The London stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. Amid these broader market fluctuations, investors might find opportunities in penny stocks—smaller or newer companies that can offer significant potential for growth. Despite the term's outdated connotations, these stocks can present valuable prospects when they possess strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.72 | £423.13M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.85 | £283.45M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.916 | £145.98M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.285 | £413.06M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.375 | £40.58M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.805 | £68.24M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.06 | £146.97M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.342 | £206.98M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.29 | £164.28M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solid State plc, with a market cap of £99.16 million, designs, manufactures, and supplies electronic equipment across the United Kingdom, Europe, Asia, North America, and other international markets.

Operations: The company's revenue is derived from two main divisions: the Systems Division, which generated £81.69 million, and the Components Division, contributing £55.26 million.

Market Cap: £99.16M

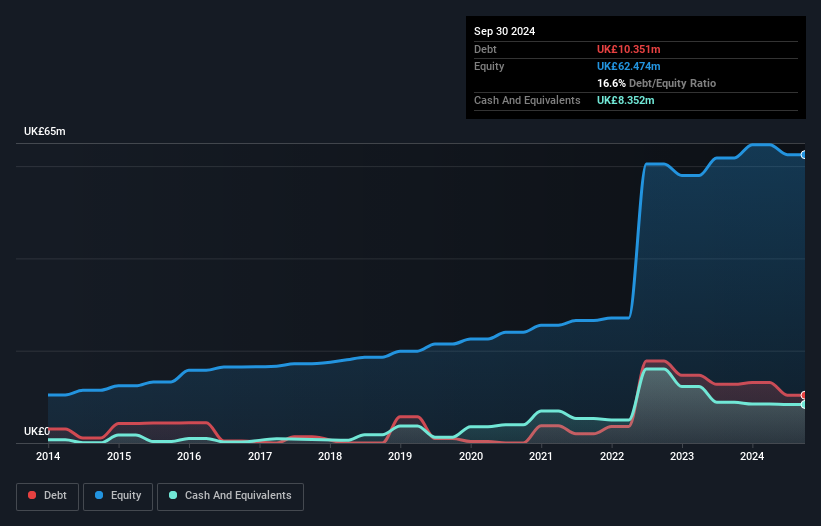

Solid State plc, with a market cap of £99.16 million, has demonstrated significant earnings growth over the past five years despite recent negative earnings growth. The company's financial health is supported by strong coverage of debt by operating cash flow and satisfactory net debt to equity ratio. Although it experienced a large one-off loss impacting recent results, its short-term assets comfortably cover both short and long-term liabilities. The stock's price-to-earnings ratio is slightly below industry average, while it maintains a reliable dividend yield of 2.46%. However, forecasted earnings decline poses potential challenges ahead.

- Navigate through the intricacies of Solid State with our comprehensive balance sheet health report here.

- Examine Solid State's earnings growth report to understand how analysts expect it to perform.

Symphony International Holdings (LSE:SIHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Symphony International Holdings Limited is a private equity and venture capital firm focusing on early-stage investments, management buy-outs, emerging growth, and other strategic financial activities, with a market cap of $176.08 million.

Operations: Symphony International Holdings Limited does not report specific revenue segments.

Market Cap: $176.08M

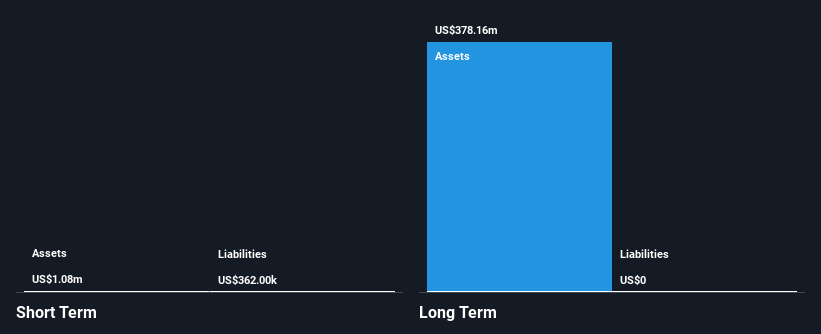

Symphony International Holdings Limited, with a market cap of $176.08 million, is currently pre-revenue and unprofitable, having experienced a 6.8% annual decline in earnings over the past five years. The firm benefits from being debt-free and maintains short-term assets ($1.1M) that exceed its short-term liabilities ($362K). Despite this financial stability, the company's negative return on equity (-6.45%) and high share price volatility present challenges for investors seeking stability in penny stocks. Additionally, its dividend yield of 7.29% is not well covered by earnings or free cash flows, posing sustainability concerns for income-focused investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Symphony International Holdings.

- Explore historical data to track Symphony International Holdings' performance over time in our past results report.

THG (LSE:THG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: THG Plc is an e-commerce technology company operating in the United Kingdom, the United States, Europe, and internationally with a market cap of approximately £489.69 million.

Operations: The company's revenue is primarily generated from THG Beauty (£1.20 billion), THG Ingenuity (£659.71 million), and THG Nutrition (£621.11 million).

Market Cap: £489.69M

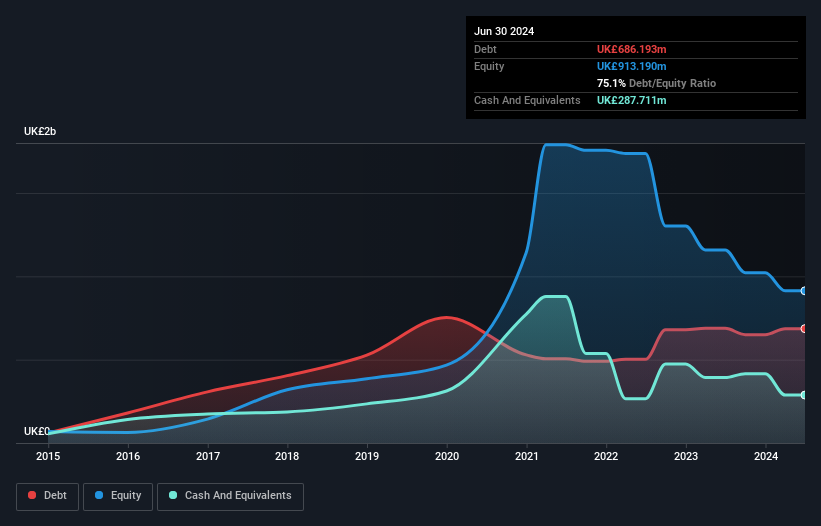

THG Plc, with a market cap of £489.69 million, faces challenges as an unprofitable e-commerce technology company. Despite its negative return on equity and increased losses over the past five years, THG maintains a positive cash flow and has reduced its debt to equity ratio significantly from 150% to 75.1%. The company's short-term assets (£836.8M) exceed its short-term liabilities (£670.9M), although they fall short of covering long-term liabilities (£997.9M). Recent board changes include the appointment of Milyae Park as an independent Non-Executive Director, potentially strengthening governance amid high share price volatility.

- Dive into the specifics of THG here with our thorough balance sheet health report.

- Learn about THG's future growth trajectory here.

Next Steps

- Investigate our full lineup of 443 UK Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Solid State, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOLI

Solid State

Designs, manufactures, and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives