- United Kingdom

- /

- Software

- /

- AIM:IDOX

Exploring High Growth Tech Stocks in the United Kingdom July 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China and a struggling global economy, investors are paying close attention to how these broader market dynamics impact the tech sector. In this environment, identifying high growth tech stocks requires focusing on companies with robust innovation capabilities and resilience to external economic pressures.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Pinewood Technologies Group | 25.20% | 40.70% | ★★★★★☆ |

| Skillcast Group | 14.74% | 52.30% | ★★★★★☆ |

| ActiveOps | 14.40% | 43.34% | ★★★★★☆ |

| Oxford Biomedica | 18.08% | 69.07% | ★★★★★☆ |

| Trustpilot Group | 15.30% | 39.03% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Windar Photonics | 36.00% | 48.66% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 53.95% | 53.30% | ★★★★★☆ |

| SRT Marine Systems | 45.43% | 91.35% | ★★★★★★ |

Click here to see the full list of 43 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, with a market cap of £589.15 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets.

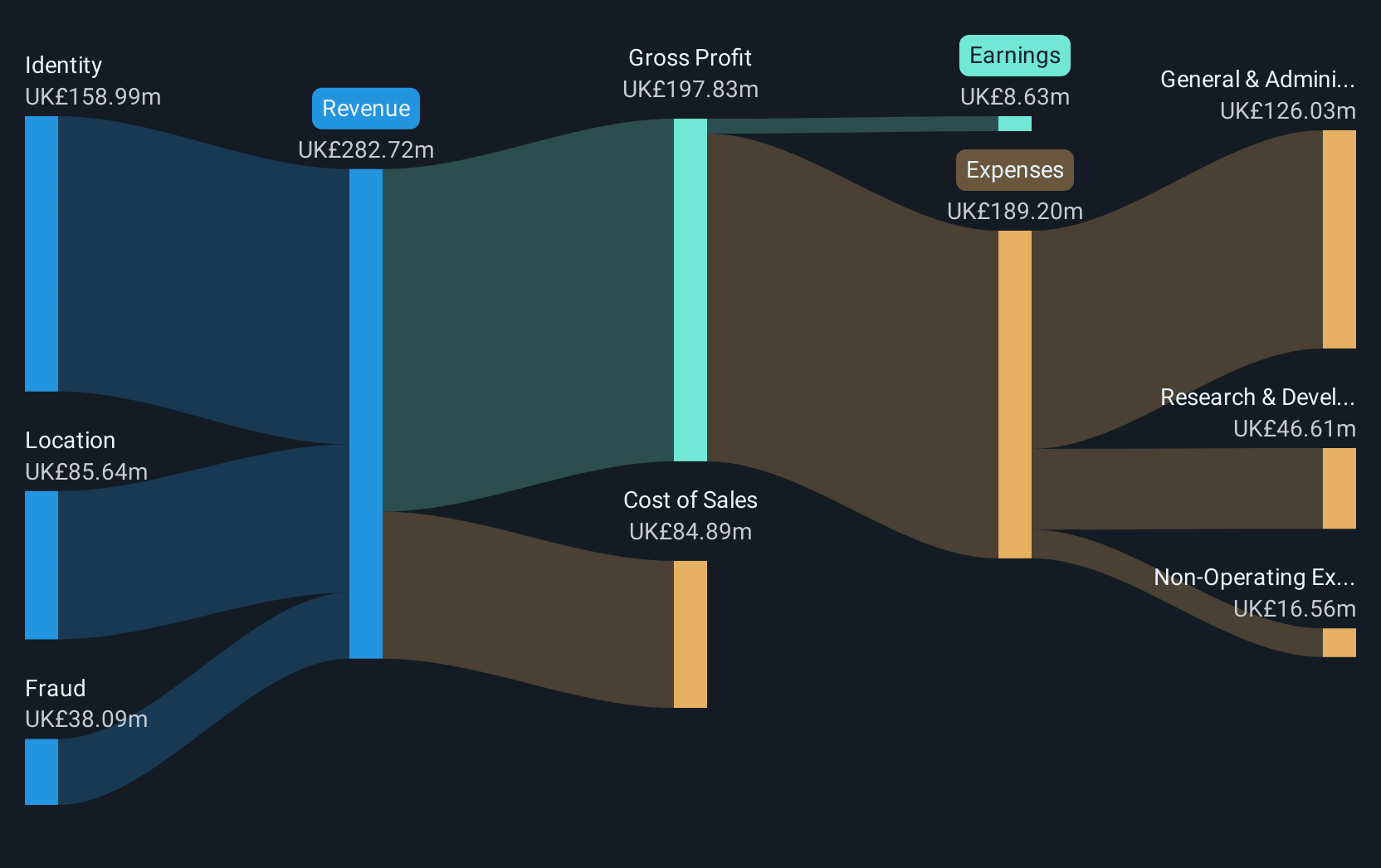

Operations: The company generates revenue through three primary segments: Identity (£158.99 million), Location (£85.64 million), and Fraud (£38.09 million).

