- United Kingdom

- /

- Software

- /

- AIM:AOM

ActiveOps And 2 Other UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnected nature of global economies. In such a fluctuating market environment, identifying stocks with strong fundamentals becomes crucial for investors looking to navigate potential opportunities. While 'penny stocks' may seem like an outdated term, they continue to offer intriguing prospects by representing smaller or newer companies that can combine affordability with growth potential when backed by solid financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.825 | £550.88M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.10 | £169.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.62 | £126.89M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.90 | £13.59M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.18 | £27.66M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.665 | $386.58M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.46 | £249.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.625 | £94.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.385 | £66.9M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service to various industries across Europe, the Middle East, India, Africa, North America, and Asia Pacific with a market cap of £180.59 million.

Operations: The company's revenue is derived from Software as a Service (SaaS) generating £26.77 million and Training & Implementation (T&I) contributing £3.69 million.

Market Cap: £180.59M

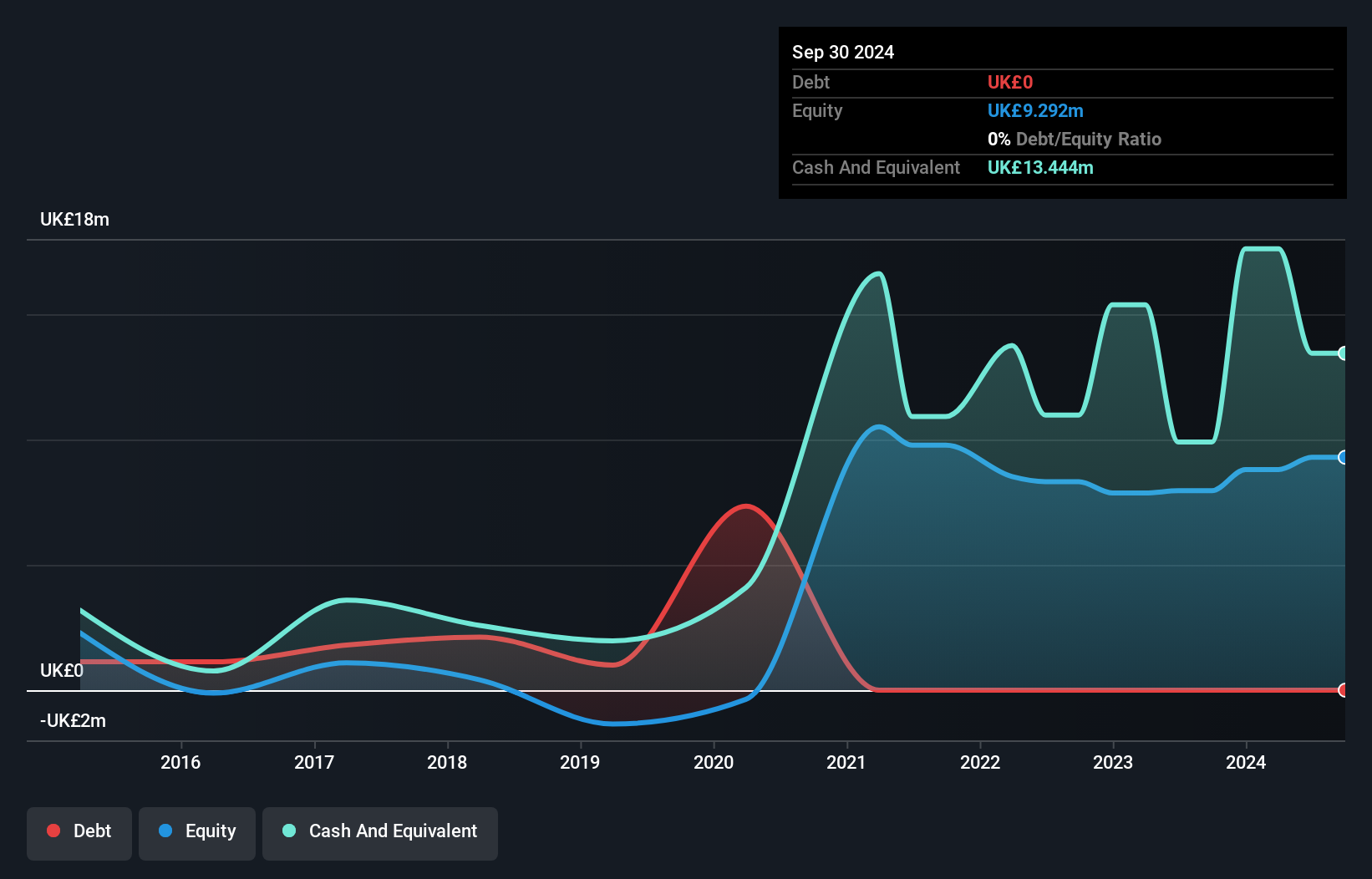

ActiveOps Plc, with a market cap of £180.59 million, is demonstrating strong growth potential in the SaaS sector, generating £26.77 million in revenue from this stream alone. Recent guidance indicates a robust 45% revenue growth for the first half of 2026, reflecting successful customer expansion and onboarding efforts. The company has no debt and maintains high-quality earnings, although its Return on Equity is relatively low at 11.2%. Despite some volatility in share price and moderate profit margins (3.6%), ActiveOps' disciplined strategy aims for sustainable growth with a target of achieving £100 million ARR and a 25% EBITDA margin.

- Click here to discover the nuances of ActiveOps with our detailed analytical financial health report.

- Review our growth performance report to gain insights into ActiveOps' future.

Fonix (AIM:FNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fonix Plc offers mobile payments, messaging, and managed services across various sectors such as media, charity, gaming, and e-mobility in the UK and Europe with a market cap of £186.29 million.

Operations: The company generates revenue of £72.78 million from facilitating mobile payments and messaging.

Market Cap: £186.29M

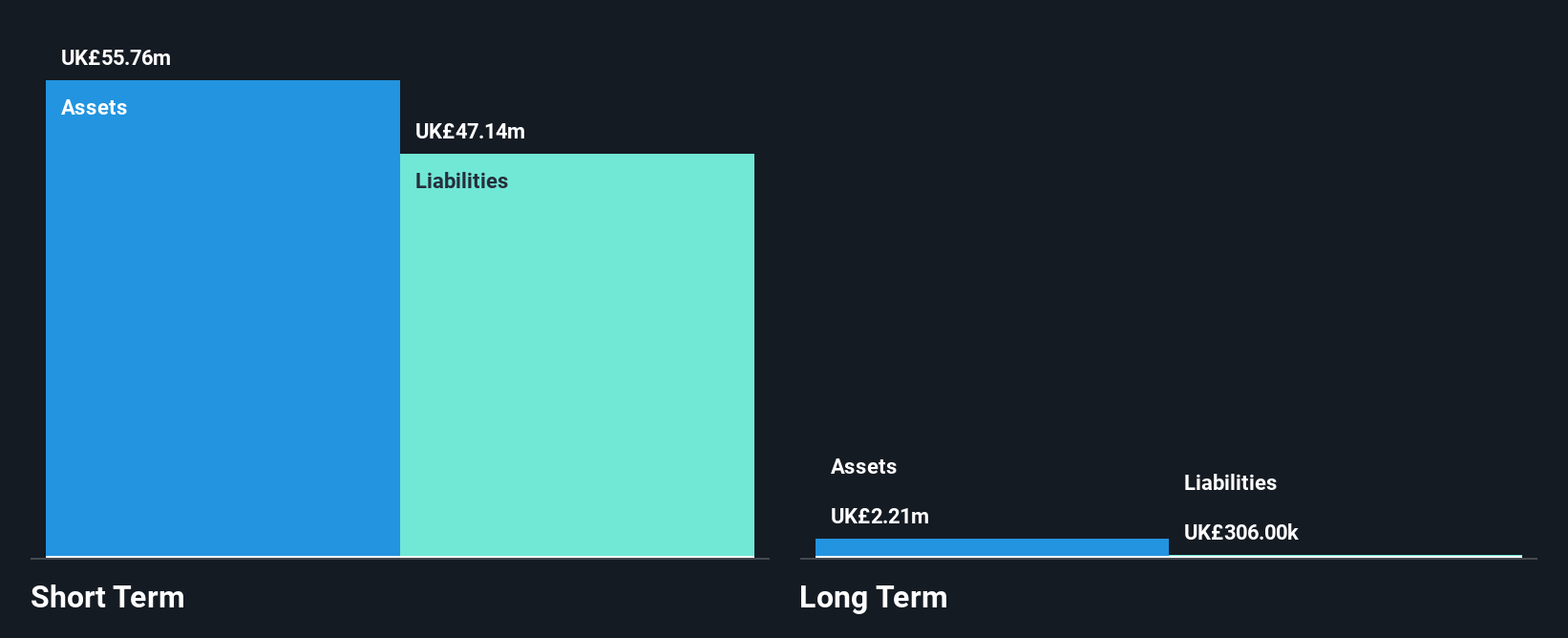

Fonix Plc, with a market cap of £186.29 million, shows financial stability with no debt and strong short-term asset coverage over liabilities. Despite a slight decline in sales to £72.78 million for the year ending June 2025, net income increased to £11.15 million, reflecting improved profit margins and high-quality earnings. The company’s Return on Equity is outstanding at 105.8%, although recent earnings growth of 5% lags behind its five-year average of 14%. Fonix's management and board are experienced, supporting strategic continuity as it recommends an increased final dividend in line with its progressive policy.

- Get an in-depth perspective on Fonix's performance by reading our balance sheet health report here.

- Explore Fonix's analyst forecasts in our growth report.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer operating in the United Kingdom with a market cap of £198.44 million.

Operations: The company generates its revenue primarily from its Retail - Gasoline & Auto Dealers segment, which accounts for £4.80 billion.

Market Cap: £198.44M

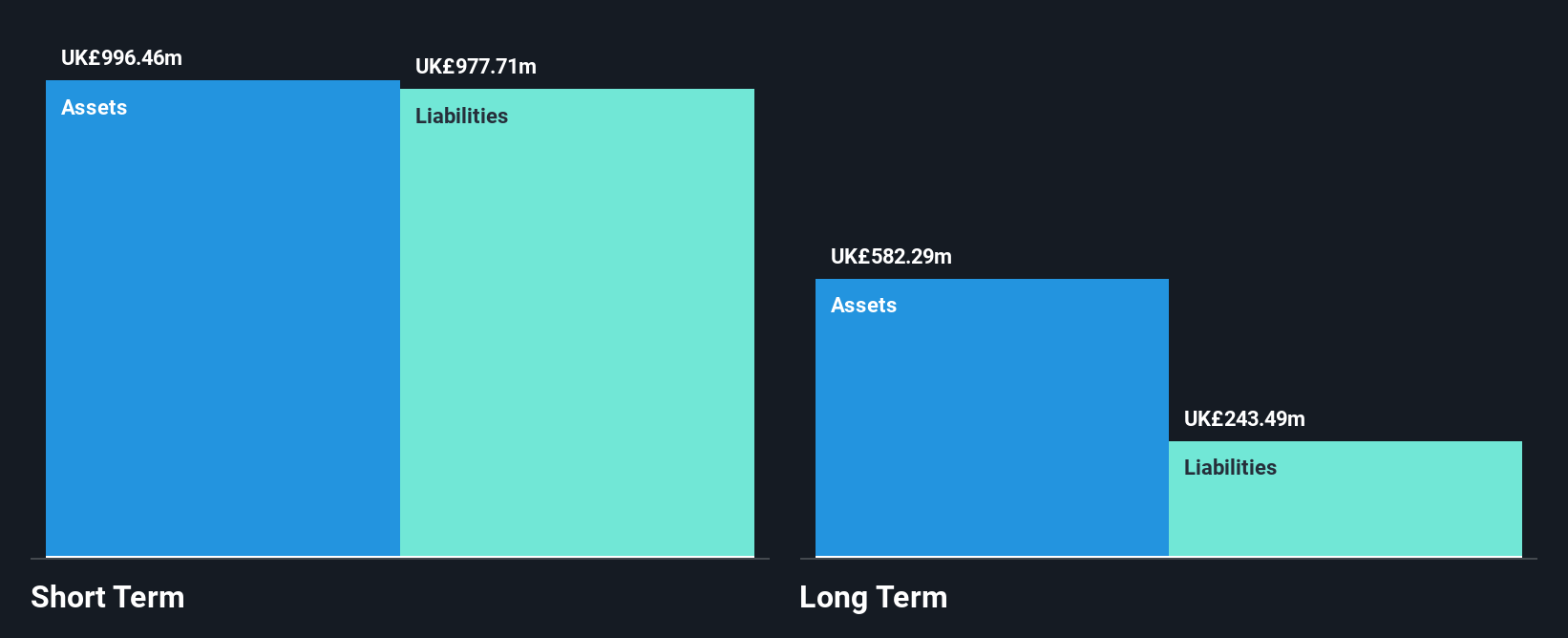

Vertu Motors, with a market cap of £198.44 million, has demonstrated mixed financial performance. Recent buybacks have reduced share count modestly, signaling potential confidence in its valuation. Despite generating substantial revenue of £4.80 billion from its core automotive segment, the company faces challenges with declining net profit margins and negative earnings growth over the past year. A significant one-off loss impacted recent results, although interest payments remain well covered by EBIT at 3.4 times coverage. The management team and board are experienced, providing stability amidst these fluctuations while maintaining satisfactory debt levels relative to equity and cash flow coverage.

- Unlock comprehensive insights into our analysis of Vertu Motors stock in this financial health report.

- Understand Vertu Motors' earnings outlook by examining our growth report.

Next Steps

- Explore the 295 names from our UK Penny Stocks screener here.

- Contemplating Other Strategies? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AOM

ActiveOps

Engages in the provision of hosted operations management software as a service solution to industries in Europe, the Middle East, India, Africa, North America, and Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives