- United Kingdom

- /

- Biotech

- /

- LSE:CIZ

Promising UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such times, investors might consider exploring opportunities beyond the established giants by looking into penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies can still offer valuable investment opportunities when they possess strong financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.15 | £810.04M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.895 | £387.38M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.175 | £67.03M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.90 | £68.16M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.64 | £191.24M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.225 | £104.55M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.27 | £195.87M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.40 | £209.66M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.27 | £418.44M | ★★★★★★ |

Click here to see the full list of 461 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service to various industries across Europe, the Middle East, India, Africa, North America, and Asia Pacific with a market cap of £80.28 million.

Operations: ActiveOps Plc has not reported any specific revenue segments.

Market Cap: £80.28M

ActiveOps Plc, with a market cap of £80.28 million, has shown significant earnings growth over the past year, reporting a net income of £0.37 million compared to a net loss previously. The company is debt-free and boasts high-quality earnings with stable weekly volatility at 5%. Its short-term assets exceed both short- and long-term liabilities, indicating strong liquidity management. Despite its recent profitability and improved profit margins from 0.4% to 4.7%, analysts forecast an average annual decline in earnings by 19.8% over the next three years, suggesting caution for potential investors in this volatile segment.

- Click to explore a detailed breakdown of our findings in ActiveOps' financial health report.

- Gain insights into ActiveOps' future direction by reviewing our growth report.

Intelligent Ultrasound Group (AIM:IUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intelligent Ultrasound Group plc develops, markets, and distributes medical training simulators in the UK, North America, and internationally with a market cap of £38.44 million.

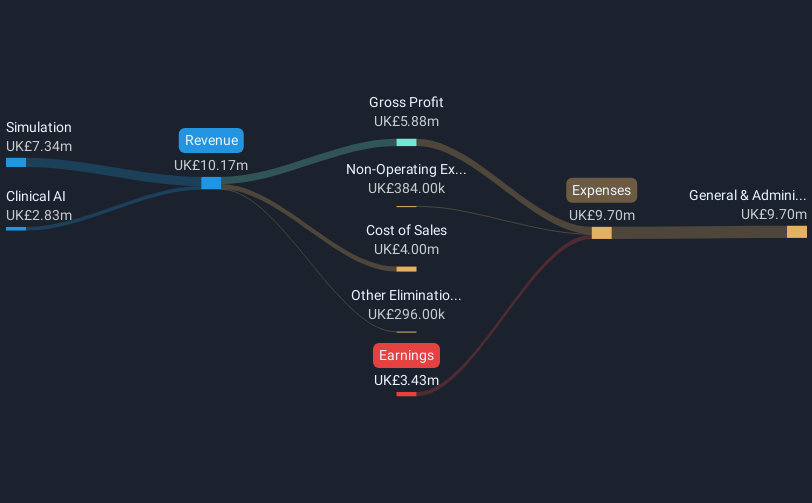

Operations: The company generates revenue from two main segments: Simulation, which accounts for £7.34 million, and Clinical AI, contributing £2.83 million.

Market Cap: £38.44M

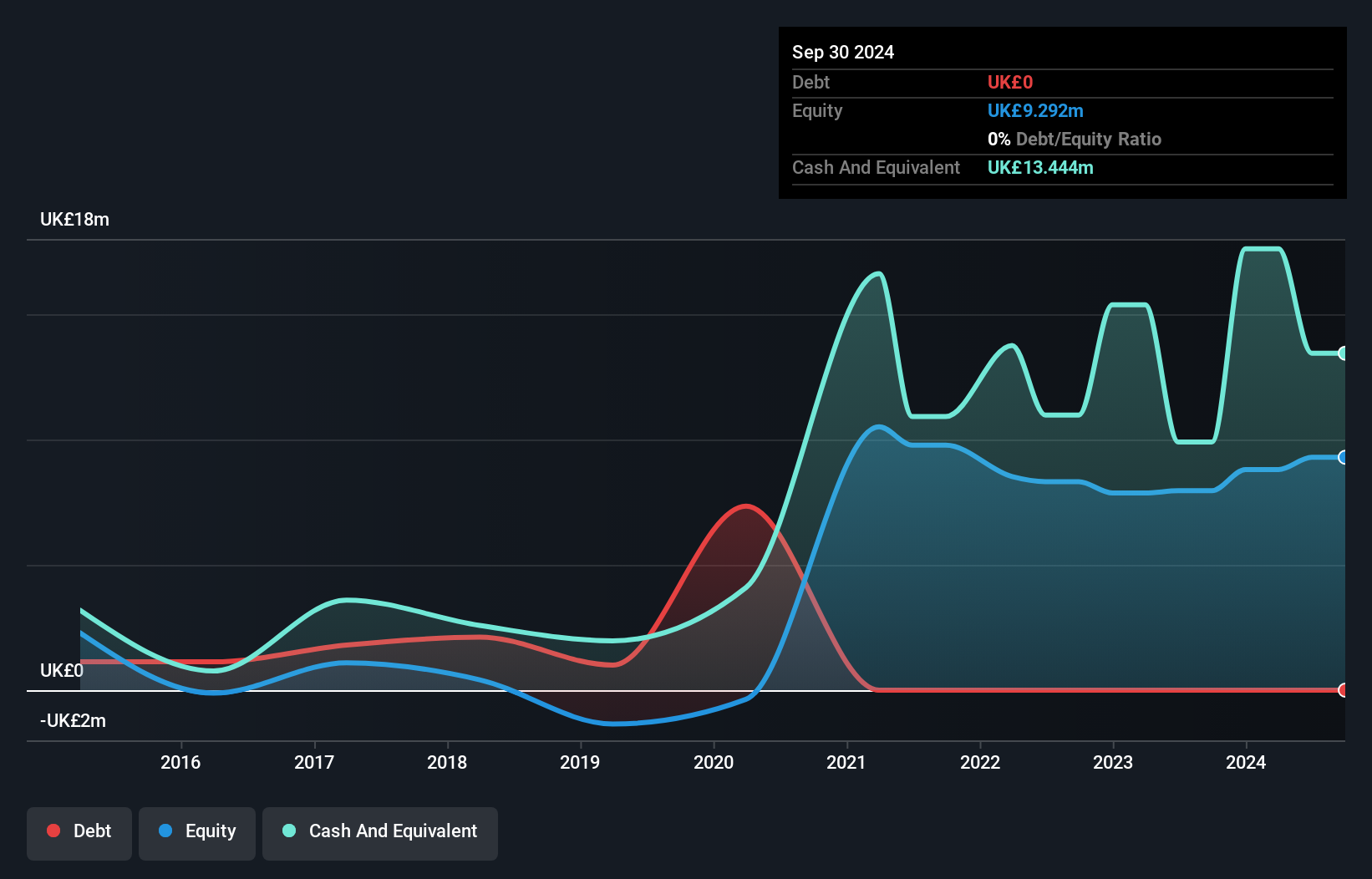

Intelligent Ultrasound Group, with a market cap of £38.44 million, operates in the medical training simulator space and is currently unprofitable with a negative return on equity (-43.15%). Despite this, the company maintains a solid financial position with short-term assets (£16.9M) exceeding both short- (£11.8M) and long-term liabilities (£715K). The management team is experienced, averaging 6.8 years in tenure, and the board averages 7.7 years, reflecting stability in leadership. Although debt-free, Intelligent Ultrasound faces challenges with less than one year of cash runway based on current free cash flow levels.

- Navigate through the intricacies of Intelligent Ultrasound Group with our comprehensive balance sheet health report here.

- Gain insights into Intelligent Ultrasound Group's past trends and performance with our report on the company's historical track record.

Cizzle Biotechnology Holdings (LSE:CIZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cizzle Biotechnology Holdings Plc focuses on developing an immunoassay test for the CIZ1B cancer biomarker aimed at the early detection of lung cancer in the United Kingdom, with a market cap of £7.53 million.

Operations: Cizzle Biotechnology Holdings Plc has not reported any specific revenue segments.

Market Cap: £7.53M

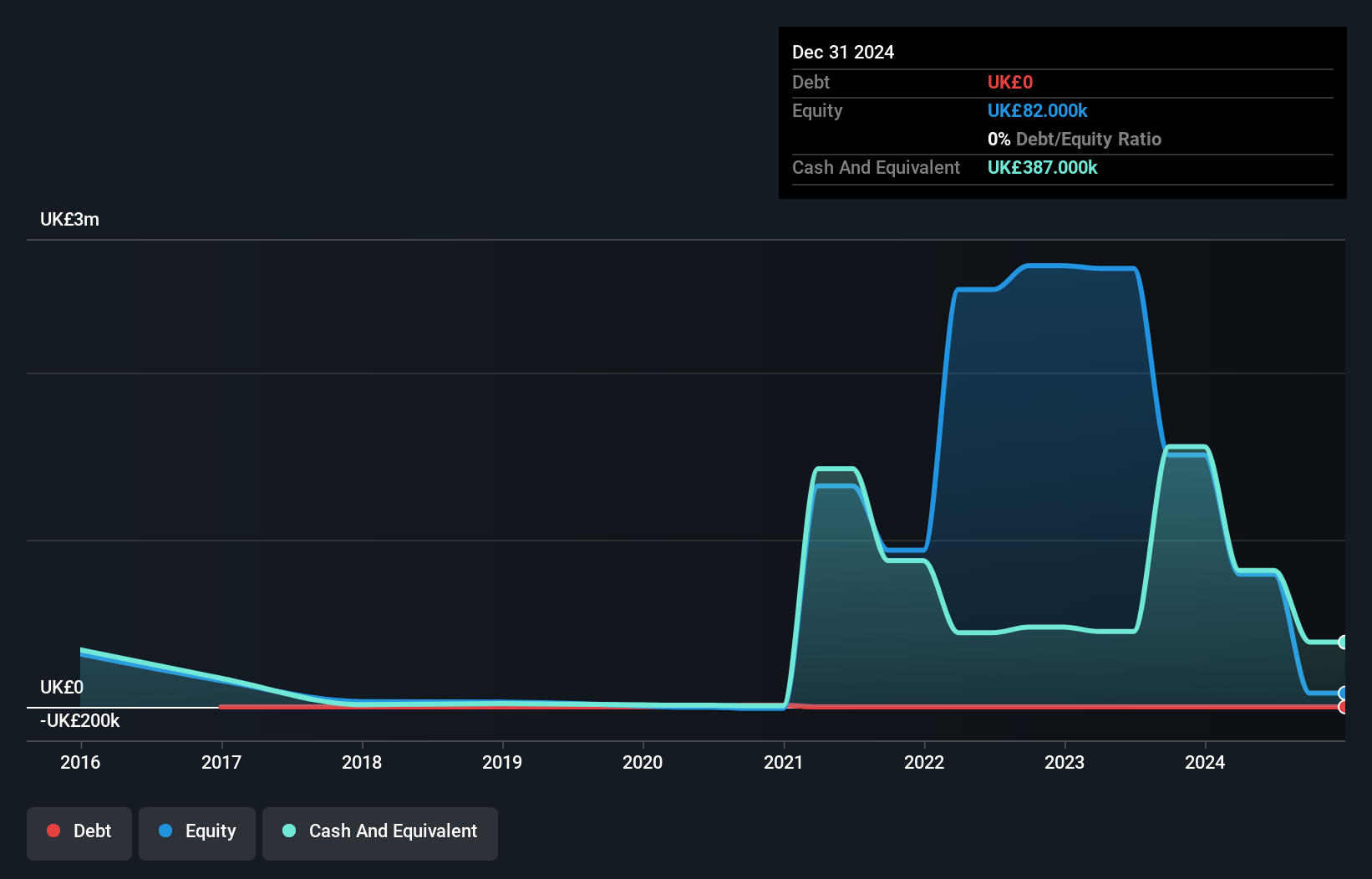

Cizzle Biotechnology Holdings, with a market cap of £7.53 million, is pre-revenue and focuses on early lung cancer detection through its CIZ1B biomarker test. The company remains debt-free and boasts an experienced management team with a 3.5-year average tenure. Recent developments include an exclusive licensing agreement with Cizzle Bio to commercialize the CIZ1B test in the USA, marking a significant milestone for potential revenue streams and global expansion plans. Despite shareholder dilution over the past year and increased losses, strategic collaborations like those with Moffitt Cancer Center aim to validate its diagnostic tool's efficacy in real-world settings.

- Dive into the specifics of Cizzle Biotechnology Holdings here with our thorough balance sheet health report.

- Explore historical data to track Cizzle Biotechnology Holdings' performance over time in our past results report.

Key Takeaways

- Unlock more gems! Our UK Penny Stocks screener has unearthed 458 more companies for you to explore.Click here to unveil our expertly curated list of 461 UK Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CIZ

Cizzle Biotechnology Holdings

Develops an immunoassay test for the CIZ1B cancer biomarker for the early detection of lung cancer in the United Kingdom.

Flawless balance sheet slight.