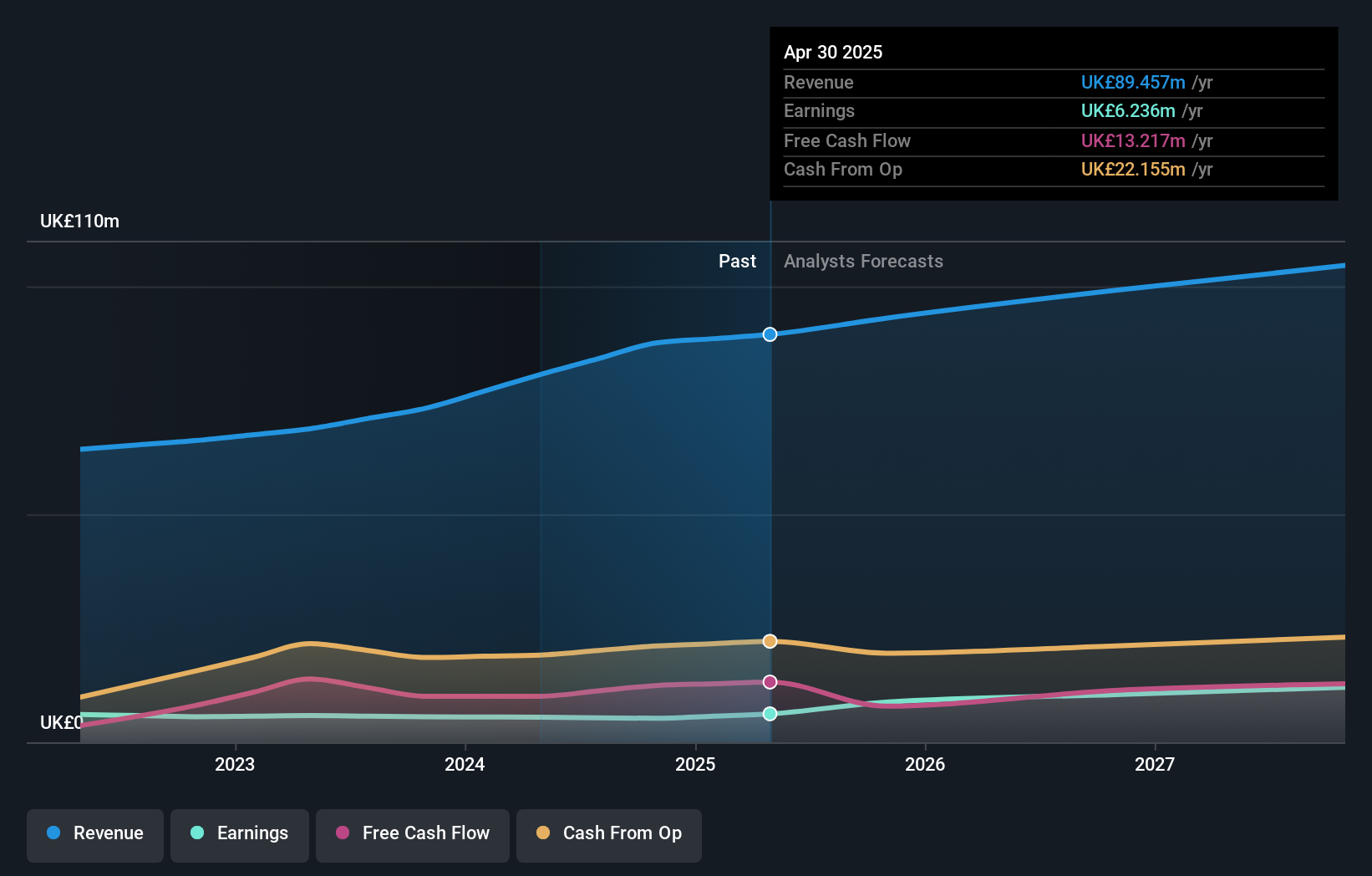

GB Group's recent transition to profitability marks a significant turnaround, with sales increasing from GBP 277.33 million to GBP 282.72 million and net income shifting from a loss of GBP 48.58 million to a gain of GBP 8.63 million year-over-year. This performance outpaces the software industry's average earnings growth of 17.6%. Looking ahead, GB Group is poised for robust growth with expected annual earnings expansion at an impressive rate of 31.5%, significantly higher than the UK market forecast of 14.5%. Additionally, the company has initiated a share repurchase program, underlining confidence in its financial health and commitment to delivering shareholder value. These strategic moves, coupled with a modest dividend increase to 4.40 pence per share, reflect GB Group’s strengthened market position and potential for sustained growth in the tech sector.

- Navigate through the intricacies of GB Group with our comprehensive health report here.

Gain insights into GB Group's past trends and performance with our Past report.

IDOX (AIM:IDOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IDOX plc, with a market cap of £300.09 million, offers software and services to manage local government and other organizations across the UK, US, Europe, and internationally.

Operations: IDOX plc generates revenue primarily from three segments: Land Property & Public Protection (£56.06 million), Communities (£17.74 million), and Assets (£15.66 million). The company provides specialized software and services tailored to the needs of local governments and various organizations globally.

