- United Kingdom

- /

- IT

- /

- AIM:BKS

UK Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China, highlighting global economic uncertainties. For investors eyeing opportunities amid these conditions, penny stocks present a unique investment area that can still offer surprising value when backed by strong financials. These smaller or newer companies may provide a blend of growth potential and stability that larger firms sometimes miss, making them worth considering for those looking to explore under-the-radar opportunities in the current market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £465.29M | ✅ 5 ⚠️ 0 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.72 | £131.73M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.905 | £13.66M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.04 | £25.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.48 | £182.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.52 | £44.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 307 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Beeks Financial Cloud Group (AIM:BKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beeks Financial Cloud Group plc offers managed cloud computing, connectivity, and analytics services for the capital markets and financial services sectors globally, with a market cap of £156.63 million.

Operations: The company's revenue is derived from two primary segments: Public/Private Cloud, generating £25.61 million, and Proximity/Exchange Cloud, contributing £10.31 million.

Market Cap: £156.63M

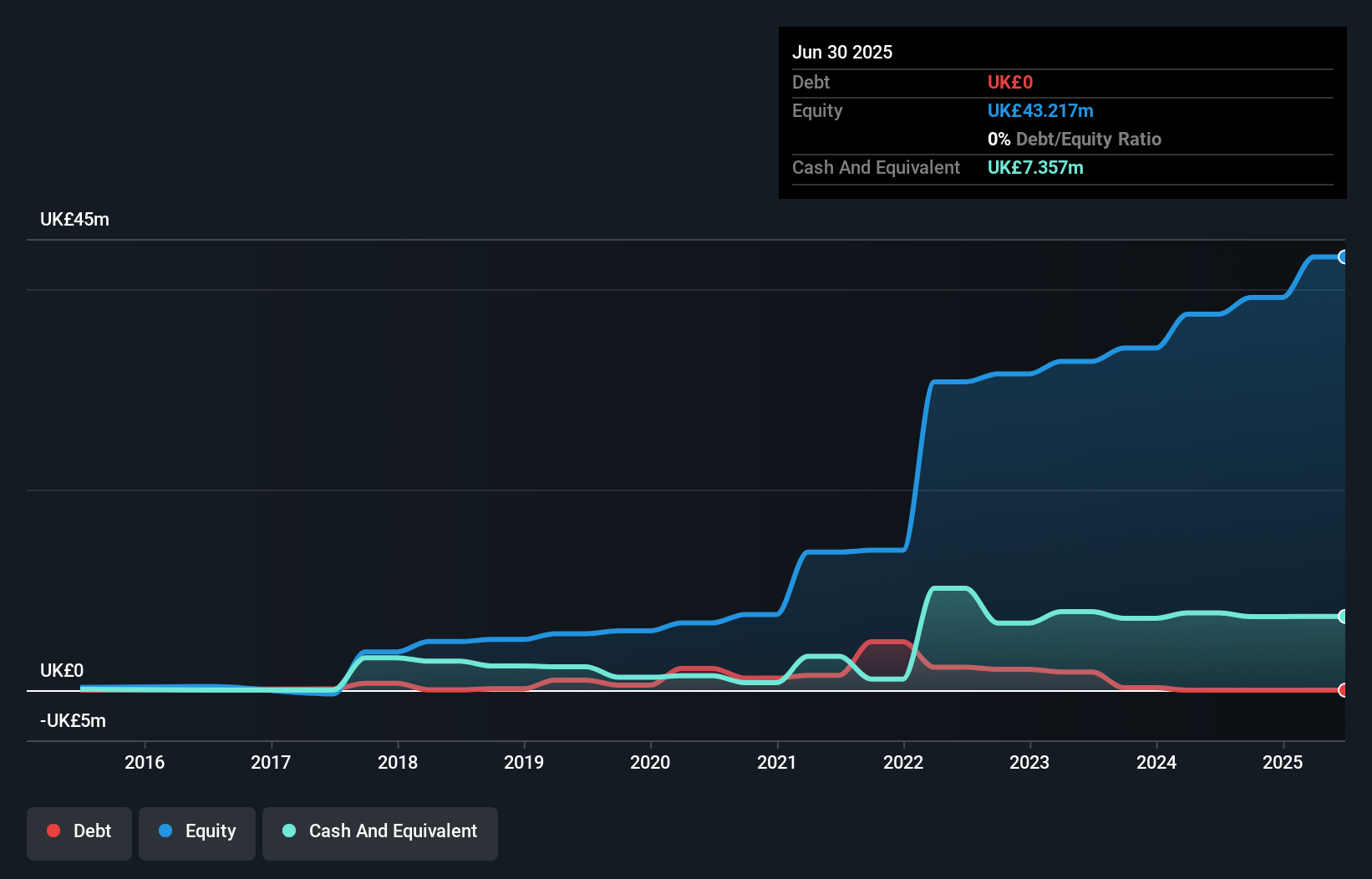

Beeks Financial Cloud Group plc has demonstrated robust financial health, with significant earnings growth of 35.2% over the past year and no debt burden, enhancing its appeal in the penny stock landscape. Recent client announcements reveal strategic contract wins, including a $1.5 million Private Cloud deal with a Canadian bank and a £2 million Proximity Cloud extension with an FX broker. These contracts are expected to bolster future revenues starting in fiscal 2026. Despite stable weekly volatility over the past year, Beeks' share price remains highly volatile short-term, which is common among penny stocks.

