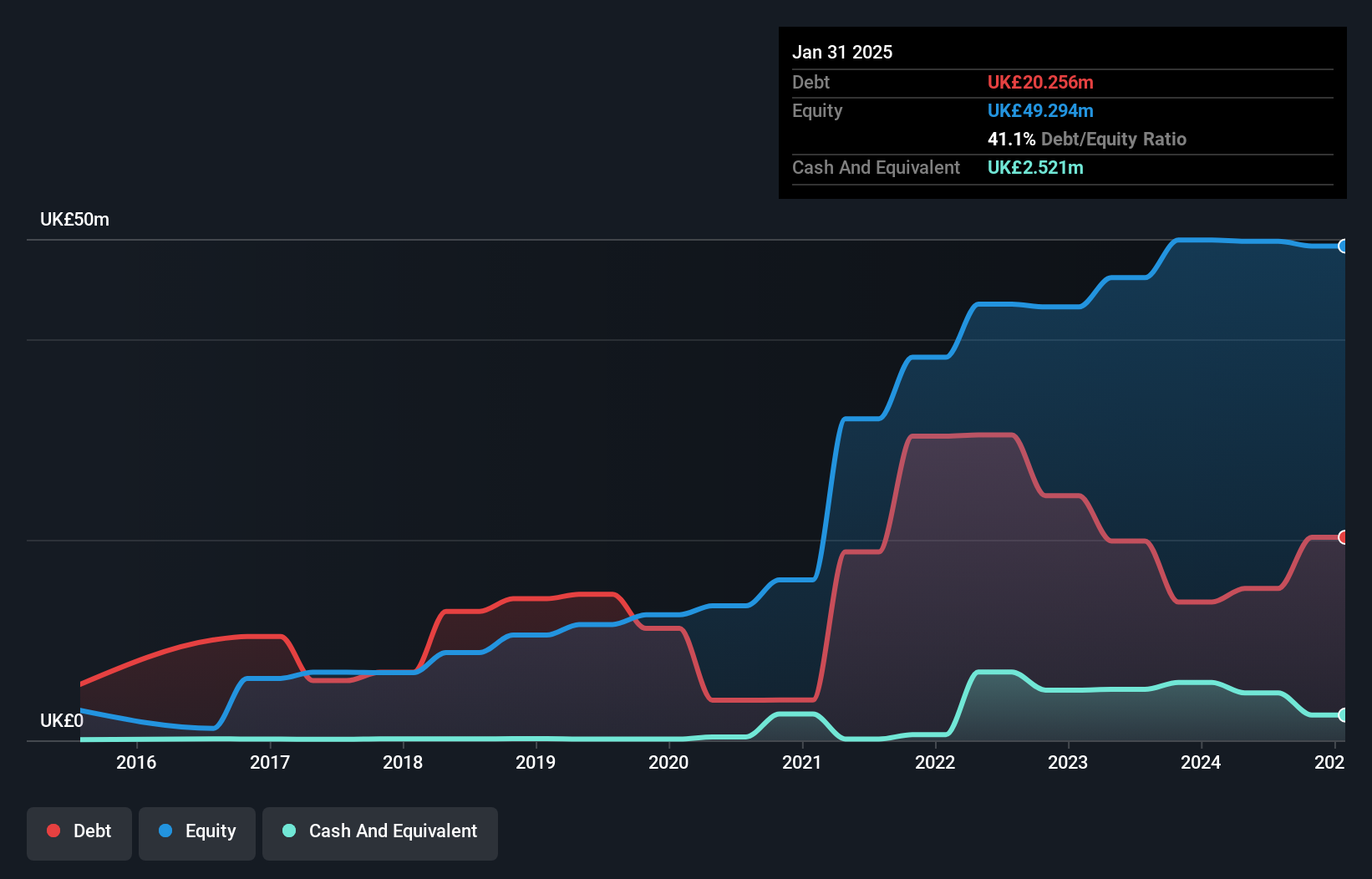

Ultimate Products Plc, with a market cap of £54.36 million, faces challenges as its net income declined to £5.81 million from £10.53 million last year, and profit margins decreased to 3.9% from 6.8%. Despite these setbacks, the company maintains a satisfactory net debt-to-equity ratio of 30.4%, and its operating cash flow covers debt well at 40.2%. Trading at a price-to-earnings ratio of 9.4x suggests good relative value compared to peers, although dividend sustainability is questionable given the recent reduction in payouts for shareholders awaiting approval in December 2025.

- Unlock comprehensive insights into our analysis of Ultimate Products stock in this financial health report.

- Review our growth performance report to gain insights into Ultimate Products' future.

Summing It All Up

- Click through to start exploring the rest of the 290 UK Penny Stocks now.

- Searching for a Fresh Perspective? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ULTP

Ultimate Products

Supplies branded household products in the United Kingdom, Germany, Rest of Europe, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives