- United Kingdom

- /

- Media

- /

- LSE:INF

Exploring Three High Growth Tech Stocks In The UK Market

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which has impacted global market sentiment and affected companies closely tied to the Chinese economy. In this context of fluctuating indices and economic pressures, high growth tech stocks in the UK market are drawing attention for their potential resilience and innovation-driven prospects amidst broader challenges.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Facilities by ADF | 26.24% | 161.47% | ★★★★★☆ |

| YouGov | 4.12% | 64.42% | ★★★★★☆ |

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Pinewood Technologies Group | 24.48% | 41.53% | ★★★★★☆ |

| Oxford Biomedica | 16.53% | 82.05% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Trustpilot Group | 15.02% | 40.20% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 36 stocks from our UK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

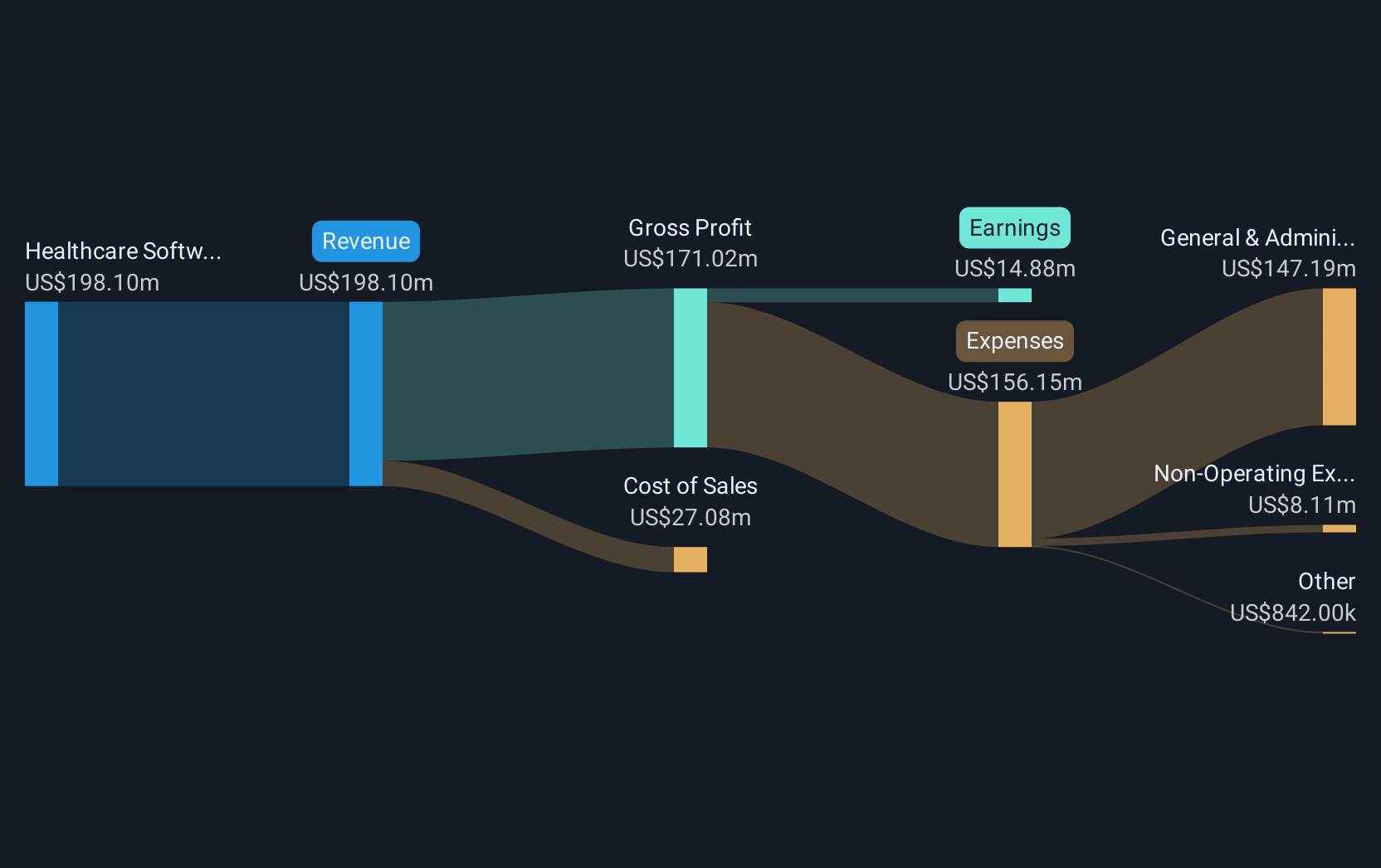

Overview: Craneware plc, along with its subsidiaries, focuses on developing, licensing, and supporting computer software for the healthcare sector in the United States and has a market cap of £548.03 million.

Operations: The company generates revenue primarily from its healthcare software segment, which brought in $198.10 million. It operates within the U.S. healthcare industry, focusing on software development and support services.

Craneware has demonstrated robust financial performance, with sales increasing to $100.05 million and net income rising sharply to $7.24 million in the last half-year, reflecting a significant earnings growth of 58.9% year-over-year. This growth trajectory is supported by an aggressive R&D strategy, crucial for maintaining its competitive edge in the healthcare software sector. Moreover, Craneware's strategic presence at key industry events like the HIMSS Global Health Conference highlights its commitment to innovation and sector leadership. The company's forecasted earnings growth of 23.9% annually outpaces the UK market prediction of 13.8%, indicating strong future potential amidst a dynamic technological landscape.

- Take a closer look at Craneware's potential here in our health report.

Explore historical data to track Craneware's performance over time in our Past section.

IDOX (AIM:IDOX)

Simply Wall St Growth Rating: ★★★★☆☆

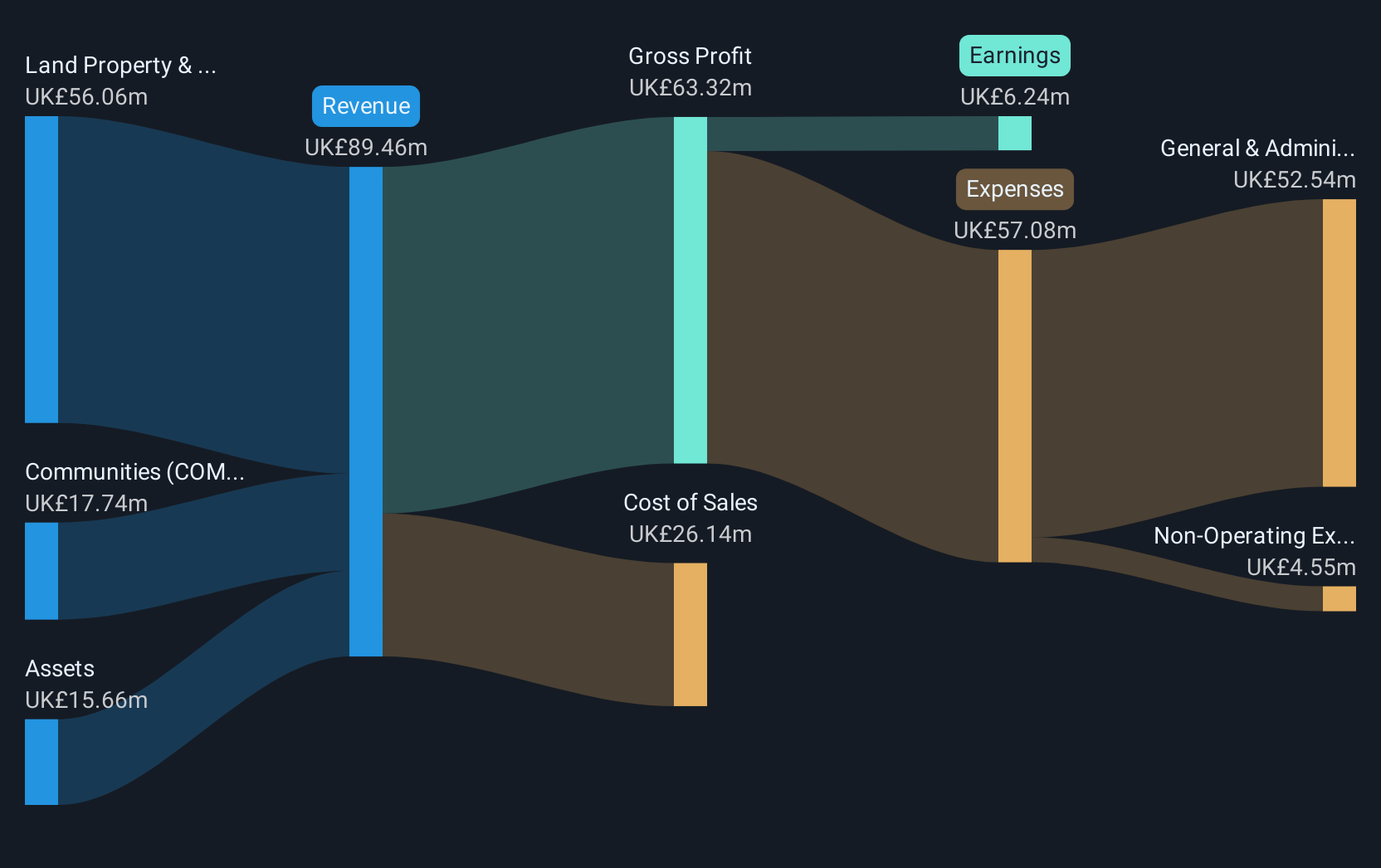

Overview: IDOX plc offers software and services for managing local government and other organizations across the UK, US, Europe, and internationally with a market cap of £247.46 million.

Operations: The company's revenue streams are primarily driven by its Land Property & Public Protection segment, contributing £55.26 million, followed by Communities at £17.44 million and Assets at £14.89 million.

IDOX, navigating a challenging landscape with a negative earnings growth of -5.8% last year, contrasts starkly against the software industry's average growth of 18%. Despite this, the company's revenue is expected to increase by 5.6% annually, outpacing the UK market forecast of 4%. This resilience is further underscored by its strategic dividend increase to 0.7 pence per share, reflecting confidence in its financial health and future prospects. With an anticipated earnings surge of 24.1% per year, IDOX remains poised for recovery and growth amidst evolving market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of IDOX.

Assess IDOX's past performance with our detailed historical performance reports.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

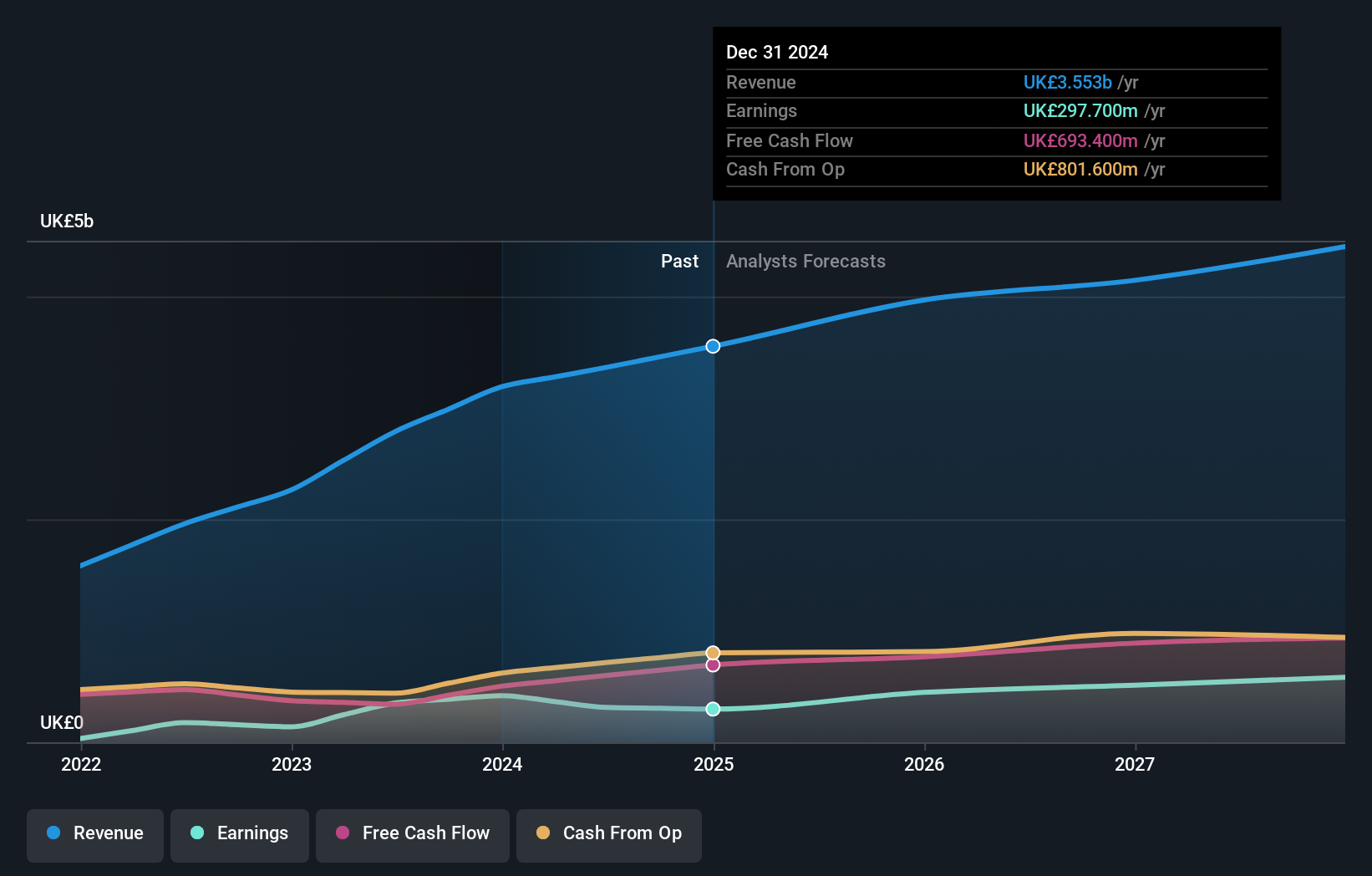

Overview: Informa plc is an international company specializing in events, digital services, and academic research across the UK, Continental Europe, the US, China, and other global markets with a market cap of £9.09 billion.

Operations: Informa generates revenue primarily from its Informa Markets (£1.72 billion), Informa Connect (£631 million), and Taylor & Francis (£698.20 million) segments, with significant contributions from Informa Tech (£423.90 million).

Despite a challenging backdrop with a notable one-off loss of £226.5 million last year, Informa's strategic positioning in high-growth sectors like energy and anti-aging medicine, as evidenced by their active participation in global conferences, underscores its adaptability and forward-looking approach. The company has demonstrated robust financial health through increased dividends to 20 pence per share and an aggressive share repurchase program totaling £1.49 billion. With expected revenue growth at 8% annually outpacing the UK market forecast of 4%, coupled with an anticipated earnings surge of 21.9% per year, Informa is poised to leverage its industry engagements and R&D focus to solidify its market position further.

Taking Advantage

- Discover the full array of 36 UK High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, North America, China, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives