- United Kingdom

- /

- Software

- /

- AIM:ALT

Altitude Group Full Year 2025 Earnings: EPS: US$0.016 (vs US$0.012 in FY 2024)

Altitude Group (LON:ALT) Full Year 2025 Results

Key Financial Results

- Revenue: US$37.3m (up 24% from FY 2024).

- Net income: US$1.19m (up 35% from FY 2024).

- Profit margin: 3.2% (up from 2.9% in FY 2024).

- EPS: US$0.016 (up from US$0.012 in FY 2024).

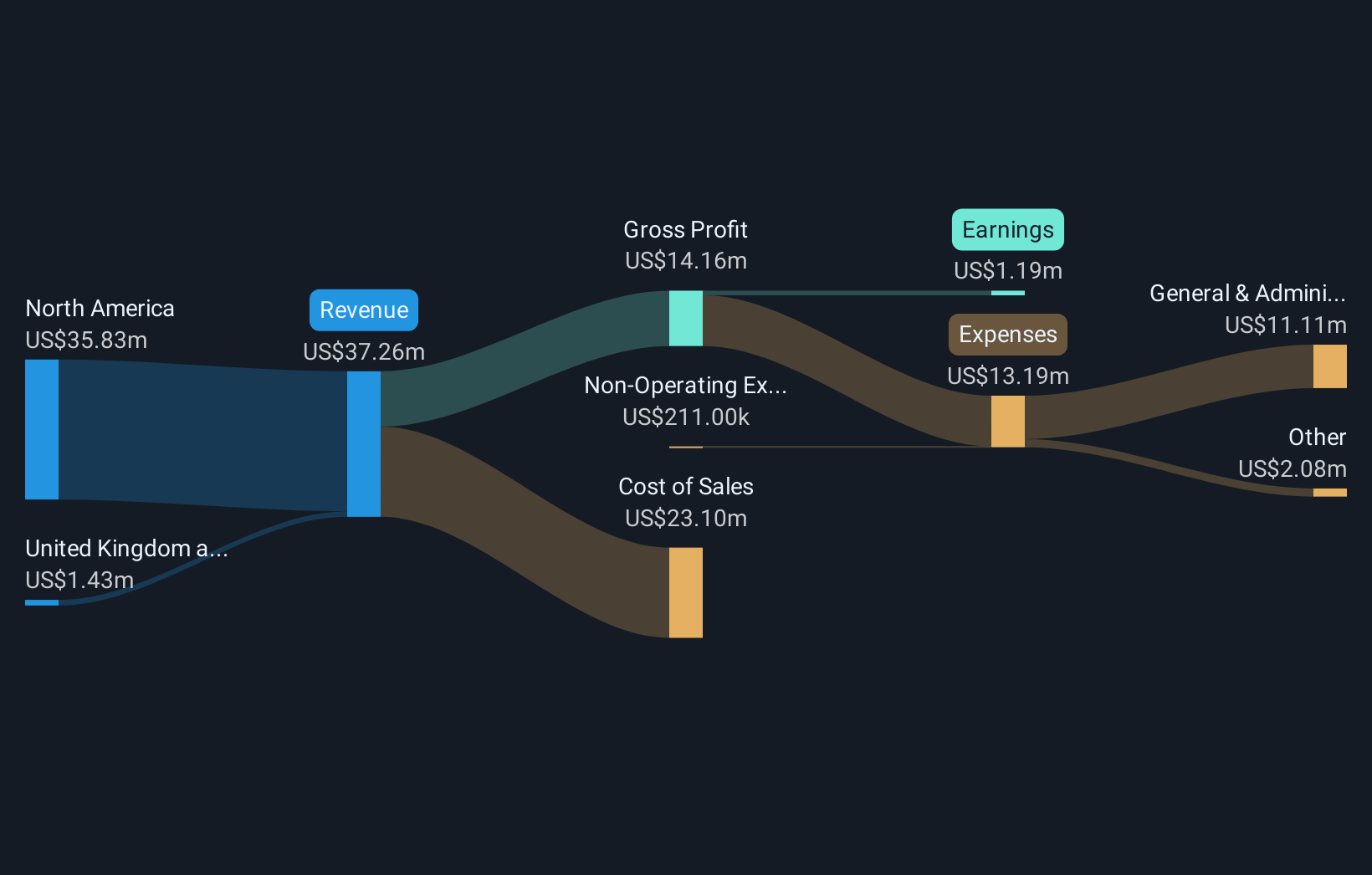

All figures shown in the chart above are for the trailing 12 month (TTM) period

Altitude Group Earnings Insights

The primary driver behind last 12 months revenue was the North America segment contributing a total revenue of US$35.8m (96% of total revenue). Notably, cost of sales worth US$23.1m amounted to 62% of total revenue thereby underscoring the impact on earnings. The largest operating expense was General & Administrative costs, amounting to US$11.1m (84% of total expenses). Over the last 12 months, the company's earnings were enhanced by non-operating gains of US$211.0k. Explore how ALT's revenue and expenses shape its earnings.

Looking ahead, revenue is forecast to grow 30% p.a. on average during the next 2 years, compared to a 8.6% growth forecast for the Software industry in the United Kingdom.

Performance of the British Software industry.

The company's shares are up 8.3% from a week ago.

Risk Analysis

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Altitude Group (1 can't be ignored) you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ALT

Altitude Group

Provides end-to-end solutions for branded merchandise in corporate promotional products industry, print vertical markets, and the higher-education sector in North America, the United Kingdom, and Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion