- United Kingdom

- /

- Personal Products

- /

- LSE:CRL

3 Promising UK Penny Stocks Under £30M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 experiencing a downturn due to weak trade data from China impacting global economic sentiment. Amidst these broader market fluctuations, investors often seek opportunities in lesser-known areas such as penny stocks. Although the term "penny stock" might seem outdated, these smaller or newer companies can offer unique growth potential when supported by strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.75 | £372.96M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.15M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £354.36M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.84 | £63.62M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.625 | £189.49M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.316 | £202.97M | ★★★★★☆ |

| Alumasc Group (AIM:ALU) | £3.01 | £108.25M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.60 | £278.36M | ★★★★★★ |

| Billington Holdings (AIM:BILN) | £4.40 | £54.31M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cordel Group (AIM:CRDL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cordel Group Plc offers data integration and analytic services for rail and road asset management across Australia, the United Kingdom, the United States, Canada, and Asia with a market cap of £16.12 million.

Operations: The company generates £4.44 million in revenue from its data integration and analytic services segment.

Market Cap: £16.12M

Cordel Group Plc has shown resilience in the penny stock market with a recent revenue increase to £4.44 million, although it remains unprofitable with a net loss of £1.3 million for the year. The company, debt-free and possessing sufficient short-term assets to cover liabilities, maintains a cash runway exceeding three years based on current free cash flow. Despite shareholder dilution and high share price volatility, Cordel's strategic partnerships like the extended contract with the Australian Rail Track Corporation underscore its innovative capabilities in rail technology. Recent Network Rail certification further enhances its credibility in infrastructure monitoring solutions.

- Dive into the specifics of Cordel Group here with our thorough balance sheet health report.

- Learn about Cordel Group's historical performance here.

Oriole Resources (AIM:ORR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oriole Resources PLC, with a market cap of £12.56 million, is involved in the exploration and development of gold and other base metals across Turkey, East Africa, and West Africa.

Operations: Oriole Resources PLC does not report specific revenue segments, focusing instead on the exploration and development of gold and other base metals in regions including Turkey, East Africa, and West Africa.

Market Cap: £12.56M

Oriole Resources, with a market cap of £12.56 million, is pre-revenue and focuses on gold exploration in regions like Cameroon. Recent updates highlight promising developments at its Mbe project, where trenching results show significant gold mineralisation across wide zones. The company benefits from strategic funding partnerships, such as BCM International's commitment of up to US$4 million for exploration efforts. Despite being unprofitable and having a negative return on equity, Oriole remains debt-free with sufficient cash runway for over two years. Its experienced management team and board support ongoing projects in high-potential areas like Bibemi and Gamboukou.

- Navigate through the intricacies of Oriole Resources with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Oriole Resources' track record.

Creightons (LSE:CRL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Creightons Plc, along with its subsidiaries, develops, manufactures, and markets toiletries and fragrances in the United Kingdom and internationally, with a market cap of £23.27 million.

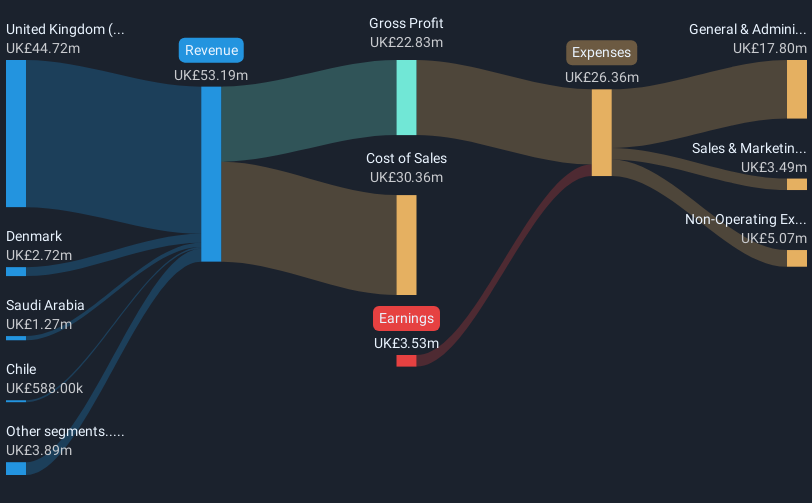

Operations: The company generates revenue of £53.19 million from its Personal Products segment.

Market Cap: £23.27M

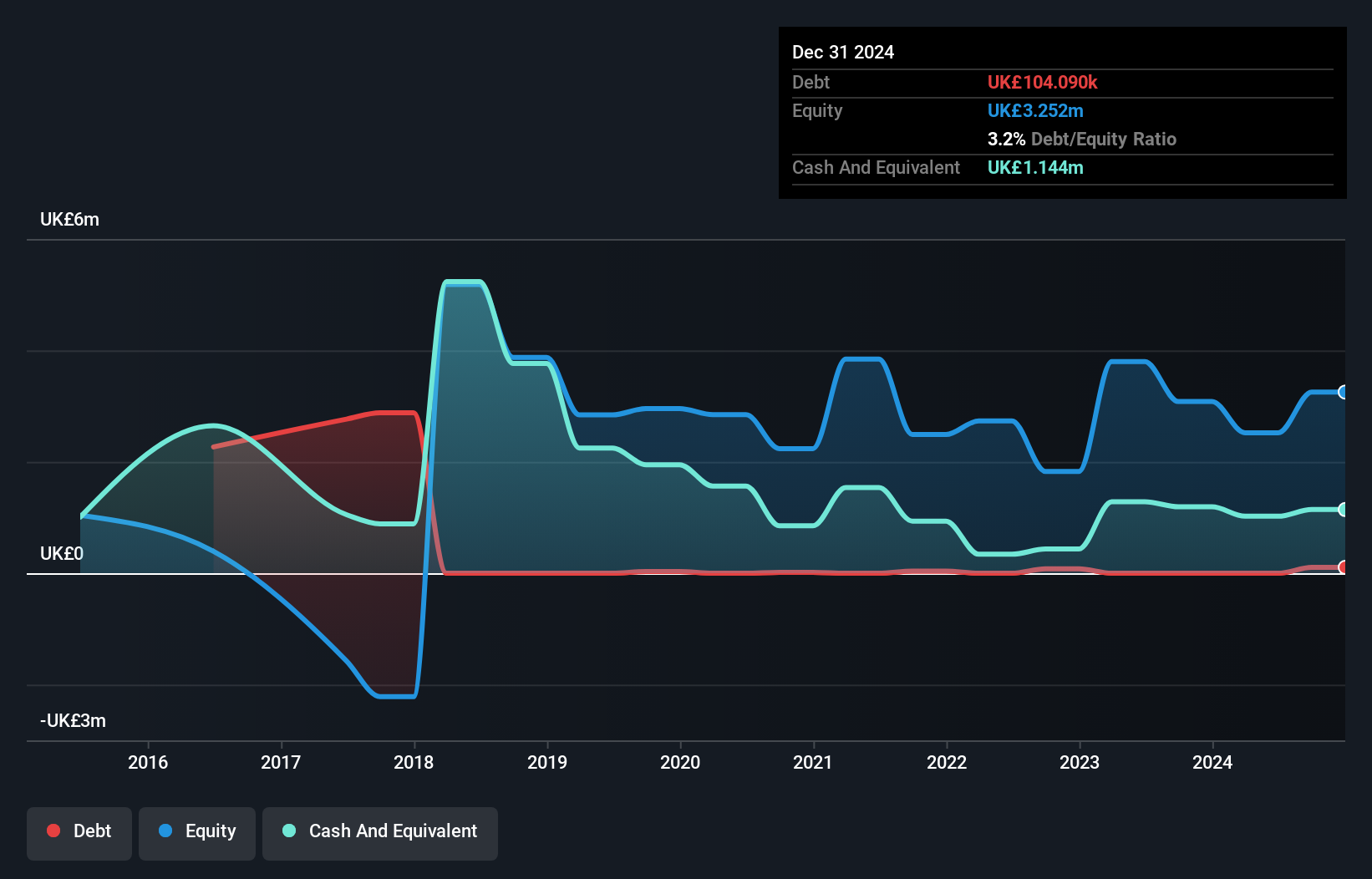

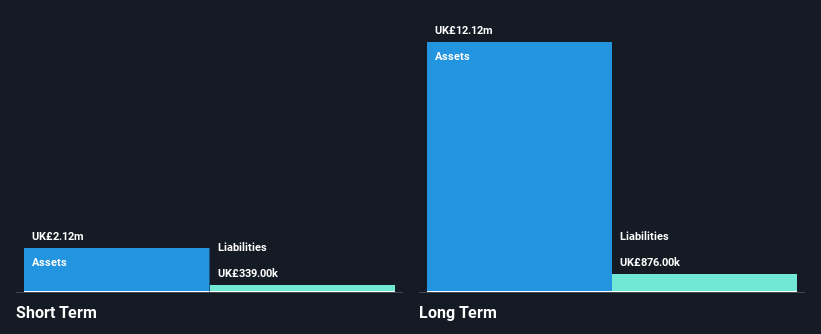

Creightons Plc, with a market cap of £23.27 million, is trading significantly below its estimated fair value, suggesting potential undervaluation. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains strong liquidity; its short-term assets of £21.9 million surpass both short and long-term liabilities. Interest payments are well-covered by EBIT at 4.4 times coverage, indicating manageable debt levels further supported by operating cash flow coverage of 205.3%. The board's average tenure of 9.8 years reflects experienced governance amidst high share price volatility compared to most UK stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Creightons.

- Evaluate Creightons' historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 466 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Creightons, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRL

Creightons

Develops, manufactures, and markets toiletries and fragrances in the United Kingdom and internationally.

Excellent balance sheet and good value.