- Get an in-depth perspective on Beeks Financial Cloud Group's performance by reading our balance sheet health report here.

- Learn about Beeks Financial Cloud Group's future growth trajectory here.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of approximately £165.75 million.

Operations: The company's revenue primarily comes from its production segment, generating $72.9 million.

Market Cap: £165.75M

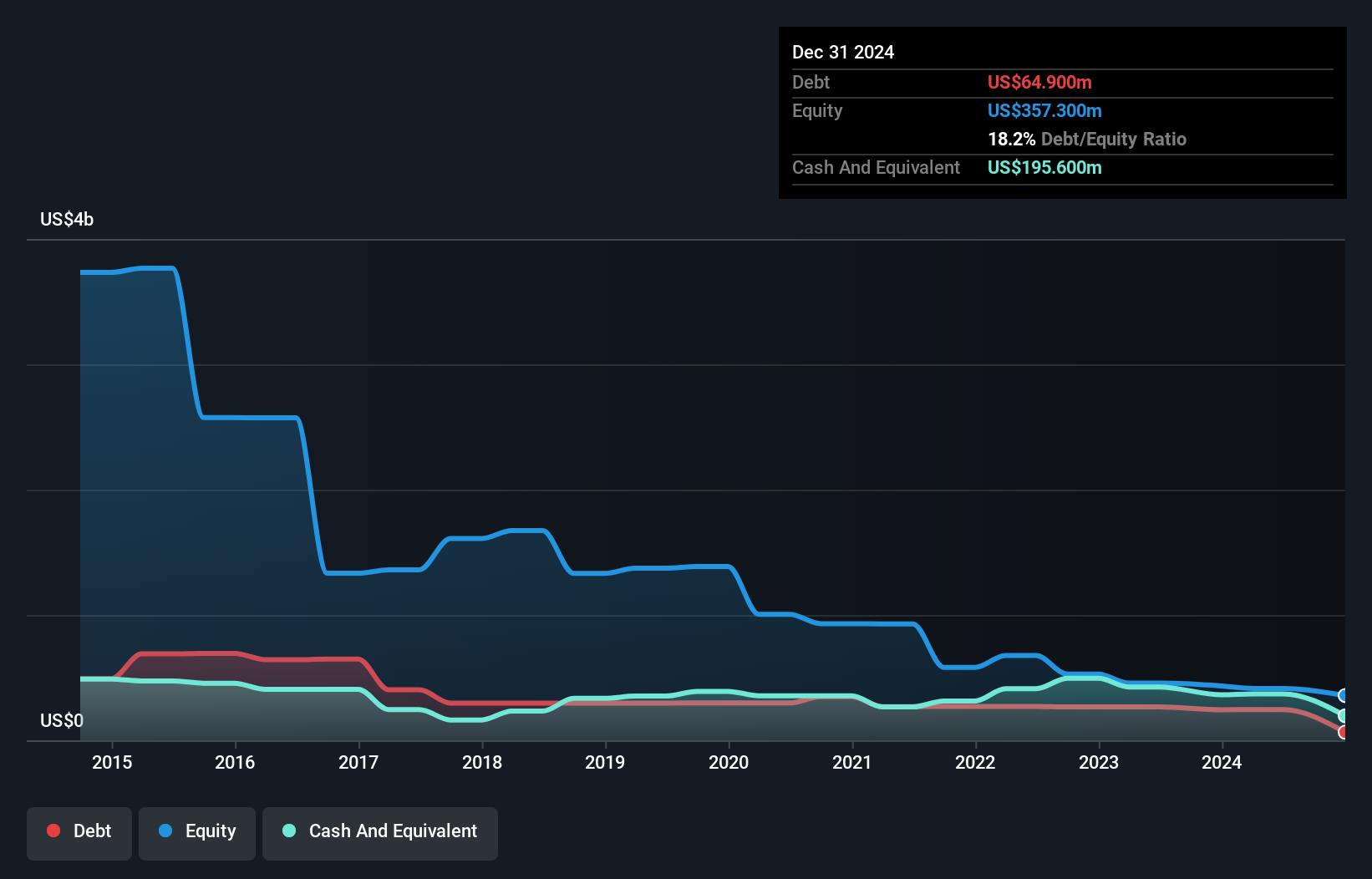

Genel Energy faces challenges typical of penny stocks, such as high volatility and current unprofitability with a negative return on equity. However, it maintains a strong financial position with short-term assets exceeding liabilities and more cash than total debt. Recent developments include the resumption of oil exports through the Iraq-Turkiye Pipeline after agreements with regional governments, potentially stabilizing revenue streams. Despite production interruptions due to drone strikes, output is recovering to pre-interruption levels. Leadership changes are underway following the retirement of Chair David McManus, which may influence strategic direction in coming months.

- Click here and access our complete financial health analysis report to understand the dynamics of Genel Energy.

- Assess Genel Energy's future earnings estimates with our detailed growth reports.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £380.89 million.

Operations: The company's revenue is primarily derived from the exploration and production of oil and gas, amounting to $163.17 million.

Market Cap: £380.89M

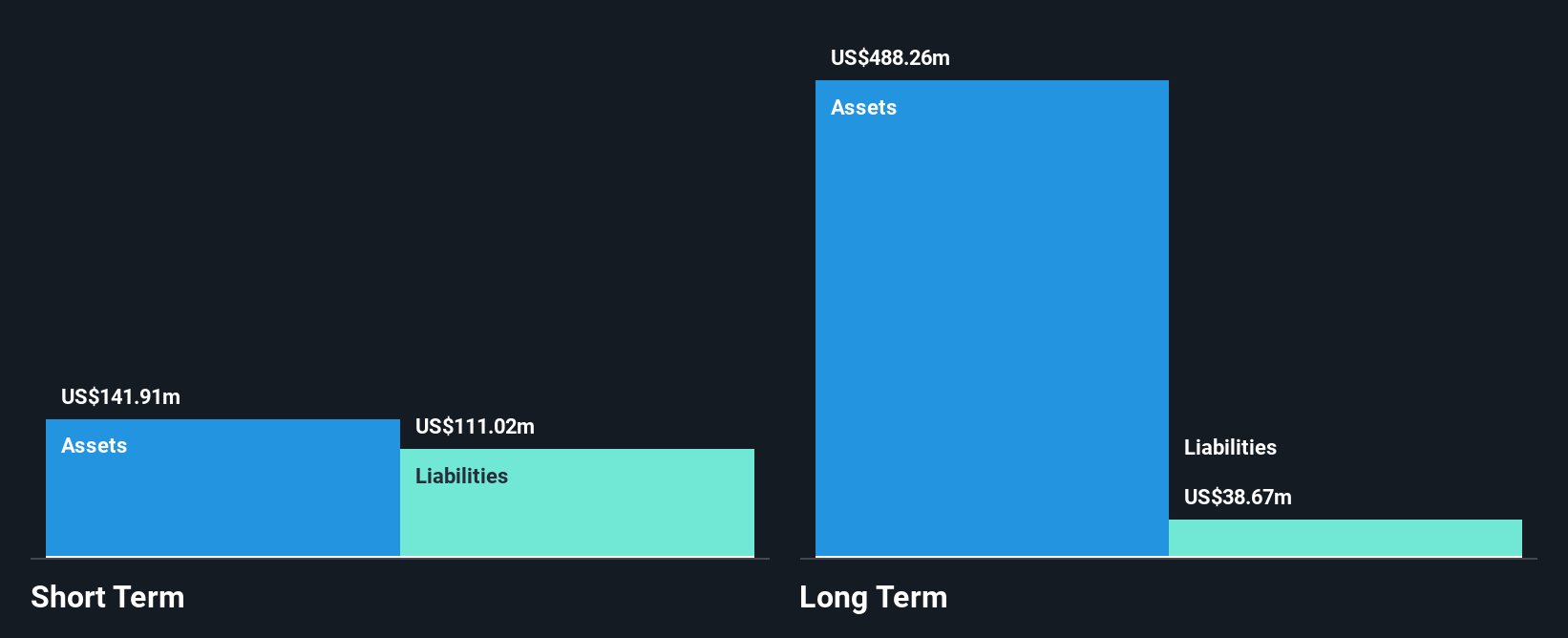

Gulf Keystone Petroleum's position as a penny stock is underscored by its unprofitability and negative return on equity, despite having no debt and sufficient short-term assets to cover liabilities. The company's management team is experienced, but the board lacks tenure. Recent agreements with the Kurdistan Regional Government and Iraq's Federal Government are set to restart crude exports from the Shaikan Field, potentially improving revenue with better realized prices during an interim period. This development could positively impact cash flow, although broader commercial negotiations remain ongoing for outstanding receivables from previous periods.

- Click to explore a detailed breakdown of our findings in Gulf Keystone Petroleum's financial health report.

- Understand Gulf Keystone Petroleum's earnings outlook by examining our growth report.

Next Steps

- Click this link to deep-dive into the 307 companies within our UK Penny Stocks screener.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beeks Financial Cloud Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BKS

Beeks Financial Cloud Group

Provides managed cloud computing, connectivity, and analytics services for capital markets and financial services sectors in the United Kingdom, Europe, the United States, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026