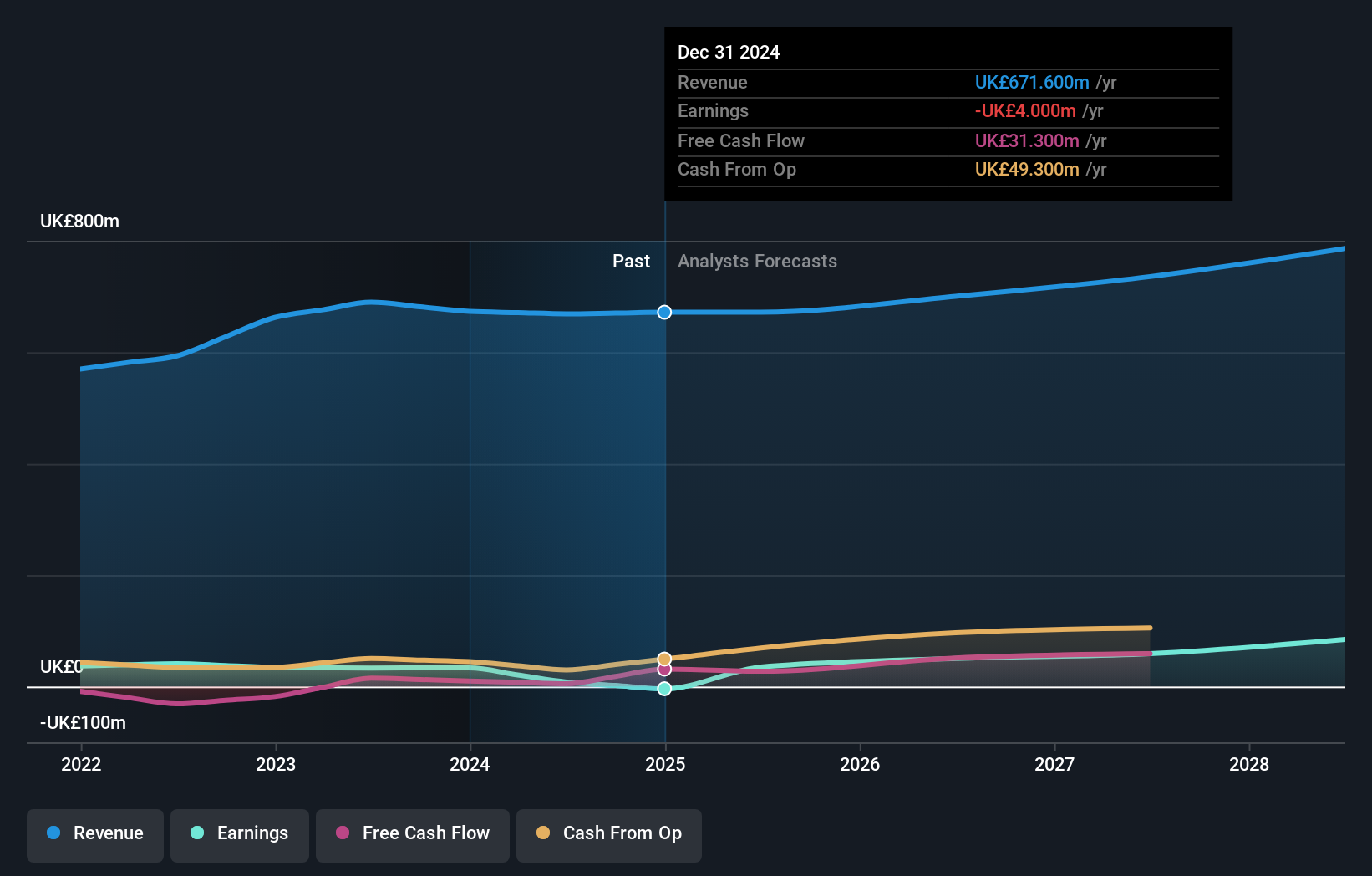

IDOX, a player in the UK's tech scene, demonstrates a robust growth trajectory with earnings expected to surge by 23.1% annually, outpacing the UK market average of 14.5%. This growth is supported by a solid revenue increase of 6.2% per year, which exceeds the broader market's growth rate of 3.5%. Strategic moves like seeking acquisitions and managing a strong cash flow—evidenced by an operating cash conversion rate against adjusted EBITDA of 141%—underscore its aggressive expansion plans and financial agility. The company's focus on mergers and acquisitions is facilitated by significant financial resources, including a revolving credit facility (RCF) totaling GBP 120 million, enhancing its capability for strategic investments and driving future earnings potential.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across multiple regions including North America, Latin America, Europe, the Middle East, Russia, Africa, and Asia, and it has a market cap of £1.61 billion.

Operations: Genus plc generates revenue primarily through its two main segments: Genus ABS, which contributed £311.10 million, and Genus PIC with £358 million. The company's operations span various global regions, focusing on animal genetics.

Genus, poised for significant strides in the biotech sector, recently celebrated a milestone with the FDA's approval of its PRP gene edit for the U.S. food supply chain. This approval not only underscores Genus's commitment to innovation but also sets the stage for enhanced market presence in key international territories including Mexico and Canada. Financially, Genus is on an upward trajectory with revenue growth forecasted at 4.1% annually, outpacing the UK market average of 3.5%. Additionally, earnings are expected to skyrocket by 51.5% per year as it moves towards profitability within three years—a testament to its robust operational strategy and forward-thinking approach in a challenging industry landscape.

- Click here to discover the nuances of Genus with our detailed analytical health report.

Evaluate Genus' historical performance by accessing our past performance report.

Make It Happen

- Reveal the 43 hidden gems among our UK High Growth Tech and AI Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IDOX

IDOX

Through its subsidiaries, provides software and services for the management of local government and other organizations in the United Kingdom, the United States, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives